Medicare.Gov Shop & Compare Tool

Part D Rx Prescription plans?

Doing away with Donut Hole and Maximum Co Pay

Links & Resources

- aarp.org 3 million will be greatly helped with $2k cap

- Guidance on Inflation Reduction Act’s Medicare Prescription Payment Plan Released July 2024 Medicare Rights

- Inflation Reduction Act 2025 Medicare Updates, what you need to know. Berwick

- Key Facts About Medicare Part D Enrollment, Premiums, and Cost Sharing in 2024 KFF

- Goodbye Medicare Part D Donut Hole; Hello $2,000 Cap Forbes

- insurance news net.com/no more part-d-commissions?

How to use Medicare.Gov to shop Rx plans

- Medicare.Gov Plan Finder for 2025

- Do not enroll on the Governments site, send us your results and we can enroll you

- Scroll down for FAQ's, instructions and how we can help you navigate Medicare. It's better to create an account and log in. That way your Rx gets saved and/or automatically listed.

Here's the webpages for the Part D Rx plans we are agents for.

How to use the Rx & Plan Finder

- How to Create a My Medicare.Gov Account

- That way your Prescriptions Rx are automatically populated

- Our email is encrypted sending & receiving by Paubox.com

-

- Our Webpages for more detail...

BE CAREFUL OF THE #SNAFUS !!!

- Medicare Drug Plan Prices Touted During Open Enrollment Can Rise Within a Month

- WellCare complaints - Pro & Con

- But instead of the $70.09 she expected to pay for her dextroamphetamine, used to treat attention-deficit/hyperactivity disorder, her pharmacist told her she owed $275.90

- “The [Medicare] Plan Finder is an outside source and therefore not reliable information,”

- We strongly urge that you use the "print" feature on Medicare.Gov and save your work! Also, check the website of the Insurance Company you want to use.

- Here's video instructions on how to use the print button 3 minute version 30 second version

- Here's video instructions on how to use the print button 3 minute version 30 second version

- We strongly urge that you use the "print" feature on Medicare.Gov and save your work! Also, check the website of the Insurance Company you want to use.

- The “Total Yearly Cost of Care” does not provide personalized or transparent information. For example, when a consumer inputs or changes personal data, such as drug information, his or her total estimated costs do not change. This is not mathematically possible based on the plan benefits. Additionally, the tool does not share what is included in the total cost. As a result consumers will likely see the total cost and assume they are receiving a personalized and tailored estimate which may not be accurate.

- The estimated total yearly cost of care is flawed. On a plan that has reduced benefits year over year, the expectation would be that the “estimated total yearly costs” would increase. However the tool is inaccurately estimating the consumer’s costs will decrease. It doesn’t make mathematical sense. For consumers on a fixed income and cost conscious, this could be detrimental to their situation.

- Most supplemental benefits are not included in the total yearly cost of care. Over the past several years supplemental benefits have expanded and provided members with options that not only treat, but prevent illness and increase quality of life. We know the high value of benefits such as vision, dental and hearing to our consumers, and they are a key way we are partners in care with our members. Some of the benefits that are not included are:

- Transportation lists copay but not number of rides.

- Eyeglasses list copay but does not share if benefit covers frames, lenses or contacts.

- Wellness Programs include a long list of possible items including fitness, nurse hotline, Personal Emergency Response and telehealth, that can’t be lumped into a single “covered” or “not covered” benefit. Excerpt from UHC Agent Memo * Forbes * GAO 7.2019 Report *

- No charge - Medication Review

Prescription Drug 2025 #RxGuide

PDF # 11109

*****************

Coverage Gap - Donut Hole $2,000 Cap

******************

- Medicare Part D Rx generally runs say $30 to $100. See link below for how to shop premiums.

- Scope of appointment - permission to discuss Rx and MAPD Plans

- Our Webpage Premiums for those with High Income Parts D Rx & B Doctor Visits

- Medicare Rules for High Income People Medicare Costs # 11579

- Our #High Income Surcharge Video Explanation

- Ways to pay your premium - See brochure above.

- Kaiser Foundation Introduction - Overview

- Fact Sheet Medicare Part D CA Health Care Advocates Hi Cap

-

. Prescription Drugs Hi Cap

- Medicare Part D: An Overview – 10-31-23

- Prescription Drug Resources – 11-07-22

- When Your Part D Prescription is Denied– 11-22-22

- Medicare Rx Benefit Manual Rev 1.2016 83 pages

- Resources: Medicare Drug Coverage (Part D) Mini-Course & Podcast Series CMS

- Network Pharmacies, Formularies & Common Coverage Rules # 11136

- Insulin Maximum Co Pay $35

- Graphic on Part D Premium Increases & Why?

- Maximus Appeals LEP Late Enrollment Penalty

- Shop & Compare Tools Part D Rx

- Get Instant Quotes, Information & Enroll online

- MANDATED wording!: ‘‘We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1–800–MEDICARE to get information on all of your options.’’ § 422.2267(e)(41).

- We disagree with the above wording, as we can use the same tools on Medicare.gov as they do!

New 2025 Medicare Payment Plan

#Monthly vs $2k at one time or as needed

- ritter im.com/preparing-clients-for-the-new-medicare-prescription-payment-plan-program/

- In 2025 you will have the option to pay out-of-pocket prescription drug costs in the form of capped monthly payments instead of all at once at the pharmacy.

- cms.gov/medicare-prescription-payment-plan

- cms.gov/fact-sheet-medicare-prescription-payment-plan-final-part-one-guidance

- cms.gov/medicare-prescription-payment-plan-fact-sheet

Sample Drugs Finder MS Multiple Sclerosis

Shopping with Multiple Sclerosis

Here’s the results of a hypothetical person with

#Multiple Sclerosis – High Cost Specialty Rx

See below and video above for more details on how to work the tools. If you prefer, you can email us [email protected] your medication list and we can do the comparisons for you. We do need you to set up a Social Security Account and send us the password, so that your Rx list gets saved.

Scroll up & down for definitions and instructions to use the Rx Plan Finder

More Assistance plans to help those who make too much $$$ for LIS Low Income Subsidy – Extra Help

Other High Cost Rx Enbrel – Humira – Remicade – infliximab

The True Cost of Healthcare

A View of Healthcare Costs from the Inside

David Belk MD

Edited by Paul Belk PhD

- “The Great American Healthcare Scam” by Dr David Belk VIDEO

- More articles by David Belk on Huffpost

- Heal-CA.org big pharma exposed

- On the other hand – Dr. Belk lost his license?

FAQ’s High Costs of #Specialty Drugs Rx

- Under Medicare Part D, $48 Billion Spent on Top 10 Drugs in 2021 Read More AJMC July 2023

- Will Ozempic bankrupt healthcare system? Many Americans need the drug, but providing it could cost Medicare billions LA Times

- What Rx plan might I get to cover Enbrel?

- Check Enbrel.com for their page on financial assistance.

- Do you have Medicare?

- 77% of prescriptions cost $50 or less per month 1, and the remaining 23% of prescriptions cost an average of $415 per month. 2,3,4,5

- 1 A one-month supply of ENBREL is typically 4 weekly 50 mg doses.

2 These data are based on paid claims data from national data providers for the period 1/1/2018 – 12/31/2018.

3 Your out-of-pocket costs can vary throughout the year depending on which phase of the Part D benefit you are currently in.

Medicare Part D drug coverage is divided into four phases, each with a different cost sharing amount. Those phases are - 1) Deductible,

2) Initial coverage,

3) Coverage gap,

4) Catastrophic. - 4 These amounts may vary if you are eligible for the Extra Help program.

5 Your actual cost may vary depending on your dose and insurance coverage. Talk to your insurance provider for specific information about your prescription coverage.enbrel.com/financial-support - See also rules about:

- Part D Rx plans having to cover 2 drugs in each therapeutic category

- Getting a formulary exception

- What about very expensive specialty drugs, like Humira? What about discount coupons?

- Cheaper competition for Humira is hitting the market, but savings will depend on your insurance Read More APNews *

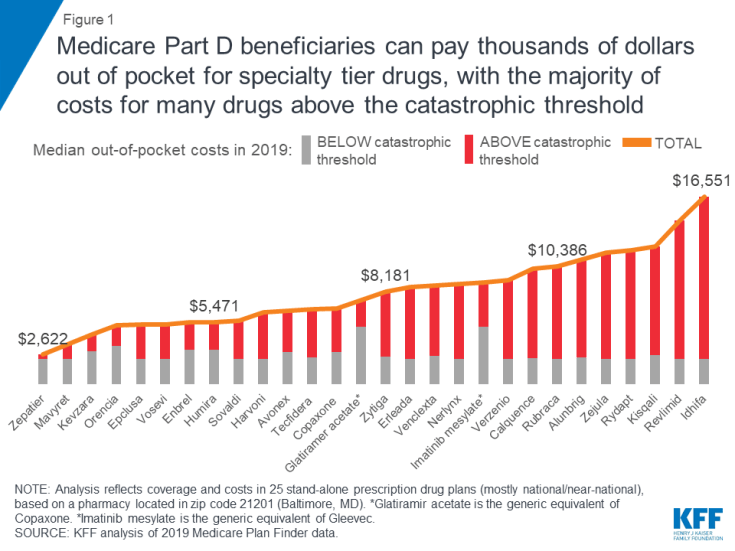

- Specialty tier drugs—defined by Medicare as drugs that cost more than $670 per month in 2019—are a particular concern for Part D enrollees in this context. Part D plans are allowed to charge between 25 percent and 33 percent coinsurance for specialty tier drugs before enrollees reach the coverage gap, where they pay 25 percent for all brands, followed by 5 percent coinsurance when total out-of-pocket spending exceeds an annual threshold ($5,100 in 2019). While specialty tier drugs are taken by a relatively small share of enrollees, spending on these drugs has increased over time and now accounts for over 20 percent of total Part D spending, up from about 6 to 7 percent before 2010.

- Medicare Part D enrollees not receiving low-income subsidies can expect to pay thousands of dollars out of pocket for a single specialty tier drug in 2019 (Figure 1). Median annual out-of-pocket costs in 2019 for 28 of the 30 studied specialty tier drugs range from $2,622 for Zepatier (for hepatitis C) to $16,551 for Idhifa (for leukemia), based on a full year of use; two of the 30 drugs are not covered by any plan in our analysis in 2019.

- With the now-complete closure of the Part D coverage gap for brand-name drugs, enrollees can expect to face lower annual out-of-pocket costs for selected specialty tier drugs below the catastrophic threshold in 2019 compared to 2016, but higher costs above—driven by an increase in underlying total costs between 2016 and 2019. For example, for Humira, for rheumatoid arthritis, median out-of-pocket costs below the catastrophic threshold decreased by $99 between 2016 and 2019 (from $3,155 to $3,057), while costs above the catastrophic threshold increased by $705 over these years (from $1,709 to $2,414)—and in total, expected annual out-of-pocket costs for Humira are $606 (12%) higher in 2019 than in 2016. Kff.org

- Can I request an appeal, formulary exception or anything to get a lower co-pay?

- new insurer tactic burdening chronic disease patients with higher out-of-pocket costs

- An exception request is a type of coverage determination. An enrollee, an enrollee’s prescriber, or an enrollee’s representative may request a tiering exception or a formulary exception.

- A tiering exception should be requested to obtain a non-preferred drug at the lower cost-sharing terms applicable to drugs in a preferred tier.

- A formulary exception should be requested to obtain a Part D drug that is not included on a plan sponsor’s formulary, or to obtain a formulary drug that is subject to a utilization management restriction (e.g., step therapy, prior authorization, quantity limit) which the enrollee or the enrollee’s prescriber believes should not apply.. cms.gov/Med Prescript DrugAppl Griev/Exceptions.

- Request for Coverage Determination

- medicare.gov/medicare-prescription-drug-coverage-appeals

- Our webpage on Appeals

- What about #ocrevus.com for MS Multiple sclerosis?

- List price is $65k/year!

- Here’s the Q & A from the manufacturer’s website

- With Medicare Coverage

- Your cost for a year of OCREVUS may range between $0 and $13,000. About half of patients pay $0.

- Your expenses may vary depending on your Medicare plan benefits, healthcare provider and location of OCREVUS administration. If you have Medicare Part B and supplemental insurance, (Medi Gap) most or all of your OCREVUS costs will be covered by the plan.

- Here are the limited times and deadlines in California, that you can get Medi Gap without answering any health questions!

- You Just turned 65

- If you are Under 65 note the 6 month deadline

- When you turn 65 you will get another enrollment period – as you’ve just turned 65. Premiums should go down.

- Get instant Medi Gap Quotes

- If you are not in CA – find a qualified agent, not a movie star.

- Here are the limited times and deadlines in California, that you can get Medi Gap without answering any health questions!

- If you have Medicare Advantage, plan designs and out-of-pocket expenses may vary depending on your other healthcare expenses and whether you have hit your out-of-pocket maximum. Check the EOC for details and use the shopping tool above.

- If you are unable to afford OCREVUS, you may be eligible for additional assistance through the Genentech Patient Foundation.

- Learn more ocrevus/how-we-help-you

- With Medicare Coverage

- So Medicare Part B would have a $233 deductible, then Medicare pays 80%. Plan G would pay the other 20%.

- Use menu above to find Plan G Evidence of Coverage or Summary of Benefits

- How is Part D coverage different from Part B coverage for certain drugs?

- It doesn’t cover most drugs you get at the pharmacy. You’ll need to join a prescription drug plan to get Medicare coverage for drugs for most chronic conditions, like high blood pressure.

- Part B covers certain drugs, like injections you get in a doctor’s office, certain oral cancer drugs, and drugs used with some types of durable medical equipment—like a nebulizer or external infusion pump. Under very limited circumstances, Part B covers certain drugs you get in a hospital outpatient setting. You pay 20% of the Medicare-approved amount for these covered drugs. Part B also covers the flu and pneumococcal shots. Generally, Medicare drug plans cover other vaccines, like the shingles vaccine, needed to prevent illness.

- Note: Medicare Part A (Hospital Insurance) or Part B generally doesn’t cover self-administered drugs you get in an outpatient setting like in an emergency room, observation unit, surgery center, or pain clinic. Your Medicare drug plan may cover these drugs under certain circumstances. You’ll likely need to pay out-of-pocket for the entire

cost of these drugs and send in a claim to your drug plan for a refund of the portion not covered. Call your plan for more information. Also, visit Medicare.gov for more information on how Medicare covers self-administered drugs you get in a hospital outpatient setting. Read More >>> Your-Guide-to-Medicare-Prescrip-Drug-Cov

- Note: Medicare Part A (Hospital Insurance) or Part B generally doesn’t cover self-administered drugs you get in an outpatient setting like in an emergency room, observation unit, surgery center, or pain clinic. Your Medicare drug plan may cover these drugs under certain circumstances. You’ll likely need to pay out-of-pocket for the entire

- ■ Injectable and infused drugs: Medicare covers most injectable and infused drugs given by a licensed medical provider if the drug is considered reasonable and necessary for treatment and usually isn’t self-administered. CMS.gov # 11315

- I don’t see remicade or infliximab on medicare.gov/find-a-plan/questions

- See our LIS page on ways, ideas and programs to get more assistance

- How Much Does Remicade Cost?

- A single dose of Remicade can cost from $1,300 to $2,500.

- The first step is determining insurance coverage for the infusion. Medicare does cover Remicade infusions. Most insurance companies require “pre-approval” for coverage. Therefore, the doctor’s office must explain to the insurance company what drug is being given, what other treatments have been tried, and why the new treatment is recommended (typically via a standard form). HMO coverage depends on the individual HMO and the particular agreement with the treating doctor. Any balance of the charges and/or co-pays should be understood prior to beginning treatment. remicade_for_rheumatoid_arthritis_treatment

- Health insurers have been increasingly cracking down on members’ use of high-cost biologic drugs, with UnitedHealthcare, Aetna and Cigna unveiling policies this year that force patients to switch to biosimilars or restrict the drug dosage an individual can receive

Medicare.Gov #Glossary

for Shopping Tool

Coinsurance

An amount you may be required to pay as your share of the cost for health care services or prescriptions after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).

Deductible

The amount you must pay for health care services or prescriptions each year, before your Medicare drug plan, your Medicare Health Plan, or your other insurance begins to pay. These amounts can change every year.

Dosage

The prescribed strength or amount of therapeutic ingredient(s) administered at prescribed intervals.

Drug Coverage

This tells you that a plan offers coverage of prescription drugs.

Drug Restrictions

The plan may have certain coverage restrictions (including quantity limits, prior authorization, and step therapy) on a prescription drug.

Example of Restrictions

Estimated Annual Drug Costs

This is an estimate of the average amount you might expect to pay each year for your prescription drug coverage. This estimate includes the following costs, as applicable:

- Monthly premiums

- Annual deductible

- Drug copayments/coinsurance

- Drug costs not covered by prescription drug insurance

If you entered your drugs into the Medicare Plan Finder, then this estimate includes the cost of those drugs.

If you selected “I don’t take any drugs,” then this amount includes only the cost of the monthly premiums that you would pay for the plan and it does not include any drug costs.

If you selected “I don’t want to add drugs now,” then this estimate includes the average drug costs for people with Medicare and may differ depending on your age and health status.

Your expenses may be lower if you have limited income and resources.

Formulary

A list of prescription drugs covered by a prescription drug plan offering prescription drug benefits.

Monthly Premium

The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. In a few cases, a note will say “Under Review” instead of a premium amount. This means Medicare and the company are still discussing the amount.

MTM Program

Medication Therapy Management (MTM) Programs

offer free services to eligible members of Medicare drug plans. These services help make sure that medications are working to improve their members’ health. Members can talk with a pharmacist or other health professional and find out how to get the most benefit from their medications. Members can ask questions about costs, drug reactions, or other problems. Each member gets their own action plan and medication list after the discussion. These can be shared with their doctors or other health care providers. Members who take different medications for more than one health condition may contact their drug plan to see if they’re eligible. Humana * Medicare.gov *

What are Star Ratings – Medicare Advantage

Medicare Part B Out Patient

Rx Drugs Covered

What types of Rx Drugs are Covered under Part B Doctor visits and then a Medi Gap plan?

- Part B covers certain drugs, like injections you get in a doctor’s office, certain oral cancer drugs, and drugs used with some types of durable medical equipment—like a nebulizer or external infusion pump.

- Under very limited circumstances, Part B covers certain drugs you get in a hospital outpatient setting. You pay 20% of the Medicare-approved amount for these covered drugs. Part B also covers the flu and pneumococcal shots. Generally, Medicare drug plans PDP cover other vaccines, like the shingles vaccine, needed to prevent illness.

- Medicare Part A (Hospital Insurance) or Part B generally doesn’t cover self-administered drugs you get in an outpatient setting like in an emergency room, observation unit, surgery center, or pain clinic.

- Publication 11109 Your Gidee to Medicare Prescription Drug Coverage Page 12 – above right on this webpage

- medicare.gov/prescription-drugs-outpatient

- Your Medicare Benefits – Prescription Drugs – Outpatient

- How Medicare Covers Self-Administered Drugs Given in Hospital Outpatient Settings Publication 11333

- Medicare Part B Home Infusion Therapy Services With The Use of Durable Medical Equipment CMS.gov

- What about an infusion at my doctors office of remicade (Infliximab) for Crohn’s or IBS Irritable Bowel Syndrome?

- Medicare covers most physician-administered drugs like REMICADE® under Medicare Part B. There are comprehensive published Part B coverage policies specific to REMICADE®. Copies of coverage policies (for example, local coverage determinations, or LCDs) are available on your regional Medicare Administrative Contractor’s, or MAC’s website.

- Medicare typically places few restrictions on REMICADE® coverage. However, some Medicare policies may limit coverage of REMICADE® to certain diagnoses, such as:

- Crohn’s disease

- Ulcerative colitis

- Rheumatoid arthritis

- Ankylosing spondylitis

- Psoriatic arthritis

- Plaque psoriasis

- You can check your regional MAC website for coverage policies for REMICADE® noridianmedicare.com/biologicals-injections or call Janssen Care Path at 877-CarePath (877-227-3728) for more assistance. janssen care path.com/

- What about:

- platelet-rich plasma (PRP) injections for osteoarthritis?

- No, it’s experimental, investigative and medical necessity issues – References Plain English Dr. Prpusa.com * Healthline.Com * CMS.Gov * Blue Cross MA *

- Corticosteroid injections for osteoarthritis of the knee: Mayo Clinic

- Yes, if Medically Necessary. References:

- Some of the things Medicare may require for a back pain treatment to be covered include:

- The treatment must be medically necessary

- Your pain must be of a certain level and/or duration (i.e., if the pain is chronic – lasting 6 weeks or more)

- You have tried less-invasive interventional treatments first (i.e., physical therapy) and they’ve been unsuccessful

- The treatment you receive to be done a certain way Learn More: UHC.com * Dayton Orthopedic Surgery.com

- Cost range $85 to $149 Medicare.Gov Cost Tool

- Some of the things Medicare may require for a back pain treatment to be covered include:

- Yes, if Medically Necessary. References:

- Hyaluronic Acid (Injection Route)

- Yes, but it’s complicated! Plain English LA Times editorial * Synvisconehcp.com * CMS.Gov * Aetna Clinic Bulletin * United Health Care Clinical Bulletin * Part B Step Theraphy Programs * John Hopkins Jurisdiction Specific Medicare Part B *

- platelet-rich plasma (PRP) injections for osteoarthritis?

How to create a

My #SocialSecurity.Gov & My Medicare.Gov Account on SSA.gov

- Create ONLINE Account Publication # 10540 pdf

- VIDEO on advantages and saving time by creating a Social Security Account

- Our webpage on how to create a Social Security and My Medicare Account

- You need a Social Security Account Enroll ONLINE for Medicare Part A Hospital & B Doctor Visits.

- Create Social Security Account Here

-

Get estimates of future benefits based on your actual earnings, see your latest Statement, and review your earnings history.

- What can you do with a my Social Security account? pdf # 10121

- Check your application status

- explanation of benefits for recent MRI and X rays, copies of bills, Etc?

- Set up or change direct deposit

- Request a replacement Social Security card

- Get a Social Security 1099 (SSA-1099) form

- Get a proof of income letter

- Change your address

- Get New ID Cards?

- SSA 3288 Social Security - Authorization to release information

FAQ’s

FAQ’s

- What about Cialis for ED?

- What are the various ways that I can pay my PDP Rx Premiums?

- You can pay your premium by: See page 17 in Publication 11109 Guide to Part D

- I know that if I get a Medi Gap plan, I can buy Part D Rx and that if I get a Medicare Advantage with Part D aka MA-PD I can’t get extra coverage to cover Rx, what are the other restrictions on what plans go with Part D and which ones don’t?

- Yeah, it’s a confusing question as so much of the questions and plans do not apply to California. See the official Medicare brochure on Part D Rx Section 4: Your Coverage Choices

- Use this link to set a Zoom meeting with us to go over the materials.

-

Is there a Pre-Existing Condition #Clause or waiting period for Part D Rx, Medicare A & B, Medicare Advantage, etc?

-

There is no waiting period or pre-existing condition clause for Medicare Parts A Hospital, B Doctor Visits, C Medicare Advantage, or D Rx.

-

Medicare Supplements do have a 6 month look back period for Pre X, which is CLEARLY stated in the first paragraph on Page 15 of Publication 02110 Choosing a Medi Gap Policy California is more liberal though!

-

However, Medicare Parts A & B will still pay. BUT look at paragraph 5, if you buy during a guaranteed issue period, like turning 65 or losing Employer Coverage there is no pre-x!

-

-

Since you just got Part B you may have a guaranteed issue period for Part D, see publication # 11219 Medicare C & D enrollment periods. We need to get a copy of your Medicare ID card to verify when, why and how you got Part A & B. More on Part A & B enrollment periods.

-

I’ve looked at looked and don’t find anything that says exactly that there is no pre – x other than every seminar and training that I’ve ever seen. However, there is NOT a single brochure, policy, evidence of coverage, etc. that says that there is. A pre-existing condition clause would have to be listed in the exclusions and limitations to be enforceable!

-

Check these links and publications:

- CA Health Care Advocates on Part D

- Medicare’s Guide to Prescription Drug Coverage Publication # 11109

- Blue Cross Evidence of Coverage – 124 pages, if this alleged exclusion isn’t here, where could it possibly be?

- While every company has limitations on formulary – what Rx they cover and co-pays for different tiers of Rx, that is not a Pre X clause.

- Here’s a reply from CA Health Care Advocates

- The prohibition against using a pre-existing condition exclusion or waiting period for Medicare Parts A, B, and D is most likely in the Social Security Act that established the Medicare program. Whatever that is would have been applied to Part D when it was enacted if there wasn’t a separate requirement or prohibition.

- But you are right that it isn’t specifically mentioned as a standard feature. Exclusions or limitations in Medicare Advantage programs probably build on that same concept so it probably isn’t specifically mentioned.

- I’ve never looked for it because we know companies can’t impose it as a matter of law on A, B or D.

- The prohibition against using a pre-existing condition exclusion or waiting period for Medicare Parts A, B, and D is most likely in the Social Security Act that established the Medicare program. Whatever that is would have been applied to Part D when it was enacted if there wasn’t a separate requirement or prohibition.

- Steve Shorr can’t find a pre-x clause in the law Section 1814 Conditions & Limitations

-

More Detail & Info

Source – Note the graph isn’t for 2024…

- Graphic courtesy of KFF – Read more

- CMS Finalizes Payment Updates for 2025 Medicare Advantage and Medicare Part D Programs

- Part D Redesign Program CMS.Gov

- 2025 Part D Redesign Program Instructions Fact Sheet

- Changes to Medicare Part D in 2024 and 2025 Under the Inflation Reduction Act and How Enrollees Will Benefitorg

- Sample Broker Brochure Berwick

- Guidance on Inflation Reduction Act’s Medicare Prescription Payment Plan Released Medicare Rights.org

- kff.org/key-facts-about-medicare-part-d-enrollment-and-costs-in-2022

- You enter the donut hole when you and your plan spend a total of $5,030 in 2024.

- In the donut hole, you pay up to 25% out of pocket for all covered medications.

- You leave the donut hole once you’ve spent $8,000 out of pocket for covered drugs in 2024.

- 2024 is the last year for the donut hole. A $2,000 out-of-pocket cap takes effect for Medicare Part D in 2025. Nerd Wallet *

- kff.org/key-facts-about-medicare-part-d-enrollment-and-costs-in-2022

- healthaffairs.org/understanding-drug-pricing-package

- Medicare negotiating drug prices? Prepare for a letdown LA Times

- Merck is suing the federal government over a plan to negotiate Medicare drug prices, calling the program a sham equivalent to extortion. LA Times

- nbcnews.com/drug-prices-might-not-help

- cnbc.com/medicare-historic-new-powers

- khn.org/drug-pricing-measures

- centralmaine.com much-needed-step-toward-lowering-prescription-drug-costs

- california healthline.org/300-billion-medicare-drug-price-negotiation

- usa today.com/lower-medicare-drug-costs-seniors

- cnet.com/important-medicare-changes

- Medicare negotiating drug prices? Prepare for a letdown LA Times

- reuters.com/newly-launched-us-drugs-head-toward-record-high-prices

- webmd.com/have-sex-now

- Medicare Part D beneficiaries projected to pay lower out-of-pocket costs A provision in the IRA would ameliorate the out-of-pocket spending increases when people transition from commercial insurance to Part D. READ MORE

- 9 ways the Inflation Reduction Act affects Medicare coverage, and what it means for you Nerdwallet 8/2022

- Here are 25 Medicare Part D drugs that have skyrocketed in price

- Regulations Take Aim At Misleading Medicare Ads As Enrollment Opens

- BLUE SHIELD OF CALIFORNIA UNVEILS FIRST-OF-ITS-KIND MODEL TO TRANSFORM PRESCRIPTION DRUG CARE; SAVE UP TO $500 MILLION ON MEDICATIONS ANNUALLY

- Key Facts About Medicare Part D Enrollment, Premiums, and Cost Sharing in 2024 Kff

News Articles on ways the Government is trying to #pass legislation to save Rx costs

- Bill aimed at lowering Medicare drug prices faces next test in the Senate CNN 7.21.2022

- Part B Premium – Aduhelm price cut Modern Health Care 15% ? 1.10.2022

- Medicare Part B Premiums Could Be Lower in 2023 – Here’s Why

- Medicare limits Aduhelm coverage to clinical trials for Alzheimers Modern Health Care 1.11.2022

- Part B $170 from $148 LA Times

- `price concession’ arrangements in which they pay reduced costs to some pharmacies for certain dispensed drugs – new rule requires Part D plans to give “all price reductions they receive from network pharmacies to the person buying the drug, which should reduce the out-of-pocket cost charged to the customer. The policy will take effect on Jan. 1, 2024 Forbes *

- 63% of Medicare Beneficiaries Paid Full Generic Drugs Cost in 2020 Health Payer Intelligence

- Drugmakers offer price plan ‘allowing Trump to say he did something’ LA Times 8.27.2020

Coping with Medical Debt Family Voice

- Owing money, having debt for your medical, doctor visits and hospital bills is not a good thing to have. I'll grant that there are new laws restricting debts for medical bills being on your credit report. See links and references below and to the right on a desktop computer.

- What can you do about large medical bills?

- The first thing would be to get health insurance coverage. We specialize in that. If you are very low income, you can enroll in Medi Cal. If your MAGI income is above 138% of Federal poverty level, you can get Covered CA tax subsidies. We can help you with that at no additional charge for our services as Covered CA pays us to help you.

- A GUIDE TO MEDICAL DEBT: YOUR RIGHTS AND OPTIONS

- Our Webpage on Appeal & Grievances? Medicare – Medi Cal – Covered CA

- A Consumer’s Guide to Coping with Medical Debt

- An Employer's Guide to Leveraging Care Navigation & Hospital Financial Assistance to Craft Affordable Benefits

- Most medical debt can no longer hurt your credit score under new California law

- ‘Buy now, pay later’ more popular and costlier than ever

- LA County launches program to eliminate $500 million in personal medical debt

- Doctors say they’ve apprehensively taken on job of preventing patients’ medical debt

- The government doesn't want you to have bills you can't afford, thus there is a mandate in CA to have coverage with penalties, even if the Federal government no longer has a financial penalty when you file taxes. CA is using the fines to give those that have Covered CA additional Coverage, that is, if you qualify for Silver 70, you get Silver 73 in 2025.

- See below how getting a debt cancelled - discharged affects Covered CA MAGI Income - Subsidies.

Parent, Child & Related Pages

https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-announces-actions-to-lower-prescription-drug-prices/

https://www.medicalnewstoday.com/articles/troop-medicare

I would appreciate your opinion on Part D

Thank you for your time on this. You have always been helpful.

https://www.columbiamissourian.com/news/state_news/in-missouri-no-donut-hole-not-enough-helpers-as-medicare-changes/article_50858df0-8c01-11ef-ab30-93bbbb1abbff.html

https://www.msn.com/en-us/money/markets/independent-pharmacies-may-skip-low-cost-medicare-drugs/ar-AA1smv1m

https://www.medicare.gov/coverage/prescription-drugs-outpatient

https://cahealthadvocates.org/medicare-part-d-reforms-what-they-are-what-starts-in-2025/

https://www.beckershospitalreview.com/pharmacy/5-things-to-know-ahead-of-the-medicare-drug-price-announcement.html

2025 Inflation Reduction Act and Medicare Part D Changes

https://youtu.be/127lwvTeJKI?si=ReF6mJT4rKZu0Rlb

We are checking to see if this video is allowed….

FAQ

https://www.uhcjarvis.com/content/dam/jarvis/secure/main/knowledge-center/2024/Medicare-Retirement/Reference-Guides/Product-Guides/2025%20Part%20D%20FAQ.pdf

Creditble coverage calculation?

https://www.aarp.org/health/medicare-insurance/info-2024/drug-costs-report.html

https://www.managedhealthcareexecutive.com/view/out-of-pocket-costs-for-ms-medications-rise-while-they-drop-for-other-neurologic-conditions

https://www.forbes.com/sites/dianeomdahl/2024/08/01/good-bye-medicare-part-d-donut-hole-hello-2000-cap/

https://www.kff.org/medicare/issue-brief/key-facts-about-medicare-part-d-enrollment-premiums-and-cost-sharing-in-2024/

Inflation Reduction Act

https://berwickinsurance.com/themes/berwick-theme/sales-files/Client_Educational_Presentation.pdf

https://www.medicarerights.org/medicare-watch/2024/07/25/guidance-on-inflation-reduction-acts-medicare-prescription-payment-plan-released

Does the shop & compare tool provide a way for me to figure out my annual out of pocket?

The tool only seems to want to show me the remaining portion of the year which I guess is assuming I have paid the deductible already.

***

Oh I see it does give me annual cost for drugs. I just need to add the deductible and premium with that. I suppose for me the lowest deductible and premium combined for me is the best way to go since my RX is not expensive.

Here’s the video we did to show the OOP Out of Pocket Maximum – Estimated total drugs costs including the monthly premium

Video of breakout of costs before and after deductible and in and out of coverage gap.

So, NO, it’s not lowest premium and deductible it’s Yearly Drug & Premium Cost

We STRONGLY urge, due to SNAFU’s that you double check the numbers on the Official Insurance Company website!!!

$288 billion — The agreement calls for prescription drug pricing reform, which will allow Medicare to negotiate drug prices. Out-of-pocket costs will be capped at $2,000, the agreement summary says. “The Inflation Reduction Act of 2022,”

There are three factors that can make a big difference in total costs.

The cost per drug tier: Most drug plans have five tiers. Tier 1 includes the cheapest generic drugs. Prices increase with each tier with Tier 5, specialty drugs, being the most expensive. Every plan determines the drugs in each tier and how much you’ll pay. Most Tier 1 and Tier 2 medications come with copayments, a flat dollar amount like $1 or $10. Plans generally charge a coinsurance, a percentage of the costs, for drugs in Tier 4 and Tier 5. Depending on the plan, Tier 3 can be either a copayment or coinsurance.

The retail cost and copayments or coinsurance: What you pay can depend on the retail price of a drug and the plan’s cost sharing. For example, in Wisconsin, a Tier 3 drug in one plan has a $47 copayment; a second plan charges 17%. If the retail cost of a drug is $100, a person would pay either $47 or $17. However, if the retail cost is $350, the cost sharing is $47 in the first plan and $59.50 in the second. And, with a coinsurance, if the retail price of a drug goes up, what you pay will also increase.

Medications subject to the Part D deductible: The same low-premium plan (in point 1) applies the deductible to Tier 2 medications. That means the drug plan member can pay up to the first $480 this year, instead of a flat copayment in plans with higher premiums that do not apply the deductible to Tier 2 drugs. Forbes.com

Do you represent any Part D Rx plans that are accepted across the US?

I’m using the plan finder on the Medicare site above and don’t see any Anthem or Blue Shield plans that are “accepted across the US”

I’m not aware of ANY plans from ANY Part D Rx carrier that is Nationwide. This question comes up in our annual mandatory training from AHIP and from each Insurance Company. They use secret meaningless slides that if we show anyone we get our contracts terminated on might be put on the Federal List of people that can’t do biz with the Federal Government, as if we were members of ISIS!

So, give me a minute to find the answer in the EOC Evidence of Coverage or the Guide to Rx Coverage.

Where can I fill my prescriptions?

Each company that offers a Medicare drug plan has a list of pharmacies you can use. If you want to continue filling prescriptions at the same pharmacy you use now, check to see if the pharmacy is on the plan’s list.

Medicare requires plans to have network pharmacies for you to choose from.

OK, let’s try the Blue Cross Evidence of Coverage EOC as an example.

Section 2. Fill your prescription at a network pharmacy or through the plan’s mail-order service

Section 2.1 To have your prescription covered, use a network pharmacy.

Section 2.2 Finding network pharmacies

Section 2.3 Using the plan’s mail-order services.

Section 2.4 How can you get a long-term supply of drugs?

Section 2.5 When can you use a pharmacy that is not in the plan’s network?.

So, download the EOC and the answer is on Page 38

UHC Part D Rx made xxx change from Premarin to Estradiol patches this year. It was good since the copay for the patches is only $10.

Now it appears that the patches are not in the formulary for 2021.

Will she have to get a different plan or will we need a doctor to request a dispensation?

We are going to need to know which Rx you and your MD prefer.

I used the Medicare.Gov finder above and the cost if you take both Rx would be $3,650 for Rx & the premium. WOW!!

Here’s the detailed breakout

Summary of the 2021 UHC Plans

First 10 of the lowest 32 plans offered in San Diego (All of CA?) We represent Blue Shield, if you want any of the others, you can get them from Medicare.gov but it would be better IMHO to do it on the Insurance Company website. If there is ever a problem… I think you would have more “juice” there. Blue Shield has a cost of $1,862.

Here’s the formulary for the 2021 Saver Plus Plan Going by the breakout above, you are right, Estradiol is not on it and Premarin is tier 3.

Here’s the evidence of coverage for Saver Plus for 2021

Tier 3 – Preferred Brand – Includes many common brand name drugs, called preferred brands and some higher-cost generic drugs. Page 3 – 8

Page 3 – 14

Section 5.3 What can you do if your drug is in a cost-sharing tier you think is too high?

If your drug is in a cost-sharing tier you think is too high, here are things you can do:

You can change to another drug

If your drug is in a cost-sharing tier you think is too high, start by talking with your provider. Perhaps

there is a different drug in a lower cost-sharing tier that might work just as well for you. You can call Customer Service to ask for a list of covered drugs that treat the same medical condition. This list can help your provider to find a covered drug that might work for you. (Phone numbers for Customer Service are printed on the back cover of this booklet.)

You can ask for an exception

You and your provider can ask the plan to make an exception in the cost-sharing tier for the drug

so that you pay less for it. If your provider says that you have medical reasons that justify asking us

for an exception, your provider can help you request an exception to the rule.

If you and your provider want to ask for an exception, Chapter 7, Section 5.4 tells what to do. It explains the procedures and deadlines that have been set by Medicare to make sure your request is handled promptly and fairly.

Drugs in our Specialty Tier are not eligible for this type of exception. We do not lower the cost sharing amount for drugs in this tier.

Since we quoted BOTH Rx here, the comparison is really meaningless. What Rx do you and your MD really want?

I would prefer Estradiol patch .025 twice a week, largely because of the price differential in 2020 plan. But also my PCP prefers it.

With CIGNA Secure Rx that would make your yearly drug & premium cost $733. We don’t represent CIGNA.

We do represent Anthem Blue Cross Medi Blue Rx Enhanced and that yearly cost would be $757.70

Based on Medicare Publication Guide to Rx Coverage talking about picking coverage that meets your needs, getting help with choices Along with Medicare making the above shopping tool, video’s etc and now with the Rx prepopulating when you use your Medicare and/or Social Security account to log in, I’d have to say, just change plans.

Please note too, that Medicare is paying 75% of the actual cost of the Part D Rx premium for those singles making less than $85K

Here’s the link to our Blue Cross Rx page. Just click on the Anthem Logo, it’s our affliate link, so we will be your broker at no additional charge, and enroll. If you need assistance, we can set a Zoom meeting with screen sharing.

Please note, applications for AEP Annual Election Period are only accepted from October 15th to December 7th.

Plan d- I wand to know policy with best coverage as I know you can’t go up once you sign up, you can always lower or change your coverage

Please define “best” as I could be committing a Federal Crime to tell you something is the best, unless I can substantiate it with supporting data.

You can change plan D to any plan available any year at AEP Annual Election Period. That’s what this whole page is all about!

I think you have this confused with the Birthday Rule for Medi Gap plans.

I would like to know what the cost of tier 1 medications are.

Specifically lisinopril hydrochlorothiazide and Atorvastatin.

Use the Medicare.Gov tool above. If you are not on Medicare, check with a licensed agent in your state. We specialize in California.