Medicare High Income Penalty SURCHARGES “IRMAA”

for Part B Doctor Visits & Part D Rx Premiums

- What to do if you think your #income is incorrect Publication 10125

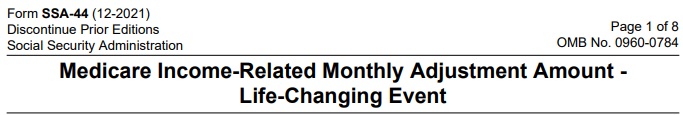

- Official form to ask for waiver and use lower income to avoid penalty

- Forbes – How to avoid high income penalties

- How much is the surcharge? Publication 11579 2022 – 2023

- Medicare Annual Verification Notices:

- Our Video Explanation of High Income Surcharge

- Here’s or webpages on the penalty’s if

- you don’t sign up for Part A when you don’t get it “free” or

- for enrolling in Part B later than you’re supposed to, regardless of income

- Part D late enrollment penalty

- FAQ’s

Are you Fortunate and earning a Great Living?

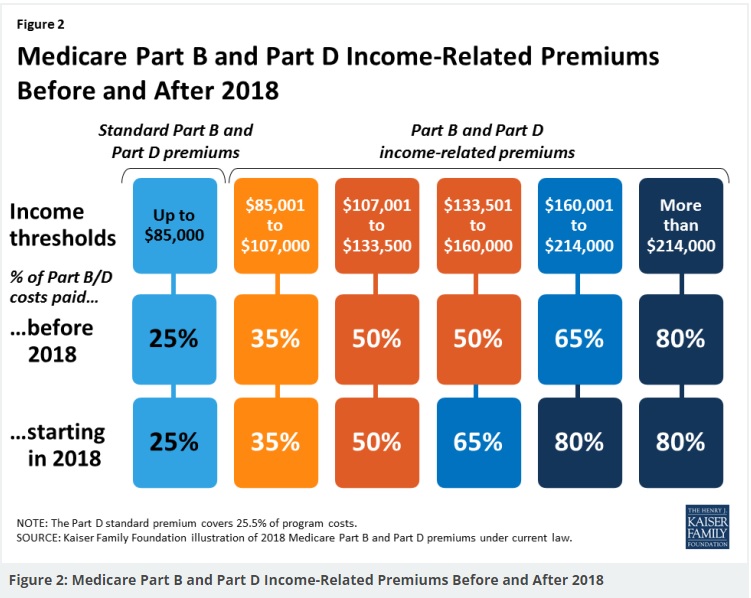

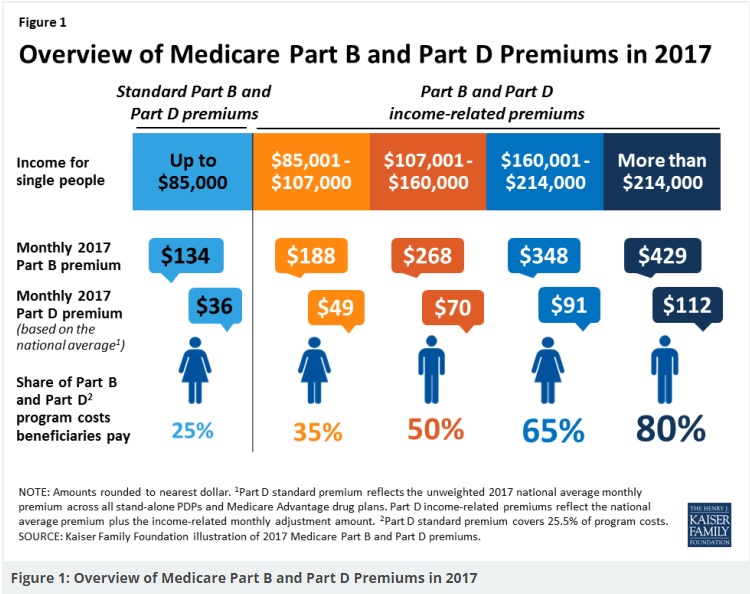

- If you earn a lot of money, be thankful. Then open up your wallet as it will cost you a little more for Part B – Outpatient – Doctor Visits and Part D Rx. Medi Gap premiums stay the same. No surcharge for Medicare Advantage, but there is a surcharge for the Rx portion. See the chart below and the publications on the right for more details.

- Note that MAGI Modified Adjusted Gross Income for under 65 in Obamacare, is different, for the Social Security surcharge it is simply AGI adjusted gross income line 11 on your 1040

Try turning your phone sideways to see the graphs & pdf's?

What year’s income is #used to determine the

High Income Surcharge IRMAA

The surcharge is based on income from your tax return two years ago—the most recent IRS data the government has when premiums are set in late fall. To determine 2017 premiums, for instance, income reported on your 2015 return filed in early 2016 was used. If your income exceeded the thresholds in 2016, you’ll probably owe the surcharges in 2018, and so on.

What if my income has gone down?

That’s the reason for the word probably in the previous answer. If you got hit with the surcharge this year, but your income has fallen since 2015, you may qualify for a waiver. If you experienced a qualifying “life-changing event,” you can easily get the surcharge waived—but you have to ask. It’s my understanding that the IRS will use a tax return ACTUALLY FILED and not just that you project or ask them nicely that your income has gone down! § 418.1201 (b) Those events include retirement, divorce or death of a spouse. 2022 Kiplincer * kiplinger.com 2017

****

To determine if you’ll pay higher premiums, Social Security uses the most recent federal tax return the IRS gives them.

Actual CFR Code of Federal Regulations

(a) In general, we will use your modified adjusted gross income provided by IRS for the tax year 2 years prior to the effective year of the income-related monthly adjustment amount determination. Modified adjusted gross income is based on information you provide to IRS when you file your Federal income tax return. 418.1135

If your income has gone down, however, due to certain specific circumstances, or if you filed an amended tax return, you can ask for a new decision without having to file an appeal. https://www.ssa.gov/pubs/EN-05-10125.pdf

-

Determinations Using a More Recent Tax Year’s Modified Adjusted Gross Income (§§ 418.1201 – 418.1270)

- § 418.1201 When will we determine your income-related monthly adjustment amount based on the modified adjusted gross income information that you provide for a more recent tax year?

- § 418.1205 What is a major life-changing event?

- § 418.1210 What is not a major life-changing event?

- § 418.1215 What is a significant reduction in your income?

- § 418.1220 What is not a significant reduction in your income?

- § 418.1225 Which more recent tax year will we use?

- § 418.1230 What is the effective date of an income-related monthly adjustment amount initial determination that is based on a more recent tax year?

- § 418.1235 When will we stop using your more recent tax year’s modified adjusted gross income to determine your income-related monthly adjustment amount?

- § 418.1240 Should you notify us if the information you gave us about your modified adjusted gross income for the more recent tax year changes?

- § 418.1245 What will happen if you notify us that your modified adjusted gross income for the more recent tax year changes?

- § 418.1250 What evidence will you need to support your request that we use a more recent tax year?

- § 418.1255 What kind of major life-changing event evidence will you need to support your request for us to use a more recent tax year?

- § 418.1260 What major life-changing event evidence will we not accept?

- § 418.1265 What kind of significant modified adjusted gross income reduction evidence will you need to support your request?

- § 418.1270 What modified adjusted gross income evidence will we not accept?

Request for Reconsideration ssa-561

Introduction to #MediGap

Our video explaining the Governments brochure on choosing a Medi Gap Policy. Click the little square on the right, to enlarge the video.

- 2025 Official Medicare Guide to choosing a Medi Gap Policy # 02110

- Spanish

- Get Quotes for Medi Gap Quotit

- Medicare Supplement Policies CA Insurance Code §§10192.1 - 10192.24

- CA Health Care Advocates HI CAP Fact Sheet

- If you have a Medigap policy and get care, Medicare will pay its share of the Medicare-approved amount for covered health care costs. In most Medigap policies, you agree to have the Medigap insurance company get your Part B claim information directly from Medicare. Then, your Medigap policy will pay your doctor whatever amount you owe under your policy and you’re responsible for any costs that are left. Learn More >>> Medicare.Gov

- Prior Authorization NOT Required! Askchapter.org *

- Supplementing Medicare: An Overview 10-30-20 Hi Cap

- Supplementing Medicare: Medigap Plans 12-14-23 Hi Cap

- Your Rights to Purchase a Medigap 12-14-23 HI Cap

- Search for Participating Doctors & Hospitals - Just about ALL of them!

- Anthem Blue Cross Information & Enrollment

- United Health Care

- Blue Shield – Medi-Gap Information & Enrollment

- Health Net

-

Medi Gap pays the medical expenses that Original Medicare Part A (Hospital) and Part B (Doctor) doesn't. Check out the chart on this page to see what Medicare Pays, what you pay and what a Medi Gap plan pays.

- If you have a Medigap policy and get care, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then, your Medi-gap policy will pay its share. You’re responsible for any costs that are left. Medicare.Gov *

- More than half of all fee-for-service Medicare enrollees without any additional coverage chose a Medicare Supplement plan in 2021 Health Care Finance *

-

Original Medicare, Medicare Advantage nor Medi Gap pay for long term care either in a nursing home or at home care. Get more information on Long Term Care here.

-

Even if you think you can't afford any extra premiums, there's a lot of valuable information to help with planning.

-

Prescription Drug 2025 #RxGuide

PDF # 11109

*****************

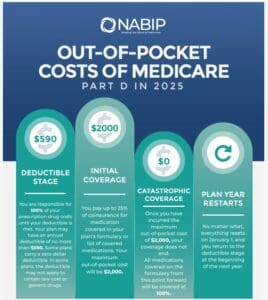

Coverage Gap - Donut Hole $2,000 Cap

******************

- Medicare Part D Rx generally runs say $30 to $100. See link below for how to shop premiums.

- Scope of appointment - permission to discuss Rx and MAPD Plans

- Our Webpage Premiums for those with High Income Parts D Rx & B Doctor Visits

- Medicare Rules for High Income People Medicare Costs # 11579

- Our #High Income Surcharge Video Explanation

- Ways to pay your premium - See brochure above.

- Kaiser Foundation Introduction - Overview

- Fact Sheet Medicare Part D CA Health Care Advocates Hi Cap

-

. Prescription Drugs Hi Cap

- Medicare Part D: An Overview – 10-31-23

- Prescription Drug Resources – 11-07-22

- When Your Part D Prescription is Denied– 11-22-22

- Medicare Rx Benefit Manual Rev 1.2016 83 pages

- Resources: Medicare Drug Coverage (Part D) Mini-Course & Podcast Series CMS

- Network Pharmacies, Formularies & Common Coverage Rules # 11136

- Insulin Maximum Co Pay $35

- Graphic on Part D Premium Increases & Why?

- Maximus Appeals LEP Late Enrollment Penalty

- Shop & Compare Tools Part D Rx

- Get Instant Quotes, Information & Enroll online

- MANDATED wording!: ‘‘We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1–800–MEDICARE to get information on all of your options.’’ § 422.2267(e)(41).

- We disagree with the above wording, as we can use the same tools on Medicare.gov as they do!

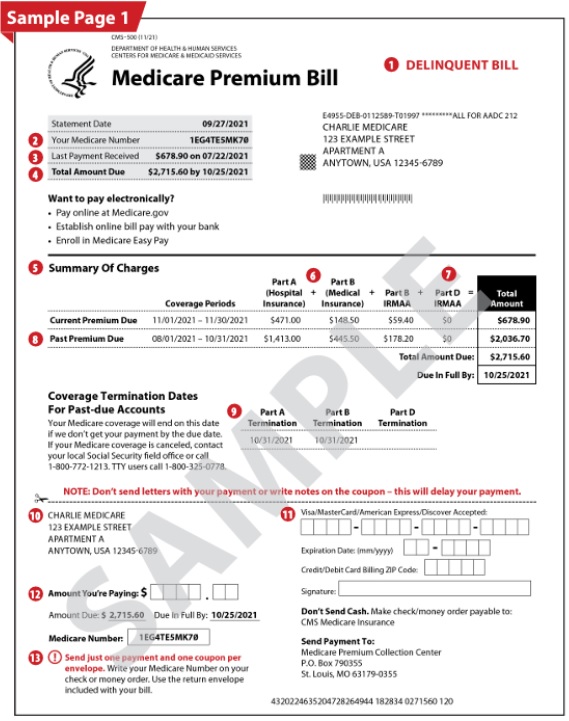

Understanding your Medicare Premium Bill

- Medicare has more detail on your billing statement at these links on the Internet:

- Steve's YouTube VIDEO to explain late payments...

- What are the payment options to pay the Part B Premium?

- medicare.gov/How to pay Part B premiums and when

- What if you pay Medicare late?

- For Original Medicare (parts A and B), Medicare sends a person an initial bill. If you pay it late, you will get a second bill, which includes the past-due premium amount and the premium that is due the following month.

- If a person does not pay the second bill by the 25th day of the month, they will receive a Delinquent Bill. People who do not pay the Delinquent Bill by the 25th day of the next month will lose their Medicare coverage.

- Basically, you may get your first bill for 4 or 5 months. After that it's monthly if taken from your Social Security Check and quarterly if you get a bill via USPS mail.

- Coverage Termination Date: You’ll only see this notification if your payment is 90 days past due. If you don’t pay the full balance of the “Total Amount Due” by the “Due In Full By” date, your Medicare coverage will be terminated.

- Easy Pay Premium Statement CMS 20143

- Medicare Premium Bill CMS 500

- Why is my first bill higher than I expected?

- After you sign up for Medicare, your first bill might include premiums owed for previous months not already billed. That means the bill might be higher than you expected.For example:

- If you sign up for Medicare in February and your coverage begins February 1st, your premium will be billed quarterly, and your first bill will be dated March 28. It will arrive around April 10 and be due April 25. This bill will be for the upcoming 3 months and include any premiums you weren't previously billed for.

- That means your first bill would include the previous amount owed (for February, March, and April) and what you owe for the upcoming 3 months (May, June, and July). Moving forward, your future bills will only be for 3 months at a time. Learn More>>> Medicare.gov

- After you sign up for Medicare, your first bill might include premiums owed for previous months not already billed. That means the bill might be higher than you expected.For example:

- Why did the Part B premium go up to $170? in 2022 Los Angeles Times

- Live Chat with Medicare - Call 1 800 Medicare

Our Webpages on Adjusted Gross & MAGI Income

#MedicareRelated Pages

- Medicare – Introduction – Part A Hospital – B Outpatient – D Rx Medi Gap & MAPD

- Coverage in Part A Hospital & B Doctor Visits? Part D Rx

- Enroll ONLINE for Medicare Part A Hospital & B Doctor Visits

- Medi Gap – Supplement Plans – non conical

- Medicare Advantage Plans – Part C

- Part D Rx Prescriptions no index

https://youtu.be/t885XZC6HmQ?si=9tIvF03_mU2eiA-W

I’ll be turning 65 soon and earn over $500k.

How might it work if I just stay on Blue Shield Silver PPO?

See our webpages on:

Part B late enrollment penalty

Medicare & Dual Coverage

Blue Shield under 65 webpage

Blue Shield under 65 EOC Limitation for duplicate coverage Medicare

Blue Shield’s rate chart doesn’t charge extra for being over 65. Silver 70 PPO Santa Barbara Region 12 is $1,240.95 for 64+

If you are only a high earner for 2020, see the Plain English explanation we answered for another website visitor, about it taking two years for your tax return to show.

Check out about asking for a Waiver. See FAQ above on annual verification in the box with the rules for high income beneficiaries.

So, if you wait to sign up… Then you’ll have the Part B late enrollment penalty and you can only sign up at certain times.

Where does one get the bill for the higher amount?

From Medicare?

Medi Gap?

Medicare Advantage?

Prescription Company?

The standard Part B premium amount in 2021 is $148.

Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

IRMAA is an extra charge added to your premium.

Part D Rx

If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($87,000 if you file individually or $174,000 if you’re married and file jointly), you’ll pay an extra amount in addition to your plan premium (sometimes called “Part D-IRMAA”). You’ll also have to pay this extra amount if you’re in a Medicare Advantage Plan that includes drug coverage. This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

Social Security will contact you if you have to pay Part D IRMAA, based on your income. The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB]. If you have questions about your Medicare drug coverage, contact your plan.

Note

The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check. If the amount isn’t taken from your check, you’ll get a bill from Medicare or the Railroad Retirement Board. You must pay this amount to keep your Part D coverage. You’ll also have to pay this extra amount if you’re in a Medicare Advantage Plan that includes drug coverage. https://www.medicare.gov/drug-coverage-part-d/costs-for-medicare-drug-coverage/monthly-premium-for-drug-plans

Question

Why do I have to pay so much for Medicare Part B Doctor Visits?

I worked hard for over 40 years and paid taxes for it!

Our Reply

The Monthly premiums for Part B Dr. Visits and Part D Rx Prescriptions for most people on Medicare only pays 1/4 of what Medicare pays out! That just doesn’t hold up considering Medical Loss Ratio, where Insurance Companies & Government need to take in a dollar to pay out 80c.

Kaiser Foundation on high income surcharges KFF.org

See also our webpage section on how Medicare is funded.

Again, See our webpage on how Medicare is Funded

How do I tell from my bill from Medicare if I have hospitalization Part A and am I paying double for a Part D Rx plan that I have with a private company?

See our excerpts of 2020 Medicare Costs above and you’ll see that the $70 charge on part D Rx along with the $462 charge on Part B Doctor Visits is because you are fortunate to earn over $163k

I can’t tell from this bill if you have Medicare Part A Hospital. There is generally no charge for Part A if you worked and paid into Medicare for 10 years.

Take a look at your Medicare ID Card and that will tell you if you have Part A. Also, we wouldn’t be able to get you a Medi Gap Plan or Medicare Advantage unless you had both.

Check out our webpage on getting a Medicare and Social Security Account, so that you can check with the government directly on what your benefits, claims and payments are.

The $70 surcharge is for Part D. Thanks for sending the bill. I was under the impression that the surcharge was billed by what ever company you had your prescription coverage with. Maybe it’s only the surcharge if you didn’t buy prescription coverage when you were supposed to.

Here’s our webpage on what Medicare A & B Cover. You can also check out Medicare and You above and for Rx that guide too above.

Here’s our webpage on what Blue Cross Medi Gap Plans pay in addition to Medicare.

United Health Care doesn’t allow us to post their brochures. I’ve sent those to you via email.

I just retired

Why does Medicare use income from my tax return – 2 years prior.

How to I get the surcharge to be lower now that I’m retired?

We’ve revamped this webpage and put the answer at the very top