Covered CA (& Medi Cal) - Calculate - #Countable Sources of MAGI Income

Short Summary

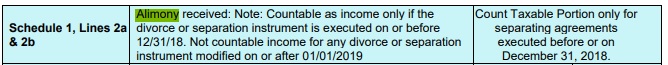

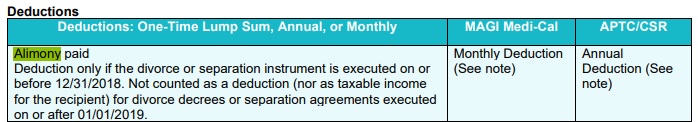

Is alimony taxable – MAGI Income Schedule 1 Line 2a for Covered CA Subsidies?

Introduction

Alimony might count as MAGI income as it’s on line 2a of schedule 1 which attaches to your 1040.

- The law relates to payments under a divorce or separation agreement. This includes:

- Divorce decrees.

- Separate maintenance decrees.

- Written separation agreements.

- In general, if you makes payments to a spouse or former spouse you can deduct it on your tax return. The taxpayer who receives the payments is required to include it in their income.

- Beginning Jan. 1, 2019, alimony or separate maintenance payments are not deductible from the income of the payer spouse, or includable in the income of the receiving spouse, if made under a divorce or separation agreement executed after Dec. 31, 2018.

- If an agreement was executed on or before Dec. 31, 2018 and then modified after that date, the new law also applies. The new law applies if the modification does these two things:

- It changes the terms of the alimony or separate maintenance payments.

- It specifically says that alimony or separate maintenance payments are not deductible by the payer spouse or includable in the income of the receiving spouse.

- Agreements executed on or before Dec. 31, 2018 follow the previous rules. If an agreement was modified after that date, the agreement still follows the previous law as long as the modifications don’t do what’s described above.

Jump to section on:

| Child Support |

IRS Publication # 504

#Divorced or Separated Individuals

pdf * (HTML)

- Community Property – Publication 555

- QDROs The Division of Retirement Benefits Through Qualified Domestic Relations Orders Dol.gov pdf

- Publications Dol.gov

- CA Court Self Help Website – Divorce

-

Dependent Care Benefits Publication # 503

- Nolo - Child Support & Custody

- Automatic Restraining Orders prohibiting changing insurance once divorce is filed fl 110

- AB 1297 Automatic temporary restraining orders Effective 1/1/2026

- Existing law blocks both parties from canceling or changing insurance policies, cashing in or borrowing against insurance or changing beneficiaries on insurance that benefits either party or their children.

- Effective Jan. 1, 2027, the law will also prohibit either party from letting insurance expire by not paying the premiums or failing to renew the policy. Sacramento Observer *

- Frequently Asked Questions for Declarations of Disclosure in California Wilkinson Esq *

#Adjustments to Income - Schedule 1

#Schedule1 1040

- Part I Additional Income

- 2a Alimony received

- 3 Business income or (loss). Attach Schedule C

- Get Health Quote for your business

- 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E

- 7 Unemployment compensation

- 8 Other income:

- a Net operating loss

- b Gambling income

- c Cancellation of debt

- d Foreign earned income exclusion from Form 2555

- e Taxable Health Savings Account distribution

- Part II Adjustments to Income

- 11 Educator expenses

- 13 Health savings account deduction. Attach Form 8889

- 15 Deductible part of self-employment tax. Attach Schedule SE

- Learn more about your Social Security Benefits

- 16 Self-employed SEP, SIMPLE, and qualified plans -

- 17 Self-employed health insurance deduction

- 19a Alimony paid

- 20 IRA Individual Retirement Account deduction

- 21 Student loan interest deduction

- Instant Business Health Insurance Proposals

All our Health plans are Guaranteed Issue with No Pre X Clause

Instant Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

- Watch our 10 minute VIDEO that explains everything about getting a quote

#Covered CA Certified Agent

No extra charge for complementary assistance

- Get Instant Health, Dental & Vision Quotes, Subsidy Calculation & Enroll

- Appoint us as your broker

- Get Instant Health Quotes, Subsidy Calculation & Enroll

Child & Related Pages

CA Court Website on Alimony – Spousal Support

[child-pages]

- VIDEO What is APTC Advance Premium Tax Credit

- Health Net VIDEO How to get subsidies – pay less for coverage

- Interactive Tax Assistant (ITA)

- Am I eligible to claim the Premium Tax Credit?

Tax #Estimators

- turbo tax.com - FREE for simple returns

- H & R Block

- E file.com

- Estimate the Subsidy for Health Insurance, benefits, premiums, etc.

- 8962 ONLINE Calculator

- Our webpage on 8962 Premium Tax Credit Reconciliation

- Tax Form Calculator.com

- e tax.com

- Marriage Higher or Lower Taxes?

ACA What You Need To Know #5187 (2020) is the most recent

- VITA - Volunteers to help you

- Publication 17 - Your Federal Income tax

- Health Savings Accounts HSA our webpage