What What does OOP Out of Pocket Maximum, Calendar Year Deductible, co payment, co-insurance, mean in Health Insurance?

Try turning your phone sideways to see the graphs & pdf's?

#OOPChart

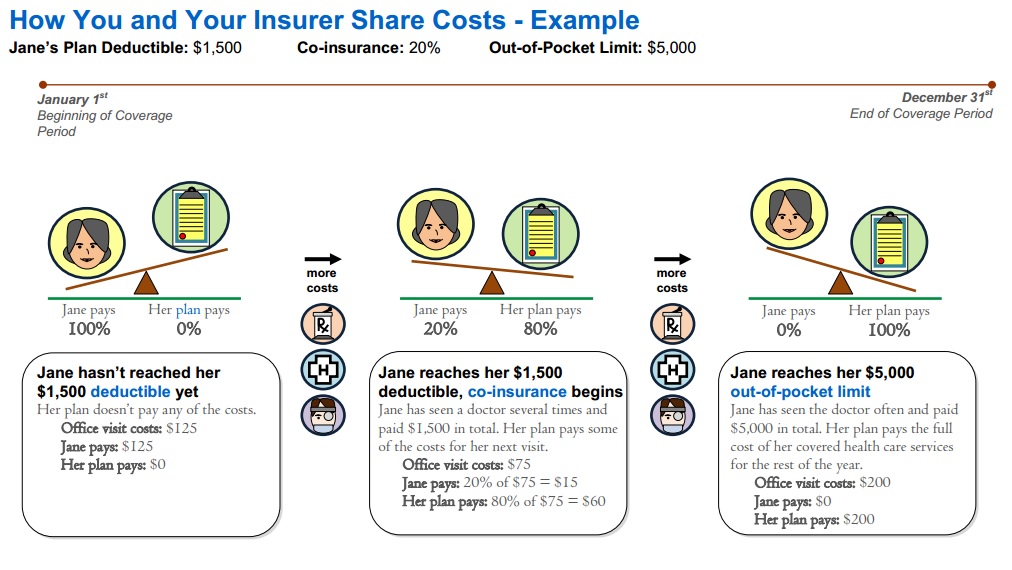

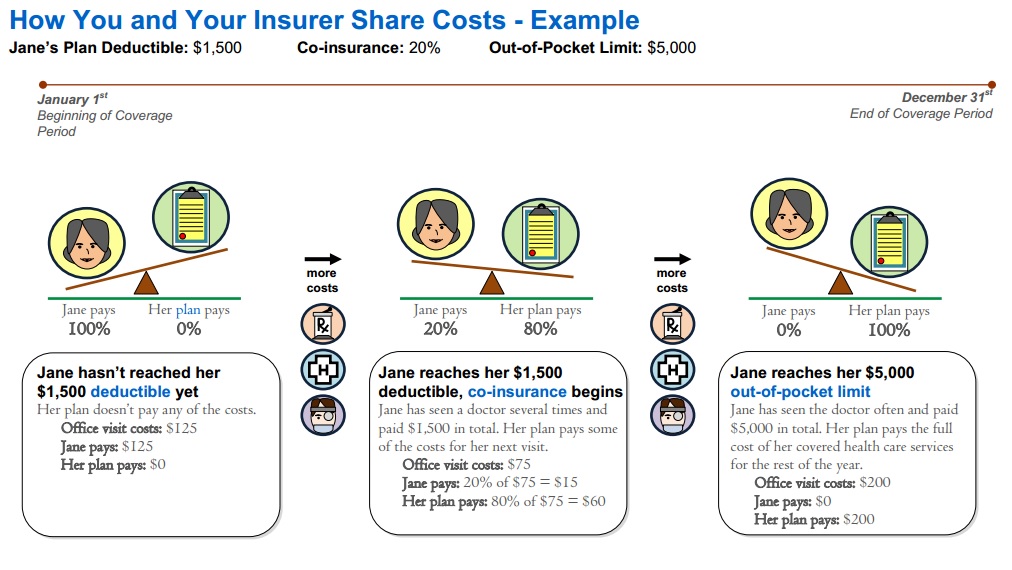

How the Out of Pocket Maximum Works in Health Insurance

Video On Maximum OOP Out of Pocket

- Graph Source Health Net Glossary Page 6

- Get quotes, subsidies, net premium, deductibles, co-pays, OOP Out of Pocket maximum from all Individual companies * Employer Group

- Provider Finder See also our Site Map for instructions & details on each companies provider finder

- Glossaries – Dictionaries

-

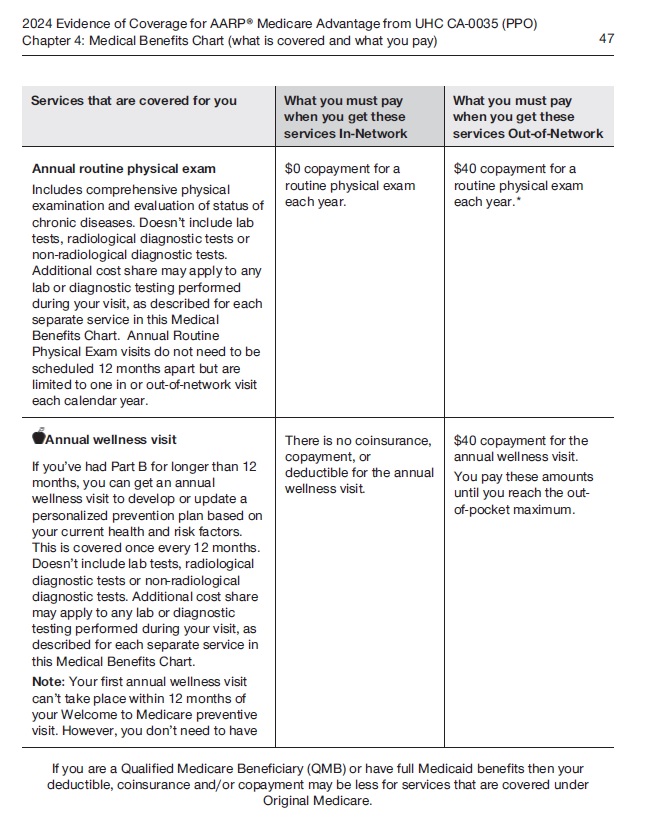

Calendar Year Deductible

- amount you must pay for specific Covered Services before the plan pays for Covered Services pursuant to this [policy] Agreement. Learn more Deductible & Co Pay

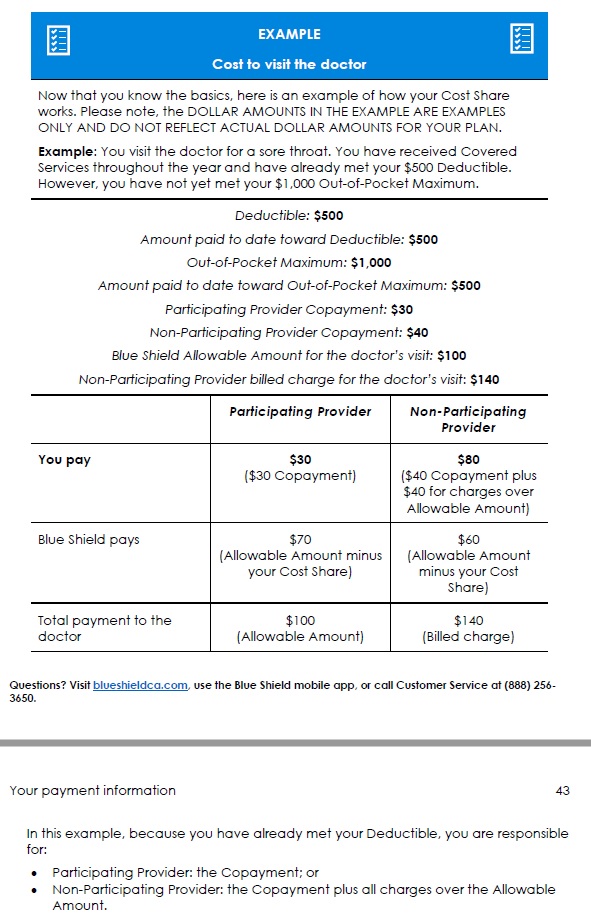

- Copayment The specific dollar amount that a Member is required to pay for Covered Services after meeting any applicable Deductible.

- Learn more Co Pays

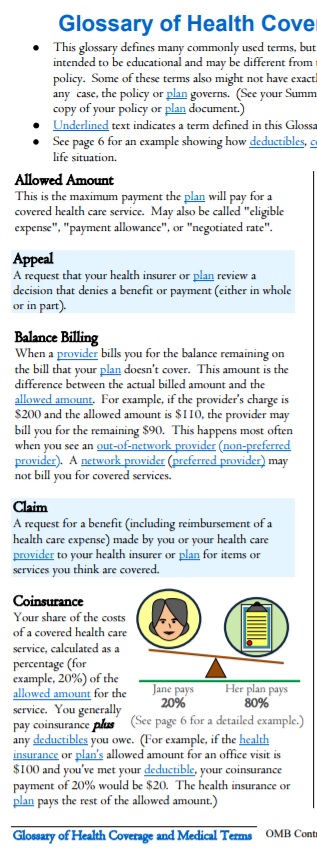

- Coinsurance The percentage amount that a Member is required to pay for Covered Services after meeting any applicable Deductible.

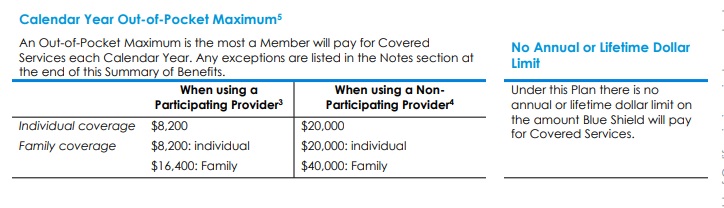

- Out-of-Pocket Maximum OOP The highest Deductible, Copayment, and Coinsurance amount an individual or Family is required to pay for designated Covered Services each year as indicated in the Summary of Benefits section. Charges for services that are not covered, charges in excess of the Allowable Amount or contracted rate do not accrue to the Calendar Year Out-of-Pocket Maximum. Sample EOC Page 107

- Maximum Out of Pocket OOP will go down in 2022 Learn More: AARP * Mercer *

- Video On Maximum Out of Pocket

- ACA’s Maximum Out-of-Pocket Limit Is Growing Faster Than Wages KFf

- Patients often can’t afford to pay off what their insurance leaves behind

- Definitions Health Insurance Terms VIDEO

- Breaking Down Covered California Health Plans By Coverage Sections Insure Me Kevin . com

- FAQs / Ask Us a Question

-

Deductible & Co Pays

#Deductible s Calendar Year & Co Pays

Deductible – The Calendar Year amount you must pay for specific Covered Services before the plan pays for Covered Services pursuant to this [policy] Agreement. Sample EOC Page 107

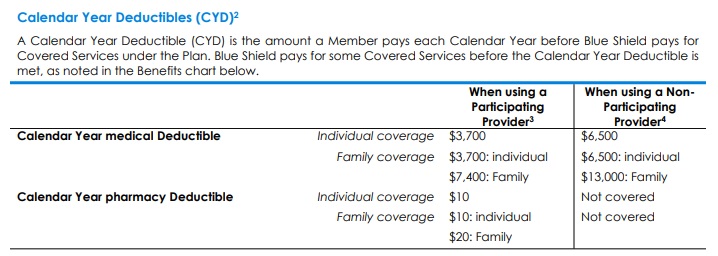

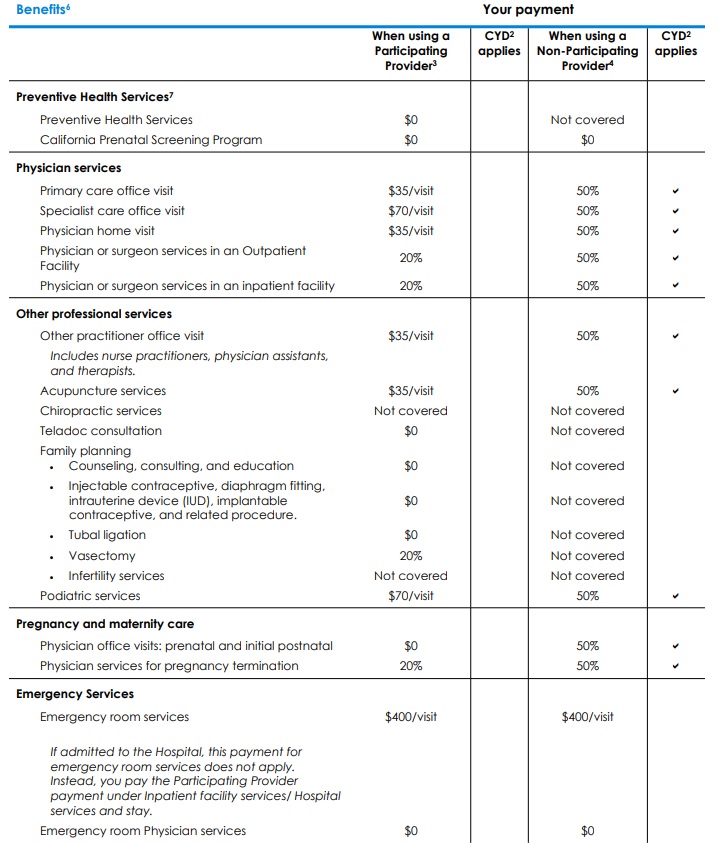

Example from 2022 Silver 70 PPO

See evidence of coverage – Cost concepts in action 2024 Page 42

- Deductibles in ACA Marketplace Plans, 2014-2024

- Metal Level Chart – Scroll to the bottom

- FAQs / Ask Us a Question

- Get Instant Quotes

Comments FAQ’s

Ask Us a Question

News reports about how high deductibles leave people effectively without medical care as people are living on the edge – paycheck to paycheck.

- Los Angeles Times May 2, 2019 * May 2 3 Kids $15k Medical Debt *

- NPR May 3, 2019

- New York Magazine.com 5.3.2019

- North County Public Radio 5.3.2019

- How to figure out the Family Deductible & OOP? Insure Me Kevin.com

- Soaring insurance deductibles and high drug prices hit sick Americans with a ‘double whammy’ LA Times

- Learn about Embedded vs aggregate deductible

- How might an HSA Health Savings Account help you save up to pay the deductible?

- FAQs / Ask Us a Question

#Co-Payments – Specific Covered Services

Footnote #2 Calendar Year Deductible (CYD):

- Calendar Year Deductible explained. A Calendar Year Deductible is the amount you pay each Calendar Year before Blue Shield pays for Covered Services under the Plan.

- If this Plan has any Calendar Year Deductible(s), Covered Services subject to that Deductible are identified with a check mark () in the Benefits chart above.

- Covered Services not subject to the Calendar Year medical Deductible. Some Covered Services received from Participating Providers are paid by Blue Shield before you meet any Calendar Year medical Deductible. These Covered Services do not have a check mark () next to them in the “CYD applies” column in the Benefits chart above.

- This Plan has a separate medical Deductible and pharmacy Deductible.

- This Plan has a separate Participating Provider Deductible and Non-Participating Provider Deductible.

- Family coverage has an individual Deductible within the Family Deductible. This means that the Deductible will be met for an individual with Family coverage who meets the individual Deductible prior to the Family meeting the Family Deductible within a Calendar Year. Any amount you have paid toward the individual Deductible will be applied to both the individual Deductible and the Family Deductible. Once the individual Deductible or Family Deductible is reached, cost sharing applies until the Out-of-Pocket Maximum is reached.

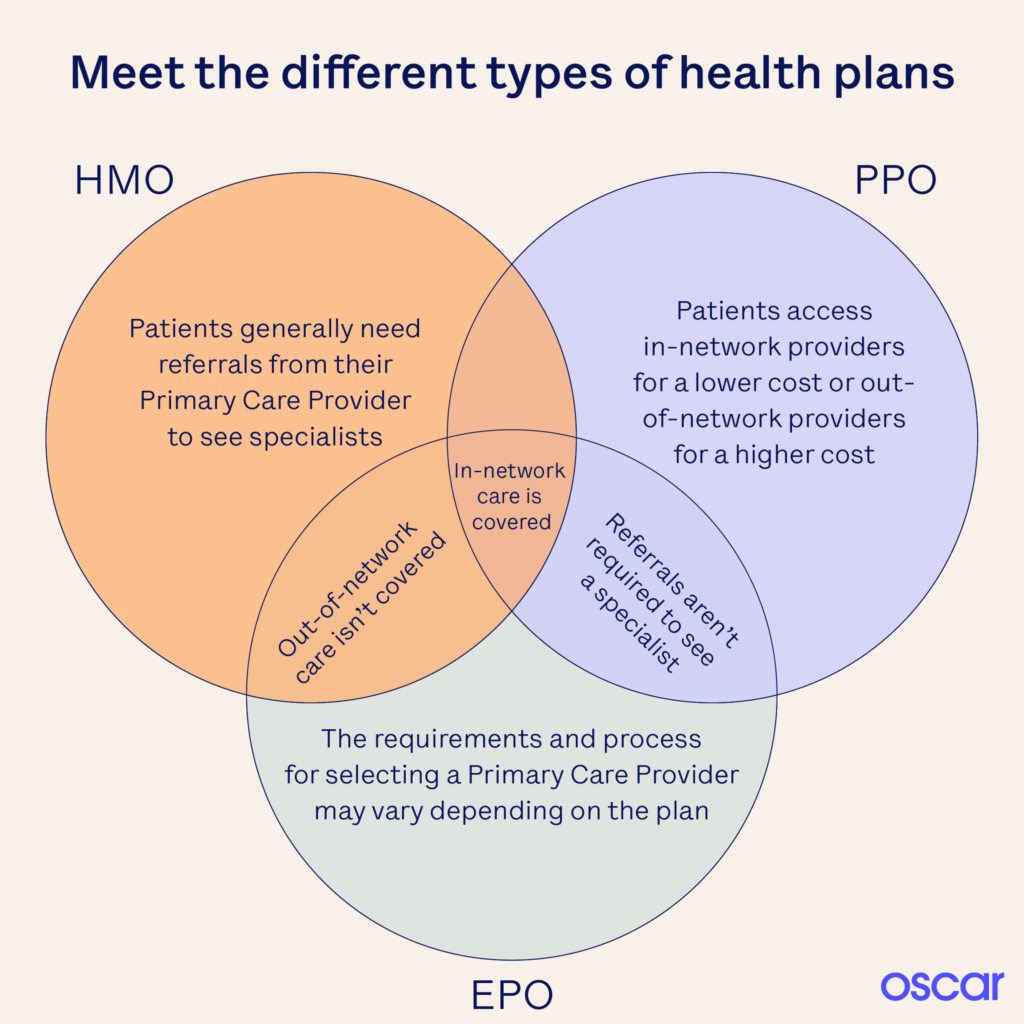

HMO – PPO – EPO

- Learn More – Oscar Explanation

- Provider Finder See also our Site Map for instructions & details on each companies provider finder

- ‘Father Of The HMO’ Dies At 95; Idea Didn’t Turn Out Like He Envisioned KFF

Notification of OOP Out of Pocket Maximum

Explanation of Benefits

- SB 368, requires most state-regulated private-sector health plans to send enrollees updates, an EOB Explanation of Benefits for every month in which they received care, showing how much they have paid toward their annual deductible — the amount a person must shell out before insurance begins to cover most of their care — and how close they are to reaching out-of-pocket limits, the amount after which the insurer pays for 100% of care. CA Health Line.org *

Our Webpage on

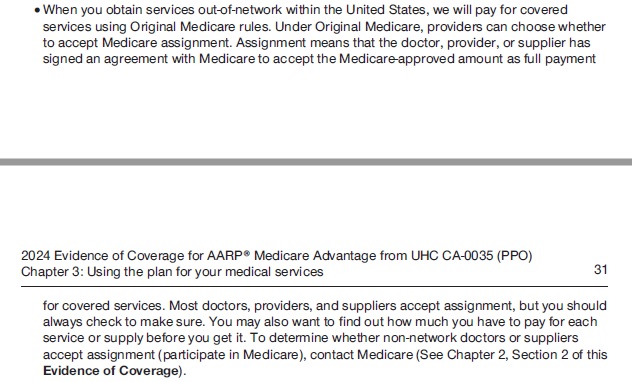

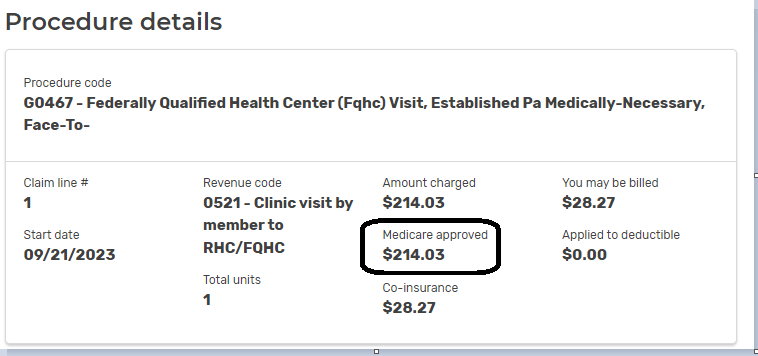

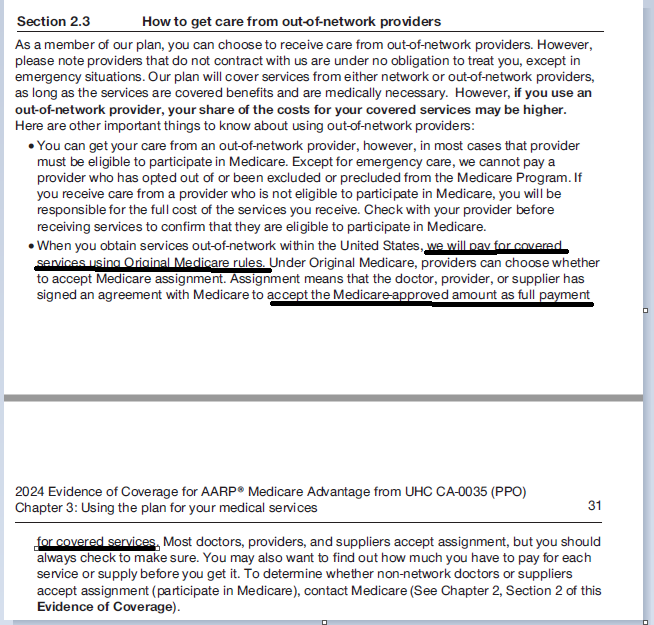

How much gets #paid to an out of network provider?

- How Your In-Network Health Coverage Can Vanish Before You Know It CA Health Line

. - Question? Scripps is no longer taking Medicare Advantage Plans, per their website. If you have a Medicare Advantage Plan MAPD PPO, will the PPO pay, how much and will Scripps take it?

. - Answer – Scripts states they take Medicare A & B on their website. The PPO pays the same benefits as A & B, thus it looks to me like the PPO will pay and Scripps should take it. Call to double check 800-727-4777. I’d email them, but I don’t find an email address. I don’t post or listen to hearsay. If you call, PLEASE get it in writing!

- See our webpage on Medicare Assignment.

- Sample MAPD Advantage EOC Evidence of Coverage.

- Email us about the Broker only explanation from UHC on options.

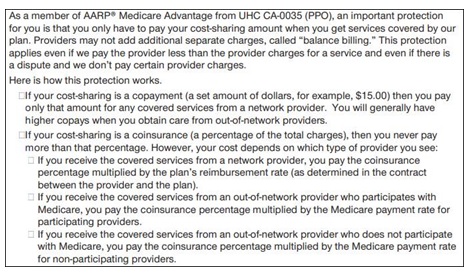

#CoInsurance

Coinsurance The percentage amount that a Member is required to pay for Covered Services after meeting any applicable Deductible. VIDEO

Out-of-Pocket Maximum

The OOP Out of Pocket Maximum is The highest Deductible, Copayment, and Coinsurance amount an individual or Family is required to pay for designated Covered Services each year as indicated in the Summary of Benefits section.

Charges for services that are not covered, charges in excess of the Allowable Amount or [negotiated] contracted rate do not accrue to the Calendar Year Out-of-Pocket Maximum.

Allowable Amount – See page 105 of Specimen Policy

Specimen Individual Policy #EOC with Definitions

Employer Group Sample Policy

It's often so much easier and simpler to just read your Evidence of Coverage EOC-policy, then look all over for the codes, laws, regulations etc! Plus, EOC's are mandated to be written in PLAIN ENGLISH!

- Find your own Individual EOC Evidence of Coverage

- It' important to use YOUR EOC not just stuff in general!

- Obligation to READ your EOC

- Plain Meaning Rule - Plain Writing Act

- Our Webpage on Evidence of Coverage

- OOP Out of Pocket Maximum - Many definitions are explained there.

VIDEO Steve Explains how to read EOC

Insurance #definitions & glossary

- The best place to look for Insurance definitions & glossary is in an actual EOC – Evidence of Coverage (specimen – Platinum) – Policy. Be sure to check your ACTUAL EOC for your specific question.

- CA Dept of Insurance Glossary

- CMS – Medicare

- Health Net 6 page glossary

- aw.com

- CA Court Site Glossary

- Medi-Cal – Helpful words to know

- Texas DOI Glossary

- Glossary of Employee Benefit Terms See the Benefits.com

- FAQs / Ask Us a Question

Prior Authorization

Brother - Sister - Sibling Side Pages Subpages

View our website with your Desktop or Tablet for the most information

Deductible #Carryover.

Many plans used to offer a provision called a deductible carryover. However, Last quarter deductible carry over has gone by way of the dinosaurs – carriers no longer offer this.

This provision allows you to carry over to the next year any unmet portion of the deductible that you, or your family, run up in October, November and December. For example, assume you had no medical claims in the first part of the year. In November, you run up $350 worth of claims. If your deductible was $500, you would start the next year with $350 of your $500 deductible already meet. Example

However, there is no deductible credit for PPO plans since all plans are set up for Calendar Year and a renewal won’t effect this nor a carrier change in the middle of the year since deductible credit for the yearly medical deductible is given by the new carrier (client has to submit EOBs) 9.11.2015 email from Heide Definition – Investopedia LISA Broker Wholesaler – How and what you need to do to get credit when moving from one insurance company to the other.

Benefit Period

The length of time we will cover benefits for Covered Services. For Calendar Year plans, the Benefit Period starts on January 1st and ends on December 31st. For Plan Year plans, the Benefit Period starts on your Group’s effective or renewal date and lasts for 12 months. (See your Group for details.) The “Schedule of Benefits” shows if your Plan’s Benefit Period is a Calendar Year or a Plan Year. If your coverage ends before the end of the year, then your Benefit Period also ends. EOC

Crediting Prior Employer Group Plan Coverage

If you were covered by the Group’s prior carrier / plan immediately before the Group signs up with us, with no break in coverage, then you will get credit for any accrued Deductible, if applicable and approved by us, under that other plan. This does not apply to people who were not covered by the prior carrier or plan on the day before the Group’s coverage with us began, or to people who join the Group later. If your Group moves from one of our plans to another (for example, changes its coverage from HMO to PPO), and you were covered by the other product immediately before enrolling in this product with no break in coverage, then you may get credit for any accrued Deductible, if applicable and approved by us. If your Group offers more than one of our products, and you change from one product to another with no break in coverage, you will get credit for any accrued Deductible, if applicable. This Section Does Not Apply To You If:

· Your Group moves to this Plan at the beginning of a Benefit Period; · You change from one of our individual policies to a group plan; · You change employers; or · You are a new Member of the Group who joins the Group after the Group’s initial enrollment with us.

What’s this about #embedded & aggregate deductibles?

Individual vs Family Deductibles?

Under family coverage, an embedded deductible is the individual deductible for each covered person, embedded in the family deductible. While it might not sound like a good thing to have two deductibles, it actually works to provide better coverage for individual members because once each family member meets his or her embedded deductible, health insurance begins paying for covered services, regardless of whether the larger family deductible is met.

Contrast this to a non-embedded deductible, also referred to as an aggregate deductible. Under an aggregate deductible, the total family deductible must be paid out-of-pocket before health insurance starts paying for the health care services incurred by any family member. While family coverage with an aggregate deductible may have a lower monthly premium, coverage won’t kick in until the total family deductible is met. In contrast, family health plans with an embedded deductible may help ensure that there is coverage for individual family members once they meet their embedded deductible, regardless of whether the family deductible is met. Unfortunately, the Summary of Benefits and Coverage won’t necessarily tell you if the deductible is embedded or not; you may have to call the plan to learn how the deductible will be applied for your coverage. Learn More⇒ Center on Health Insurance Reforms AB 1305

If two or more on a policy it’s the Family Deductible NOT individual, with a family max?

See excerpt of Blue Cross Bronze HSA Page 55 on Family or Individual Deductible

NEW for 2016!!! Embedded – HSA plans had an aggregate deductible where one person could meet the entire family deductible. Now a family member will not be charge more than the individual deductible and be able to receive benefits sooner. BC RSM Email 9.29.2015 SHRM.org AB 1305 2015 Bonta

2017 NEW Laws & Regulations effective 1.1.2017 AB 1305, 339 & 1954 SB 999 – Deductible & OOP Maximums FAQ’s

What is the Maximum that can be contributed to an HSA – Health Savings Account?

Prior #Authorization

- Preauthorization is A decision by your health insurer or plan that a health care service, treatment plan, prescription drug or durable medical equipment (DME) is medically necessary. Sometimes called prior authorization, prior approval or precertification.

- Your health insurance or plan may require preauthorization for certain services before you receive them, except in an emergency. Preauthorization isn’t a promise your health insurance or plan will cover the cost. Health Net Glossary * See also YOUR EOC, Evidence of Coverage!

- IMHO Insurance Companies are not doctors and a lot of people and regulators agree, thus the pending laws and investigations.

- Exhausted by prior authorization, many patients abandon care: AMA survey

- Prior Authorization in Medicare Advantage Plans: How Often Is It Used? KFF 10/2018

- Prior Authorization - Regulatory Investigation aka “preauthorization” and “precertification” KFF.org 5.20.2022

- California Senate Bill 250 * Senator Pan would require that insurers consult with doctors on which services require authorizations, streamline the process, less paperwork and allow patients to get the care they need faster.

- SB 250 would require health plans to exempt physicians from prior authorization rules if they have practiced within the plan's criteria 80% of the time. CMA.Docs.org

- PRIOR AUTHORIZATION REQUIREMENTS HALTED FOR CERTAIN SERVICES

- Parody If Health Care was honest VIDEO

- UnitedHealth launches ‘gold card' to ease prior authorization burden

- Use of Prior Authorization Up in Medicare Advantage Plans, Senate Report Finds

- ajmc.com/prior-authorizations-and-the-adverse-impact-on-continuity-of-care

- See our main webpage on Medical Necessity

Resources, Links & Bibliography

- cal matters.org/new-bill-pushes-insurers-to-stop-playing-doctor

- Payer Denial Tactics — How to Confront a $20 Billion Problem

- cal matters.org/richard-pan

- cma docs.org/prior-authorization-bill

- Plaintiff whose insurer delayed surgery is awarded $14 million over opioid dependency

UCR Reasonable and customary amount

“the UCR usual, customary, and reasonable amount,” and “the prevailing rate” are among the standards that various health care benefit plans may use to pay out-of-network benefits. Before ACA/Obamacare and the rise of HMO’s UCR was quite common.

Please review this page more details and explanations of each of the key terms as they are interrelated.

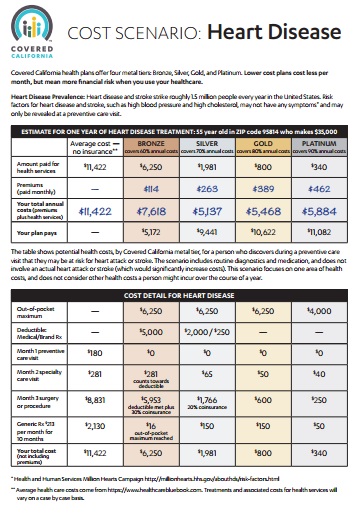

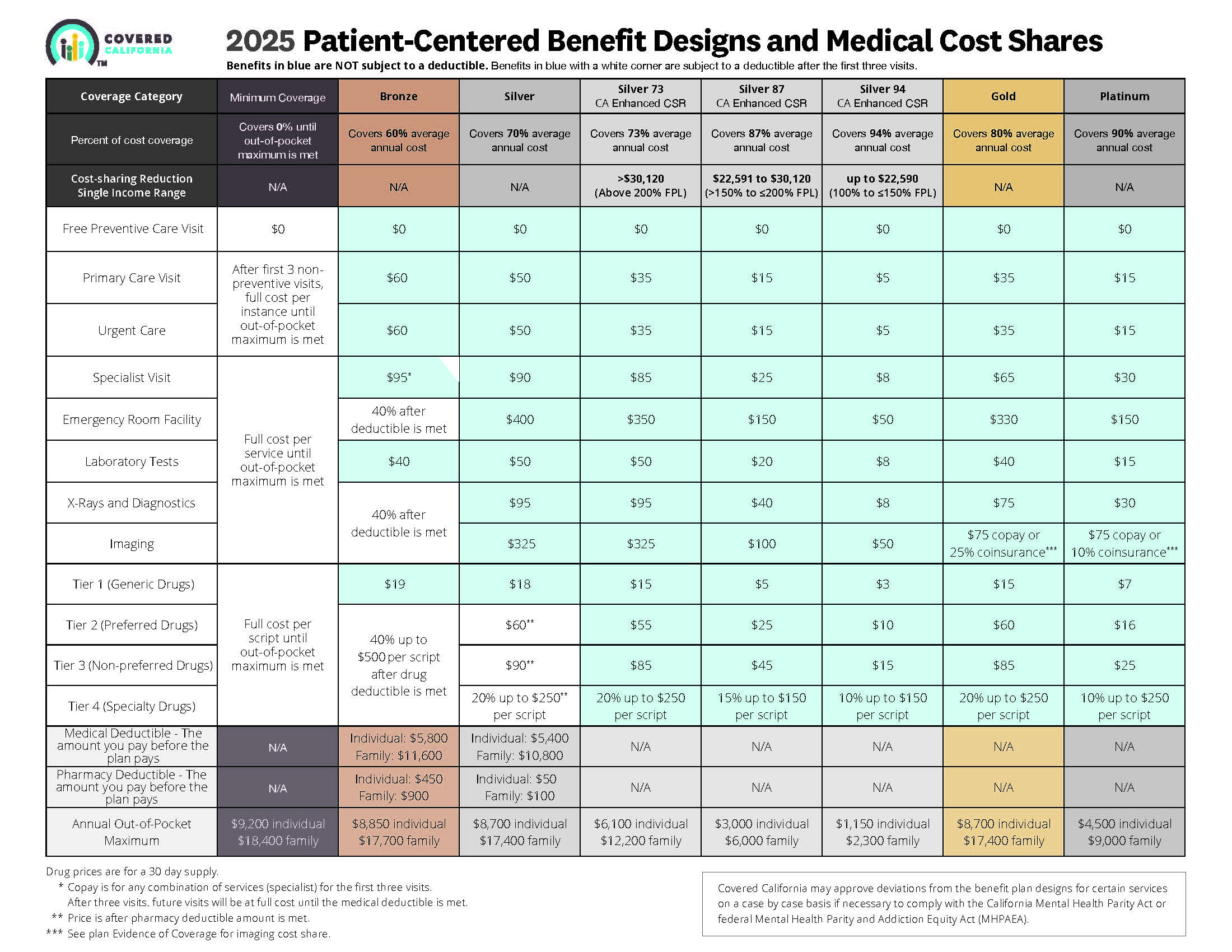

- 2025 Source

- Source and see a sharper image 2024 Patient Centered Designs * *

- Covered CA bulletin on new and improved Enhanced Silver CSR Cost Sharing Reduction

- Do you think your medical bills will be higher or lower than average for your age & zip code?

- Expected Payout (AV)

- MLR Medical Loss Ratio

- Bronze 60%

- Enhanced Silver 70% - 94% Gold 80% Platinum 90%

- Metal Levels are based on Expected Claims Payment - that is the actuarial value (AV).

- Renewal Tool Kit

- Did you notice LOWER deductibles & Co Pays???

- This is one way Health Care Reform hopes to make shopping and comparing Instantly - easier. So, if you get a lower priced plan with less or fewer benefits, co-pays, deductibles you simply pay more when you have a claim. Don't worry, there is a stop loss - maximum out of pocket OOP, of say $7k so that you won't break the bank.

- All plans cover the 10 Federal essential benefits and CA mandated benefits.

- Our main webpage on Metal Levels

(Chinese)

(Chinese)

https://www.latimes.com/business/story/2025-01-08/column-heres-one-key-reform-that-can-fix-us-healthcare

https://www.fiercehealthcare.com/payers/unitedhealth-shareholders-urge-company-review-utilization-management-practices

https://hbexstorage.blob.core.windows.net/regulations/PDFs/Covered%20California%20Comment%20Letter%20re%20CMS%20Marketplace%20Integrity%20and%20Affordability%20Proposed%20Rule%200.pdf

https://www.cms.gov/newsroom/fact-sheets/2025-marketplace-integrity-and-affordability-proposed-rule

https://healthexec.com/topics/healthcare-management/business-intelligence/unitedhealth-launches-gold-card-ease-prior-authorization-burden