How to get Medicare Coverage if you have End Stage Renal Disease? (ESRD)

Chronic Kidney Disease?

Need Dialysis

Medicare Coverage of Kidney Dialysis and Transplants # 10128

- Average Billed Charges – 2017 Transplant Kidney - $414k

- Transplant Costs & Insurance - Kidney.org

- Medicare and People with Disabilities: An Overview–Hi Cap

- Medicare and People with End Stage Renal Disease (ESRD) Hi Cap

- No Cash, No Heart. Transplant Centers Require Proof Of Payment. CA Health Line

- Rated – Surcharged Policies Pre Existing Conditions

- The Government Booklet above will answer these questions:

- When does Medicare Coverage Start if you have kidney problems...

- Kidney Failure Definition Stanford Health

- End-Stage Renal Disease (ESRD) CMS.gov

How to get Medicare Coverage if you have End-Stage Renal Disease (ESRD)

You can get premium-free Part A Hospital if you get regular dialysis treatments or need a kidney transplant, have filed an application for Medicare, and meet 1 of the following conditions:

- Have worked the required amount of time under Social Security, the Railroad Retirement Board (RRB), or as a government employee; or

- Are getting or are eligible for Social Security or RRB benefits; or

- Are the spouse or dependent child of a person who has worked the required amount of time under Social Security, the RRB, or as a government employee; or are getting Social Security or RRB benefits.

Part A Hospital coverage begins:

- The 3rd month after the month in which a regular course of dialysis begins;

- See FAQ for more detail, or

- The first month a regular course of dialysis begins if the individual engages in self-dialysis training; or

- The month of kidney transplant;

- FAQ for more detail,

- Transplant Costs & Insurance -Kidney.org or

- Two months prior to the month of transplant if the individual was hospitalized during those months in preparation for the transplant. Citations – (CMS) * Publication 10128 Page 6 *

- FAQ about full recovery after transplant and special enrollment to get new coverage

- Part A & B Enrollment – Sign Up?

Resources & Links

Jump to section on

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

More Info

How much does kidney dialysis cost?

How is it covered under the various options for Medicare Coverage?

How costly is kidney failure treatment?

Kidney failure treatment—hemodialysis, peritoneal dialysis, and kidney transplantation—is costly, and most people need financial help. The average cost to Medicare per person in 2011 was1

- almost $88,000 for hemodialysis, a treatment for kidney failure that filters blood outside the body

- more than $71,000 for peritoneal dialysis, a treatment for kidney failure that uses the lining of a person’s abdominal cavity as a filter

- almost $33,000 for a transplant, surgery to place a healthy kidney from someone who has just died or a living donor, usually a family member, into a person’s body nih.gov *

**********

Dialysis is used during end-stage kidney failure to replace the functions of the kidneys — including waste removal and regulation of blood levels of potassium and sodium.

Typical costs:

- Dialysis is covered by health insurance.

- For patients covered by health insurance, out-of-pocket costs typically include the deductible, and coinsurance for the treatment cost.

- For example, with Medicare, a patient, once the deductible of about $150 is met, typically would pay coinsurance of 20%; but many Medicare patients also have secondary insurance to cover all or part of that cost.

- A study published in Health Affairs[1] showed that the average U.S. patient pays $114 for dialysis-related drug costs and about $10 in dialysis costs per month. health.costhelper.com/dialysis.html *

New Rule to promote at-home dialysis services

- kidney.org/home hemo

- fresenius kidney care.com/home-hemodialysis

- home dialysis.org/home-dialysis-basics

- davita.com/can-anyone-do-dialysis-at-home

and transplant care for people from underserved communities —- decisive step to ensure people with Medicare with chronic kidney disease have easy access to quality care and convenient treatment options 42 CFR Parts 412, 413 and 512 Final Rule Modern Health Care *

New rule to promote at-home dialysis services and transplant care for people from underserved communities, which marks the agency’s first effort to tackle health disparities for Medicare enrollees with kidney failure in the decade since Congress established the prospective payment system for ESRD providers. CMS published the proposed rule for ESRD payments in July. .modernhealthcare.com/payment/medicare-drops-changes-esrd-payment-health-equity-mind

- See our page on what Medi Gap and Medicare Pay.

- View Typical Summary of Benefits for MAPD

- latimes.com/dialysis-industry-political-spending

- kevin md.com/involuntary-discharge-dialysis

- Dialysis Management Solutions (DMS) provides services to help self-funded employers and brokers manage the impact of dialysis claims and ease the stop-loss renewal process.

FAQ’s

- What about staying with under an under 65 plan? Covered CA?

- Who gets on the list for a kidney?

- Are patients being forced into Medicare – Insurers making Dialysis clinics out of Network?

- Supreme Court sides with insurer in dialysis coverage case

- Supreme Court rules in favor of insurance plan that pushed kidney failure patient to Medicare

- The Supreme Court’s Dialysis Ruling Reinforces Self-funding as the Only Affordable Option

- Medicare expenditures could be reduced by increased peritoneal dialysis use

- does-medicare-cover-nutrition-counseling Medicare.Gov *

- Helping employers manage all aspects of outpatient dialysis claims by reducing costs and focusing on patient care.

- A transplanted pig kidney offers a grandmother hope for life without dialysis NPR.Org *

- Medicare is experimenting with how it pays for kidney transplants Association of Health Care Journalists

- Tool of genocide’: Chinese government is forcibly removing organs from prisoners’ bodies USA Today June 2022

- Covered CA Guaranteed Issue SEP Special Enrollment Period for when you lose Medicare Kidney Coverage our webpage

-

Medi-Gap policy?

Can you get or keep one?- If you have a Medi Gap plan before you are diagnosed with ESRD, you can keep it.

- There is also a guaranteed issue opportunity when you turn 65, Medicare Publication Kidney Dialysis & Transplant Services # 10128. page 42.

- If you get a Medicare Advantage plan, you could then change to Medi Gap under the 1 year free trial rule MAYBE!!!

- If this is your situation, ask us and we will double check. One must read the law 3 times and then when you think you understand it, read it again.

- One could also hope for a “Underwriting Holiday.”

- Anthem MediBlue Plus & SNP

- Blue Shield 65 Plus – Inspire HMO 2024

- Scan

- SNP Special Needs Plans Medicare Advantage

- UnitedHealthcare

- If you are not in a guaranteed issue period, here’s the underwriting questions, so forget it.

#Medicare10050 and You 2025

Spanish

Everything you want to know

- Steve's Video Seminar Introduction to Medicare & You

- Clear View to Medicare Patient Advocate.org - 36 pages

- Get Ready for Medicare * Spanish

***********

- Your Medicare #Benefits # 10116

- Inpatient ONLY - How Medicare Pays for your Surgery Part A vs Part B Very Well Health.com

- Enroll in Blue Cross

- Use our scheduler to Set a phone, Skype or Face to Face meeting

- #Intake Form - We can better prepare for the meeting (National Contracting Center)

- Get more information and FAQ's

- #Intake Form - We can better prepare for the meeting (National Contracting Center)

Medicare Advantage

Special Needs Plans

#Understanding Medicare Advantage Plans (PDF) #12026

- Set a Zoom Meeting

- We can now do SOC Scope of Appointment, before the Meeting via a 3 minute recorded meeting 2 days before. AHIP Training Module 4 Page 14 *

- #Intake Form - Please email us [email protected] for the form - That way we can better analyze your situation to give you the answers to your needs and questions.

- Get Quotes, Full Information and Enroll

- MANDATED wording!: Think Advisor * ‘‘We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1–800–MEDICARE to get information on all of your options.’’

- We disagree with the above wording, as we can use the same tools on Medicare.gov as they do!

- Visit our general webpage on Medicare Advantage for much more detail and information.

Medicare Advantage Plans

Guaranteed Acceptance!

All Medicare Advantage plans will accept customers with ESRD! AHIP * Modern Health Care * 21st Century Cures Act

- Anthem MediBlue Plus

- UnitedHealthcare

- Blue Shield 65 Plus – Inspire HMO 2022

- SCAN

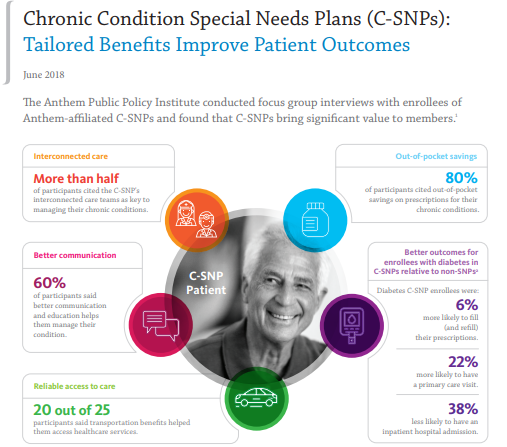

Medicare MAPD Special Needs #SNP

& Chronic Condition – C-SNP Plan?

Definition:

To enroll in a Medicare SNPs you must have one of these specific diseases or characteristics. Medicare SNPs tailor their benefits, provider choices, and drug formularies to best meet your specific needs. Medicare.gov

There are three different types of SNPs:

- Chronic Condition SNP (C-SNP)

- Dual Eligible SNP (D-SNP) Medicare & Medi Cal

- Institutional SNP (I-SNP) cms.govSpecialNeedsPlans *

Medicare SNPs CMS.gov also see Special Needs Plans are subtype of Medicare Advantage Plan.

- Can I get my health care from any doctor, other health care provider, or hospital?

- You generally must get your care and services from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis).

- Prescription drugs

- Yes. All SNPs must provide Medicare prescription drug coverage (Part D).

- Do I need to choose a primary care doctor?

- Generally, yes.

- Do I have to get a referral to see a specialist?

- In most cases, yes. Certain services, like yearly screening mammograms, don’t require a referral.

- What else do I need to know about this type of plan?

- A plan must limit membership to these groups:

- 1) people who live in certain institutions (like nursing homes) or who require nursing care at home, or

- 2) people who are eligible for both Medicare and Medicaid, or

- 3) people who have specific chronic or disabling conditions (like diabetes, End-Stage Renal Disease, HIV/AIDS, chronic heart failure, or dementia).

- Check with us, there might be additional rules [email protected]

- A plan must limit membership to these groups:

- Plans will coordinate the services and providers you need to help you stay healthy and follow doctors’ or other health care providers’ orders.

- Scan Foundation Summary on Chronic Care Act

- Forbes *

- Social Services

- UnitedHealthcare VIDEO on SNP Plans

- SNP plans may also offer home-delivered meals, transportation for nonmedical needs, pest control, indoor air quality equipment (e.g., air conditioner for someone with asthma), and minor home modifications (e.g., permanent ramps, widening of hallways or doorways to accommodate wheelchairs).

- Learn More

- Health IT.gov *

- Model of Care - HRA - Blue Shield Promise

- Modern Health Care *

- Oscar TeleHealth

- Medicare Managed Care Manual Chapter 16-B: Special Needs Plans

- Taking Stock of Medicare Advantage: Special Needs Plans Commonwealth Fund

- Our webpage on

- Proposed Rule 2023 to lower out of pocket Medicare Part D prescription drug costs and improve consumer protections, reduce disparities, and improve health equity in Medicare Advantage (MA) and Part D. CMS.Gov Fact Sheet *

-

SNP enrollment is year around.

- Learn More

You cannot buy additional coverage through #Covered California

if you have premium-free Medicare Part A Hospital

Medicare complies with Health Care Reform, so you do NOT need to get a an Individual policy or a subsidized one from Covered CA. It fact, it's illegal for anyone to sell you a policy! Kaiser Health News * Covered CA Medicare Fact Sheet * Medicare.Gov Medicare & Market Place #11694 * CMS.Gov FAQ Medicare & Marketplace * HealthCare.Gov when - how to change from Covered CA to Medicare * Social Security §1882 * Health Care.Gov

NOTE: This information also applies to people younger than 65 whose benefits begin the first month they receive disability benefits because they have Amyotrophic Lateral Sclerosis (ALS), better known as Lou Gehrig’s Disease, and to people younger than 65 who have Medicare because of a disability and are receiving SSDI Social Security Disability Insurance.

There are a lot of ands, if or buts in this complex issue. Please refer to the source material below. There are some exceptions, but they are very complex. Don't even think of getting a 1/2 correct answer over the phone. If you have to pay for Part A Hospital, then are options, like subsided Covered CA Plans. Email us [email protected]

Video about Covered CA – if no Premium Free Part A – jump to 2:30 Medicare & the Marketplace (Covered CA

- Medicare Publication # 11694 Medicare & Covered CA

- Covered CA Medicare Fact Sheet

- Medicare vs Covered CA - Publication 11694

Selling Covered CA Plans To Medicare Beneficiaries Will Be Illegal Kff.org

- InsureMeKevin.com

- Publication 02179 How Medicare works with other Insurance Our webpage

(3)(A)

(i) It is unlawful for a person to sell or issue to an individual entitled [no premium] to benefits under part A or enrolled under part B of this title (including an individual electing a Medicare+Choice plan [MAPD] under section 1851)—

(I) a health insurance policy with knowledge that the policy duplicates health benefits to which the individual is otherwise entitled under this title or title XIX,

(II) in the case of an individual not electing a Medicare+Choice plan, [aka MAPD Medicare Advantage] a medicare supplemental policy with knowledge that the individual is entitled to benefits under another medicare supplemental policy or in the case of an individual electing a Medicare+Choice plan, a medicare supplemental policy with knowledge that the policy duplicates health benefits to which the individual is otherwise entitled under the Medicare+Choice plan or under another medicare supplemental policy, or

(III) a health insurance policy (other than a medicare supplemental policy) with knowledge that the policy duplicates health benefits to which the individual is otherwise entitled, other than benefits to which the individual is entitled under a requirement of State or Federal law.

(ii) Whoever violates clause (i) shall be fined under title 18, United States Code, or imprisoned not more than 5 years, or both, and, in addition to or in lieu of such a criminal penalty, is subject to a civil money penalty of not to exceed $25,000 (or $15,000 in the case of a person other than the issuer of the policy) for each such prohibited act. Sec. 1882. [42 U.S.C. 1395ss]

Our webpages that touch on this Issue:

LIPITOR can cause serious side effects

These side effects have happened only to a small number of people. Your doctor can monitor you for them. These side effects usually go away if your dose is lowered or if LIPITOR is stopped. These serious side effects include:

- Muscle problems. LIPITOR can cause serious muscle problems that can lead to kidney problems, including kidney failure. You have a higher chance for muscle problems if you are taking certain other medicines with LIPITOR.

- Liver problems. Your doctor should do blood tests to check your liver before you start taking LIPITOR and if you have symptoms of liver problems while you take LIPITOR. Call your doctor right away if you have the following symptoms of liver problems:

-

- Feel tired or weak

- Loss of appetite

- Upper belly pain

- Dark, amber-colored urine

- Yellowing of your skin or the whites of your eyes

- Learn More===> lipitor.com/side-effects

People who take high doses of popular cholesterol-lowering drugs called statins may be more likely to develop kidney problems, a new study suggests.

“If you are concerned about your statin then go talk to your doctor,” he said. “Do not panic. There are both urine and blood tests your doctor can use to monitor your kidneys.”

Signs of kidney injury could include dark urine, difficulty urinating or less frequent urination. “If you are on a higher dose of a statin and there is any issue with urination, call your doctor,” Steinbaum said. “Instead of a high-dose statin, we can use a lower-dose statin along with another type of cholesterol-lowering medication.”

Whatever you do, Mehta added, “do not stop taking statins abruptly. Have a conversation with your doctor to discuss your benefits and risks, and ask if your kidney function has been tested.” Read the whole article==> Web MD

- ESRD – General Information

- Clinical Performance Measures (CPM) Project

- End-Stage Renal Disease (ESRD) Quality Improvement Initiative

- ESRD Network Organizations

- cms.gov/ESRD-Center

-

ESRD Info on Medicare Website

-

Medicare Info for Children with End Stage Renal Disease (ESRD) From CMS.Gov

From KidneyFund.org

- What causes kidney failure?

- Symptoms

- Treatment of kidney failure

- New to dialysis

- Adjusting to kidney failure

- Complications of kidney failure

- Disaster preparedness

- Kidney failure/ESRD diet

- california health line.org/dialysis-patients-panic-as-kidney fund no longer pays premium for private health plan

- Kidney fund may give wrong advise on Insurance Coverage for their benefit, not the consumers… LA Times

More Links

- Medicare Advantage

- Medi-Gap (Supplements) ♦

- davita.com Kidney Care Resource Web MD on Chronic Kidney Disease

- 42 U.S. Code § 1395rr – End stage renal disease program

- Medical Necessity

- Clinical Guidelines for transplant

- Kidney.org – Travel ♦

- Pre-X for International Travel Plans ♦

- Medicare Outside of USA Insbuy

- Get the FULL policy – evidence of coverage

- Federal Register Final Rule 1.1.2020