Dental Coverage designed to lower Income for Share of Cost Medi Cal

Visit our main webpage on lowering Share of Cost to ZERO!

- The AmFirst is our most popular plan for those who need to buy health insurance to lower their income for Medi Cal Share of cost!

- Plans are available from $85 up to $425/month

- Application – Just fill it out, check off the premium you need, take a picture and email [email protected] to us

- Proof of coverage for upload to BenefitsCal.com is issued often the same day!

- Source of image above

- Need to spend more than $310 – up to $435??

- Scroll down to learn about Medi Gap, Part D, etc.

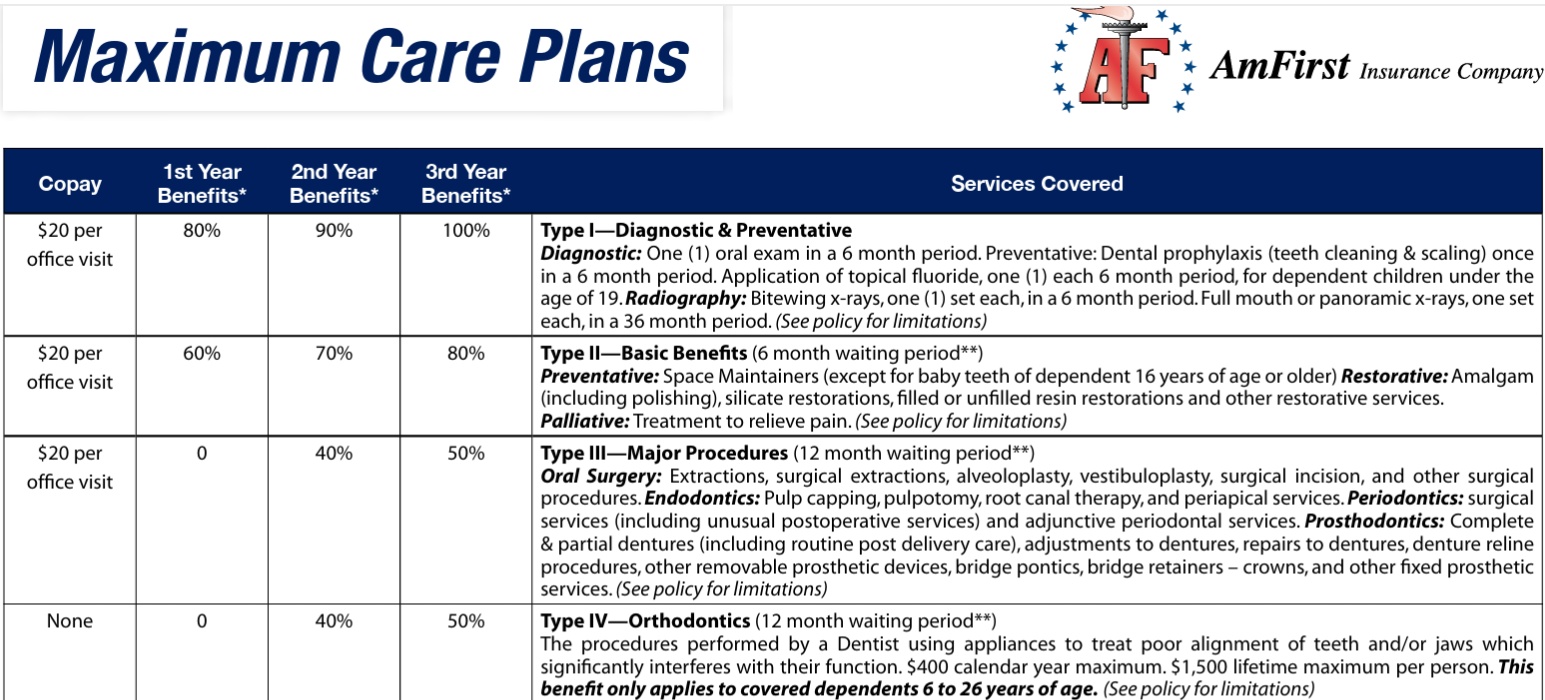

- Special Plan for Share of Cost – Maximum Care Plans

- Maximum Care Plans Summary of Benefits

- Plus Plan

- If you need to spend more for Share of Cost – Check out the Dental Plus Plan

- You get proof of coverage to upload to Benefits Cal.com the next day!

- Enrollment Form Plus & Maximum Care Plans

- Just fill out the form, take a picture and email to us at [email protected]

- There is no charge for our expertise in helping you. We get paid by the Insurance Company.

- Receipt and proof issued within 24 working hours

- AI summary of proofs needed by Medi Cal

- Submit proof of your health insurance premiums to the county Medi-Cal office

- Effective date only the 1st of the month, but can be BACKDATED as far back as the last day of the month.

- Client – Member Portal

- Just fill out the form, take a picture and email to us at [email protected]

- Use ANY Dentist – UCR Usual Reasonable & Customary

- Certificate of Coverage EOC

- travel and fitness.org dues are included in the premium

- You should get approval and your policy in a day or two. Then just upload (get instructions) to BenefitsCal.com

- How to upload documents to BenefitsCal.com

- How to use medical expenses to lower share of cost

- Share of Cost FAQ’s

Need to spend more $$$ to get to Zero Share of Cost?

Ways to lower your Medi-Cal #Share of Cost

If you don’t have Full Scope Medi Cal

Get a Vision, Dental or Medi Gap Policy

You can Avoid a Share of Cost dpss flyer in the (ABD-MN) Aged, Blind and Disabled our webpage – Medically #Needy Program (CANHR Fact Sheet 8.14.2023) (My highlighted version) program and then qualify for no-cost Medi Cal A & D FPL.

Just purchase Health Insurance California Code of Regulations 22 ccr 50555.2 : CA Insurance Code §106

- dental or vision insurance get quotes Quotit.

- Special Plan for Share of Cost – Maximum Care Plans

- I just heard at a CA Advocates HI CAP webinar that you can get several dental and vision policies. This kind of makes sense as there isn’t a COB Co Ordination of Benefits Clause on Individual Plans, so you could possibly collect more than the actual claim

- Medi-Gap

- Note that if you have Kaiser or another Medicare Advantage Program, you can’t get Medi Gap

- We are NOT telling you to cancel your MAPD program, but you might want to consider it.

- MAPD vs Lower Share of Cost?

- SEP’s Special Enrollment Periods to drop MAPD if Medi Medi any quarter Medicare.gov

- MAPD options for Dual Eligibles Medi Cal and Medicare

- GET QUOTES & ENROLL Medi Gap Quotit *

- Contact us [email protected] if you want quotes from UnitedHealthcare

- Note that if you have Kaiser or another Medicare Advantage Program, you can’t get Medi Gap

- Part B Medicare

- Part D Rx,

- Do you have this in your Medicare Advantage Program?

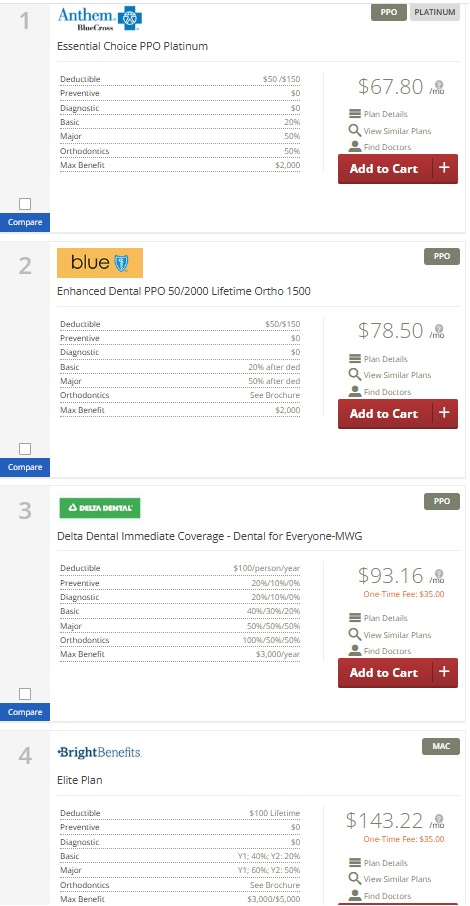

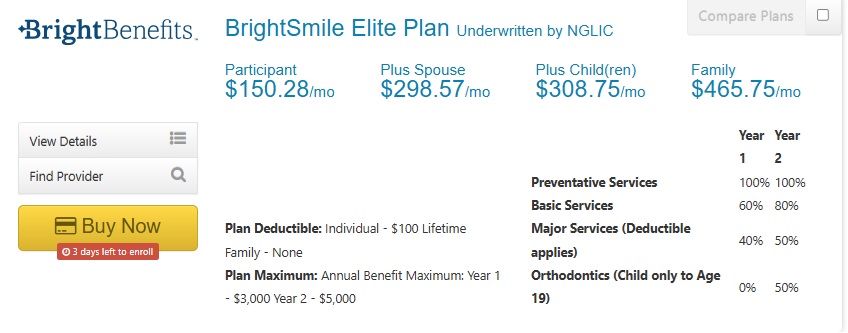

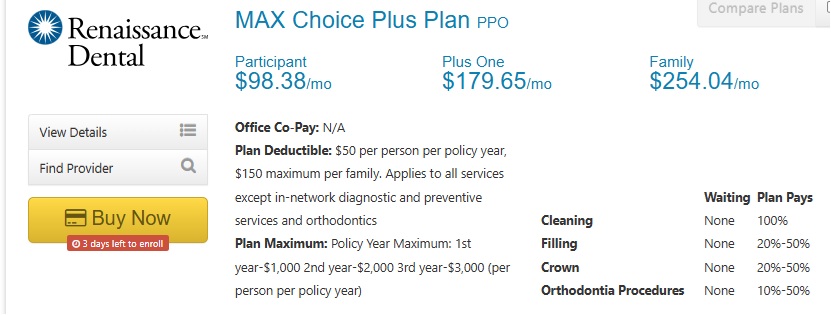

Sample Dental Plans with Quotit – Get proposals

All our Health plans are Guaranteed Issue with No Pre X Clause

Instant Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

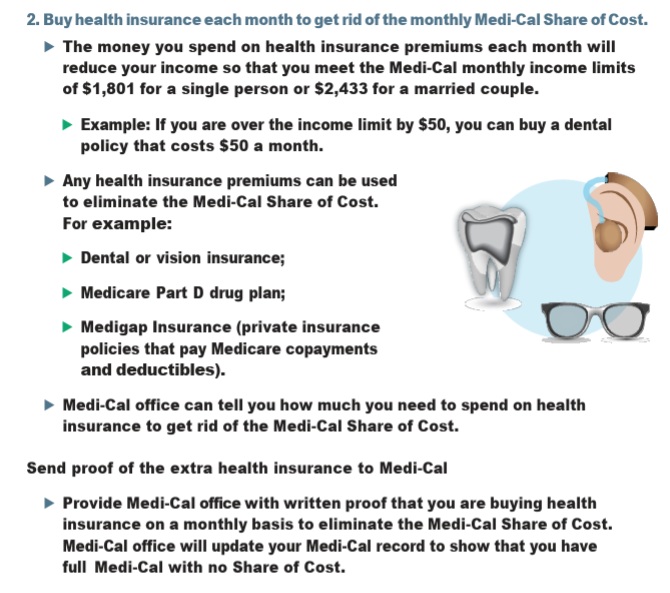

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

- Watch our 10 minute VIDEO that explains everything about getting a quote

|

Hi Steve, Good Morning! Medi-Cal reviewed my Mom’s case and eliminated her share of cost effective as of February 1. My family is very grateful that this issue was resolved in a very timely manner. Thank you very much again for your assistance in facilitating this effort. I will definitely keep your contact information for any future insurance needs. Sincerely, Don V

****************** Thank you so much. Eliminating her share of cost will allow her to stay living at our home longer so it’s very wonderful. Mary |

Hi Steve, THANK YOU SO MUCH for getting back with me. You are a wealth of knowledge and I am so grateful to connect with you Thank you! Carie C

|

Dental For #Everyone,

has an excellent website with full brochures, Instant online quoting and enrollment

- Dental for Everyone includes quotes from

- Careington Discount Plan

- Bright Benefits

- Renaissance Dental

- Delta Dental

- AmFirst

- One of our colleagues on how Dental for Everyone Works.

- Some of our webpages on dental

- VSP Vision

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

General Information on Share of Cost

Center for Health Care Rights

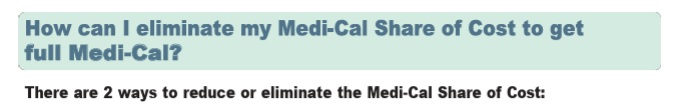

- There are 2 ways to reduce or eliminate the Medi-Cal Share of Cost:

- 2. Buy health insurance each month to get rid of the monthly Medi-Cal Share of Cost.

- ► The money you spend on health insurance premiums each month will reduce your income so that you meet the Medi-Cal monthly income limits of $1,801 for a single person or $2,433 for a married couple.

- ► Example: If you are over the income limit by $50, you can buy a dental policy that costs $50 a month.

- ► Any health insurance premiums can be used to eliminate the Medi-Cal Share of Cost. For example:

- ► Dental or vision insurance;

- ► Medicare Part D drug plan;

- ► Medigap Insurance (private insurance policies that pay Medicare copayments and deductibles).

- ► Medi-Cal office can tell you how much you need to spend on health insurance to get rid of the Medi-Cal Share of Cost.

- Send proof of the extra health insurance to Medi-Cal

- ► Provide Medi-Cal office with written proof that you are buying health insurance on a monthly basis to eliminate the Medi-Cal Share of Cost. Medi-Cal office will update your Medi-Cal record to show that you have full Medi-Cal with no Share of Cost.

- See My Medi Cal information

- 2. Buy health insurance each month to get rid of the monthly Medi-Cal Share of Cost.

More explanation of how share of cost works and ways to eliminate it – bring it to ZERO!

Share of Cost in California Explained (Medi-Cal Rules)

If you live in California and have Medi-Cal with a share of cost, you’re not alone — and you’re probably frustrated. Share of cost is one of the most misunderstood parts of Medi-Cal, and it affects thousands of Californians every month.

This page explains how share of cost works in California, what expenses count, and when alternatives like Covered California health plans may cost less overall.

What Is Share of Cost in California Medi-Cal?

In California, share of cost is the amount you must pay (or incur in medical bills) each month before Medi-Cal begins paying for covered services.

It functions similarly to a deductible — but with important differences:

-

It resets every month

-

It is based on income, not plan design

-

It applies only to certain Medi-Cal programs

Once your share of cost is met in a given month, Medi-Cal pays for the rest of that month’s approved services.

Why California Uses Share of Cost

California applies share of cost when your income is:

-

Above standard Medi-Cal limits

-

But still low enough to qualify after allowable deductions

This often applies to:

-

Seniors (65+)

-

Individuals with disabilities

-

People receiving Social Security

-

Individuals with variable or non-MAGI income

California uses specific income rules that differ from MAGI Medi-Cal, which is why many people are surprised when they receive a share of cost notice.

How Share of Cost Is Calculated in California

California considers:

-

Gross monthly income

-

Household size

-

Certain allowable deductions

-

Living arrangements

The final number becomes your monthly share of cost, and it resets every calendar month.

⚠️ A small reporting error can result in a much higher share of cost than necessary.

What Medical Expenses Count Toward Share of Cost in California?

Many expenses can be applied toward your share of cost, including:

-

Doctor visits

-

Hospital services

-

Prescription medications

-

Dental care

-

Vision services

-

Medical equipment

-

Some unpaid medical bills from prior months

Rules can vary by county and situation, so verification matters.

Can Share of Cost Be Reduced or Avoided in California?

In many cases, yes.

Depending on your situation, options may include:

- Get Health Insurance… Namely Dental, see above!

-

Correct income categorization (MAGI vs non-MAGI)

-

Proper deduction reporting

-

Household or filing status changes

Get Help With Share of Cost in California

If you’re dealing with share of cost in California, you deserve clear answers.

I help Californians:

- Get health insurance so that the premiums count against income to get you down to the Medi Cal limit!

-

Understand Medi-Cal share of cost rules

-

Estimate subsidies accurately

-

Avoid unnecessary medical expenses

👉 See our contact form above!

How to Lower Your Medi-Cal Share of Cost (Los Angeles County)

If you have Medi-Cal with a share of cost, you may be paying more than required.

Certain out-of-pocket medical expenses — including dental insurance premiums —

can lower your share of cost dollar-for-dollar.

What Lowers Share of Cost?

- Dental insurance premiums

- Vision insurance premiums

- Medicare Part B and Part D premiums

- Medicare supplement (Medigap) premiums

- Other private health insurance premiums

How the Math Works

Every $1 of allowable medical expense lowers share of cost by $1.

What to Upload

Upload a premium bill, policy summary, insurance letter, or bank statement

showing the premium amount.

What to Write

Out-of-pocket dental insurance premium. Please apply as an allowable medical

expense to reduce Medi-Cal share of cost.

Follow Up

Call LA County DPSS at 1-866-613-3777 after 3–5 business days.

Presented by Steve Shorr, Licensed Insurance Agent

How to Lower Your Medi-Cal Share of Cost (Los Angeles County)

Intro (short + reassuring)

If you have Medi-Cal with a share of cost, you may be paying more than required.

Many people don’t realize that dental insurance premiums and other health premiums can lower share of cost dollar-for-dollar.

This page explains exactly how it works, what documents to upload, and what to say to Los Angeles County so it gets applied correctly.

What Is Share of Cost?

Share of cost is the monthly amount you must pay for medical expenses before Medi-Cal starts paying.

The good news:

Certain out-of-pocket medical expenses reduce it.

Expenses That Can Lower Share of Cost

If you pay these yourself, they usually count:

-

Dental insurance premiums

-

Vision insurance premiums

-

Medicare Part B premiums

-

Medicare Part D premiums

-

Medicare supplement (Medigap) premiums

-

Other private health insurance premiums

Employer-paid premiums do not count.

How Much Will My Share of Cost Drop?

It’s simple math:

Every $1 of allowable medical expense lowers your share of cost by $1.

Example:

Dental premium: $52 per month

Share of cost: $850

➡ New share of cost = $798

Multiple premiums can be combined.

What Documents Do I Need?

Upload one of the following:

-

Insurance premium bill

-

Policy summary showing monthly cost

-

Letter from the insurance company

-

Bank statement showing the premium payment

Documents must show:

-

Name of the Medi-Cal member

-

Insurance company name

-

Monthly premium amount

-

Recent date

Where to Upload (Los Angeles County)

Upload documents at BenefitsCal.

Choose:

-

Upload Documents

-

Document Type: Medical Expense

What to Write in the Comment Box

Copy and paste this exactly:

“Out-of-pocket dental insurance premium. Please apply as an allowable medical expense to reduce Medi-Cal share of cost.”

Important: Follow Up

After 3–5 business days, call LA County DPSS:

📞 1-866-613-3777

Say:

“I uploaded proof of dental insurance premiums and am requesting it be applied to reduce share of cost.”

If You Get Pushback

Dental insurance premiums are allowed.

-

42 CFR § 435.726 (Federal regulation)

-

California Welfare & Institutions Code § 14005.12

Dental and vision premiums are allowable medical expenses under Share-of-Cost Medi-Cal.

Need Help?

If you’re unsure what counts or want help reviewing your situation, contact a licensed health insurance professional.

Presented by Steve Shorr, Licensed Insurance Agent

Who pays Medicare Part B you or Medi Cal?

Medicare Savings Programs & LIS Low Income Subsidy aka Extra Help

If you pay, it lowers your Share of Cost!

Visit our Webpage on how to lower costs using

unreimbursed Medical Expenses

More explanation, details & Faq’s

Explanation of Share of Cost #SOC

- If your monthly income is higher than the limits to qualify for SSI or the A&D FPL program, but you meet the criteria of the low asset-level requirements, you may still qualify and be eligible for Medi-Cal with a share of cost (SOC).

- Uh Oh 2026 it looks like there is an asset test! Learn More Insure Me Kevin.com * Daily News * CANHR Fact Sheet * CANHR FAQ’s *

- SOC functions like a deductible, it’s not a percentage, like a Co-Pay. You must pay this amount in any month you incur medical costs. After your SOC is paid, Medi-Cal will pay the remaining amount of your medical bills for that month.

- Note: A SOC is not a monthly premium. It is more like a deductible. It is the amount of medical expenses you are responsible to pay for before you can get full Medi-Cal coverage for the remainder of the month. If you have no medical expenses, you pay nothing.

- More detail on how & where to pay your share of cost when you have IHSS In-Home Supportive Services Scroll down and see our references & links too.

- VIDEOs

Income Limits

To be eligible for the A&D FPL or the Blind FPL Medi-Cal programs, an applicant’s Countable Income for SSI Program cannot exceed a level set by the state that is based on the Federal Poverty Level. The countable monthly income limit for an individual adult or child is based upon the Federal Poverty Level (100% FPL), plus $230.37 Welf. & Inst. Code § 14005.40(c)(1) See Western Poverty Law Page 91 for what seems like the best and understandable explanation

Cal Matters – Problems with Income Limits – Inflations – Numbers haven’t changed in 30 years.

References & Links

- CHCF explanation SOC Share of Cost Rev December 2017

- Includes cost calculation worksheets

- CANHR Aged & Disabled Program

- CA Health Care Advocates

- Health Consumer Alliance Fact Sheet

- Disability Rights CA Share of Cost – Nursing Home Resident

- Medi-Cal What it means to you Phamplet outdated?

- Covered CA Agent Certification Circa 11.2013 Page 5 et seq)

- Health Rights Hotline. Our number is 1-888-354-4474.

- 1-800-952-5253 to get a fair hearing

- Medi-Cal Contact Info

- Working Disabled Program – Premium may be less than Share of Cost

- Nolo – Spend Down

- Health Consumer Alliance Helping Californians get the health care they need

- McKay Law Medicaid Qualification

- CA Department of Aging Find Services

- This overview of the Medi-Cal program addresses issues relevant to older adults and persons with disabilities. At the end of this chapter is a listing of other sources of information about Medi-Cal, including information about consumer informational fliers and Medi-Cal mental health services. Bet Tsezak

- Eligibility Procedure Manual dhsc.gov

- IHSS Share of Cost

- AB 1900 to Relieve California’s Seniors, the Disabled, and Low-Income Families from the Hardship of Medi-Cal ‘Share of Cost’ Expenses

- Ways to Lower or Stop your Medi-Cal Share of Cost

- Medi-Cal Notice of Action (NOA) – Frequently Asked Questions

- Medi Cal Forms

Clarification from Hi Cap

Hello Mr. Shorr,

Mrs. Burns shared your latest email with me, and I will respond.

- First, California Health Advocates (CHA) focuses primarily on Medicare issues. We leave the topic of Medi-Cal calculations and regulations for share of cost determination to the appropriate county Medi-Cal office.

- Second, when Medicare beneficiaries request help from the local HICAP, we encounter the fact that many beneficiaries are very much connected to their Medicare Advantage Plan, and often that works against them if they have a large Medi-Cal Share of Cost (SOC) . Sometimes the only option is to return to Original Medicare during the Open Enrollment (October 15 to December 7), or other Special Enrollment Periods, and try to get a Medi gap with a premium that will help them with reducing their countable income. But then as you know, their situation would have to meet one of California’s Guarantee Issue regulations, otherwise they’d be subject to underwriting.

- Third, if a beneficiary feels that their SOC was not calculated correctly, the HICAP can refer the beneficiary to their

- Area Agency on Aging partner – Legal Services – for assistance. [Bet Tzedek – Los Angeles]

- This is the proper referral as established under the Older Americans Act.

I hope this helps with your concerns, and have to emphasize that CHA does NOT do policy or advocacy work on Medi-Cal related issues.

All the best,

Tatiana

Tatiana Fassieux

Education & Training Specialist

California Health Advocates (CHA)

Resources & Links

- Worksheets for Determining Eligibility Under the Aged & Disabled Federal Poverty Level (A&D FPL) Medi-Cal Program Disability Rights CA

- CHCF explanation SOC Share of Cost Rev December 2017

- Includes cost calculation worksheets

- Chapter 2 – DETERMINATION OF MEDI-CAL ELIGIBILITY AND SHARE OF COST

- Medically #Needy Program (CANHR Fact Sheet 8.14.2023) (My highlighted version)

- Western Poverty Law *

- CA Health Care Advocates * Read the full article from CHCF *

- AB 715 Fact Sheet *

- CHCF for 3 other examples!

- CHFC explanation of Share of Cost

- Legal Aid of San Mateo is your Share of Cost Calculated Correctly

- CA Code of Regulations Article 10 Income

Artificial Intelligence Summary

(with our review)

While Medicare and Medicaid are primary funding sources, you can also be eligible with Medicare or through private payment if you don’t qualify for Medicaid but meet the other requirements. [1, 2, 3, 4, 5, 6, 7, 8]

- Age: You must be 55 years of age or older. [1, 2]

- Location: You must live in a geographic area served by a PACE program. [1, 3, 5]

- Nursing Home Level of Care: You must be certified by your state as needing a nursing facility level of care. This means you need a significant amount of help with daily tasks like bathing, dressing, or walking. [1, 9, 10]

- Safety: You must be able to live safely in your home or community, even with the support of PACE services. [1, 9]

- Contact your local PACE provider: Find a PACE organization that serves your area and contact them to discuss your eligibility. [9]

- We can help you. Email us [email protected]

- Assessment: The PACE interdisciplinary team will assess your physical and functional needs to determine if you qualify for a nursing home level of care. [10, 11]

- Enrollment: If you meet all the requirements, you can enroll in PACE. [9]

- With Medi Cal : If you have Medi Cal , you typically do not pay a monthly premium for long-term care services through PACE.

- With Medicare: If you have Medicare but do not qualify for Medi Cal you will pay a monthly premium for the long-term care portion of the PACE benefit.

- Private Pay: If you don’t have Medicare or Medi Cal, you may be able to pay privately for PACE services.

- my place health.com/

- myPlace Health specializes in providing value-based, comprehensive care and coverage for older adults with significant needs so they can thrive in the homes they love and in the communities they cherish.

- Our myPlace PACE (Program of All-Inclusive Care for the Elderly) model provides seamless primary care, integrated health plan coverage, personalized social engagement, and customized services – all at no cost if you are eligible for Medi-Cal or both Medicare and Medi-Cal.

- .dhcs.ca.gov/PACE

- cal pace.org/

- dhcs.ca.gov/ inclusive care for the elderly

- medicaid.gov/ /program-all-inclusive-care-elderly

- medicare.gov/PACE

- cms.gov/pace/factsheet

I appreciate your guidance on getting to zero share of cost, very informative! 🌟

Thank you for your help – I’ve spent years trying to figure this out and I’m glad you were able to help me.

Hi Steve,

Thank you for the nice presentation, [Loom explanation of an email] very helpful to see everything onscreen.

Best regards,

Leslie

Hi Steve,

Our zoom meeting this morning was very much appreciated.

I really benefited a lot from our discussion

Thank you very much for your assistance.

Sincerely,

Don V