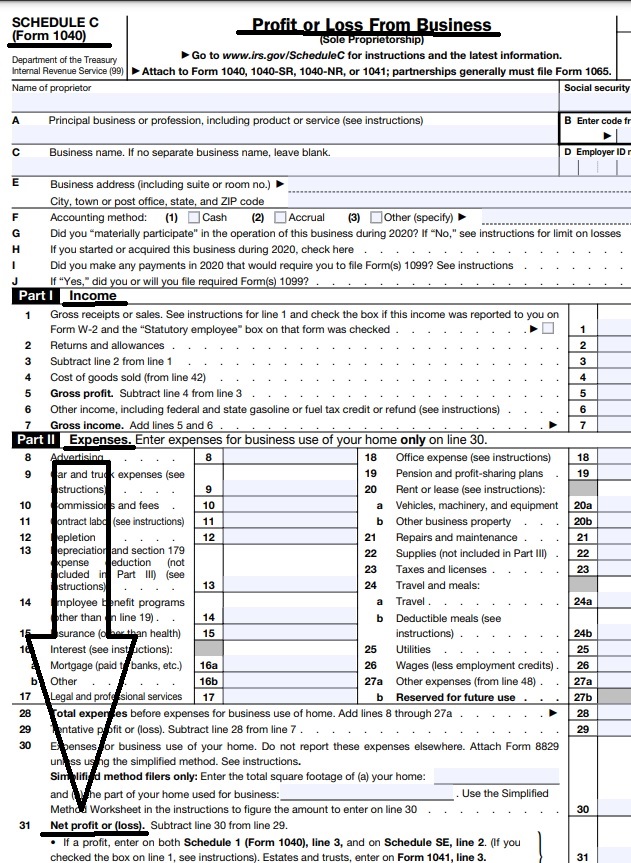

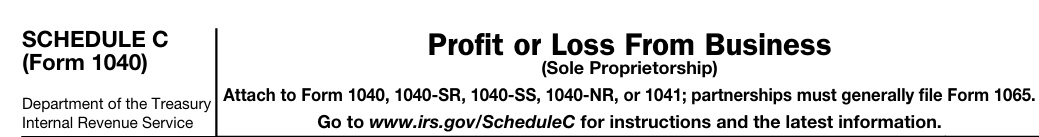

Schedule C 1040 Profit or Loss from Business

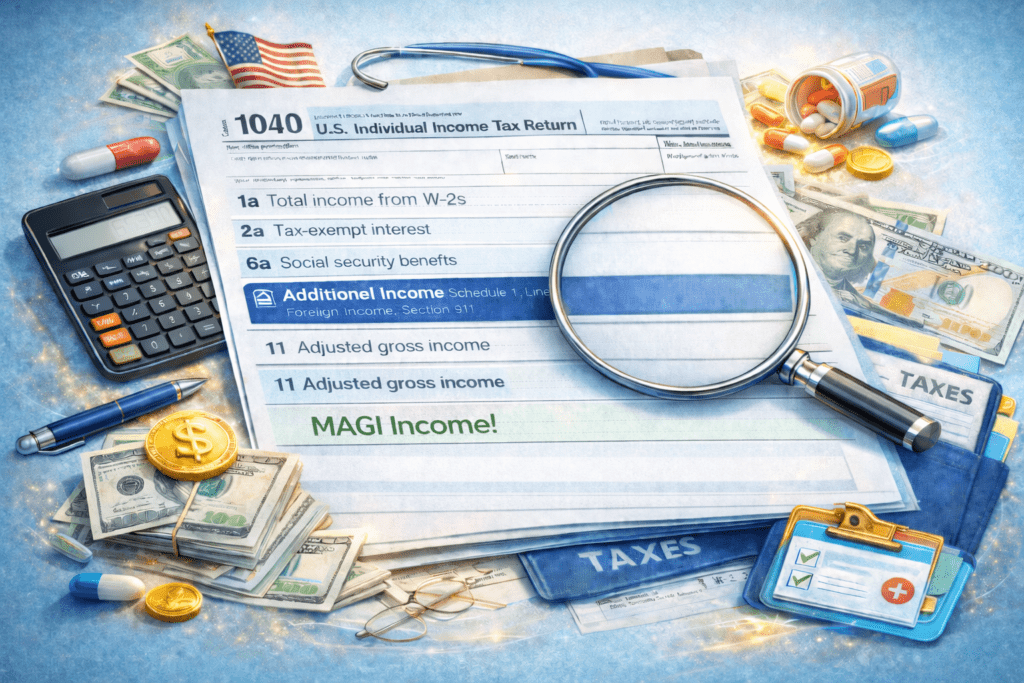

Income from your business get's reported for Covered CA MAGI Income subsidies basically by what you put on your Schedule C, line 31 Schedule 1 and 1040 Form .

VIDEO Explanation Part 1 ** Part 2

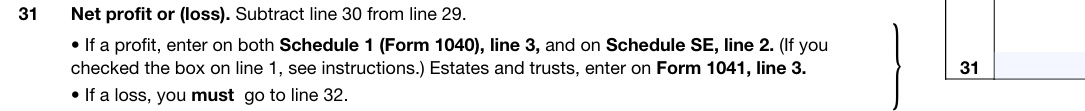

Line 31 Net Profit or Loss from Schedule C goes on line 3 Schedule 1 of your 1040.

- Schedule C line 31 Self employment – business income Covered CA.com

- Count the Taxable Portion of your Schedule C for Covered CA MAGI Income

Try turning your phone sideways to see the graphs & pdf's?

How does Self Employment Income Sole Proprietor – 1040 Schedule C

get reported for

MAGI – Modified Adjusted Gross Income?

Calculate your Covered CA MAGI Income

Take #Line8b 11 or your projected IRS 1040 Adjusted Gross income for the upcoming year then

add line 2a, 6a & 8 (Foreign Income)

Chat GBT isn't showing the numbers quite right, but you get the idea.

-

-

IMPORTANT!!!

The upcoming year - the future for what you tell Covered CA!

Sure, many people think it’s the past as Covered CA may ask for last years paperwork, but that’s BS! You might have to give back all the subsidies when you file Subsidy Reconciliation form #8962!

- Visit our MAIN webpage on MAGI Income

-

Just Enter your census or securely send us an excel spreadsheet or a list of employees and get instant proposals

for all these companies that we are Authorized Agents for in California

#Adjustments to Income - Schedule 1

#Schedule1 1040

- Part I Additional Income

- 2a Alimony received

- 3 Business income or (loss). Attach Schedule C

- Get Health Quote for your business

- 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E

- 7 Unemployment compensation

- 8 Other income:

- a Net operating loss

- b Gambling income

- c Cancellation of debt

- d Foreign earned income exclusion from Form 2555

- e Taxable Health Savings Account distribution

- Part II Adjustments to Income

- 11 Educator expenses

- 13 Health savings account deduction. Attach Form 8889

- 15 Deductible part of self-employment tax. Attach Schedule SE

- Learn more about your Social Security Benefits

- 16 Self-employed SEP, SIMPLE, and qualified plans -

- 17 Self-employed health insurance deduction

- 19a Alimony paid

- 20 IRA Individual Retirement Account deduction

- 21 Student loan interest deduction

- Instant Business Health Insurance Proposals

All our Health plans are Guaranteed Issue with No Pre X Clause

Instant Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

- Watch our 10 minute VIDEO that explains everything about getting a quote

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

IRS Publications

- IRS Publication 535 Business Expenses

- IRS Publication 463 Travel #Gift, Meals & Car Expenses

- If I take a client, prospect, my web designer or another member of my profession to pick their brain to lunch, how much is tax deductible?

- GUIDANCE FOR BUSINESS MEALS

allowable business meal expense if:- 1. The expense is an ordinary and necessary expense under § 162(a) paid or incurred during the taxable year in carrying on any trade or business;

- 2. The expense is not lavish or extravagant under the circumstances;

- 3. The taxpayer, or an employee of the taxpayer, is present at the furnishing of the food or beverages;

- 4. The food and beverages are provided to a current or potential business customer, client, consultant, or similar business contact; and

- 5. In the case of food and beverages provided during or at an entertainment activity, the food and beverages are purchased separately from the entertainment, or the cost of the food and beverages is stated separately from the cost of the entertainment on one or more bills, invoices, or receipts. The entertainment disallowance rule may not be circumvented through inflating the amount charged for food and beverages. irs.gov

- GUIDANCE FOR BUSINESS MEALS

- Publication 587 Biz use of Home

#Home Office Deduction

up to $1,500 a Year Publication 587

- Where on what forms do I Deduct Business Use of the home?

- Deduct expenses for the business use of your home on Form 1040 or Form 1040-SR. Where you deduct these expenses on the form depends on whether you are a self-employed person or a partner.

- Self-Employed Persons

- If you use your home in your trade or business and file Schedule C (Form 1040 or 1040-SR), report the entire deduction for business use of your home

- Whether you need to complete and attach Form 8829 to your return depends on how you figure your deduction. See Line 30 in the Instructions for Schedule C for more information. IRS 587 *

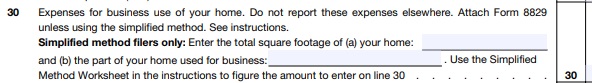

- Schedule C Line 30 Business Use of Home

8829 Expenses for Business Use of Home

- Home Office Deduction

- If you use your home for business, you may be able to deduct expenses for the business use of your home. If you qualify, you can claim the deduction whether you rent or own your home. You may use either the simplified method or the regular method to claim your deduction.

- Regular and Exclusive Use.

- As a general rule, you must use a part of your home regularly and exclusively for business purposes. The part of your home used for business must also be:

- Your principal place of business, or

- A place where you meet clients or customers in the normal course of business, or

- As a general rule, you must use a part of your home regularly and exclusively for business purposes. The part of your home used for business must also be:

A separate structure not attached to your home. Examples could include a garage or a studio.

- Simplified Option. If you use the simplified option, multiply the allowable square footage of your office by a rate of $5. The maximum footage allowed is 300 square feet. This option will save you time because it simplifies how you figure and claim the deduction. It will also make it easier for you to keep records. This option does not change the rules for claiming a home office deduction.

- Regular Method. This method includes certain costs that you paid for your home. For example, if you rent your home, part of the rent you paid may qualify. If you own your home, part of the mortgage interest, taxes and utilities you paid may qualify. The amount you can deduct usually depends on the percentage of your home used for business.

- Self-employed taxpayers file Form 1040, Schedule C, and compute this deduction on Form 8829.

- Deduction Limit. If your gross income from the business use of your home is less than your expenses, the deduction for some expenses may be limited.

- Self-Employed.

- If you are self-employed and choose the regular method, use

- Form 8829, Expenses for Business Use of Your Home, to figure the amount you can deduct.

- You can claim your deduction using either method on Schedule C, Profit or Loss From Business.

- See the Schedule C instructions for how to report your deduction.

- Employees.

- You must meet additional rules to claim the deduction if you are an employee. For example, your business use must also be for the convenience of your employer. If you qualify, you claim the deduction on Schedule A, Itemized Deductions.

For more on this topic, see Publication 587, Business Use of Your Home. Scroll down or it’s in the right hand column

Simplified Method for Home Office Deduction

There are special rules for certain business owners:

- Daycare providers complete a special worksheet, which is found in Publication 587.

- Self-employed individuals use Form 1040, Schedule C, Line 30 to claim deduction.

- Farmers claim the home office deduction on Schedule F, Line 32.

FAQ

- The person who prepared my Tax Return used Schedule C – Profit or Loss from Business for my Home Business expenses as a day care provider instead of the 8829 Expenses for Business Use of your home Form, which resulted in the State (not the federal) disallowing all of my deductions.

- Does a 8829 have to be used in order to receive my full refund after I amend, or should the Schedule C be suffice?

- Covered CA does not allow agents to give tax advice, here’s their recommendations to get assistance

- See Tip # 3 above and page 12 of Publication 587 and simplified worksheet on page 24 check the index too

- Tax a look though at the forms and I think you will see the answer!

IRS Tax Tips for Self Employed

If you are self-employed, you normally carry on a trade or business. Sole proprietors and independent contractors are two types of self-employment. If this applies to you, there are a few basic things you should know about how your income affects your federal tax return. Here are six important tips from the IRS:

- SE Income. Self-employment can include income you received for part-time work. This is in addition to income from your regular job.

- Schedule C or C-EZ. You must file a Schedule C, Profit or Loss from Business, or Schedule C-EZ, Net Profit from Business, with your Form 1040. You may use Schedule C-EZ if you had expenses less than $5,000 and meet certain other conditions. See the form instructions to find out if you can use the form.

- SE Tax. You may have to pay self-employment tax as well as income tax if you made a profit. Self-employment tax includes Social Security and Medicare taxes. Use Schedule SE, Self-Employment Tax, to figure the tax. If you owe this tax, attach the schedule to your federal tax return.

- Estimated Tax. You may need to make estimated tax payments. Try IRS Direct Pay. People typically make these payments on income that is not subject to withholding. You usually pay estimated taxes in four annual installments. If you do not pay enough tax throughout the year, you may owe a penalty.

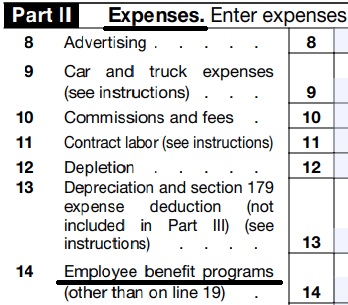

- Allowable Deductions. You can deduct expenses you paid to run your business that are both ordinary and necessary. An ordinary expense is one that is common and accepted in your industry. A necessary expense is one that is helpful and proper for your trade or business.

- Our webpage on the Home Office Deduction

- When to Deduct. In most cases, you can deduct expenses in the same year you paid, or incurred them. However, you must ‘capitalize’ some costs. This means you can deduct part of the cost over a number of years.

Visit the Small Business and Self-Employed Tax Center on IRS.gov for all your federal tax needs. You can also get IRS tax forms on IRS.gov/forms anytime.

Each and every taxpayer has a set of fundamental rights they should be aware of when dealing with the IRS. These are your Taxpayer Bill of Rights. Explore your rights and our obligations to protect them on IRS.gov.

Additional IRS Resources:

- Form 1040-ES, Estimated Tax for Individuals

- Publication 505, Tax Withholding and Estimated Tax

- Publication 535, Business Expenses

IRS YouTube Videos:

Sharing, #Gig, On Demand, Access Economy, Air Bnb, Lyft, Uber

If you use one of the many online platforms available to rent a spare bedroom, provide car rides, or to connect and provide a number of other goods or services, you’re involved in what is sometimes called the sharing economy.

An emerging area of activity in the past few years, the sharing economy has changed how people commute, travel, rent vacation accommodations and perform many other activities. Also referred to as the on-demand, gig or access economy, the sharing economy allows individuals and groups to utilize technology advancements to arrange transactions to generate revenue from assets they possess – (such as cars and homes) – or services they provide – (such as household chores or technology services). Although this is a developing area of the economy, there are tax implications for the companies that provide the services and the individuals who perform the services.

This means if you receive income from a sharing economy activity, it’s generally taxable even if you don’t receive a Form 1099-MISC, Miscellaneous Income, Form 1099-K, Payment Card and Third Party Network Transactions, Form W-2, Wage and Tax Statement, or some other income statement. This is true even if you do it as a side job or just as a part time business and even if you are paid in cash. On the other hand, depending upon the circumstances, some or all of your business expenses may be deductible, subject to the normal tax limitations and rules.

Learn More ===> irs.gov/sharing-economy

The following tax issues may apply to those participating in the sharing economy:

- Issues for Individuals Performing Services

- Issues for the Companies Providing Services

Our webpage on AB 5 & 1099 vs

Check out our webpages on how 1099 & Gig workers can apply for unemployment & PPP Loans

Unreimbursed #Employee Expenses – Publication 529

- Business use of your car. Publication 463 Travel, Entertainment, Gift and Car Expenses.

- Publication 529, Miscellaneous Deductions.

- Schedule A

#Hobby or Business?

Are you a Business or a Hobby? A key feature of a business is that people do it to make a profit. People engage in a hobby for sport or recreation, not to make a profit. Consider nine factors below when determining whether an activity is a hobby. Make sure to base the determination on all the facts and circumstances. For more about ‘not-for-profit’ rules, see Publication 535, Business Expenses.

9 Factors distinguish between a business and a hobby?

In making the distinction between a hobby or business activity, take into account all facts and circumstances with respect to the activity. A hobby activity is done mainly for recreation or pleasure. No one factor alone is decisive. You must generally consider these factors in determining whether an activity is a business engaged in making a profit:

- Whether you carry on the activity in a businesslike manner and maintain complete and accurate books and records.

- Whether the time and effort you put into the activity indicate you intend to make it profitable.

- Whether you depend on income from the activity for your livelihood.

- Whether your losses are due to circumstances beyond your control (or are normal in the startup phase of your type of business).

- Whether you change your methods of operation in an attempt to improve profitability.

- Whether you or your advisors have the knowledge needed to carry on the activity as a successful business.

- Whether you were successful in making a profit in similar activities in the past.

- Whether the activity makes a profit in some years and how much profit it makes.

- Whether you can expect to make a future profit from the appreciation of the assets used in the activity.

You may find more information on this topic in section 1.183-2 (b) of the Federal Tax Regulations. IRS.gov * Publication 535 *

Allowable Hobby Deductions.

Within certain limits, taxpayers can usually deduct ordinary and necessary hobby expenses. An ordinary expense is one that is common and accepted for the activity. A necessary expense is one that is appropriate for the activity.

Limits on Hobby Expenses.

Generally, taxpayers can only deduct hobby expenses up to the amount of hobby income. If hobby expenses are more than its income, taxpayers have a loss from the activity. However, a hobby loss can’t be deducted from other income.

How to Deduct Hobby Expenses.

Taxpayers must itemize deductions on their tax return to deduct hobby expenses. Expenses may fall into three types of deductions, and special rules apply to each type. See Publication 535 for the rules about how to claim them on Schedule A, Itemized Deductions.

Use IRS Free File.

Hobby rules can be complex and IRS Free File can make filing a tax return easier. IRS Free File is available until Oct. 16. Taxpayers earning $64,000 or less can use brand-name tax software. Those earning more can use Free File Fillable Forms, an electronic version of IRS paper forms. Free File is available only through the IRS.gov website.

Additional IRS Resources:

- Publication 529, Miscellaneous Deductions

- Publication 17, Your Federal Income Tax

- IRS.gov – Hobby or Biz

- Fool.com – Hobby or Biz

- Nolo – prove hobby is Biz

- VIDEO What is APTC Advance Premium Tax Credit

- Health Net VIDEO How to get subsidies – pay less for coverage

- Interactive Tax Assistant (ITA)

- Am I eligible to claim the Premium Tax Credit?

Tax #Estimators

- turbo tax.com - FREE for simple returns

- H & R Block

- E file.com

- Estimate the Subsidy for Health Insurance, benefits, premiums, etc.

- 8962 ONLINE Calculator

- Our webpage on 8962 Premium Tax Credit Reconciliation

- Tax Form Calculator.com

- e tax.com

- Marriage Higher or Lower Taxes?

ACA What You Need To Know #5187 (2020) is the most recent

- VITA - Volunteers to help you

- Publication 17 - Your Federal Income tax

- Health Savings Accounts HSA our webpage

How much can you deduct as a business expense for health insurance if you are getting Covered CA subsidies ? #Iteration

- If you are self employed and get tax subsidies through Covered CA to pay your premium, the deduction claimed for the premiums under §106 * line 16 and the Premium Tax Credit (PTC) that gets computed, taking the deduction into account, must be less than or equal to the premiums

- Now that’s a mouth full isn’t it!

- Check out Publication 974 where there are special instructions for figuring the self-employed health insurance deduction and PTC Premium Tax Credit if you or your spouse was self-employed, you or a member of your tax family was enrolled in a qualified health plan and you may be eligible for the PTC.

- Because the amount of the self-employed health insurance deduction may affect the amount of the PTC, and the amount of the PTC may affect the amount of the deduction, a taxpayer who may be eligible for both may have difficulty determining the amounts of those items.

- A taxpayer who may be eligible for both may follow the instructions in this part to determine amounts of the self-employed health insurance deduction and PTC that are allowable under the law. Publication 974

Resources & Links

- VITA IRA Volunteer Income Tax Assistance

- IRS Publication #535 Business Expenses

- What about estimating and uneven income? Kaiser Foundation FAQ’s.

- IRS Pub. #974 Page 56. Use the Premium Tax Credits and not the Self-Employed Health Insurance Deduction Worksheet in Publication #535.

- Our webpages on:

1099 Independent Contractor

- Question: I received a Form 1099-MISC with an amount in box 7 for nonemployee compensation. What forms and schedules should I use to report income earned as an independent contractor?

- Answer: Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship).

- However, you may qualify to use Schedule C-EZ (Form 1040), Net Profit from Business (Sole Proprietorship).

- Self-Employment Tax, if net earnings from self-employment are $400 or more. This form allows you to figure social security and Medicare tax due on your net self-employment income.

- You may need to make estimated tax payments. Refer to Form 1040-ES, Estimated Tax for Individuals, for more details on who must pay estimated tax. If you need to make estimated tax payments and do not pay them timely, you may also need to file Form 2210, Underpayment of Estimated Tax by Individuals, Estates & Trusts.

Additional Information:

- Our webpage on 1099 Independent Contractor vs Employee & Other Defintions

- Publication 334, Tax Guide for Small Business

- Instructions for Schedule SE (Form 1040), Self-Employment Tax

- Instructions for Schedule C (Form 1040), Profit or Loss From Business

- Instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts

- Do You Have to Pay Estimated Tax?

How does retirement income – pension, IRA distributions count for MAGI Income and subsidy qualification?

Check our webpage on retirement distributions