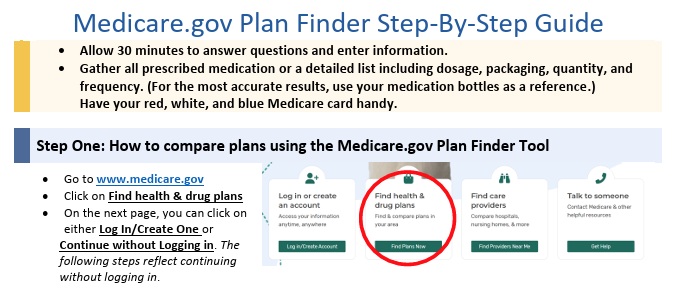

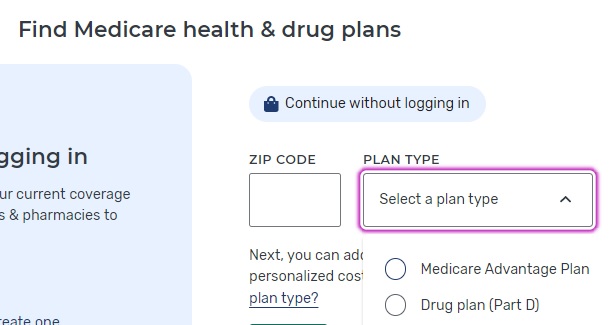

Instructions to Use Medicare.Gov Plan Finder

Medicare.Gov How to use the Shop & Compare Tool

Part D Rx Prescription plans?

- Medicare.Gov Plan Finder Instructions

- Scroll down for FAQ's, instructions and how we can help you navigate Medicare. It's better to create an account and log in. That way your Rx gets saved and/or automatically listed.

How to use the Rx & Plan Finder

- How to Create a My Medicare.Gov Account

- That way your Prescriptions Rx are automatically populated

- Our email is encrypted sending & receiving by Paubox.com

Prescription Drug 2025 #RxGuide

PDF # 11109

*****************

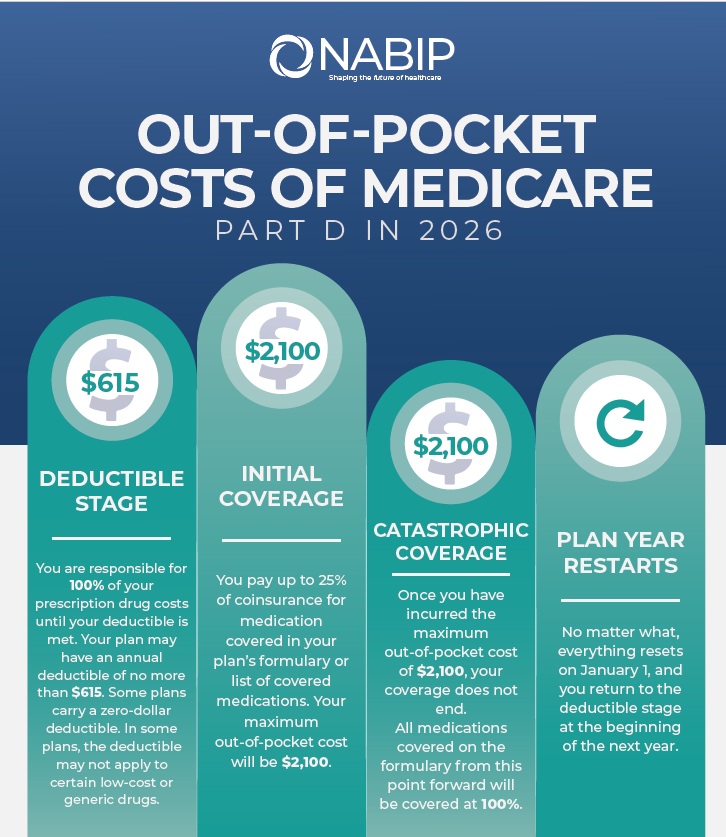

No more Coverage Gap - Donut Hole $2,100 Cap

******************

- Medicare Part D Rx premiums can be found on Medicare . Gov See instructions on how to shop premiums.

- Scope of appointment - permission to discuss Rx and MAPD Plans

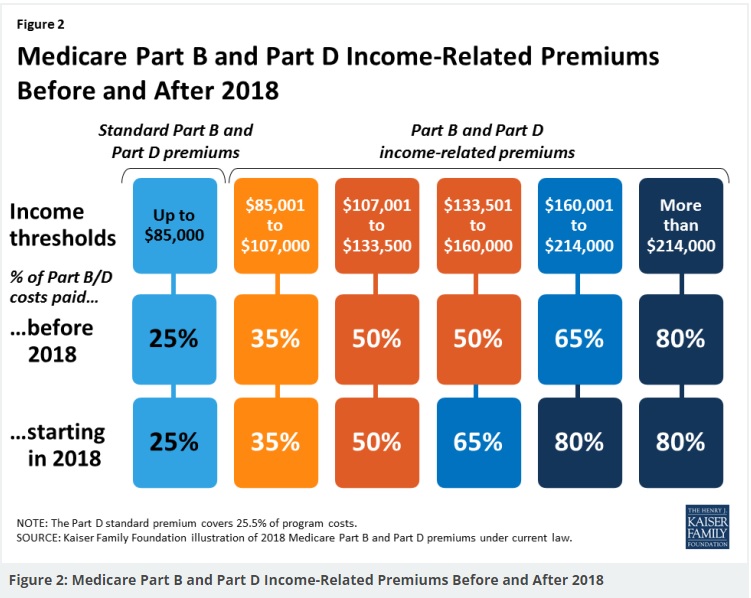

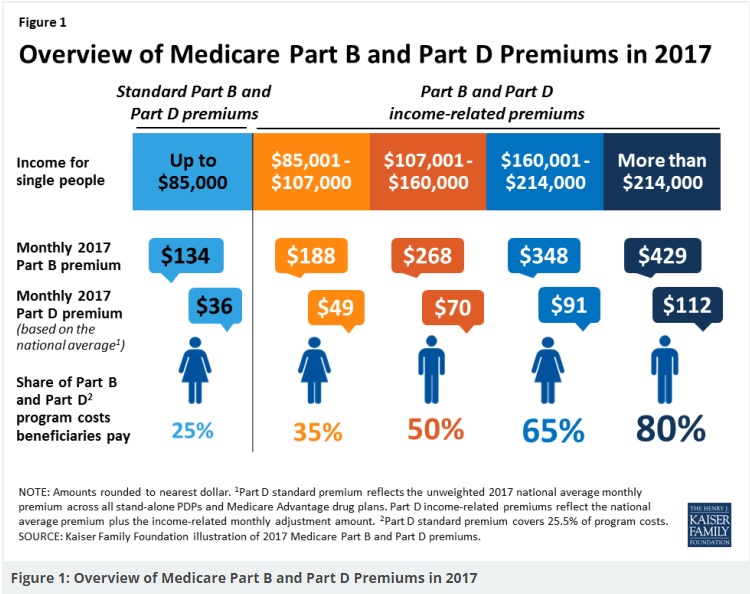

- Our Webpage Premiums for those with High Income Parts D Rx & B Doctor Visits

- Medicare Rules for High Income People Medicare Costs # 11579

- Our #High Income Surcharge Video Explanation

- Kaiser Foundation Introduction - Overview

- Fact Sheet Medicare Part D CA Health Care Advocates Hi Cap

-

. Prescription Drugs Hi Cap

- Medicare Part D: An Overview – 10-31-23

- Prescription Drug Resources – 11-07-22

- When Your Part D Prescription is Denied– 11-22-22

- Shop & Compare Tools Part D Rx

- Get Instant Quotes, Information & Enroll online

- See our web page on Part D Shop & Compare for more information & FAQ's

- MANDATED wording!: ‘‘We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1–800–MEDICARE to get information on all of your options.’’ § 422.2267(e)(41).

- We disagree with the above wording, as we can use the same tools on Medicare.gov as they do!

AI Generated

Key reasons for the commission cuts

- Reclassifying “compensation”: In an effort to curb deceptive marketing practices, CMS issued new rules that went into effect in 2024, redefining what counts as agent compensation. The changes eliminated supplemental payments, sometimes referred to as “administrative fees” or “overrides,” that insurers previously paid to third-party marketing organizations (TPMOs) for additional services beyond a base commission.

- Centralizing control: The rule aimed to create a fixed compensation structure for agents, regardless of which plan a beneficiary enrolls in. This would prevent financial incentives that could lead agents to steer beneficiaries toward one plan over another based on higher payouts. [8, 9, 10, 11, 12]

- Limiting growth: Some insurers are cutting commissions to slow down their enrollment numbers. This typically happens when a company has enrolled a large number of people in a plan and becomes concerned that rising medical costs will hurt profitability.

- Managing costs: As medical utilization and costs increase, many insurers are prioritizing profit margins over enrollment growth. Cutting agent commissions is one way for companies to reduce their overall expenses.

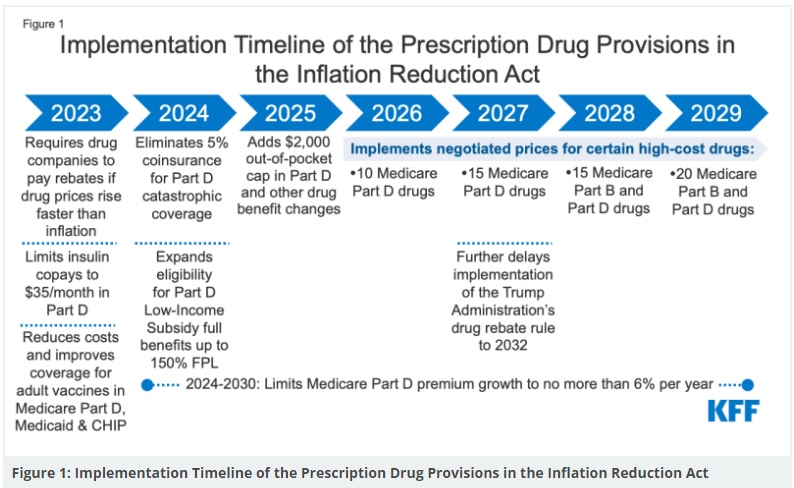

- Responding to inflation: Regulations like the Inflation Reduction Act have also placed cost pressure on carriers, prompting many to find ways to restrict sales of certain products. [3, 6, 13, 14, 15]

- Legal setbacks: The CMS rule that sought to limit compensation was challenged in court, and enforcement of the rule was paused in mid-2024. However, this legal uncertainty has led some carriers to continue reducing or eliminating commissions on their own. [16, 17, 18]

How this impacts agents

- Financial instability: Independent agents who rely on commissions are experiencing significant financial strain. Many have spoken out, arguing that the cuts devalue their expertise and threaten their ability to provide year-round service to beneficiaries.

- Reduced incentive for Part D: Historically, Part D plans have offered lower commissions than Medicare Advantage plans. The elimination of commissions makes it even less appealing for agents to assist with these plans, which are already complex for consumers to navigate.

- Negative effect on consumers: Without agent compensation, many agents are no longer able to assist with Part D enrollments. Critics argue that this leaves seniors, especially those needing expert guidance on complex prescription drug options, confused and underserved. [1, 19, 20, 21, 22]

Resources for agents

. You can learn more about their efforts and resources on the

.

Links & Resources

- medicare.gov/prescription-drugs-outpatient

- ritterim.com/2026-medicare-part-d-redesign-updates-agents-should-know

- Final CY 2026 Part D Redesign Program Instructions

- Fact Sheet: President Donald J. Trump Announces Actions to Lower Prescription Drug Prices

- Why Part D Rx Premiums are likely to increase in 2026

- increased use of some higher-cost prescription drugs;

- a law that capped out-of-pocket spending for enrollees; and

- changes in a program aimed at stabilizing price increases that the Trump administration has continued but made less generous. Learn More >>> Kff.org *

- What to know about Medicare’s true out-of-pocket (TrOOP) costs

- Ask us about Medicare Advantage, where Part D Rx is usually included! [email protected]

- 3 million will be greatly helped with $2k cap

- Guidance on Inflation Reduction Act’s Medicare Prescription Payment Plan Released July 2024 Medicare Rights

- Key Facts About Medicare Part D Enrollment, Premiums, and Cost Sharing in 2024 KFF

- Goodbye Medicare Part D Donut Hole; Hello $2,000 Cap Forbes

- insurance news net.com/no more part-d-commissions?

New 2025 Medicare Payment Plan

#Monthly vs $2k at one time or as needed

- ritter im.com/preparing-clients-for-the-new-medicare-prescription-payment-plan-program/

- In 2025 you will have the option to pay out-of-pocket prescription drug costs in the form of capped monthly payments instead of all at once at the pharmacy.

- cms.gov/medicare-prescription-payment-plan

- cms.gov/fact-sheet-medicare-prescription-payment-plan-final-part-one-guidance

- cms.gov/medicare-prescription-payment-plan-fact-sheet

More information & FAQ’s on Medicare Rx Plans

- Scope of appointment – permission to discuss Rx and MAPD Plans

- Our Webpage Premiums for those with High Income Parts D Rx & B Doctor Visits

- Medicare Rules for High Income People Medicare Costs # 11579

- Our #High Income Surcharge Video Explanation

- Kaiser Foundation Introduction – Overview

- Fact Sheet Medicare Part D CA Health Care Advocates Hi Cap

-

. Prescription Drugs Hi Cap

- Medicare Part D: An Overview – 10-31-23

- Prescription Drug Resources – 11-07-22

- When Your Part D Prescription is Denied– 11-22-22

- Medicare Rx Benefit Manual Rev 1.2016 83 pages

- Resources: Medicare Drug Coverage (Part D) Mini-Course & Podcast Series CMS

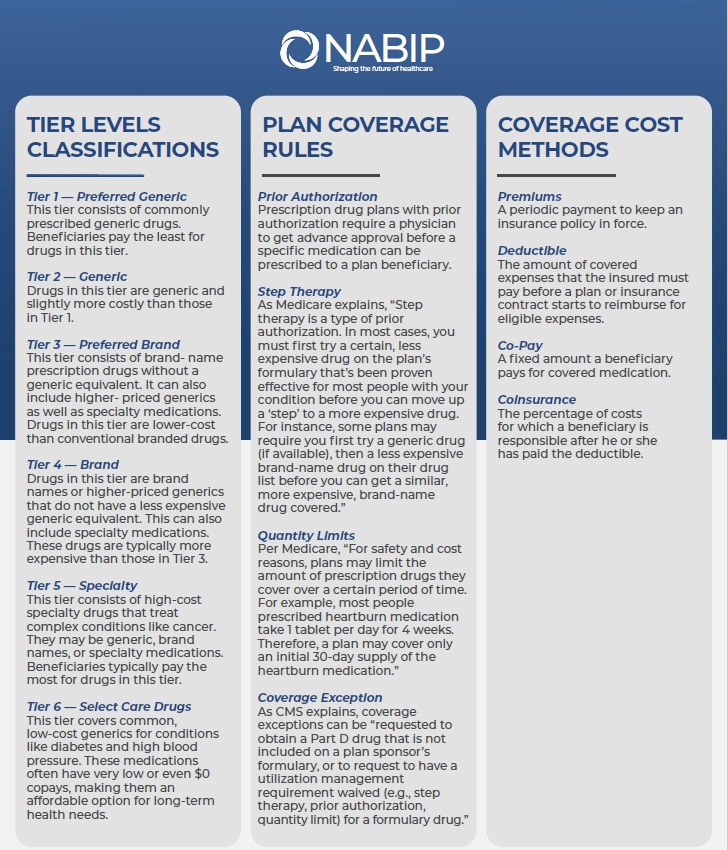

- Network Pharmacies, Formularies & Common Coverage Rules # 11136

- Insulin Maximum Co Pay $35

- Graphic on Part D Premium Increases & Why?

- Our webpage on Maximus Appeals LEP Late Enrollment Penalty

- Shop & Compare Tools Part D Rx

- Get Instant Quotes, Information & Enroll online

- MANDATED wording!: ‘‘We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1–800–MEDICARE to get information on all of your options.’’ § 422.2267(e)(41).

- We disagree with the above wording, as we can use the same tools on Medicare.gov as they do!

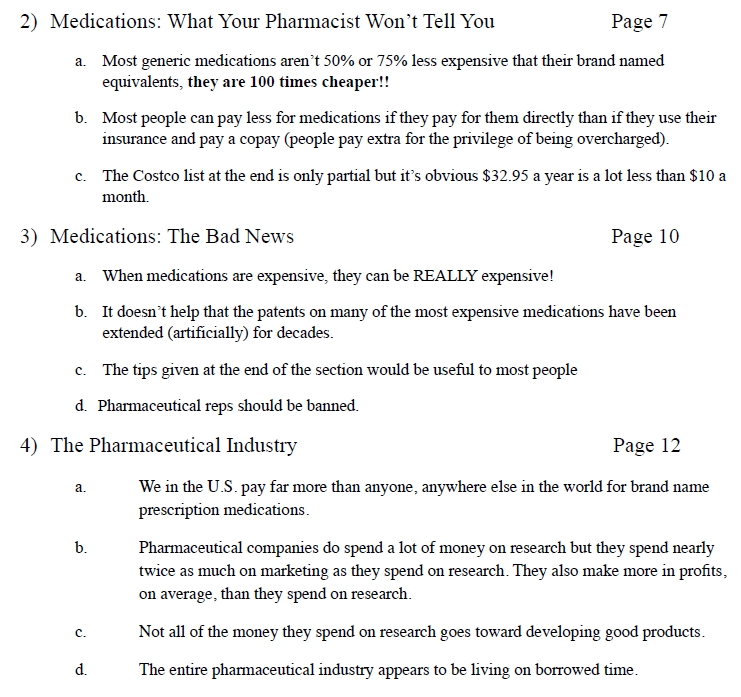

The True Cost of Healthcare

A View of Healthcare Costs from the Inside

David Belk MD

Edited by Paul Belk PhD

- “The Great American Healthcare Scam” by Dr David Belk VIDEO

- More articles by David Belk on Huffpost

- Heal-CA.org big pharma exposed

- On the other hand – Dr. Belk lost his license?

- Gross Negligence in treatment of a patient

- Yelp.com – Big Farma got him

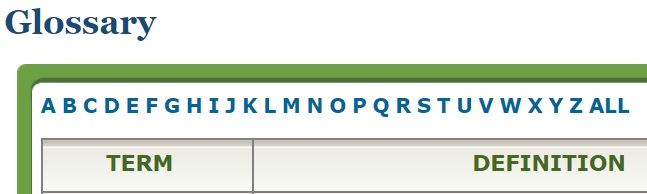

Medicare.Gov #Glossary

for Shopping Tool

Coinsurance

An amount you may be required to pay as your share of the cost for health care services or prescriptions after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).

Deductible

The amount you must pay for health care services or prescriptions each year, before your Medicare drug plan, your Medicare Health Plan, or your other insurance begins to pay. These amounts can change every year.

Dosage

The prescribed strength or amount of therapeutic ingredient(s) administered at prescribed intervals.

Drug Coverage

This tells you that a plan offers coverage of prescription drugs.

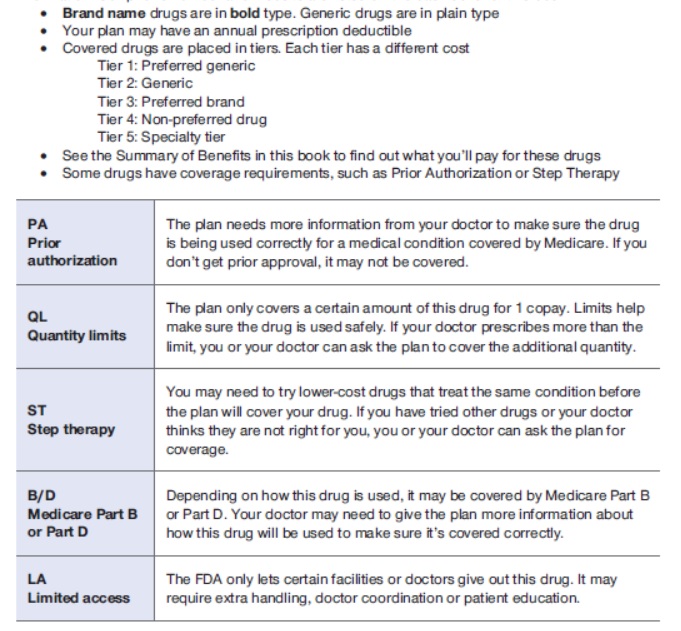

Drug Restrictions

The plan may have certain coverage restrictions (including quantity limits, prior authorization, and step therapy) on a prescription drug.

Example of Restrictions

Estimated Annual Drug Costs

This is an estimate of the average amount you might expect to pay each year for your prescription drug coverage. This estimate includes the following costs, as applicable:

- Monthly premiums

- Annual deductible

- Drug copayments/coinsurance

- Drug costs not covered by prescription drug insurance

If you entered your drugs into the Medicare Plan Finder, then this estimate includes the cost of those drugs.

If you selected “I don’t take any drugs,” then this amount includes only the cost of the monthly premiums that you would pay for the plan and it does not include any drug costs.

If you selected “I don’t want to add drugs now,” then this estimate includes the average drug costs for people with Medicare and may differ depending on your age and health status.

Your expenses may be lower if you have limited income and resources.

Formulary

A list of prescription drugs covered by a prescription drug plan offering prescription drug benefits.

Monthly Premium

The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. In a few cases, a note will say “Under Review” instead of a premium amount. This means Medicare and the company are still discussing the amount.

MTM Program

Medication Therapy Management (MTM) Programs

offer free services to eligible members of Medicare drug plans. These services help make sure that medications are working to improve their members’ health. Members can talk with a pharmacist or other health professional and find out how to get the most benefit from their medications. Members can ask questions about costs, drug reactions, or other problems. Each member gets their own action plan and medication list after the discussion. These can be shared with their doctors or other health care providers. Members who take different medications for more than one health condition may contact their drug plan to see if they’re eligible. Humana * Medicare.gov *

What are Star Ratings – Medicare Advantage

Medicare Part B Out Patient

Rx Drugs Covered

What types of Rx Drugs are Covered under Part B Doctor visits and then a Medi Gap plan?

- Part B covers certain drugs, like injections you get in a doctor’s office, certain oral cancer drugs, and drugs used with some types of durable medical equipment—like a nebulizer or external infusion pump.

- Under very limited circumstances, Part B covers certain drugs you get in a hospital outpatient setting. You pay 20% of the Medicare-approved amount for these covered drugs. Part B also covers the flu and pneumococcal shots. Generally, Medicare drug plans PDP cover other vaccines, like the shingles vaccine, needed to prevent illness.

- Medicare Part A (Hospital Insurance) or Part B generally doesn’t cover self-administered drugs you get in an outpatient setting like in an emergency room, observation unit, surgery center, or pain clinic.

- Publication 11109 Your Gidee to Medicare Prescription Drug Coverage Page 12 – above right on this webpage

- medicare.gov/prescription-drugs-outpatient

- Your Medicare Benefits – Prescription Drugs – Outpatient

- How Medicare Covers Self-Administered Drugs Given in Hospital Outpatient Settings Publication 11333

- Medicare Part B Home Infusion Therapy Services With The Use of Durable Medical Equipment CMS.gov

- What about an infusion at my doctors office of remicade (Infliximab) for Crohn’s or IBS Irritable Bowel Syndrome?

- Medicare covers most physician-administered drugs like REMICADE® under Medicare Part B. There are comprehensive published Part B coverage policies specific to REMICADE®. Copies of coverage policies (for example, local coverage determinations, or LCDs) are available on your regional Medicare Administrative Contractor’s, or MAC’s website.

- Medicare typically places few restrictions on REMICADE® coverage. However, some Medicare policies may limit coverage of REMICADE® to certain diagnoses, such as:

- Crohn’s disease

- Ulcerative colitis

- Rheumatoid arthritis

- Ankylosing spondylitis

- Psoriatic arthritis

- Plaque psoriasis

- You can check your regional MAC website for coverage policies for REMICADE® noridianmedicare.com/biologicals-injections or call Janssen Care Path at 877-CarePath (877-227-3728) for more assistance. janssen care path.com/

- What about:

- platelet-rich plasma (PRP) injections for osteoarthritis?

- No, it’s experimental, investigative and medical necessity issues – References Plain English Dr. Prpusa.com * Healthline.Com * CMS.Gov * Blue Cross MA *

- Corticosteroid injections for osteoarthritis of the knee: Mayo Clinic

- Yes, if Medically Necessary. References:

- Some of the things Medicare may require for a back pain treatment to be covered include:

- The treatment must be medically necessary

- Your pain must be of a certain level and/or duration (i.e., if the pain is chronic – lasting 6 weeks or more)

- You have tried less-invasive interventional treatments first (i.e., physical therapy) and they’ve been unsuccessful

- The treatment you receive to be done a certain way Learn More: * Dayton Orthopedic Surgery.com

- Cost range $85 to $149 Medicare.Gov Cost Tool

- Some of the things Medicare may require for a back pain treatment to be covered include:

- Yes, if Medically Necessary. References:

- Hyaluronic Acid (Injection Route) Cleveland Clinic

- Yes, but it’s complicated! Plain English LA Times editorial * Synvisconehcp.com * CMS.Gov * * Part B Step Theraphy Programs * John Hopkins Jurisdiction Specific Medicare Part B *

- platelet-rich plasma (PRP) injections for osteoarthritis?

More Detail & Info

Source – Note the graph isn’t for 2024…

- Graphic courtesy of KFF – Read more

- CMS Finalizes Payment Updates for 2025 Medicare Advantage and Medicare Part D Programs

- Part D Redesign Program CMS.Gov

- 2025 Part D Redesign Program Instructions Fact Sheet

- Changes to Medicare Part D in 2024 and 2025 Under the Inflation Reduction Act and How Enrollees Will Benefitorg

- Guidance on Inflation Reduction Act’s Medicare Prescription Payment Plan Released Medicare Rights.org

- kff.org/key-facts-about-medicare-part-d-enrollment-and-costs-in-2022

- You enter the donut hole when you and your plan spend a total of $5,030 in 2024.

- In the donut hole, you pay up to 25% out of pocket for all covered medications.

- You leave the donut hole once you’ve spent $8,000 out of pocket for covered drugs in 2024.

- 2024 is the last year for the donut hole. A $2,000 out-of-pocket cap takes effect for Medicare Part D in 2025. Nerd Wallet *

- kff.org/key-facts-about-medicare-part-d-enrollment-and-costs-in-2022

- healthaffairs.org/understanding-drug-pricing-package

- Medicare negotiating drug prices? Prepare for a letdown LA Times

- Merck is suing the federal government over a plan to negotiate Medicare drug prices, calling the program a sham equivalent to extortion. LA Times

- nbcnews.com/drug-prices-might-not-help

- cnbc.com/medicare-historic-new-powers

- khn.org/drug-pricing-measures

- centralmaine.com much-needed-step-toward-lowering-prescription-drug-costs

- california healthline.org/300-billion-medicare-drug-price-negotiation

- usa today.com/lower-medicare-drug-costs-seniors

- cnet.com/important-medicare-changes

- Medicare negotiating drug prices? Prepare for a letdown LA Times

- reuters.com/newly-launched-us-drugs-head-toward-record-high-prices

- webmd.com/have-sex-now

- Medicare Part D beneficiaries projected to pay lower out-of-pocket costs A provision in the IRA would ameliorate the out-of-pocket spending increases when people transition from commercial insurance to Part D. READ MORE

- 9 ways the Inflation Reduction Act affects Medicare coverage, and what it means for you Nerdwallet 8/2022

- Here are 25 Medicare Part D drugs that have skyrocketed in price

- Regulations Take Aim At Misleading Medicare Ads As Enrollment Opens

- BLUE SHIELD OF CALIFORNIA UNVEILS FIRST-OF-ITS-KIND MODEL TO TRANSFORM PRESCRIPTION DRUG CARE; SAVE UP TO $500 MILLION ON MEDICATIONS ANNUALLY

- Key Facts About Medicare Part D Enrollment, Premiums, and Cost Sharing in 2024 Kff

Parent, Child & Related Pages

https://www.medicarerights.org/medicare-watch/2025/09/25/final-rule-and-new-special-enrollment-period-will-aid-those-misled-by-provider-directories#:~:text=Important%20New%20Special%20Enrollment%20Period,that%20the%20directory%20was%20wrong.

https://www.cms.gov/files/document/application-medicare-part-part-b-special-enrollment-period-exceptional-conditions.pdf

https://www.cms.gov/files/document/cms-10797-application-medicare-part-and-part-b-special-enrollment-period-exceptional-conditions.pdf

https://youtu.be/uzBeYZh4BZc?si=hh0kipsDPLwOxDOO