Try turning your phone sideways to see the graphs & pdf's?

- Source - Covered CA

- Covered California’s Rates and Plans for 2025: The Most Financial Support Ever to Help More Californians Pay for Health Insurance Press Release 7/24/2024

- When Your Tax Return Income Makes You Medi-Cal Eligible Insure Me Kevin

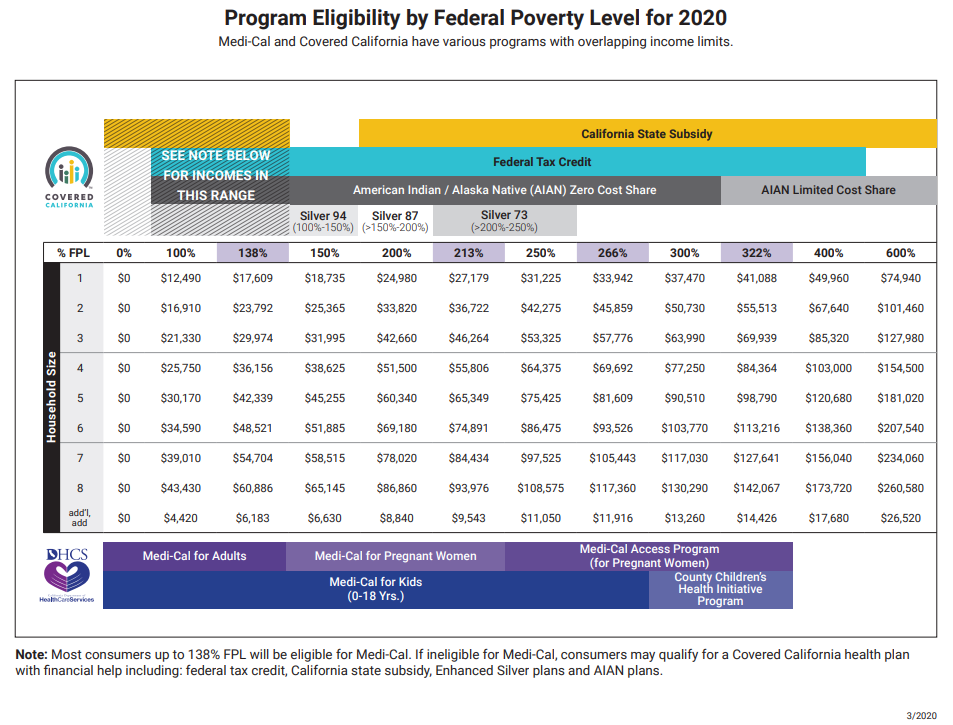

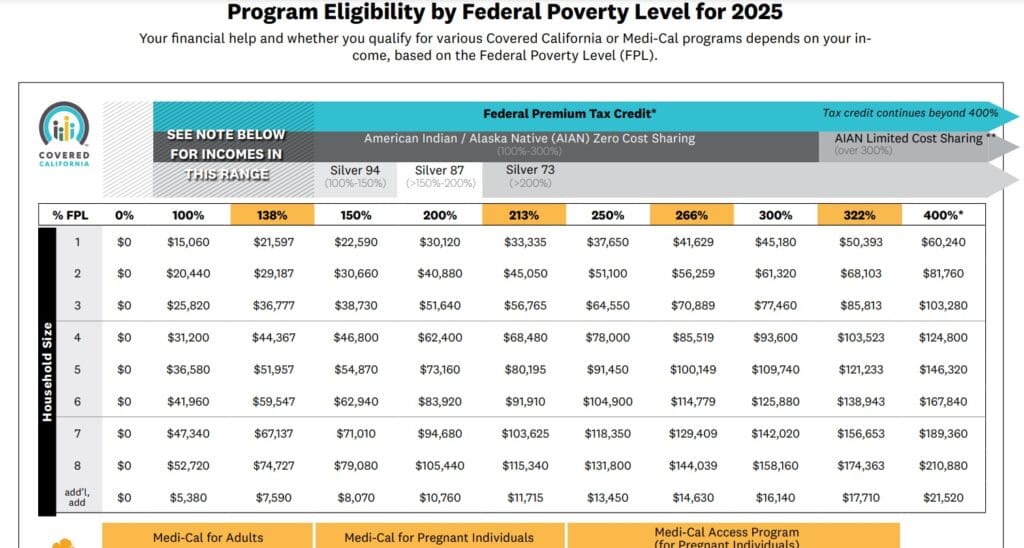

- American Rescue Plan of 2021 (APRA) aka Covid Relief Bill - MORE subsidies!

- See footnotes & FAQ's below!

- Divide by 12 for monthly Medi Cal Figure $1,731.91

Income Chart Footnotes

#FAQ ‘s, Explanations & More Details

Footnotes

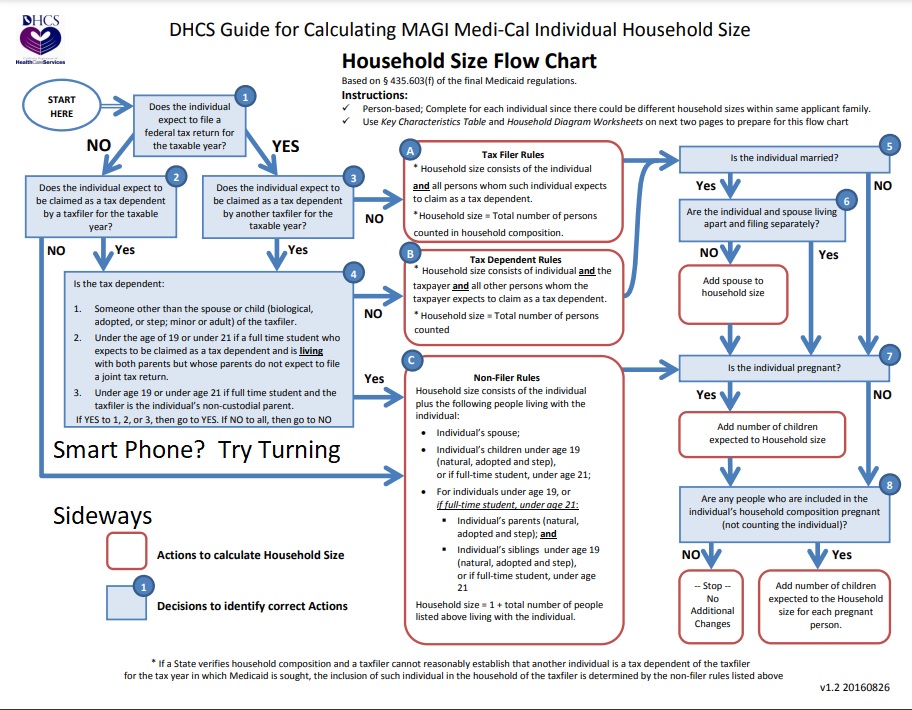

1 What is my Medi Cal or Covered CA Household Size– Definition

Try this Flow Chart for a simpler explanation

How many dependents are on your Tax Return? Section 151

Household Income includes all dependents on your return

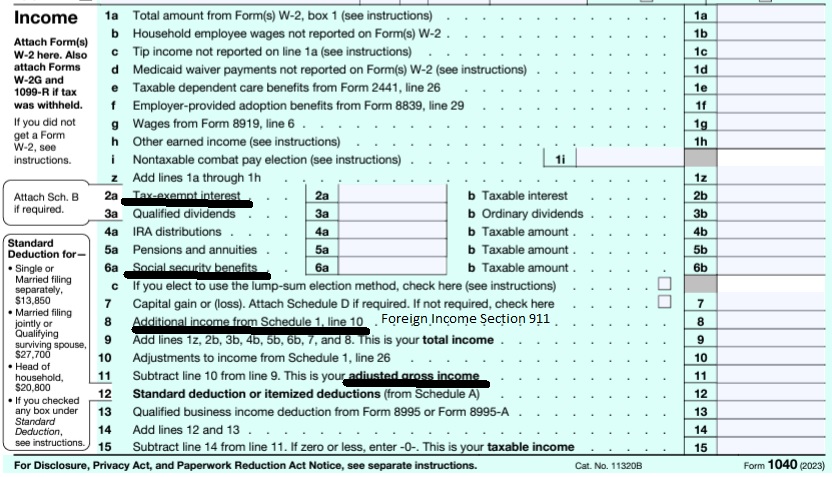

2 What is MAGI Modified Adjusted Gross Income – Line 11 AGI + Social Security, Tax Exempt Interest & Foreign Income

Tax Return Reconciliation of Subsidy is on 8962 at the end of the year

4 MAGI based Medi-Cal One can get FREE Medi-Cal base on MAGI Income Line 37 of your 1040 – If your income falls below 138% of the CA Poverty Line on the chart above. There is no longer an asset test, nor estate recovery.

Medi-Cal versus Covered California Income, Who Decides? Kevin Knauss

5 MAGI Medi-Cal for Pregnant Women

6 Medi-Cal Access Program If you’re pregnant – up to 322% of FPL – Formerly AIM

7 C-CHIP County Children’s Health Initiative Program in three northern CA counties

8 Kids under 19 go in Medi-Cal if MAGI Income is below 266% of Federal Poverty Level. While you can purchase coverage direct from an Insurance Company at Open or Special Enrollment, there is no PTC subsidy or premium tax credit.

Learn More ==> Western Poverty Page 72

9 Enhanced Silver – Cost Sharing 94, 87 & 73 – in addition to subsidies, you get lower deductibles & Co Pays. 94 is better than platinum which is 90 and 87 is better than gold which is 80 – metal level.

Silver 70 has a $2,500 Deductible and Standard Metal Levels, Bronze $5k deductible, Gold and Platinum $0 Deductible

10 Federal Poverty Level FPL My Coverage Plan.com – Definition

FPL gets adjusted annually, IMHO the best way to calculate is to Click here to calculate your premium assistance and get proposals

Federal Poverty Level (FPL): “An income level based on the official poverty line as defined by the federal Office of Management and Budget and revised annually or at any shorter interval that the Secretary of Health and Human Services deems feasible and desirable.” 22 CCR § 50041.5; see also 10 CCR § 6410

Subsidies now go to 600% CA Health Line *

Why Your Covered California Health Insurance Subsidy Dramatically Drops with an Income Increase Kevin Knauss

11 Use our free calculator to see how much subsidy and enhanced silver benefit you might qualify for. Less than 138% of FPL generally qualifies one for Medi-Cal.

Silver 94 – Under 138% Only if you can’t get Medi-Cal

12 Silver 94 – Under 138% Only if you can’t get Medi-Cal

13 Click here to calculate your premium assistance and get proposals

We are paid by Covered CA and the Insurance Companies to help you, when you appoint us as your agent NO CHARGE!

All our plans are Guaranteed Issue with No Pre X Clause

Quote & Subsidy #Calculation

There is No charge for our complementary services

Watch our 10 minute VIDEO

that explains everything about getting a quote

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- Get more detail on the Individual & Family Carriers available in CA

How to calculate MAGI Income

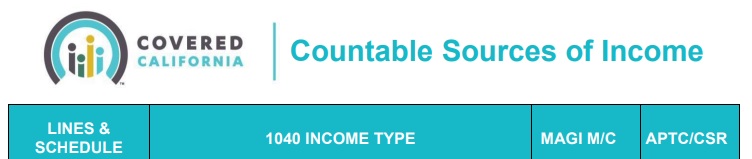

Covered CA (& Medi Cal) - Calculate - #Countable Sources of MAGI Income

Short Summary

Calculate your Covered CA MAGI Income

take #Line8b 11 Adjusted Gross income then add line 2a, 6a & 8 (Foreign Income)

- 1040 IRS Annual Tax Form

- Schedule 1 Additional Income & Adjustments to Lower your MAGI Income

- IRA Retirement

- Health Savings Account

- Trumps Big Beautiful Bill - may lower line 6 A Social Security Income Learn More >>> Newsweek * PBS *

- Estimate next years MAGI Income?

- Get instant quotes, subsidy calculation and coverages

- NO ASSET TEST for MAGI based subsidies in Covered CA or MAGI Medi Cal Qualification. Steve's VIDEO

- Nor is there a lien against your estate for Covered CA or MAGI Medi Cal

- Schedule 1 Additional Income & Adjustments to Lower your MAGI Income

- VIDEO What is APTC Advance Premium Tax Credit

- Health Net VIDEO How to get subsidies – pay less for coverage

- Interactive Tax Assistant (ITA)

- Am I eligible to claim the Premium Tax Credit?

- IRS FAQ on Premium Tax Credit

Tax #Estimators

FAQ’s & Medi- Cal

FAQ’s – on FPL Income Chart Frequently Asked Questions”

- In CA. What is the max income for children medical , family of 6?

- 266% of Federal Poverty Level. $86k – Higher in some counties under C-Chip. Use our complementary calculator.

- If my line 37 on my return is $40,103.. 3 people in house, i am only insured, 92656 is zip… I want blue shield Platinum, 90/10…can I get tax credits and if so how much?

- Get a complementary quote and subsidy calculation by clicking here. We do not know the dates of birth. We guessed at that information and you will get a ball park quote shortly. Based on total guess work, you may get $400 in tax credits and qualify for Silver 87. We suggest you take the Silver Enhancement rather than pay for Platinum. What is your reason for Special Enrollment, rather than waiting for Open Enrollment?

- I have a Anthem PPO 70 Silver plan. I have one dependent, therefore a household size of 3. I currently am receiving a subsidy of approximately 900-1000 per month based on a $60,000 income. If I were to make more money, where does the subsidy stop. I’m not sure how you figure a household size of three.

- Please enter your information into our complementary quote and subsidy calculator and just play with the household income, when you get your calculations. Our income chart isn’t fully accurate and it doesn’t show the lowest cost silver plan.

- I’m 66 years old My question is; if my income goes to about 16,000 do I qualify for Medi cal with no out of pocket expense including premium?

- Since you are over 65, I don’t believe you are eligible for MAGI based Medi-Cal since you now have Medicare, don’t you?

- Here’s our webpage on what Medi-Cal offers in benefits.

- Here’s our webpage on Medi-Cal eligibility for aged & disabled. Then see the CA Health Care Advocates Site for Medi-Cal qualification if you have Medicare.

- We don’t get paid to assist you to get into Medi-Cal. We can help you with a Medicare Advantage Plan Medi-Medi though.

- I was wondering if you could possibly help me with some questions I have about medical and covered California income requirements…

- Please state your questions and we will reply. Telephone support is only available for those you have appointed us as their Covered CA agent – Instructions.

- Please get a free quote, FPL determination – Medi-Cal or subsidy calculation here. Then we can be more helpful on whether you qualify for enhanced silver 94.

- Here’s the definition of what counts as MAGI income.

- 1. I have two children with my boyfriend and I am not employed at the moment. 2. We were told that myself and the kids were covered under medi-cal but my boyfriend is not because his income is too high. 3. I was wondering if this could be because I claimed the children on this past years taxes? 4. I have looked at the income charts and were well below as a family of 4 and qualify for food stamps so why not medi-cal?

- 2. Right, since you are not married, you would have two different 1040 forms and two different MAGI calculations.

- Your boyfriend can get FREE quotes and enroll in a Covered CA plan with us as his agent, assuming we can find a special enrollment trigger. Change in Income?

- 3. Use the FREE subsidy and FPL calculator with your boyfriend and the kids and see what happens.

- Do the kids qualify as dependents for your boyfriend under Section 152?

- 4. You are not a family of four. You’re filing two different returns right?

- Please contact Medi-Cal direct for further qualifications to get in there. I don’t get paid to enroll or assist with Medi-Cal.

- What about child support – Dependent Exemptions??

- 1. I am on disability retirement and my wife is still working, self-employed psychotherapist. 2. I get disability payments from Liberty Mutual (LM) which are not considered taxable income. 3. Our cobra ends at the end of April. 4. So I’m trying to continue with Kaiser but get the federal tax credit on the monthly premiums. 5. Both Kaiser and Covered California told me that without including the LM payments we would qualify for Medi-Cal, but I know we would be disapproved because we have investment savings that would disqualify us. 6. So, back to Covered California, they tell me go ahead and include the LM income so then I would qualify for the federal tax credits….was told that our total was just under the limit for 2 people of $63,720 so we qualify. 7. I go through the application online with them on the phone and we get to the point of choosing a plan, and nothing shows up for the federal credit amount…..it just shows the full monthly price for the plan I chose. 8. They went through the whole application again to make sure I didn’t make any errors, and they say its a glitch, that it should be showing a credit. 9. They send a report to their Resolution Team. Tonight I get an online notification saying that our total income is over the limit!! 10. Did the income limit get lowered, they don’t say. 11. Do you agree that the $63,720 is the correct income limit to be under to be able to get federal tax credit? 12. I know that Medi-cal disqualifies you for having too much assets, but does Covered California do that as well?

- 2. The big issue here is whether your non-social security disability – retirement income counts as MAGI Income – Line 37 of your 1040 + 3 other things – Foreign Income, Tax Exempt interest and Social Security Benefits. Click on the link for the EXACT definition.

- Do the Liberty Mutual Disability Payments show up on line 16 of your 1040? Anywhere on your 1040?

- For more information on whether Disability Payments are taxable check these links:

- Disability vs SDI State Disability

- Taxable vs Non Taxable Income

- IRS Publication 525 Taxable vs Non Taxable Income See page 17 the section on Disability Pensions.

- My interpretation, which I’m not allowed to give you, as I’m not a CPA or Tax Attorney is that your LM payments are showing up on line 7 of your 1040. Is that correct? Please check with competent tax counsel and respond below or email me privately as to what your line 37 Adjusted Gross Income will be for 2016.

- 3. Cobra ending will give you a special enrollment period.

- 5. I do not care what anyone says over the phone. Medi-Cal no longer has an asset test for Health Insurance Coverage under Health Care Reform. It’s all MAGI Income. Here’s a chart showing the income levels, Medi-Cal, Enhanced Silver and max amount for subsidies.

- 6. While you might be under the limit of $63,720 – 400% of Federal Poverty Level – there is a complex formula CFR 1.36 B that tells you exactly what the credit will be. It’s not a yes or no credit – it’s how much. Click here to use our FREE Quote Engine to calculate your credit.

- 11. Yes I agree, that’s what’s on the income chart. But it’s not a yes or no question. Use our Quote Engine to calculate.

- 12. Covered CA is basically just a sales agent for Medi-Cal. It’s the same rules. Assets are no longer relevant for Medi-Cal.

- If you don’t qualify for subsidies and even if you do, the premium would be deductible from your wife’s self employment on line 29 of your 1040.

- How about going direct to an Insurance Company using the quotes from our quote engine above so that we can get paid for helping you and being honest about referring you to tax counsel and official IRS publications as to whether your LM income counts as MAGI income. IMHO it does, thus Medi-Cal is off the Table anyway. Did your phone calls get you any actual reference materials or citations. If you have a complex claim, who will be there to actually help you? Here’s 15 reasons how we can be of help. How long were you on the phone with Covered CA & Kaiser? if by chance our quote engine and your CORRECT MAGI income estimate gets you subsidies. There is NO EXTRA charge for our help. Covered CA and Kaiser will pay us, so that they don’t have to hire as many telephone people.

- Please note also that if your income goes over 400% of Federal Poverty Level for 2016 you have to pay back all the subsidies! Learn more ===> Premium Tax Credit Form # 8962

- Publication 974 Premium Tax Credit

- Here’s where a guy had to pay back $13k as Covered CA said Social Security Income didn’t count.

- Ways to keep your income under 400% of poverty level. But do not even think of asking me to get involved in any shenanigans with you!

- Hi Steve,

Been meaning to respond and give you updates. First off, thank you so much for your response back then with great information! You were right on many points.

We ended up qualifying for Medi-cal because they don’t look at assets just “taxable” income. Since the LM disability income isn’t taxable we only had some dividend income and my wife’s small income (on our 1040) so we were under the limit to qualify us. We started 6/1 the day after cobra ended. It took a month, til 7/1, to get back on Kaiser again…Medi-cal through Kaiser. Had a health emergency on 6/9 and had to go to our neighborhood health clinic, but that lasted only a week fortunately.

I’m awaiting an appeal on SS disability (initial SSDI claim was denied in March). That, I believe, will be considered taxable income, right? If so that could then kick us off Medi-cal, but will have to cross that bridge if/when that happens. LM required me to apply for SSDI and then appeal too because if it is approved they won’t have to pay me as much (about 90% of what they’re paying me now). Thank you again Sara- Here’s the rules & details on MAGI calculation of Social Security Benefits

- Hi Steve,

My main question, that I can’t seem to find an answer to anywhere, is whether SS Disability income is considered taxable in the same way as SS retirement income is calculated. Everything I see is talking about SS retirement income, not disability income. Is there any difference when it comes to taxes?

Thanks,

Sara- Social security benefits include monthly retirement, survivor, and disability benefits. They do not include Supplemental Security Income (SSI) payments, which are not taxable Page 1, Introduction Publication 915

- I kind of hope they don’t approve the SSDI appeal. Not only will there likely be some of it taxed, but the non-taxable LM [Liberty Mutual] disability funds will be reduced, and we will be kicked off Medi-cal so will have to start paying something toward a covered california policy. A benefit, I guess, to getting SSDI, however, is that Medicare starts 2 years later and won’t have to wait til I’m 65 (so it’ll be about a year early for me).

- Check out our complementary quote engine, above right, to see what your subsidies and enhanced silver levels are, depending on your MAGI income. You should be able to get a much wider provider list, which is also in our quote engine.

- 1. I have Covered Ca plan since 2014, I am self-employed. 2. In 2015, my gross revenue was just short of $25,000. 3. I had to lend my business lots of money. 4. I have a 94 [Enhanced] Silver Plan and used to have a Silver 87 through Anthem. 5. I have to send in a Profit & Loss Statement [Schedule C] for 2015 and am worried I may not be able to keep my insurance. 6. What are your thoughts?

- 2 The question is, what number will you be putting on line 12 of your 1040 Business Income or Loss.

- 3. I don’t know where lending money to a business shows on Schedule C. See our Schedule C page for Official IRS Instructions or contact competent tax counsel. Here’s VITA which is run by volunteers and its free.

- 5. What will you have for line 37 MAGI Income?

- 6. If your income is too low, then you get FREE Medi-Cal. If you want private coverage, you can opt out of subsidies and pay the full price. Here’s our FREE Quote Engine. The quote engine will calculate subsidy and Medi-Cal qualification based on MAGI Income.

- Hi Steve— 1. I’ve CCed [redacted] (my wife), and [redacted] (my Mom, who has strong opinions re my healthcare) 2. For the last 2 years I’ve been on an [redacted] PPO through the [redacted] union. 3. On March 31 my coverage ended. 4. I’m trying to figure out how to best proceed. I would like a PPO (my Mom feels strongly that it’s a plan where I could be treated at a hospital of my choice out of state if I’d like). 5. Also, this year (for the first time) I’m filing my taxes jointly with my wife. 6. She has been on Medi-Cal due to her tax bracket, but we’re presuming that since we’re filing jointly now, she may be ineligible for Medi-Cal some point soon. 7. How does that work? How/when would we be notified? 8. Finally, I’m curious how your services work re payment. Will using your services cost me more money than going through the Covered CA marketplace? Thanks so much! Best, Jerry

- 3. That gives you 60 days to get new coverage – Learn More

- 4. Click here to get quotes from ALL companies, with and without subsidies, in and out of Covered CA.

- 7. The quote engine will give you a calculation of what plans your qualify for based on MAGI Income. Line 37 of your expected 2016 tax return. But that is simplistic – click on the click for exact definition of MAGI income. See also the income chart.

- You are supposed to notify Medi-Cal within 30 days of income or family status changes. You will hear from them if your wife no longer qualifies. I don’t get paid to do Medi-Cal. Here’s everything I have on Medi-Cal. When your wife gets notified that she’s losing Medi-Cal that gives her a special enrollment period. Also, there is a special enrollment period when one gets married.

- 8. I get paid from whatever insurance company you choose. The 10 minutes I spent answering your questions today – save them time and money. I would also hope that with my education, background and experience, you are getting better and more helpful answers here.

- Is the income limit for premium assistance based on the persons AGI (adjusted gross income) as I was told by the agent at Covered California ?

- That is very close and I would still give that phone representative the cigar, however it’s not fully accurate.

- First, the term is MAGI, Modified Adjusted Gross Income, which is AGI plus a few extra things for some people. Learn more on our MAGI page. Be sure to read carefully and never trust anything over the phone and without documentation. Here’s where Covered CA’s advise caused at $13k refund of all the subsides as they didn’t tell the client that he needed to add back in Social Security Income.

- Second, what you did last year is only a guide. The issue is what do you expect your CURRENT year MAGI income to be? Thus, if you earned say 20K last year as a single, sure you get premium assistance and enhanced silver benefits but if you earn over $47k you have to pay back all* the subsidies at tax time. That is why there is a rule to report income changes within 30 days.

- my income did not change from the number I used when I signed up; and it isn’t going to change this year either. They approved me for premium at that income but when I do my taxes- Im told I owe it all back…!

- Please when stating income, give more details.

- What was your MAGI Income, line 37 of your 1040 + a few extras for 2014 and 2015?

- What is your line 22 total income?

- How are you defining income?

- What was the reason your tax person said that you owe all the Advance Premium Tax Credit back?

- Do you get Alimony, line 11?

- Schedule C Business Income Line 12?

- Were you offered affordable coverage 9.5% at work?

- Are you claimed as a dependent on your parents tax return?

- Student Loans?

- Eligible for coverage on parents coverage? Spouses Coverage?

- Lawfully Present in the USA?

- Please co-operate, since we are not your agent and not getting paid to help you, by getting a FREE quote and subsidy calculation on our website, so that we have an idea of what your MAGI income is and what the subsidy should be.

- Covered CA states all over their website that they don’t give tax advise. One must read the OFFICIAL IRS Rules Publication 974 – 71 pages to get authoritative answers. Here’s where the wrong answer from Covered CA caused someone to pay back $13k as Social Security counts as MAGI Income.

- It’s a real shame that our government is so much like the emperor wears no clothes. I went to a seminar where our local congress person had a speaker give us WRONG information about how things were Pre Obama Care. When I raised my hand to correct her, the Congress Woman’s Aid and the other speaker told me that I must NEVER correct or interrupt a well respected Congresswoman’s Dog & Pony show!

- You are welcome to email me the relevant documents privately.

- Hi, i am currently on Medi-cal. i am about to turn 65 and will be required to register for medicare. How do the two work together? What will my choices for coverage be? What about the supplements? Thanks so much

- See our webpage on Introduction to Medicare

#My Medi-Cal

How to get the Health Care

You Need

24 pages

Smart Phones - try turning sideways to view pdf better

-

- More explanation

- Enroll with Benefits Cal

- What is Medi Cal - VIDEO

-

How to VIDEO

-

Medi-Cal Managed Care HMO – Health Care Options

- Benefits Cal is a one-stop-shop to apply for...

- Cal Fresh

- Ages 26 through 49 Adult Full Scope Medi-Cal Expansion regardless of immigration status

- Cal WORKs

- Medi-Cal

- CMSP (County Medical Services Program)

- Disaster Cal Fresh

- GA/GR (General Assistance and General Relief )

- Briefing — Medi-Cal Explained: An Overview of Program Basics

- chcf.org/medi-cal-explained/

- #BenefitsCal is a one-stop-shop to apply for...

- Medi-Cal

- County Medical Services Program (CMSP),

- Food Assistance - Cal Fresh (formerly known as Food Stamps)

- How to use Eat Fresh.org VIDEO

- Cooking & Nutrition

- California Work Opportunity and Responsibility to Kids (CalWORKs) or check their other website

- Medi-Cal

-

Here you can review and choose the HMO that you want to deliver your Medi-Cal health Care.

-

BIC Benefits Identification Card

https://insuremekevin.com/why-your-covered-california-health-insurance-subsidy-dramatically-drops-with-an-income-increase/

https://insuremekevin.com/medi-cal-versus-covered-california-income-who-decides/

https://youtu.be/VwvPWxEmWLI?si=-HRoBZSlDGMWGMgu

Our MAGI income for 2021 is $19k for a family of 3. We have business income of way more than that, so we should have Covered CA subsidies.

We don’t think you know what you are doing and we are going elsewhere.

Video Explanation

When you read the chart above, to get out of Medi Cal you need at least 138% of Federal Poverty Level. For a family of three that would be $30k. One could have million dollars in business income, but the number that count’s is line 31 of your schedule C net profit or loss which then gets added to Schedule 1 line 3 and then goes on your 1040 Line 10 A to get added to line 11 Adjusted Gross income for MAGI Income.

Pick Medi Cal HMO Plan

How to get out of Medi Cal to go to Covered CA

Subsidy Tax Fraud???

Verify subsidy at the end of the year pay back or get tax refund

Western Poverty Law – on tax credits...

I won a labor case and received $12,000 from my former employer and my attorney received $6,000 a total of $18.000

do i qualify for medical[sic] Medi Cal since i only receive $12,000 annually but on my 1099 they put 18k.

See page 4 of Covered CA’s list of countable income. You only count the taxable portion. That begs the question, how much is taxable?

Let’s check out Publication 525 Taxable & Non Taxable Income Page 31

See also:

Publication 4345 Settlements – Taxability

IRS.gov tax implications of settlements & Judgements

Sorry, your question is beyond our pay grade -ZERO, we don’t get anything for assistance with Medi Cal.

Try VITA volunteers in Tax Assistance

I’d just go ahead and apply for Medi Cal, let them figure it out. There is also MONTHLY Income qualification for Medi Cal!

According to my tax preparer my federal adjusted gross income is 11532,

Do i qualify for medical or any insurance available?

Yes, see the income chart at the top of this webpage.

I am applying for covered california and I have reduced income from the Korna and I am not sure how to apply –

my last year’s tax return and stuff is going to be way off and I haven’t filed yet anyway –

is this something you can help me with?

What would be the cost to me?

I am sure I qualify for a subsidy but not sure how to do it…

First thing is to get a no obligation quote and subsidy calculation

2nd – if you’ve already started a Covered CA application, appoint us as your agent here. NO EXTRA CHARGE – we get paid from whatever company you select.

What is your expected MAGI Income for 2020? That is, adjusted gross income line 8b and add back in a few things if you have that.

What health insurance do you have now?

There is no extra charge for our services. I wish Covered CA would state that in their advertising!

Use our quote engine and then we can see what kind of subsidy you might get.

When you apply for Covered CA you promise to file a tax return.

After you get your quotes… we can set a Zoom Meeting https://steveshorr.com/intro/set-a-meeting/

I’m assuming these are gross income figures – not after tax withholding?

Please, follow the links that we gave you. We’ve added a “Short Form” definition of MAGI Income as #14 above. If you won’t take the time to click the link, just scroll up. We do not like to “summarize” the law. It may get us into misunderstandings or legal difficulties.

I have several questions before submitting our Medi-Cal renewal redetermination application:

1. Will my 19 year old who is a full time college student living at home and is claimed as a dependent on my husband and my tax returns be still eligible under our medi-cal account?

2. What is the income threshold for a family of 5 or if he counts as part of our family, then what is the income threshold for a family of 6?

3. Do assets and bank savings count in the eligibility determination?

If so, what is the max we can have?

If so, Will money in kids custodial savings accounts count as an asset?

4. We have a small business that hasn’t made money. It is an S Corp.

Will a paystub from our own company count as income verification?

19 year old College Student — See the chart and rules on our page about dependents… If you have more questions, ask there.

Near as I can tell, I don’t get compensated to help people with Medi-Cal and I get no training, other than having attended a public university – he would be covered under your account.

Income thresholds…

No

Assets – Bank Accounts?

Paystub? What about your other income?

Did you need a term life insurance quote?

Could you please help us to determine what option would be available at this point for health insurance for one person household with salary of $27,949 in 2018 and less than $10,000 in 2019 living in 92604

You can get quotes and subsidy calculations here.

Since your MAGI income is less than 138% of FPL Federal Poverty Level you won’t qualify for tax subsidies, but will qualify for no premium Medi Cal, under MAGI Income Rules.

When your income increases, you’re mandated under Medi Cal to report within 10 days and under Covered CA within 30 days. When your income goes over 138% Medi Cal will notify you and then you can get a special enrollment into Covered CA with subsidies. We can help you with that, at no extra charge. Just appoint us as your agent.

You’re past earnings are not really relevant. It’s what you expect to earn in 2020. That’s what will be on your taxes, when you file your 1040 and 8962 Subsidy Reconciliation.

This page shows the Managed Care Providers This page shows the benefits of Medi Cal. See the links there on Dental & Vision.

Apply for Medi Cal in Orange County here

You said that my friend does not make enough for her and the baby to be on blue Shield so we are going by what you said. That is why we did not list the baby on the Covered CA application. We do not want the baby on Medi-Cal.

We do not allow clients, web visitors or prospects to quote what we said, or worse yet, what you think we said. What we said or what you think we said doesn’t count. It’s what the law, regulation, case law or actual brochure says. You may only cite those going forward.

Medi-Cal offers a Blue Shield option. Talk to your Social Worker about it. We don’t get paid to help you with Medi Cal.

Please take another look at the income chart above. Please note that the subsidies, qualification, etc. go by household size. So, if the baby isn’t listed, then we only have a household of one.

We do not need any hassles with household members going uninsured. It’s not Open Enrollment and Covered CA’s interpretation says that going into Medi-Cal is NOT a loss of coverage. Thus, the baby can’t get individual coverage till January. We are not willing to be party to this lawsuit waiting to happen.

We are not willing to engage in any possible tax fraud or allegation.

Also, we do not deal with 3rd parties when the person who wants coverage is a competent adult.

So, please, would stop getting in the middle and have the client, fill out the application properly, including all family members, so that we can upload all the information to your Covered CA account and make sure the information in the online portal is correct.

Even if the baby gets enrolled in Medi Cal, you can have a private plan, that you will not get subsidies on and Medi Cal.

I’m making more than 600% of Federal Poverty Level, per chart above.

Does that me I can’t have no longer eligible Covered CA anymore?

Does that mean I have to get new coverage?

Can your Certified Agency help me either stay with Covered CA or get coverage direct with an insurance company?

There is no maximum income for Covered CA.

They might ask for income documents though.

If you are already with Covered CA, I suggest you just stay there, no hassle in filling out a new application. Automatic renewal, etc.

Note, if your income goes down unexpectedly during the year, you can’t get back into Covered CA unless you’re already there….

Covered CA and Direct are pretty much mandated to be the exact same coverage, guaranteed issue and premium. One caveat, due to a court case… The subsidies for enhanced silver… didn’t work out. So, if you want a Silver Plan and are not getting subsidies, the premium is less if you go direct to an Insurance Company.

See link above to get quotes. Covered CA and the Insurance Companies pay us, so there is no charge to you for our expertise.

The 2020 FPL’s are forecasted FPLs. Until the Feds actually release the FPL numbers, sometime in January 2020, these are just estimates. I assume they were used to forecast the potential subsidy amount. Also forecast are the numbers of people who would

a. Qualify for the subsidy., and

b. Those who will actually take advantage of it.

I am very skeptical they can actually deploy the subsidy for 2020. That would be asking FTB to develop a whole new system and software for the accounting, from scratch, to have it in place for Jan 2020.

What’s this about the subsidy qualification amount increasing to 600%?

See our new page on the Mandate Penalty and Increase to 600% of FPL

I don’t understand the chart above where it lists number of people in the household going down and FPL Federal Poverty Level percentage across with amounts in the middle.

What does the amount represent?

Max Min ?

The dollar amount on the chart represents what one expects to earn as MAGI Income for the upcoming year. Namely, adjusted gross income + Social Security, Foreign Income and Tax Exempt interest.

If one is less than 138% of federal poverty level and a family of one, or $16,754 MAGI income, you would go Medi Cal. If your income is over 138% or $16,754 up to 250% or $30,350, not only do you get subsidies, but they give the the Silver Plan lower co pays, deductibles, etc. Click here for more details on enhanced silver aka CSR Cost Sharing Reductions.

If you are over 250% of FPL you get subsidies, but not the lower deductible, co pay, etc. The easiest way to figure all this out is just to play with our quote engine.

Please note, the screen shot is only an EXAMPLE. Please use our quote engine and get your own individual – private quote.

I’m just confused because it seems you are looking primarily insurance that falls under covered California which is means tested.

I don’t qualify for that this year.

When I emailed you, why do you ask so many questions about my income?

We want to make sure that you have a plan and payments that best suit your needs. We didn’t do all the education just to have you order any old policy. We consult with you and make sure it fits your needs with what is available in the marketplace. We do grant, that our time is limited and those wishing to use our services, must be internet savvy enough to fill out the affiliate enrollment application on their own. We didn’t get all the education and build this extensive website to do clerical work.

The average person might not know if they qualify for subsidies. The term MAGI income can be quite complex. The new tax forms don’t have a line 37 AGI Adjusted Gross Income anymore. AGI is NOT MAGI!

Don’t forget, President Trump said insurance was very complicated! Scroll down to see video.

Means tested is a big word for us… I’m not sure it’s the correct one…

A means test is a determination of whether an individual or family is eligible for government assistance, based upon whether the individual or family possesses the means to do without that help. https://en.wikipedia.org/wiki/Means_test

This just goes to show how complex it all is and why we assist people even if they think they know more than us or even if they actually do.

Note also the 200% increase in subsidy eligibility for 2020!

My wife and I are here on a Visitor Visa. She’s pregnant and due soon. We are a family of 4 with foreign income of $70k from my job. What coverage can we get for her.

We will answer that question on our lawful presense page http://bit.ly/2C13ugO

Plain English explanation of health insurance how it works and health claims are paid by Oscar insurance

https://www.hioscar.com/news/how-health-insurance-works-cost-structure/?utm_source=social_paid&utm_medium=fb_cost_sharing&utm_campaign=CA4

we are a family of 4 our in come ranges between 4,500-5,000 per month . what health plan best suits us and will it be expensive?

Here’s an excerpt of the chart above as it applies to your situation.

Your family would qualify for Silver 73, with the kids on Medi-Cal.

We write with all carriers in CA. There are 19 different rates areas for different zip codes.

You might want to take Bronze plan to save $$$.

The best way to see what plans are available to you, is to use our complementary quote engine with instant results!

Are we correct that we can purchase health insurance off of the exchange without premium assistance even though we fall into the Medi-Cal category?

Yes. Get quotes and enroll here.

Do you have the 2018 numbers for Covered California. I can only find 2017 on the internet.

I can’t find a new table either. The best way to find out what program and subsidy you qualify for is to use our free, no obligation quote engine, which will have all rates & benefits for all companies starting tomorrow 11.1.2017 for 2018.

Here’s the 2018 Federal Poverty Levels from Covered CA’s August 2017 preliminary information for 2018.

What is the max [maximum] income that a family of 4 can make and still qualify for L. A. Care?

Do you mean on Medi-Cal or with Covered CA subsidies? Click here and get a complementary proposal, benefits and subsidiy calculation. Note that Medi-Cal is 138% of FPL for the whole family. If you are above that, the parents can get Covered CA with enhanced silver and subsidies, while the children stay on till 266% of FPL. In certain northern counties till 322% of fpl. Again, the best way to see is getting the free quote. Even if you don’t qualify for Medi-Cal, with subsidies, the premiums are VERY low!

With a income of 22,818.00 a year what does cover ca pay on a health net silver 87 plan, and what do I pay out of pocket.

Click here for a complementary proposal which will include subsidies, enhanced silver level, policy benefits and your net premium.

My question is about my mom, who is both a senior and disabled.

She is currently receiving Medi-Cal aid since she requires a significant amount of home care during the day and early evenings.

What is the income level for her to receive 100% Medi-Cal benefits for home care.

Rather than the rate based on a “cost-sharing reduction”.

How old is your Mom? It sounds like she might qualify under the Aged & Disabled Program. Please review that and if you have further questions, ask on that page.

Does she have Medicare?

i am having a hard time trying to see if i can get medi-cal. i dont understand most of those charts. i am 60 years old drawing ssi – Supplemental Security Income from my deceased husband. i make 18,588.00 a year, i cant work and i am trying to get on disabilty. but not went through yet. can you send me to the right web site, or tell me if i can get it?

The first thing to do is get a quote by clicking on the icon that says 1 to 3 get a quote and you’ll see what you subsidies and available benefits are the deadline is Monday however if you get covered California through an authorized agent like us they’ve extended it February 4th

Here’s our website on Social Security Disabilty.

If you are on SSI, you should automatically be eligible for Medi-Cal.

Thank you very much for posting a more direct reply to Vonnie’s question. Here’s the citations for automatic qualification.