Grace Periods – Can I get Reinstated?

Grace periods under ACA/Health Care Reform

- The grace period 31 day's if you are direct with an Insurance Company & don't get subsidies Specimen Policy Page #39 * Health & Safety Code 1365 a 1 * dmhc.ca.gov guidance *

- If you do get subsidies (APTC advance payments of the premium tax credit), the Insurance Company - (QHP Qualified Health Plan issuer) must provide a grace period of three consecutive months (more detail on 3 month grace period) as long as you've previously paid at least one full month's premium during the benefit year. Health Care.Gov * 45 CFR 156.270 (d

- Full payment is required to keep coverage in force

- If you do get into a grace period situation, please understand that making partial payments on the debt will not serve to extend the coverage period, that is stretch out the grace period or delay cancellation. After your notified about premiums overdue, you must pay the full amount owed before your grace period ends to avoid losing their coverage. Insurance Company memo

- Jump down to more detail on Grace Periods

- Individual Companies – Carriers

- Carriers – Companies Employer Group

- See our special enrollment page They keep on extending Open Enrollment or creating FEMA special enrollment

Consequences of cancellation

Once a member is terminated for non-payment, they cannot be reinstated.

In the past, as an agent, we would get late notices, now we don’t or rarely do. So, read up, email us and let’s see what we can do to keep coverage in force for when you need it and avoid tax penalties, bankruptcy or not getting the medical treatment you need – 10 essential benefits.

Clients need to know that cancellation for not paying premiums can have serious consequences. Here’s what happens if they lose their coverage:

• They will still owe unpaid premiums for the first month of their grace period

• They will still owe providers for any health care services they got during the second and third months of the grace period

• They will have to repay any premium tax credits form 8962 1095 A the government paid on their behalf during the second and third months of the grace period

• They won’t be able to get new coverage for themselves or their dependents until the next open enrollment period, unless a life event triggers a special enrollment period

- Health Insurance Denied For Past Due Premiums

- Cancellation for Non-Pay – won’t be a qualifying event either!!!

- If you own a business – a group plan.

Sample Reinstatement as a ONE TIME Courtesy

Dear xxx

Thank you for contacting xyz Insurance. We value the fact that you have chosen xxx as your daughter’s health plan.

We are responding to the grievance we received on May 23, 2022, on your behalf by xxx regarding the termination of your coverage.

She has requested to reinstate the health plan, without a lapse in coverage.

The request has been approved as a one-time exception.

The plan was cancelled effective May 1, 2022, because you did not pay the premium dues by the due date. Before we can reinstate the health plan, we require the dues be paid to current based on the current billing period.

We will contact you shortly to make this payment or you may wish to contact Customer Service at (888) xxx, to make this payment. If payment is not received as requested, xxx will not be able to reinstate the coverage.

Additionally, there are no provisions in the health plan that allows for reinstatement after termination.

It is important to understand that this decision has been made on an exception basis and, in making this decision, xxx does not waive any of its rights to enforce the provisions of your health plan on this or any other claim.

When we receive a grievance, it is assigned to a Grievance Coordinator who is knowledgeable about the plan’s benefits and coverage.

If you have general questions about the plan benefits, please contact Customer Service at (888)xxx. If you have specific questions about this grievance, please call our Grievance Department at xxx.

Sincerely,

Morgan D.,

Grievance Coordinator

Grievance Department

Enclosures:

Information regarding the DMHC

Information regarding ERISA

Notice informing individuals about Nondiscrimination and Accessibility Requirements

CC: Department of Managed Healthcare

- Check your insurance company’s policy to see what their late payment policy is. [4]

- Pay your premiums on time and in full to avoid retroactive denials. [6]

- Talk to your provider about whether the service you received is a covered benefit. [6]

- JUMP TO SECTION ON:

- Coronavirus? Open & Special Enrollment?

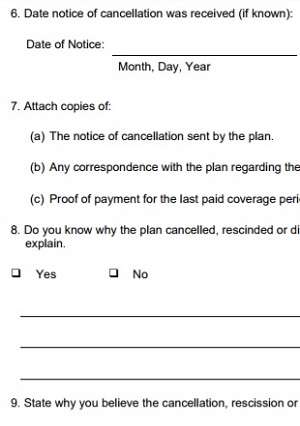

REQUEST FOR #REVIEW OF CANCELLATION –

CA Department of Managed Health Care

- Cancellation Notice from Kaiser

- DMHC Request Review Cancellation

- See our webpage on Appeals & Grievances

Payment options

- Pay Online – Clients can go to anthem.com/ca, log into their account and click on the Pay My Bill Online link

- Pay By Mail – Clients can mail their invoice with payment. They must mail in time for us to get it on or before the last day of the grace period.

- Pay By Phone – Clients can call the number on the back of their member ID card to use our free Auto Pay Phone Service. Or, they can call Member Services at (855) 634-3381 to pay by credit card or check.

- Check with each Insurance Companies rules & procedures. If you ask, they are often more liberal than required!

- Individual & Family Health Insurance CA

-

- Companies – Carriers

- Covered CA – Ways to pay

- Blue Cross – Anthem Individual

- Blue Shield 2022 PPO & Trio

- Health Net 2022 Individual Information & Enroll

- Kaiser Permanente – Enrollment – Pay Premium ONLINE

- LA Care – Medi Cal & Covered CA

- Molina Health Care

- Oscar Health Insurance

- Sharp Health Plan – Employer & Family

- Sutter Health Insurance Individual & Employer Plans 2022

- Western Health Advantage Individual & Small Group

- Companies – Carriers

Wild Thoughts?

Are you having a bad month? Low income this or the next few months? Try Medi-Cal. They use monthly income and annual income, whichever is lower! Medi-Cal will give you coverage that meets all 10 essential benefits, plus CA mandated benefits! If your income goes back up, that gives you a special enrollment period back into Covered CA where we can be your agent, no extra charge, Covered CA pays us to help you or direct with an Insurance Company, get a quote.

Try qualifying for Minimum – Catastrophic coverage?

- What is the proper way to #cancel Health Insurance?

- So that I don’t have to pay extra premiums

- I’m not restricted when, if I want to reapply.

- Don’t have problems with Advance Premium Subsidies

. - Answer Just let Covered CA or your Insurance Company know at least 15 days ahead of time. See the menu above for the administrative page – contact information for each Insurance Company. However, take a look at this excerpt of email from Covered CA dated 5.24.2018:

-

Agents and client can cancel the plan directly in the web site but they need a 15 day window to terminate at the end of the month. If it is less than 15 days of the termination date, they need to call Covered California. Covered CA can terminate it with less than 14 days.

2022 – Note – Covered CA’s website now seems a lot friendlier on this point. Appoint us as your broker, no extra charge and we can take care of it.

-

- We provide cancellation help for our clients, at no additional charge as we are paid by the Insurance Companies when we are appointed as your broker. However, we must have proof of new coverage. We will not cancel a policy for a client, without proof of new coverage. We don’t need any malpractice allegations.

- The main point is not to let coverage lapse for non-payment of premium as the Insurance Company might send a 10 day demand letter and send you to collections. Saying you didn’t use the Insurance won’t work. That isn’t what Insurance is. Risk Pooling. Proving that you have other coverage will probably work.

Resources & Links

- Termination of coverage or enrollment for qualified individuals. 45 CFR § 156.270 –

- Termination of Exchange enrollment or coverage. § 155.430

#Narrow Network – 3 month Grace Period

- DOCTORS, Hospitals & other providers do NOT get reimbursed if a policy gets cancelled, because the insured did not pay their portion of the subsidized premium in the 2 or 3 month of the grace period. 45 CFR 155.430 (b) (2) (ii) (A) & (B) and 156.270 (d) – Federal Regulation 41866

- See our page on Balance Billing for information at AB 72 to help resolve the issue of going to a hospital or doctors office that is on the list, but still getting out of network bills.

- (d) Grace period for recipients of advance payments of the premium tax credit. A QHP issuer must provide a grace period of three consecutive months if an enrollee receiving advance payments of the premium tax credit has previously paid at least one full month’s premium during the benefit year. During the grace period, the QHP issuer must:

- (1) Pay all appropriate claims for services rendered to the enrollee during the first month of the grace period and may pend claims for services rendered to the enrollee in the second and third months of the grace period;

- (2) Notify HHS of such non-payment; and,

- (3) Notify providers of the possibility for denied claims when an enrollee is in the second and third months of the grace period.

- (e) Advance payments of the premium tax credit. For the 3-month grace period described in paragraph (d) of this section, a QHP issuer must:

- (1) Continue to collect advance payments of the premium tax credit on behalf of the enrollee from the Department of the Treasury.

- (2) Return advance payments of the premium tax credit paid on the behalf of such enrollee for the second and third months of the grace period if the enrollee exhausts the grace period as described in paragraph (g) of this section. 156.270

Benefits of #Automatic Premium Payments

What if you’re in a coma in the hospital when the premium is due?

Here’s a Long Story –

Bill Duncan* called in and asked if we could get medical insurance for his Mother who has an adrenal problem and possibly has Addison’s Disease and is on Paxil for Major Depression.

Her prior coverage had lapsed for non-payment of premium as she states that she has memory loss due to her medical conditions. The Insurance Company** so far has told them that they won’t reinstate and said that they would send a grievance form for them to fill out. I found a standard grievance form and emailed it to my friend.

I don’t know how this will come out, but I looked all over the California Case Law section on FindLaw.com and so far have found nothing in the sister’s favor. The closest cases were on Life and Disability Policies that had a special provision at additional cost that will pay your premiums, if you are disabled for say 6 months or more. Under COBRA and other Insurance Laws, Anti-Discrimination, etc. they all allow cancellation for non-payment of premium.

Here’s a letter from an Attorney on a similar issue.

The only medical plan I can find for her at this point is MR. MIP, which is really great as it covers virtually anyone who for medical reasons can’t get Individual coverage, the down side was that they have a waiting list to get in.

So, the moral of the story is, make sure that you have a method to pay your medical premiums so that the Insurance Company can’t cancel you, when you need it the most!

Unfortunately, if you can’t remember to pay your premiums, you will probably have trouble working too. Check out Disability Coverage , if you have a Retirement Plan or Cash Values in Life Insurance you might be able to access that money. If all else fails the Government has various plans available. Healthy Families to cover your children, Medi-Cal if you’ve become poor, Social Security Disability – SSI which will qualify you for Medicare – after 2 years of disability and the Free Clinic.

- *Name changed for privacy

- **Insurance Company named not mentioned as we may be filing a grievance and as near as I can tell, all companies and HMO’s would cancel for non-pay, regardless of the reason.

- Blue Cross form Ways to pay your premium or Email us for the form to have your premiums automatically withdrawn from your checking account or credit card

- Blue Shield

No more reinstatements on late payments 1/1/2010

- Find Member Portal for Individual Health Companies CA

If you #lose your Advanced Premium Tax Credits (APTC) be careful,

One Can lose ALL Coverage for just missing ONE month Premium!

- Excerpt of email blast from one or our carriers:

- We are aware that some of our members lost their subsidy and now owe a full month of premium payment(s). Some were able to supply proof needed by the exchange and had their subsidy reinstated, however there is a month or more gap where the government subsidy lapsed, therefore the member is responsible for the full premium during that time. We sympathize and understand that most of our members cannot afford to pay a full month and are therefore skipping that month and trying to pay the following month.

- We are receiving a lot of questions asking:

- “If the client does not pay the month(s) without subsidy and they pay the following month with subsidy will they be able to use the insurance?”

- Unfortunately, the answer is No, they will not. Members must pay their responsible portion of the premium or the policy will lapse. For example:

- Month of May Member’s responsibility after applying the subsidy is $22.50 (member sends in $22.50)

- Month of June Member’s responsibility is the full Premium after subsidy lost is $550.00 (member did not pay)

- Month of July Member’s responsibility after applying the reinstated Subsidy $22.50 (Member sends in $22.50)

- In the example noted above, since the member did not pay for the month of June, the $22.50 will be applied to the June premium of $550.00 leaving a balance of $537.50 owed for month of June, and $22.50 still owed for July which will bring it back up to a balance due of $550.00. If the whole balance is not paid, the member will be suspended and will have no coverage until account is brought to current status.

- After 90 days the client will be terminated for non-payment, and, unless they have an SEP – Special Enrollment Period, cannot enroll again until open enrollment starting in November and no coverage till January 2016. Molina will not send the member to collections for the owed amount however; they will still owe that until paid in full.

- Unfortunately, the answer is No, they will not. Members must pay their responsible portion of the premium or the policy will lapse. For example:

- “If the client does not pay the month(s) without subsidy and they pay the following month with subsidy will they be able to use the insurance?”

- The member always has the right to file an appeal to the Exchange. They would need to submit a letter or an Appeal Request form to:

- Health Insurance Marketplace Attn. Appeals

- Department of Health & Human Resources

- 465 Industrial Blvd, London, KY 40750-0061

- The following information MUST be in the uppers corner on EVERY page, If not on a page it will NOT be considered as received: First and last name, SSN# and State.

- Successful eligibility appeal results will be communicated to the Issuer via a HICS case.

- Thank you for your inquiry and hope this information helps in the future. As always if you have any questions please feel free to give us a call.

All our plans are Guaranteed Issue with No Pre X Clause

Quote & Subsidy #Calculation

There is No charge for our complementary services

Watch our 10 minute VIDEO

that explains everything about getting a quote

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- Get more detail on the Individual & Family Carriers available in CA

Grace Periods

#Grace Periods

Cancellation for non-payment of premium:

- When premiums are not paid, coverage will cancelled due to non-payment following our standard grace period rules (see below). Members will receive a notice when premium is past due. The notice includes the date when the grace period ends and that coverage will terminate unless the member sends the full past due amount before the grace period ends. Reinstatement is not allowed if the policy is cancelled for nonpayment.

- The grace period is an additional period of time during which coverage remains in effect and refers to either:

- The three month grace period required for individuals receiving Advance Payments of the Premium Tax Credit

(APTC), or

For individuals not receiving the APTC it refers to any other applicable grace period (All States except Maine:

31 days; Maine: 30 days).

- The three month grace period required for individuals receiving Advance Payments of the Premium Tax Credit

- If the full amount of the premium is not paid by the premium due date, the grace period begins. If the required premium is not paid by the end of the grace period, coverage is terminated. The member is not be eligible to apply for other coverage until the next open enrollment period unless they experience a qualifying event. See below for specific information about the two types of grace periods.

- Grace period for members receiving Advanced Premium Tax Credits (APTC)

- Members who receive APTC Subsidies are provided with a three month grace period.

- During the first month of the three month grace period, coverage remains in effect.

- During the second and third month of the grace period coverage will be suspended and the member(s) will be ineligible for benefits under their health benefit plan unless they pay all premiums due before the end of the grace period. Any outstanding authorizations, approvals for services or certifications for health care services to be provided during or after the second and third month of the grace period are also suspended. We will not provide any benefits or coverage for services, supplies, or prescription drugs obtained while the suspension is in effect even if previously approved, authorized or certified.

- The application of the grace period to claims is based on the date of service and not on the date the claim was submitted.

- If full premium is not received during the grace period, members:

- Will have no coverage for claims incurred after the first month of the three month grace period. They are liable for the full cost of any services they receive after the first month of the three month grace period.

May be required by their health care providers to pay for any health care services they need.

Will be liable to us for the premium payment due for the period through the last day of the first month of the three month grace period.

Will be liable to us for any claims payments made for services incurred after the last day of the first month of the three month grace period.

May be required to repay any premium tax credits the government paid on their behalf during the second and third months of the grace period.

- Will have no coverage for claims incurred after the first month of the three month grace period. They are liable for the full cost of any services they receive after the first month of the three month grace period.

- If your client makes timely payment of all premiums due before the end of the grace period, coverage will be reinstated, and claims for covered services received during the grace period will be processed.

- Grace period for members not receiving APTC

- These members have a grace period of 31 days (in all states except Maine which is 30 days). This means if any premium payment is not paid on or before the date it is due, it may be paid during the 31 (30 in Maine) day grace period. During the grace period, coverage will stay in force. If the full premium payment is not made during the grace period, coverage will be terminated on the last day of the grace period. They will be liable to us for the premium payment due including those for the grace period, as well as for any claims payments made for services incurred after the grace period. Copied from Blue Cross CONFIDENTIAL agent manual Form 03673MUBENMUB 10/25/16 *

- See also this jpg from Blue Cross Confidential Manual

- Grace Period & Cancellation Procedure

Reference Materials - ocregister.com/2014/ask-emily-covered-california-is-a-hard-plan-to-cancel/

- Insure Me Kevin.com terminating coverage for Covered CA can be tricky

- health for california.com/covered-california/cancel-existing-plan

Examples of how a #three-month grace period works

Copies of emails to clarify the rules:

Let’s say your client entered the grace period and owes premiums for two months. Here’s an example of what can happen:

• During the first month in grace period, your client’s health benefits stay in effect. We will honor claims incurred during this period. Your client must still pay any unpaid premiums, copayments, coinsurance and deductible amounts, as set forth by the health plan. • During the second and third months of the grace period, your client’s coverage will be suspended.

No one on the plan will be eligible for benefits, unless the full amount due is paid before the end of the grace period. During this time, we will not pay for any health care services, supplies or prescriptions, even if they were approved before. Now, let’s say your client pays for one of the two overdue months right away. Doing so will not extend the grace period or delay suspension, as the grace period moves into the second month. Your client will be on the hook for any claims during this time while coverage is suspended, unless the account gets paid in full before the grace period ends. Ultimately, if your client doesn’t pay the remaining amount due by the end of the grace period, we will cancel coverage. We also will refund the partial premium payment made in the second month because it doesn’t cover the full premium owed. We will only honor claims incurred in the first month of the grace period.

Premium payment grace period clarification

Regulations require a 90-day grace period for on-exchange members receiving subsidies for their health plan. For off-exchange members not receiving subsidies, the grace period is 30 days. For a member who is on a 90-day grace period and does not pay 100% of their total premium due, the grace period does not start over.

Example: A member owes $600.00 for their premium for March and April. In April, they pay one month’s premium for the month of March. In this scenario, the member is still in their 90-day grace period with 30 days left until they are cancelled. Blue Shield Agent Email 6.7.2016

Here are excerpts various bulletins we’ve received about Grace Periods under Health Care Reform

New Payments (Covered CA) can be made here. Policies cancelled for NO reason or explanation

Learn More ==> CA Health Line 3.22.2016 Learn More ⇒ Molina bulletin

In either case, the grace period starts on the date we mail members the first warning notice that their premium is overdue. The letter tells them when their grace period ends. It warns that they will lose their coverage unless they send us the full past due amount before the grace period ends. It says we won’t be able to reinstate them afterward, if their policy gets canceled for not paying premiums. We also send them one or more reminder letters repeating this information, depending on how long their grace period is.

Grace Period and Review of Cancellation in Sample EOC Evidence of Coverage – Policy

Health Net Cancellation Procedures

References & Links

45 CFR § 156.270 – Termination of coverage or enrollment for qualified individuals.

§ 155.430 * Termination of Exchange enrollment or coverage.

USPS Informed Delivery

The USPS now has a feature called #informed delivery.

Prove you NEVER got the bill?

- I’m not an attorney and I can’t find a citation, but if you have this feature in the future it looks like it would be excellent evidence to backup an assertion that the Insurance company never sent a bill or late notice.

- Visit the USPS site for more information. informed delivery.usps.com

- View the envelope of all your snail mail before it arrives – save emails to prove a letter was never sent to you?

- How to prove you never got a bill?

- There is no evidentiary proof of a negative act (i.e. failing to receive a document).

- There is a presumption of regularity with the mail

- US Court of Appeals *

- Marquette Law Review *

- PAA * Berkeley Law Review Presumptions *

- Case Text.com

- Evidence: Receipt of Mailed Letters: Overcoming Presumptions

-

- so it would be tough Avvo.com *

- The “mailbox rule” provides that depositing a properly addressed letter with prepaid postage with the post office raises a presumption that the letter reached its destination by due course of mail. However, seemingly insurmountable “rebuttable” presumptions like the mailbox rule can in fact be rebutted with the right combination of law, luck, and attention to detail. PAA * WNYLC.com *

- There is a presumption of regularity with the mail

Informed Delivery Video’s

FAQ’s & Comments

This is probably hearsay, it would also almost certainly fall under the “business records” exception in California (Evidence Code § 1271), leginfo.legislature.ca.gov 1271. and, consequently, be admissible.

1271. Evidence of a writing made as a record of an act, condition, or event is not made inadmissible by the hearsay rule when offered to prove the act, condition, or event if:

(a) The writing was made in the regular course of a business;

(b) The writing was made at or near the time of the act, condition, or event;

(c) The custodian or other qualified witness testifies to its identity and the mode of its preparation; and

(d) The sources of information and method and time of preparation were such as to indicate its trustworthiness.

1270. As used in this article, “a business” includes every kind of business, governmental activity, profession, occupation, calling, or operation of institutions, whether carried on for profit or not.

***So, I guess a private person, not in business wouldn’t count?

That’s interesting.

While, of course, it might not show that someone never sent something, it could possibly serve as evidence that something was never delivered.

Generally speaking, the way that’s handled now is someone makes a statement under oath or by affirmation (the whole “I declare under penalty of perjury” thing), and unless the other person can show by certified, registered, or delivery confirmation mail that it was delivered, the lack of receiving is presumed. Sometimes, though, if the person can show that it was mailed as in a certificate of mailing by a law office, it will be presumptively received, but judges don’t usually like that argument.

We’ll have to see how accurate the post office is found to be with this new service!

FAQ

Question

1. I read with interest parts of your website. I have a problem with my Blue Shield health insurance individual PPO, which was a grandfathered plan from the 80s. I have owned a business and carried my own insurance since that time,

2. but in February I signed up for auto pay on the internet and there but the money was not debited from my checking account. I called Blue Shield last week and they said their system is down and they can’t help me and I might be cancelled.

3. If I get cancelled, can you help me find insurance?

4. Do you know if they can get away with blaming their system for not properly submitting my auto pay?

5. I almost feel like this was purposely done to kick me off their plan.

6. If the cancellation goes through, I guess I would not qualify for a special event for Obama care because of non-payment of premiums.

7. I’ve never been without insurance and quite distressed over this.

8. Thank you for any assist and for your informational website. I hope I will hear from you.

Cathy

1. Thanks for finding and the interest in our website.

2. Auto pay is usually a good thing. See our page on proving that you had auto pay and that they took the $$$ out.

3. Yes, but it might be difficult, unless we can find a material violation.

4. I doubt they can get away with claiming that their auto pay doesn’t work and allowing a policy to lapse. Do they claim to have informed you of this in writing? If you have the proofs, we can file appeals, make complaints and maybe a class action lawsuit.

5 This is a problem with ACA Obamacare – if you get cancelled you generally can’t get a special enrollment for loss of coverage as that excludes non-payment of premium.

Did you get the bulletin about the changes in easy pay?

6. Right

8. Do you have an online account with Blue Shield? I suggest you make the payment right now! If nothing else, send a check certified mail. If you appoint us as your agent, I’ll send you the form, we can do our best to get you on auto pay again and to make sure that your February & March payments get made.

There are also temporary plans…

Payroll Deduction IRA for Small Biz # 4587

A payroll deduction individual retirement account (IRA) is an easy way for businesses to give employees an opportunity to save for retirement. The employer sets up the payroll deduction IRA program with a bank, insurance company, or other financial institution, and then the employees choose whether to participate. Employees decide how much they want deducted from their paychecks and deposited into the IRA. They may also have a choice of investments, depending on the IRA provider.

Many people not covered by an employer retirement plan could save through an IRA, but don’t. A payroll deduction IRA at work can simplify the process and encourage employees to get started.

Under Federal law, See Publication 590 A individuals saving in a traditional IRA may be able to receive some tax advantages on the money they contribute, and the earnings on the contributions are tax-deferred. For individuals saving in a Roth IRA, contributions are after-tax and the earnings are tax-free.

Advantages of a payroll deduction IRA:

- Simple for employees to set up an IRA.

- Employees make all of the contributions. There are no employer contributions.

- Many employees find smaller, regular contributions a more manageable way to save.

- Low administrative costs.

- No filings with the government to establish the program or any annual reports.

- However

- You have to register and tell Cal Savers on their website.

- Payroll deduction IRAs with automatic enrollment are considered a qualified plan Cal Savers *

- However

- No minimum number of employees required.

- Program will not be considered an employer retirement plan subject to Federal reporting and fiduciary responsibility requirements as long as the employer keeps its involvement to a minimum.

- May help attract and retain quality employees.

- Learn more - read Payroll Deduction IRA for Small Biz # 4587

Links & Resources

CA Department of Insurance is requesting

all Insurance Companies provide a 60 day grace period

- Here’s the notice the DOI sent.

- July 14th Notice

3 comments on “Narrow Networks – 3 month grace period”

I have Blue Shield Silver 1850 PPO individual and family plan- it is not covered California. I have had 3 different offices turn down our health insurance because they said it was a “mirrored plan” to covered California.

Does covered California actually have a matching plan or are these people just misguided?

See the above page about the rules, laws and mandates that plans offered in Covered CA must also be offered outside of Covered CA too. I think your question really is, how do I find a participating MD.

See our page on Scarpo vs Blue Shield alleging that bogus doctor listed were knowingly provided to the public.

See our general page on finding a provider. On this page, there are also links on how to use each specific companies provider list.

If your MD’s are on the list, but they say they won’t treat you, let us know and we can look into appeals, grievances, etc.

I didn’t pay my premium last year and got cancelled. I applied to the same insurance company this year, during open enrollment and got new coverage for 1.1.2020. They billed my for last years premium. Is that right? Legal? Enforceable? Do I have to pay it? Can they cancel 2020 coverage if I don’t pay it?

If your health insurance company ends your coverage because you didn’t pay all outstanding health insurance premium payments in full by the end of your grace period:

When you apply [at Open Enrollment] and are found eligible to enroll in a Marketplace [Covered CA] plan, you may be able to enroll in the same plan [or another one] you lost if it’s still available. If your health insurance company has clearly described (in paper or electronic form) the consequences of non-payment on future enrollment before your loss of coverage, they may, in order to complete your enrollment, require you to pay any past-due premium amounts you owe them for coverage in the past 12 months. https://www.healthcare.gov/apply-and-enroll/health-insurance-grace-period/

Help, I’m a victim of identify theft and there were phony checks written on my account. My bank changed my account # and thus auto pay was discontinued. My health insurance got cancelled. Is there a law or something to protect victims of identity theft, fraud, something???

Well, if you had a professional agent like myself, you are in luck!!! I did NOT get a late notice for you. Thus, we have a good case!!! Blue Shield Broker Guide

Research Materials

Proof late notices were not mailed to me USPS Informed Delivery

Sample Policy see page 39 about grace periods and notification

consumer.ftc.gov/articles/pdf-0119-guide-assisting-id-theft-victims.pdf

https://www.peoples-law.org/node/3338

mercuryinsurance.com/insurance/5-steps-take-youre-victim-identity-theft/

Notify your homeowners, condo or renters insurance carrier, as well as your auto insurer of your situation, so you aren’t dinged with unpaid premiums and to make sure they know no one else is able to file claims under your name. You should also contact the places (e.g., libraries, gyms, and wholesale clubs) where you have memberships.

https://insuremekevin.com/blue-shield-billing-system-cancels-health-plans/

One place above it says after 31 days grace period all bets are off.

Another said notice must be given to the agent or client.

Which is it?

We will have to submit our case to Blue Shield and see what happens. I don’t have a crystal ball. If they say no, we can file an appeal, etc.

why would they not reinstate? They are a business and I want to buy their services and give them money

Maybe they figure that if you let your coverage lapse, but now you want coverage, it’s because you had a claim? They can’t ask your health history anymore and must cover pre existing conditions from day 1.

Sure, you might give them maybe $1k/month premium, but you might turn in bills that can total $400,000 for a kidney transplant or $1.3 million for a heart, plus monthly costs that average $2,500 for anti-rejection drugs that must be taken for life, https://californiahealthline.org/news/no-cash-no-heart-transplant-centers-require-proof-of-payment/

I’ve been purchasing my Kaiser through the covered ca marketplace the past 2 years. Been with them since 98 via employers, and even cobra coverages.

I just got an email came that I’ve been terminated back to 3/31?

I never received suspension or anything warning nothing.

I do get subsidy too.

We edited out a significate portion of your “story.”

Would you please send all proofs of payment and appoint us as your broker. Here’s instructions. https://healthreformquotes.com/15-reasons/covered-ca-agent-appointment-instructions/

As you can see from above, it’s very difficult to get coverage reinstated. A case that makes sense and written in plain English helps very much. Here’s our information on appeals. https://individuals.healthreformquotes.com/metal-levels/10-essential-benefits/appeal-grivances/

So, when you send us your proofs of payment, please write a more concise cover letter. We will take it to Covered CA, Kaiser, Department of Managed Health Care, etc.

My policy was canceled on April 1st for non payment.

I have Blue Cross Blue Shield,

***In CA you must be more exact. Did you have Blue Cross in Northern CA or Blue Shield?

I was paying $80/month

***Subsidies are great. Which also give you 90 days grace period as long as you paid January. Do you have proof of January payment?

and it was not put on auto pay- I thought my agent put it on auto pay for me.

****Do you have any proof? Maybe we can get a special enrollment period https://individuals.healthreformquotes.com/open-enrollment-for-individuals-families/ccr-code-regulations-ca-§6504-special-enrollment-periods/ for company error?

I am really concerned about this. I would love to be reinstated and am willing to pay fees and anything I need to to get this back.

***Please appoint us as your agent with Covered CA https://healthreformquotes.com/15-reasons/covered-ca-agent-appointment-instructions/ We can’t make any promises, it’s a very difficult thing to get reinstated.

We will do our best. If all else fails, there are temporary plans. https://individuals.healthreformquotes.com/open-enrollment-for-individuals-families/short-term-temporary-plans/

Please advise and help!

We answered this one in interlineation…. rather than Q & A

I was just cancelled by Kaiser for Non-Payment. They are reviewing my file.

1. Are you available on the weekends to review and advise me by telephone?

2. Can my wife, son, daughter, friend listen in and ask questions?

We are happy to set up phone, skype & face to face meetings. Click here to schedule one. Please note our terms of service and the preliminary information that we need.

Hello,

I hope you can help me. I have Anthem blue cross. It happened, that I missed the payment for July, but I did make the payment, but apparently it didn’t go through. So I was about to make a payment today and found out that my payment was due July 1st. I messaged them, thinking it was a system mistake, but that is what I got back; ( I haven’t received any warning letters from Anthem either):

Dear Ms. R:

“Thank you for your e-mail inquiry dated 08/03/2017. I’m glad you wrote to us today so that we can take care of this right away. Our records show the last payment received was on 6/6/2017 and was applied to the June premium. No other payments were received. Late payment letter was sent 6/30/2017 advising should the July payment not be received by the end of July the policy would cancel. No payment was received and regretfully your coverage was terminated effective July 1st. ”

Any way I can get it back if I pay the balance now or any other possible way to get me covered till the next enrollment? I am not qualified for medicare.

Appreciate your help,

What proof do you have that you did make the payment? Bank Records, bill paying service, check register? In the future, USPS Informed Delivery might hold up in court as proof you didn’t get a late notice.

You might consider filing an appeal, if you have your proofs and ducks in a row.

Enroll in a Temporary Plan for 3 months and then renew it.

Steve,

Thank you for your help. The payment didn’t go through and I do not have evidence to proof it. If I apply for the short-term insurance, I might owe money when I file my taxes, is this correct?

Appreciate your help

Yes, but 3 months of the penalty is waived.

Steve

I have an Anthem policy with the 90 day grace period running out on July 31. I’m on unemployment and won’t have the funds to bring current until August 7.

Is there any possible solution that will keep the policy from terminating?

Thank you,

How about if you beg or borrow May’s premium and pay that now? That ought to keep you current, as you’ve paid May. June and July premiums should still have 30 and 60 days to go.

Here’s instructions to appoint us as your agent. We can then check your exact payment status and seek out more possibilities to resolve your situation.

You might also take a picture with your smart phone of all the invoices and relevant documents. Then email those to us.

What is your estimated MAGI income for 2017? Medi-Cal might be available if under $17k.

I’m not sure if this is the place to ask this question, but thought I would try. I live in Oregon and have purchased my health insurance directly from healthnet the entire time. I got no subsidies, and did not use the Exchange.

On April 18 I paid 2 months of premiums at once (April & May),.

I learned on April 25th when I tried to get a medication refill, that my coverage had been cancelled for non-payment. Apparently April 15th is the grace period cutoff. I always thought it was the 18th, but I’ve always paid it earlier anyway. I appealed the case on the same day, April 25, and today I found out that my appeal is DENIED. Also, I am not able to purchase new insurance until November 1, 2017.

After all these years, I paid 3 days late and they kicked me off insurance? How can that be legal?!

If you paid March, I don’t think your cancellation for non-pay on the 18th is legal. I’m basing this on CA Health & Safety Code 1365 (a) (1) (A)

(a) An enrollment or a subscription shall not be canceled or not renewed except for the following reasons:

(1) (A) For nonpayment of the required premiums by the individual, employer, or contractholder if the individual, employer, or contractholder has been duly notified and billed for the charge and at least a 30-day grace period has elapsed since the date of notification or, if longer, the period of time required for notice and any other requirements pursuant to Section 2703, 2712, or 2742 of the federal Public Health Service Act (42 U.S.C. Secs. 300gg-2, 300gg-12, and 300gg-42) and any subsequent rules or regulations has elapsed.

Yes, I guess I could see where this is confusion. If the bill for April when out on March 15th, would that mean the 30 day grace is April 15th or 30 days after the March premium is used up on March 31st?

Let’s check the Department of Managed Health Care Guidance Sorry, but that page must be copy protected. I can’t cut and paste here. So click on the prior link and review it yourself. I only research CA and Federal Law, please check with a competent Insurance Agent in Oregon, your Insurance Commissioner or an attorney. In CA the guidance says that the grace period only would start after the March premium is used up.

Here’s our page on appeals & grievances – for general reference.

I made my Jan payment on 31st of Dec. I made it through doxo support. It was a Saturday . So they sent it again on Jan. 2nd. It left doxo at 8:45am and Anthem verified it on the same day at 2:08.

I have called and waited over and over and then I sent to the office who does not do that. Even Headquarters in Massachusetts did that today.

My name is Rhonda W

. My ID is xxx or x. I used the 6 because it had a pad of numbers and not letters.

Can you please call me at xxx?

My financial discount for January is $598.00.

I really can’t help you. I only represent Anthem in CA. Also, I’m not your agent so they won’t do anything for me. Privacy and all. I did forward you inquiry, but I doubt anything will happen. Did your check clear the bank? Try sending WRITTEN proofs via certified mail.

I HAVE BLUE CROSS C PLUS;;

I WILL HAVE NEW PROVIDER IN JAN. OF 2017;

DO I HAVE TO PAY THE LAST PAYMENT IN DEC. OF 2016 TO BLUE CROSS;;

NEW COVERAGE STARTS IN JAN. 2017 WITH HUMANA

I don’t see any reason why you don’t owe the premium for a month of coverage.

WHAT I WANT TO KNOW IS WILL THE GRACE PERIOD COVE ME FOR THE LAST MONTH?

I’m insulted that I’m even asked this kind of a question.

As a licensed agent, I’m mandated to take an ethics class every two years, in addition to each Insurance Companies Code of Ethics, AHIP training – Fraud, and of course what I learned in Boy Scouts and Sunday School.

Using a CA Blue Cross Evidence of Coverage as an example on page 200 says when you are allowed to leave a Medicare Advantage Plan… I don’t see getting coverage in January as a reason to leave in December.

Plan C is not a California Plan, you are going to have to check with Blue Cross in your State. IMHO you owe the money, Blue Cross could take you to Small Claims Court for it.

What are you going to do if you have a claim?

Excerpt from page 20

We have the right to pursue collection of the … amount you owe. In the future, if you want to enroll again in our plan (or another plan that we offer), you will need to pay the amount you owe before you can enroll.

Why do so many people expect Insurance Companies to promptly pay claims, but want to get a free months coverage? It’s a two way street.

Medicare Advantage plans are highly regulated by CMS!

Only paying the premium, if you have a claim, violates basic principles of Insurance.

pooling funds from many insured entities (known as exposures) to pay for the losses that some may incur. The insured entities are therefore protected from risk for a fee, with the fee being dependent upon the frequency and severity of the event occurring. In order to be an insurable risk, the risk insured against must meet certain characteristics. Learn More ===>wikipedia

Hi Steve

What happened to our health care savings of $2000/year per family? LOL

Pray that Trump gets elected and that he puts our health care system back to what it was and makes real healthcare reform without these blood sucking so called providers.

Rhode Island

Paid the first months premium. Never got an invoice for future months premiums.

*****We’ve copied and will respond to this comment – question, on this new webpage.

Hello…

1. I was cancelled by Kaiser (terminated) owing 4 payments totaling 1400.00…

2. i will turn 65 on Oct. 2nd…

3. there is no way to pay a lump sum like that on a fixed income…

4. will i have to go to county hosp. for treatment and perscriptions… i am a heart patient with 3 seperate heart issues…

Thank You for any help you can answer to me…

sincerely Theresa.

1. Is Kaiser even offering to reinstate you? If so, I’d check all the social service agencies, churches, synagogues, etc. to raise the $$$.

2. Click here to enroll in Medicare for October. We can then help you get into a Medicare Advantage plan.

3. Do you qualify for Medi-Cal? I’m not sure where you can be treated without payment. Check with all Social Service agencies. Free Clinics

How about a temporary plan till October? Mr Mip covers pre-existing conditions, although the rates do not compare to subsidized Covered CA rates.

Question about dental insurance through CC. I have Anthem BC/BS and my policy was canceled after 30 days of non-payment. But above you state that the grace period is 90 days for CC. Was my policy canceled too early?

Were you getting subsidies in Covered CA? Did you make the first initial payment? Did you want to appoint us as your broker, no charge, if we can get your plan reinstated? Please email us a copy of all relevant documents.

Do you mean your dental coverage got cancelled and not the medical portion? If so, that wouldn’t be protected by the 90 day rule. 45 CFR 156.270 (d) Dental is not a QHP Qualified Health Plan – Essential Benefit

On the other hand though, you don’t have to wait till Open Enrollment to purchase dental nor have a special enrollment period. Click here to view dental plans and enroll.

Dear Mr. Shorr,

HELP!!

I had no idea what I was in for with the California Care mess. I went to a broker that seemed to have my best interest in mind.

She however, failed to explain all the pros and cons about auto pay vs billing and what happens if you are late. What a mess and what a RIP OFF this Cal Care “thing” is.

Unless I come up with $ 7….. 00 off dollars I will be cancelled. This is such a nefarious structure.

Please help.

B.T.Y: I’m referring to to my Blue Shield PPO plan.

Maia

What is your question for me and how would you like me to help?

What is the cancellation date?

Please take a picture with your smart phone of all relevant documents and email those to me

Please go into your covered California account and in the upper right-hand corner where it says find help appointment as your agent so I can check that account and see how I can help you you may have to manage delegations and take off the other agent

What wd be your benefit in helping? Your fee we be?

Help me get them to stop denying my visits as I’m paying down the $700.00 off $$.

My policy started in Jan in Feb I didn’t realize she had me on auto pay.

They surprisingly took $185. – $190.00 out & really messed up my accnt. I requested regular billing

Take a look at my website, my bio, the testimonials the role of an agent, etc. I help a lot of my clients, with the background, experience, education and training. The law states that you are entitled to buy direct from Covered CA, Blue Shield or through an agent at the SAME price! 42 U.S. Code § 18021 Thus there is no fee as long as you appoint us as your agent.

As soon as you appoint us as your agent, both with Blue Shield and Covered CA we can look into your account and see what we can do on getting a payment plan. It will be difficult though. If it was easy, they would have done it for you already.

I’m confused on what your monthly premium was. How much was the subsidy and how could auto pay mess you up. They should have taken out the full premium that you owe, minus the APTC Advance Premium Tax Credit. Please take a photo off all relevant documents, all invoices & proof of payment, etc. and privately email them to me. Please also use our FREE quote engine which includes a subsidy calculation.

Do you have an online account with Blue Shield? Send us your user name & password too, so that we can get the information to get your issues resolved.

Please note also that when you get the free quote it will calculate if you get free Medi-Cal and that’s basically if you’re Maggie income is less than 138% of federal poverty level or about $16,800

When you qualify for Medi-Cal that’s direct through the county social service agency We don’t get paid to help you with that

covered California should’ve already told Medi-Cal that you’re eligible for Medi-Cal. Medi-Cal should be contacting you directly for enrollment. Medi-Cal also has a rule that they cover you once the application process starts. So, even if you don’t have your Medi-Cal card, they can probably pay your pending claims, if you went to a MD that accepts Medi-Cal.

it sounds like the $190 deduction was for your net premium if you did qualify for covered California assistance

If you asked to pay for private insurance then you have to pay the full premium, no subsidies. So, if you qualify for Medi-Cal you can’t get a subsidy for the full premium. Just take the Medi-Cal no premium. Check around and see if you can find a better job or get another part time job to boost your earnings.

I had BC/BS ppo in FL. High premiums forced me to look elsewhere. United Health sold me short term insurance without giving me all details – full disclosure. They told me to cancel BC/BS.

I did and now I have no major medical. [or coverage to meet the 10 minimum essential benefits or mandate – shared responsibility requirement.] THe BC/BS premium was paid same day I cancelled. Can I get reinstated with BC/BS.

It would be a tough fight, but IMHO and you might want to check with legal counsel… you may be entitled to a special enrollment or reinstatement under Section 4 of CFR § 155.420

(4) The qualified individual’s or his or her dependent’s, enrollment or non-enrollment in a QHP [Qualified Health Plan] is unintentional, inadvertent, or erroneous and is the result of the error, misrepresentation, misconduct, or inaction of an officer, employee, or agent of the Exchange or HHS, its instrumentalities, or a non-Exchange entity providing enrollment assistance or conducting enrollment activities.

For purposes of this provision, misconduct includes the failure to comply with applicable standards under this part, part 156 of this subchapter, or other applicable Federal or State laws as determined by the Exchange.

Also, IMHO BC/BS ought to have told you that the Short Term Policy was not qualifying coverage, when you sent them a copy of the ID card to cancel.

Insurance reinstated. Thanks for all help.

We got behind on our monthly payments due to taxes. We continued to pay the monthly premiums plus an additional $40.00 per month to address the unpaid balance due. The last payment the Public Employees Benefit board received was Feb 6th, 2016.

Although we make our payments via home computer for our online banking account, for some reason a payment on Feb 26th, 2016 was not transmitted.

We missed a payment we thought we made at the end of February. Our insurance was cancelled on March 23, 2016 with a cancellation date of 12,29,2015.

I had surgery on Feb 29th, 2016. Now we have bills exceeding 120,000.00 for expenses from Jan 2016 to the present.

What state are you in? I’m not an agent for the Public Employees Benefit Board http://www.hca.wa.gov/pebb/Pages/index.aspx I can only suggest that you file an appeal. Did you actually make the payment at the end of February? Will your bill paying service assist you? This is why, when we remember, we insist that everyone put their payments on auto pay.

Did you get permission from anyone at the public employees board to pay $40/month to make up arrearages?

You might check into Medi-Cal – Medicaid??? Share of Cost?

Did you get any other late notices or cancellation warnings?

Check the FULL policy, EOC – Evidence of Coverage here’s a specimen and see what the rules are on cancellation and notice.

Got coverage through Covered CA starting February, and my old Blue Cross PPO got terminated due to non payment (on purpose.) Now Blue Cross demanding me to pay the 30 day grace period premium for the month of February of else they will take it to collections. I got Covered CA because Blue Cross was too expensive.. do I still have to pay February premium?

I suggest that you send a copy of your ID card, invoice, etc. what ever you have to prove that you have new coverage effective for February. Then Blue Cross should cancel for February. If you don’t have proof get it. If you don’t have new coverage pay the bill. Coverage is mandated and Blue Cross has to issue a 1095 B for your taxes.

Learn more in specimen policy page 39 grace periods 142 it doesn’t appear to have a co-ordination clause with other insurance, thus you could turn in claims and get paid in full from TWO companies! Termination Page 33 your supposed to give notice Note that coverage also terminates when you are not longer eligible. Page 25 #8 can’t be covered by another group or individual plan.

Thus, we not only answered your question, but have shown you the advantage of having a certified agent, with years of experience and tons of education to show you where the information is in the actual policy – contact. Please click on the link above in the menu on how to appoint us as your Covered Ca agent so that we can get paid for helping you, at NO additional cost to you!

1 My mom and dad were both covered under my dad’s insurance plan (Covered California subsidy)

2 through his employer in 2015, until the end of October, when his employer suddenly switched insurance companies and provided each employee with a short cancellation letter for them to fill in and mail out to the insurance company they were leaving..

3 My dad didn’t notice only his name (and not my mom’s) was on the letter and sent it out that way. His policy was apparently cancelled, but my mom’s wasn’t, so her bills kept coming in for the last couple months. Upon learning she was still being billed, I called my mom’s insurance provider to cancel. They said to call Covered Callifornia to cancel. I called Covered California and they told me that the insurance provider would cancel.

4 I was very frustrated didn’t know what to do. A day later I called both the insurance provider and Covered California again and explained the situation and how I was being given the runaround and both told me to simply stop paying the bill, which would cause the policy to be cancelled automatically.

5 Of course, this didn’t help and the insurance provider has sent numerous notices asking for payment for November and December 2015 (my mom has insurance again as of January 2016, with another provider), and the last one has threatened to send the bill to collections.

6 What can be done??

7 I did what I could and after reading up a bit more on this, it seems a cancellation letter was the way to go, but even so, it probably takes a couple months for it to be effective, so what would be the point?

8 Any help on this would be greatly appreciated.

9 My parents have a nearly perfect credit history and getting a bill sent to collections will really mess it up, but don’t want them to pay if it’s not their fault or required, since it seems that even employees working for the insurance company and Covered California aren’t sure about how to go about this. If they’re in the dark, how are we supposed to know?

2 First of all, it’s a tax violation to have individual plans through an employer Learn More ==> IRS Notice 2013-54 It sounds like your employer learned this rule and put in a bonafide group plan.

5 However, it sounds like the employer is trying to finagle the 9.5% affordabilty rule So, since your Dad apparently has affordable coverage, your Mom is not eligibile for subsidies. It sounds like your Mom was NOT on the group plan. Is that right?

6 If your Mom has other coverage for November and December, send the proof to Covered CA and the prior Insurance Company and it shouldn’t be a problem to cancel. If not, pay the bill. She’s mandated to have coverage.

By the way, as Certified Agent, I only get paid for maintaining this website and researching answers, when I’m appointed as your agent, no charge. Here’s instructions.

Q & A is generally anonymous, let me know if you want me to edit out your “real” avatar.

Great blog!!

I’m a knucklehead. (True story): Paid January monthly premium ($875.00) for my Blue Cross policy. Then, pipe broke upstairs in my house, flooding most of my house, caving in kitchen and family room ceiling.

Major household dislocation. Due to inside construction, literally FORGOT to pay Feb/March premiums. Received termination notice yesterday (March 18th) even though it was in my house in a pile of mail since March 10th. (Dated March 8th)

Despite this obvious stupidity on me, can my policy be re-instated?? It’s a Saturday night, and, I can (obviously) contact them until Monday. I’m a self-employed stockbroker in a one man office. Very busy, but, obviously disorganized.

Thanks!

Thanks!

Unfortunately no. It doesn’t sound like you were getting Covered CA subsidies which would have given you a 90 day grace period. See links above for special enrollment periods and temporary plans. I’m doing what I can to get all my clients set up on auto pay, so this doesn’t happen. Do you have a non spousal employee you were thinking of hiring? That would get you the opportunity to purchase a group plan which has year around enrollment.

Hi….Thanks for quick reply. I live in Pennsylvania, but, have spent entire day tooling around the web and found your blog.

I’ll call them 1st thing Monday morning with the (true) “dog ate my homework” story.

Many Thanks, Steve……(We are in our late 50’s, good health…..does this mean we can’t get insurance??)

Not that I know of, other than a temporary plan. If you do learn of something I don’t know, please post it here. It could be possible that your state has more protection than the national rules or what CA has.

I just received a random letter today (March 7, 2016) from blue cross blue shield of alabama that said they canceled my policy for “non-payment” and that the effective date of this cancellation is January 1st. However, I set up auto pay and checked my account and I was billed and paid for January and February. What should I do? Can I be reinstated??

I’d like to see the letter and your proofs. Reading a letter at least 3 times can be very helpful. It sounds to me like you have a clear case for reinstatement. Try calling member support. Send an email to your agent and BC/BS. Check your policy – Evidence of Coverage for the appeal & grievance procedures. If that doesn’t work check with the Alabama Department of Insurance. See the links below for CA on grievance procedures and the link to the specimen policy grievance page.

Got it all resolved now! When I got the letter, I went into panic mood and started reading up on others that had this issue before. They did not have such a pleasant time getting reinstate. However, the lady I talked to was very helpful and fixed the issue!

We had regular anthem blue cross for over a decade .

Then when our premium went from $150 a month to 1500 a month we fell for the covered California trap

at first it was hard because none of the doctors took it.

It has gotten easier lately until the new year hit and I was supposed to get some sort of forms from anthem in the mail but I never received them. I am super busy and very stressed due to the fact that I have 5 kids 4 are still at home and my oldest is deployed with the Marines. I also work fulltime. I always paid the premium but since j didn’t receive the new amount in the mail I simply over looked it.

My husband is having extreme depression, insomnia and anxiety . He went to the e.r and that is when I called anthem and found out my policy had been canceled .

I begged them to believe me that I never received anything in the mail and to please re enstate the policy due to the fact that my husband is having serious health issues. That was on February 14th. They said they would file a grevance and I have called back twice and I have also called some emergency number out of Washington and left two desperate messages. I have heard nothing.

Anthem told me I have to wait for something to come in the mail. I still haven’t recited anything. My husband need medical help badly.

How can I get someone to call me back from anthem…

Were you getting subsidies from Covered CA? If so, that gives you a 90 day grace period. If not, I hate to say this, but you are SOL. Health Care Reform has the positive of giving everyone coverage, regardless of health, but on the other hand you can only buy coverage during Open Enrollment. Take a look on our page and see if you qualify for a Special Enrollment. Check our Grievance Page – Check the Specimen Policy for Grievance Procedures.

Since you are with Covered CA, if you appoint us as your agent, we might be able to get you back in.

Medi-Cal has some share of cost thing for the Uninsured? See also our webpage on Share of Cost and CHCF Foundations explanation. I don’t get paid for Medi-Cal so I’m not fully familiar with it.

I doubt anyone will call you back. I don’t think there is a way to prove they didn’t send you a bill. On my grievance page, you can also complain to the Department of Insurance.

I have a similar situation with a consumer who has Anthem Blue Cross. When the EPO plans in So. Cal. went to PPO plan, they were technically NEW plans and a Binder payment had to be made. For some reason, my client never received any new billing as his premium payments had always been drafted from his checking account.

Long story short, Anthem is considering reinstating his plan to Jan. 1. Covered California did accept a SEP enrollment, but the plan doesn’t start until April 1. He is considering short term medical but he doesn’t know if Anthem will retro is plan or not.

Editors note – Kevin is a top notch agent too

Yes, we were getting subsidies . I told them we were supposed to get a 90 day grace period but anthem said since they didn’t get our first of the years payment they didn’t have to give us a grace period.

If you appoint us as your Covered CA agent, I say we have a 35% chance of getting you coverage for April 1st. Did you have Covered CA and Blue Cross for 2015? It looks like Anthem is right about having to pay the 1st month premium. Learn More Health Affairs.org CFR 156.270 (d) (d)

ECFR

Grace period for recipients of advance payments of the premium tax credit.

A QHP issuer must provide a grace period of three consecutive months if an enrollee receiving advance payments of the premium tax credit has previously

paid at least one full month’s premium during the benefit year

She needs to file a complaint with Dept of Managed Health Care 1-888-466-2219 or Dept of Insurance 1-800-927-HELP. I believe Anthem is regulated by CDI not DMHC.

MAX

Editors Note – Max is also a top notch Insurance Agent and is on the DOI Educational Committee

I just started Molina…my first premium due the 25th…I won’t receive retirement check until the 29th. Will this be OK? Thank you!

Did you start February 1st or March 1st? Are you direct or through Covered CA? Are you getting subsidies? Did you want to appoint us as your agent, no charge? If February 1 – NO!!! per agent bulletin dated 2.17.2016 If you appoint us as your agent, we can check if you are good for March 1st. covered-ca/agent-designation/

In your private email to us, you state it’s March 1, that should not be a problem. Again, if you appoint us as your agent, we can double check that.

Covered CA payment methods – options

45 CFR 155.240

There has “always?” been say a 10 day time after the effective date to pay. It’s often been extended. Insure Me Kevin.com Appoint us as your agent and we will double check Molina’s deadline for March. Their deadline for February was yesterday, the 25th.

Molina just issued an agent bulletin Friday 2.19.2016 12:19 PM stating the initial – binder payment for March is also extended to the 25th.