Definition & Explanation

MLR – Medical Loss Ratio Rule

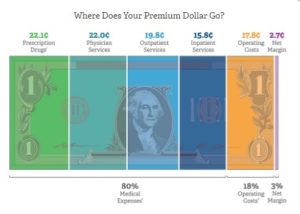

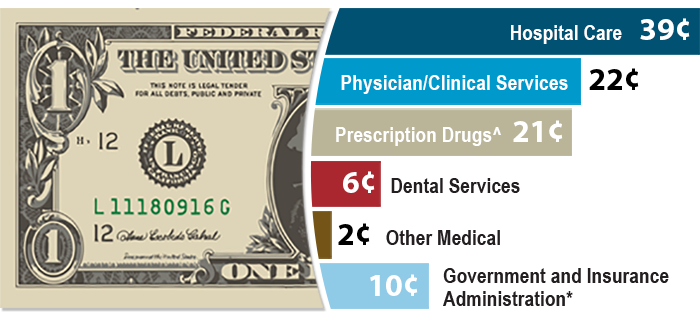

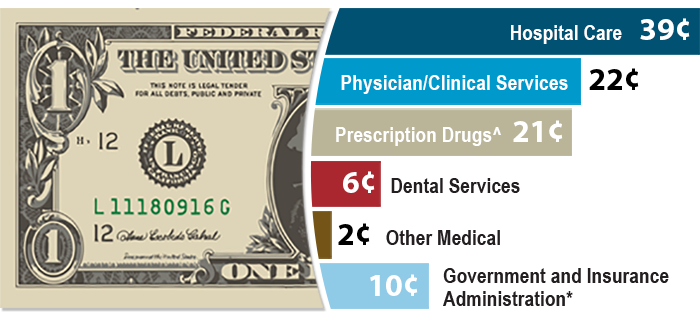

The MLR – Medical Loss Ratio Rule requires Insurance Companies to at least spend 80 percent of premium dollars on medical services – claims, over all, not on each policyholder. If they don’t, they have to give refunds – rebates. * CMS.Gov * NAIC * (health care.gov) Thus, a higher premium plan MUST pay more in claims, a lower premium plan, can cut claims… by decreasing benefits such as,

- deductibles,

- co-pays,

- limiting the number of doctors you can see – narrow networks,

- metal levels and

- limited Rx formularies.

- the medical loss ratio rule, was touted by the Obama administration as a tool for lowering premiums, but in the long run, it may be having the opposite effect. Modern Health Care 3.14.2020

- Why insurers are cutting broker pay for exchange plans Adverse selection – Open Enrollments

- Risk Adjustment in Medicare Advantage

- What is the law of large numbers Investopedia 8/2021

Do your part to keep costs down by

- watching your weight,

- preventative care

- Social Distancing

- Who pays for rioting & looting?

- and wellness programs

- COVID Precautions – Hospitalizations Payments may increase rates! Vaccinations? InsureMeKevin.com

- BROKER ONLY – Warner Pacific

- proposed Office of Health Care Affordability AP News 3.14.2022

What’s on this page?

Medical Loss Ratio 80% Claims - 20% Operating Costs & Profit

So, why trade $$$ back and forth if you can afford not to?

Image from BCBS.com

Steve's Explanation of MLR Medical Loss Ratio

More Video's

- Kaiser Health News - Medical Loss Ratio video

- White House – YouTube Channel on Health Care Reform

- Tom Petersen Insurance 101 History of Lloyds to present EXCELLENT!!!

- Our Webpage on MLR & Actuarial Value

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

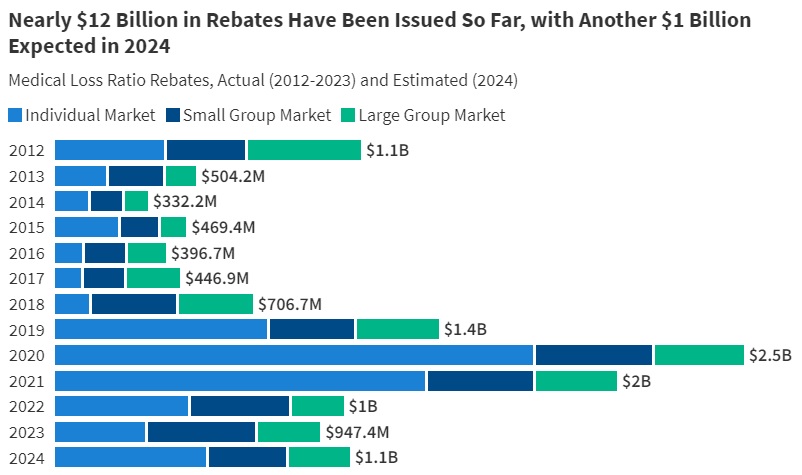

Rebates – You get a refund if the Insurance Company

collected too much $$$ to pay 80% of premium in Claims

#Rebates Return of Excess Premium

- Anthem 2023 Rebates

- Source KFF

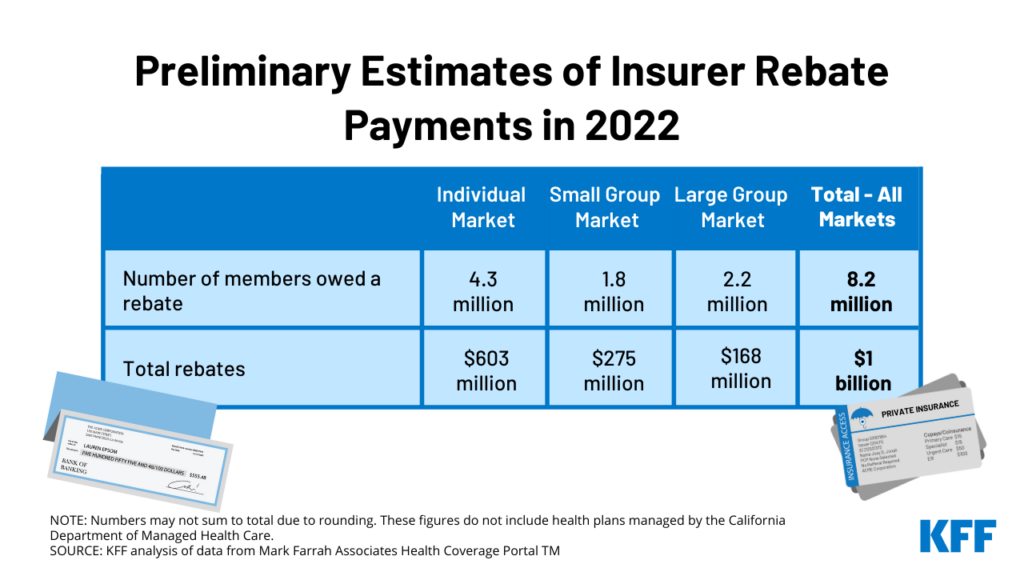

- $1 Billion in Rebates to for 2022 for Setting Premiums Too High Relative to Medical Costs Read More CNBC * Kff.org

- roughly $141 per plan member in the individual market,

- $155 per member in the small group market and

- $78 per member in the large group market, Kff.org

- UnitedHealthcare show great profits during pandemic LA Times 10.15.2020 *

- FAQ on how to distribute rebates to employees

- Blue Cross Group Rebates for 2019 *** FAQ’s

- Tools & Research to find MLR Medical Loss Ratio

- Covered CA *

- CMS.gov *

2019 Rebates

Aetna

- aetna.com/affordable-care-act-employers

- Then click on “Minimum Medical Loss Ratio”

- What states are getting Rebates?

- What types of plans are getting rebates?

Industry

Insurers will owe massive MLR rebates next year, even if 2020 is normal Modern Health Care *

There might be rebates for 2018

Kaiser Family Foundation, in a report published this week, said 2018 was “the most favorable year in the ACA-compliant market’s history.” The insurers were so profitable, in fact, that they’ll have to rebate a record $800 million in overcharges to consumers by Sept. 30. The expectation, however, was that the market would eventually stabilize. That’s exactly what has happened. Financial conditions in the individual market began to improve in 2016, when average premiums first began to outpace claims. By last year, when average monthly premiums per enrollee were $559, they outpaced average per capita claims by $167. * Los Angeles Times 5.8.2019 *

Due to some better-than-expected claims results, along with cost-saving measures that have been implemented, Anthem’s Medical Loss Ratio (MLR) dropped below 80% over the 2015-2017 period.

What does this mean? It means that Anthem clients who were enrolled in the 2017 calendar year are getting some money back.

- The annualized rebates will average approximately $142 per member over a 12-month period.

- The rebate checks are distributed directly to the employer and should be sent by September 8th.

- The employer has the option to distribute the rebate to employees or apply it toward future premiums.

- Cal-COBRA members will receive a check directly from Anthem.

- Anthem is required to inform employees that their employer is receiving a rebate. Employee letters are required to be mailed and will be sent by September 18th.

Anthem is committed to providing access to high-quality health care providers and services while working to drive down cost in the health care system. In addition, Anthem is striving to improve its customers’ experience, and efficiently managing their costs is part of that experience.

- Blue Shield – Employer Rebates 11.1.2016 CA Health Line

- Blue Shield accused of not giving high enough rebates for 2014 – LA Times 6.28.2016 – Lawsuit filed CA Health Line 7.18.2016 * 9.20.1206 Talking points for Small Biz Rebates for 2015

- The LA Times reports on 8.5.2015 that Blue Shield (talking points) will pay out $83 million for 2014 an average of $136/policy holder and $21 million to 19,000 small employers, about $1,000.

- Health Net 2014 results – no rebates

- CA Companies appear to have fine tuned their premiums and claims to meet the MLR Rule and do not have to refund any money for 2013 (Word & Brown Survey) Learn More in Blue Cross Presentation.

- Rebates were expected to be 1.3 Billion in 2012!LATimes 4.27.2012 The Hill 5.2014 $332 Million in 2013 – as companies are fine tuning their rates to comply with the rule. Modern Health Care UnitedHealthcare has announced a $3,500,000 refund to CA Small Biz. Blue Cross, Blue Shield & Kaiser $50 million LA Times 6.2.2012 Nor, no one can say that Insurance is a Scam, it’s simply a mechanism to share the losses. If you want to pay less premium and are willing to take more of the risk yourself, avoid the 20% “handling charge,” take the Bronze Plan, where you pay 40% of the essential covered benefits. Click here for more info from UnitedHealthcare

- Blue Shield is voluntarily limiting net income to 2% and giving refunds.

- Merced Property & Casualty Co out of biz due to Paradise Camp Fire LA Times 12.3.2018 *

Testimonials & Accolades

Thank you so much for your assist in navigating this complicated insurance process.

I feel so lucky to find you!

I would like to contact you if I have any questions in the future because you are the only one who can give me a clear answer in this field.

I really, really appreciate you. 🙏

Julie L

Read our other clients testimonials and/or write one

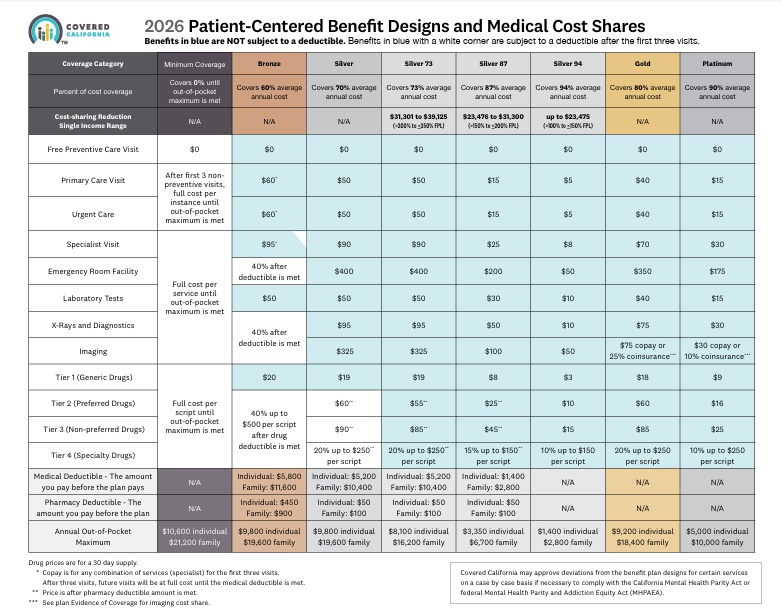

Actuarial Value

What is #actuarial value and how does it affect premiums?

The actuarial value of a health insurance policy is the percentage of the total covered expenses that the plan covers, on average for a typical population. [Age & Zip Code] For example, a plan with a 70% Silver actuarial value means that consumers would on average pay 30% of the cost of health care expenses through features like deductibles and coinsurance. The amount that each enrollee pays will vary substantially by the amount of services they use.

The health reform law specifies a benchmark level of coverage for the purposes of premium subsidies using actuarial values. Premium subsidies will be tied to Silver plans, which have an actuarial value of 70%. Additional subsidies for people making between 100 and 250% of the poverty level limit cost sharing and raise the actuarial value of Silver plans. Our calculator also illustrates premiums and subsidies for Bronze plans, which have an actuarial value of 60%. Bronze plans represent the minimum level of coverage most people are required to maintain under health reform, and these plans will have higher cost sharing on average. Regardless of the level of actuarial value, insurers will have to cover a defined set of health care services and cap the total amount of cost sharing required of consumers at defined levels, but can generally otherwise vary the structure and degree of cost sharing so long as minimum actuarial value thresholds are met.

- Graphic Summary of the four metal levels & percent of cost of coverage

- 45 CFR 156.140 Metal Levels of Coverage

- Kaiser Foundation 6 page pdf summary

Market Stabilization

Guide to the Rule Making Process 11 pages pdf

Metal Level Chart showing Actuarial Value

- 2026 Covered California 2026 Patient-Centered Benefit Plan Designs Final Approval 7/28/2025

- Get Instant Quotes & Subsidy Calculation

- Covered CA bulletin on new and improved Enhanced Silver CSR Cost Sharing Reduction

- Do you think your medical bills will be higher or lower than average for your age & zip code?

- Expected Payout (AV)

- MLR Medical Loss Ratio

- Bronze 60%

- Out-of-Pocket Pain From High-Deductible Plans Means Skimping on Care Kff 12/2025 *

- Enhanced Silver 70% - 94% Gold 80% Platinum 90%

- Metal Levels are based on Expected Claims Payment - that is the actuarial value (AV).

- Renewal Tool Kit

- Patients often can’t afford to pay off what their insurance leaves behind

- This is one way Health Care Reform hopes to make shopping and comparing Instantly - easier. So, if you get a lower priced plan with less or fewer benefits, co-pays, deductibles you simply pay more when you have a claim. Don't worry, there is a stop loss - maximum out of pocket OOP, of say $7k so that you won't break the bank.

- Lessons from the ACA: Simplifying Choices to Optimize Health Coverage 12/2025 Commonwealth Fund *

- All plans cover the 10 Federal essential benefits and CA mandated benefits.

- Team Trump’s Answer to Ballooning Obamacare Premiums: Less Generous Coverage KFF.org *

- Our main webpage on Metal Levels

All our Health plans are Guaranteed Issue with No Pre X Clause

Instant Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

- Watch our 10 minute VIDEO that explains everything about getting a quote

Actual Law, Regulations and more detail

General highlights of the regulations include:

- Rate Increases must be certified by an Actuary CA SB 1163 New Ballot Measure Prop 45 requires Deparment of Insurance Approval

- MLR (Medical Loss Ratio)rebates will be sent to policy holders,which include employers or employee organizations as well as individual plan policyholders.

- Insurers may distribute rebates to employers; in turn, employers would need to issue rebates to employees, based on employee contributions.

- Policyholders are potentially eligible for a rebate determined on a “block” basis. The “block”is defined by:

- Organization size (individual; small or large employer group)

- Legal entity issuing coverage

- State of issuance

- Limited medical and expatriate international plans handled separately

- Small group is defined as 2-50 employees unless a state defines it differently until at least 2016.

- For the 2011 reporting year, issuers of limited medical (mini-med) and expatriate international plans are subject to separate calculation rules.

- The plan’s numerator of the total claims incurred and expenditures for activities that improve health care quality would be multiplied by two.

- Carriers will be required to complete additional quarterly reporting through 2011.

- After reviewing this additional reporting, these adjustments will be revisited by the Secretary for 2012 and beyond.

- Broker commissions will be included in the MLR calculation.

- Non-U.S. insurance companies do not file MLR.

A preliminary analysis of the regulation and the data from this survey support four key points:

- Initial compliance costs (especially accounting, auditing, and contracts with providers and employers) will likely exceed the estimates that accompanied the regulation by a substantial amount for many health plans.

- Plans serving the individual and small-group markets are the most likely to be affected.

- There is no guarantee that the federal MLR rule will lower health costs and premiums. In fact, the incentives under the rule may lead to higher administrative costs, higher-cost benefits, and higher premiums.

- The rule could reduce the number of health plans competing in some markets. ahip hi wire.org Like Aetna and PacifiCare leaving the CA Individual Market

The rate review regulation process

Consumer Resources

- CMS.Gov on MLR

- Insure Me Kevin.com – How are premiums determined 3.9.2017

- Patient Protection and Affordable Care Act (PPACA)

- Government Tool to find out about Rate Increases or Loss Ratio for each Insurance Company

- health care.gov FAQ Value for Premium $$$

- Health Net paid the minimums in 2011 and will not be sending rebates Aetna met minimums in CA

- YouTube Channel

- Blue Cross Memo on MLR – Medical Loss Ratio’s

#Insubuy Travel Health Insurance

Instant Quotes, Details and ONLINE Enrollment

Steve talks about International Travel Insurance VIDEO

US State Department - Travel - Insurance

Our webpage on Travel Insurance

#Code of Federal Regulations (CFR)

PART 158—ISSUER USE OF PREMIUM REVENUE: REPORTING AND REBATE REQUIREMENTS

Visit prior versions of this page HISTORICAL on Archive.org

https://www.youtube.com/watch?v=iO4rhE9JQe8