Medicare Funding

Medicare for All California AB 1400 – CalCare

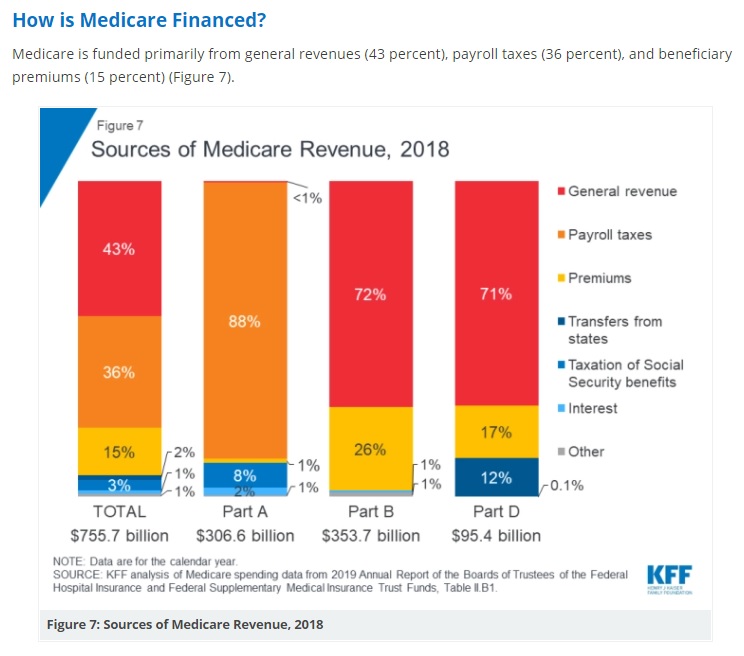

- Part A Hospital is financed primarily through a 2.9 percent tax on earnings paid by employers and employees (1.45 percent each) (accounting for 88 percent of Part A revenue). Higher-income taxpayers (more than $200,000/individual and $250,000/couple) pay a higher payroll tax on earnings (2.35 percent).

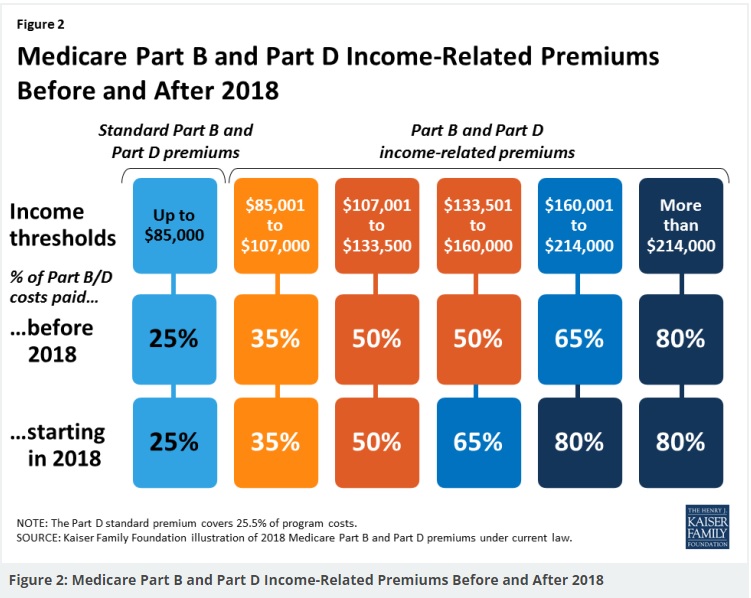

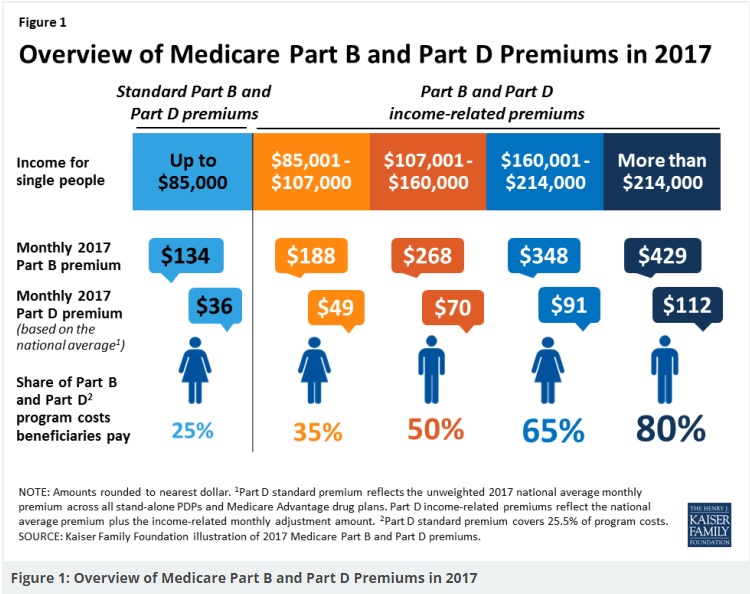

- Part B Doctor Visits is financed through general revenues (72 percent), beneficiary premiums (26 percent), and interest and other sources (2 percent). Beneficiaries with annual incomes over $85,000/individual or $170,000/couple pay a higher, income-related Part B premium reflecting a larger share of total Part B spending, ranging from 35 percent to 85 percent.

- Part D Rx is financed by general revenues (71 percent), beneficiary premiums (17 percent), and state payments for beneficiaries dually eligible for Medicare and Medicaid (12 percent). Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

- The Medicare Advantage program (Part C) is not separately financed. Medicare Advantage plans, such as HMOs and PPOs, cover Part A, Part B, and (typically) Part D benefits. Beneficiaries enrolled in Medicare Advantage plans pay the Part B premium, and may pay an additional premium if required by their plan; about half of Medicare Advantage enrollees pay no additional premium. Kff *

- See the Medicare & You Manual for more background information.

Medicare Trust Funds

- Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare.

- Medicare Part A is facing a shortfall. Here’s how that could affect you.

Hospital Insurance (HI) Trust Fund

How is it funded?

- Payroll taxes paid by most employees, employers, and people who are self-employed – See publication 15 pdf

- Other sources, like income taxes paid on Social Security benefits, interest earned on the trust fund investments, and Medicare Part A premiums from people who aren’t eligible for premium-free Part A

What does it pay for?

- Medicare Part A (Hospital Insurance)benefits, like inpatient hospital care, skilled nursing facility care, home health care, and hospice care

- Medicare Program administration, like costs for paying benefits, collecting Medicare taxes, and combating fraud and abuse

Supplementary Medical Insurance (SMI) Trust Fund

How is it funded?

- Funds authorized by Congress

- Premiums from people enrolled in Medicare Part B (Medical Insurance) and Medicare prescription drug coverage (Part D)

- Other sources, like interest earned on the trust fund investments

What does it pay for?

- Part B benefits

- Part D

- Medicare Program administration, like costs for paying benefits and for combating fraud and abuse copied from Medicare.Gov

- Learn More ==> Kaiser Foundation, including spending

This might end with AHCA – Replace Obamacare

See also our section on the ratio of Part B & D premiums to actual costs of Medicare.

How the $$$ is spent

Links & Resources

- wikipedia.org/Medicare

- very well health.com/is-medicare-going-to-run-out-of-money

- common wealth fund.org/options-extending-medicares-trust-fund

- fool.com/how-is-medicare-funded

- tax policy center.org/what-medicare-trust-fund-and-how-it-financed

- Kaiser Foundation facts on Medicare Spending & Financing

- medicare.gov/talk-to-someone

- house.gov/find-your-representative

- Despite rosier trust fund outlook, time running out to stabilize Medicare funding, researchers warn

FAQ’s

Questions

- Why do I have to pay so much for Medicare Part B Doctor Visits?

- I worked hard for over 40 years and paid taxes for it!

Gov. Gavin Newsom signed a unified healthcare financing bill, Senate Bill 770, into law on Oct. 7th. California has become the first state in the country to pass such a bill, paving the way towards greater healthcare equity and accessibility.

The bill requires the secretary of California Health and Human Services Agency (CalHHS) to consult with stakeholders and the federal government to pursue a waiver framework for a comprehensive package of medical, behavioral health, pharmaceutical, dental, and vision benefits. By Nov. 1st, 2025, the CalHHS secretary is required to provide the legislature and Newsom with a report of the finalized waiver framework. Read More State of Reform

California SB 770

Guaranteed Health Care for All

The California #Guaranteed Health Care for All Act, CalCare,

AB 1400 DIED January 31, 2022 LA Times *

We are very concerned that Medicare for All, National Health Insurance, CalCare, etc. would be like Medi Cal, not some great wonderful thing that pays for any doctor, any hospital anytime for any reason and no concern about Narrow Networks, Medical Necessity or MLR Medical Loss Ratio.

The California Guaranteed Health Care for All Act, CalCare, would provide comprehensive universal single-payer health care coverage and a health care cost control system for the benefit of all residents of the state.

CalCare would cover a wide range of medical benefits and other services and would incorporate the health care benefits and standards of other existing federal and state provisions, including the federal Children’s Health Insurance Program, Medi-Cal, & Medicare program.

The Legislature finds and declares all of the following:

(1) PPACA Obamacare still leaves many Californians without coverage or with inadequate coverage.

(2) Californians, have experienced a rise in the cost of health care including rising premiums, deductibles, and copayments, as well as restricted provider networks and high out-of-network charges.

(4) Individuals often find that they are deprived of affordable care and choice because of decisions by health benefit plans

********Then why does Medi Cal mandate that you have an Insurance Company HMO?

Why does Medicare seem to encourage Insurance Medicare Advantage Plans?

guided by the plan’s economic needs rather than patients’ health care needs.

*****And you don’t think the Government has the same problems?

(6) Billions of dollars that could be spent on providing equal access to health care are wasted on administrative costs necessary in a multiplayer health care system. Resources and costs spent on administration would be dramatically reduced in a single-payer system, allowing health care professionals and hospitals to focus on patient care instead.

***How much Fraud do we have in Government Programs?

(7) It is the intent of the Legislature to establish a comprehensive universal single-payer health care coverage program and a health care cost control system for the benefit of all residents of the state.

(b)

(1) universal health coverage for every Californian, funded by broad-based revenue.

(2) any federal funds would be paid by the federal government to the State of California

(4) Those programs would be replaced and merged into CalCare, which will operate as a true single-payer program.

(g) It is the further intent of the Legislature to address the high cost of prescription drugs and ensure they are affordable for patients.

Read the ACTUAL Bill and not just summaries….

California AB 1400

Actual Bill

- ACA Assembly Constitutional Amendment #11 – allowing taxation

- LA Times 1.7.2022

- CA Health Line 1.6.2022

- CAHIP, NAFIA & IIABCAL Opposition Letter 1.17.2022

- a $400 billion dollar price tag per year and no guarantee of better healthcare

- minimum funding shortfall of over $150 billion per year.

- benefit structure determined by what government feels it can afford, not on what the consumer may want or need..

- it does not guarantee access to medical care

- consumers who are denied coverage for a surgery, procedure or prescription by a carrier can turn to their health insurance agent for help appeals – IMR Independent Medical Review AB 1400 eliminates hundreds of thousands of jobs in California.

- Gosh, how many agents are helping people with Medi Cal for no compensation what so ever!!!

- The consumer is left undefended in the hands of a government-run single-payer bureaucracy.

- Los Angeles Times Opinion June 6, 2021 – Public Option First

One reason why nothing happened in 2021

The California legislature operates on a series of deadlines that are outlined in the Constitution and in Legislative Rules. There are deadlines to introduce bills, amend bills and have bills heard (i.e. voted on in a hearing) in a policy committee. The deadline for any bill with a fiscal component to be heard in a policy committee is next week, April 30th. On matters of health insurance and healthcare, virtually every bill has a fiscal component, so it must receive a majority of votes to pass out of policy committee (most often the Health Committee) or it is dead for the year. AB 1400 was held in the Assembly Rules Committee, and accordingly will not be heard in a policy committee in time to meet the legislative deadline necessary to advance CAHU email dated 4.23.2021

Links & Resources

Health Insurance unfortunately is very complicated

President Trump February 27, 2017

- Thus, if we haven't simplified and explained in PLAIN ENGLISH what you are looking for:

#Medicare10050 and You 2025

Spanish

Everything you want to know

- Steve's Video Seminar Introduction to Medicare & You

- Clear View to Medicare Patient Advocate.org - 36 pages

- Get Ready for Medicare * Spanish

***********

- Your Medicare #Benefits # 10116

- Inpatient ONLY - How Medicare Pays for your Surgery Part A vs Part B Very Well Health.com

- Enroll in Blue Cross

- Use our scheduler to Set a phone, Skype or Face to Face meeting

- #Intake Form - We can better prepare for the meeting (National Contracting Center)

- Get more information and FAQ's

- #Intake Form - We can better prepare for the meeting (National Contracting Center)

What are the #threats to Medicare?

We paid for it for all our working career, can they take it away?

We have to generate economic growth which generates revenue, while reducing spending. That will mean instituting structural changes to Social Security and Medicare for the future.”

“The driver of our debt is the structure of Social Security and Medicare for future beneficiaries,”

No one should be fooled by this argument. Rubio is pursuing the classic strategy of the enemies of social insurance programs to make them increasingly irrelevant to future generations by promising cuts that the affected beneficiaries “wouldn’t really notice.” This only eases the path toward eliminating those programs outright.

But members of those future generations should take notice. Like today’s beneficiaries and those of the past, they’re paying for their future benefits with every paycheck, and they should be profoundly aware that Rubio and his fellow Republicans are merely preparing to rip them off. Los Angeles Times 11.30.2017

**********

Medicare was projected to become “insolvent” in 2026, three years earlier than was projected last year… Social Security is stable, and in some respects, improving fiscally. Read the actual article, this quote is what they are explaining. Los Angeles Times 6.5.2018 GOP policies have hurt Social Security & Medicare

****

- Trump on Social Security, Medicare cuts: ‘There is a lot you can do’

- Medicare’s Independent Payment Advisory Board has been killed. It was authorized by the Affordable Care Act to serve as a check on higher Medicare expenses. It was quickly labeled a death panel by opponents and became such a lightning rod that no board members were ever named.

- The rules for Medicare’s Part D drug plans were changed. The much-maligned coverage gap (or donut hole) in these plans has been shrinking for years under the Affordable Care Act, and was supposed to end in 2020, at which time consumers in the gap would pay no more than 25 percent of the costs of their drugs. That end date was moved up a year to 2019.

- Consumers who have spent a lot on drugs and have entered the so-called catastrophic phase of Part D plans will pay no more than a few dollars for each prescription or, for costly drugs, no more than 5 percent of the cost of the drug. While this percentage will not change, the responsibility for paying the other 95 percent of the cost will be borne even more heavily by the government, and is expected to save pharmaceutical companies billions of dollars. Taxpayers, of course, ultimately will be on the hook for those higher government expenses. It’s a more significant if largely invisible change.

- Medicare’s caps on covered expenses for outpatient therapyhave been officially repealed. People with persistent therapy needs have bumped against these caps for more than 20 years, and Congress has regularly eased those rules. While claims above current cap levels may be subject to review, people who legitimately need extensive therapy will not have to depend on year-to-year congressional fixes.

- Medicare’s high-income premium surcharges will carry even more of a bite for wealthier enrollees. Those making more than $500,000 a year ($750,000 for couples) will pay 85 percent of the actual costs of Part B and D in 2019, up from 80 percent this year. Most Medicare enrollees pay premiums that equal about 25 percent of these costs.

- Congress also made numerous and potentially far-reaching changes to the rules for Medicare Advantage plans.

- That includes allowing such plans to pay for limited long-term care expenses – something that until now has not been covered by Medicare.

- Air conditioners for people with asthma,

- healthy groceries,

- rides to medical appointments and

- home-delivered meals

- “As we tip the scales more in favor of Medicare Advantage, it’s to the detriment of people in traditional Medicare.”

- NPR Medicare Changes 2.14.2018 * Medicare Rights.org * PBS.org * KHN.org *

- “As we tip the scales more in favor of Medicare Advantage, it’s to the detriment of people in traditional Medicare.”

- That includes allowing such plans to pay for limited long-term care expenses – something that until now has not been covered by Medicare.

Resources & Links

CMS 2018 Annual Report on Medicare

Kaiser Foundation Medicare Spending & Financing

All our Health plans are Guaranteed Issue with No Pre X Clause

Instant Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

- Watch our 10 minute VIDEO that explains everything about getting a quote

Jump to section on:

- Medi Cal Information & Reference Materials

- Did ACA/Obamacare change anything in Medicare?

- California AB 1400 – Cal Care

- How is Medicare Funded?

- Instant ACA/Obamacare Quotes & Enrollment

- What is Medicare for All?

- Threats to Medicare?

- Current Medicare & You Booklet

- High Income Medicare Taxes?

- Welcome to Medi Cal

- Network Limitations

Information – What is Medicare for #All?

Scholarly Articles

- The Case for Medicare-For-All

- The ‘Public Option’ on Health Care Is a Poison Pill

- The Case for A Non-Profit Single-Payer Healthcare System Physicians for a National Health Program

Links & References

- Health Broker’s Journal

- Benefits Pro – Single Payer Proposals – Newsom

- Cal Matters – Newsome slows down on Single Payer

- Yale Study says Medicare for All would save $450 Billion and prevent 70k/deaths’ per year https://www.democracynow.org/2020/2/19/lancet_report_medicare_for_all

- Britain has long waits for Care https://www.forbes.com/sites/sallypipes/2019/04/01/britains-version-of-medicare-for-all-is-collapsing/?sh=19f207c336b8

- 20 Reasons Japanese Women Stay Slim and Don’t Look Old

Becerra Has Long Backed Single-Payer. That Doesn’t Mean It Will Happen if He’s HHS Secretary.

Did Health Care Reform – #ObamaCare

make any Changes to Medicare?

- Medicare Advantage

REDUCTIONS IN PAYMENTS AND OTHER REQUIREMENTS – - The federal government pays more for beneficiaries enrolled in Medicare Advantage plans than for beneficiaries in fee-for-service Medicare. [My understanding was that these plans were created to SAVE $$$] That additional funding provides enrollees with additional benefits, such as reduced cost sharing and coverage of items not covered by traditional Medicare, which are seen as necessary to attract enrollees to these managed care plans. However, all Medicare beneficiaries, not just those enrolled in Medicare Advantage plans, have ended up footing the bill for these extra payments.

- The new law freezes the extra Medicare payments to Medicare Advantage plans in 2011 and begins to reduce the payments to plans in 2012. It also requires Medicare Advantage plans to pay at least 85 percent of the premium dollars they collect for medical claims. However, it also makes it possible for Medicare Advantage plans to receive higher payments if they demonstrate that they are providing high-quality care to enrollees. Health Affairs.org

- Federal reimbursement rates for insurance carriers administering Medicare Advantage products to performance, as measured by the Stars rating system. Bonus payments are attached to stars ratings, and bonus revenue will be awarded, gradually increasing with maximum bonus opportunity in 2014 Wikipedia 5 Star Rating System

- FAQs / Ask Us a Question

- Medicare Part B premiums include a fee of over $43.20 more each year to subsidize Medicare Advantage plans N4A.org

- I don’t have a citation, but I believe Medicare has more preventative care as Health Care Reform requires it for most everything else.

- Quality Control – Medicare oversight of MAPD – Medicare Advantage Plans – Chinese Community Plan – censured insuremekevin.com

- [CMS] “is establishing a policy to allow enrollees to switch plans when they are affected by significant mid-year provider network terminations initiated by their Medicare Advantage Organization without cause,”

- The CMS now will require plans to give 90 days’ advance notice of “any significant changes to their provider networks in order to ensure help compliance with provider access requirements.”

- Health plans, particularly UnitedHealth Group, had responded to expectations for lower rates by terminating providers from their networks—much to the surprise of doctors in Connecticut, Florida, Indiana, New Jersey, New York and Rhode Island in particular.

- In October, plans said the terminations were being made in anticipation of rate cuts.

- modernhealthcare.com/

- Medicare Advantage Cuts 2.28.2014

- additional cuts could raise beneficiaries’ Medicare Advantage premiums by between $420 and $900 per year

- californiahealthline.org

- ahip coverage.com

- modern healthcare.com

- wikipedia.org – Health Risk Assessment

- AHIP info See our Introduction to Medicare Page

- Kaiser Foundation comparison for 2017 bills

What is the #Additional Medicare Tax and Who Pays It?

Some taxpayers may be required to pay an Additional Medicare Tax if their income exceeds certain limits. Here are some things that you should know about this tax:

- Tax Rate. The Additional Medicare Tax rate is 0.9 percent.

- Income Subject to Tax. The tax applies to the amount of certain income that is more than a threshold amount. The types of income include your Medicare wages, self-employment income and railroad retirement (RRTA) compensation. See the instructions for Form 8959, Additional Medicare Tax, for more on these rules.

- Threshold Amount. You base your threshold amount on your filing status. If you are married and file a joint return, you must combine your spouse’s wages, compensation or self-employment income with yours. Use the combined total to determine if your income exceeds your threshold. The threshold amounts are:

| Filing Status | Threshold Amount |

| Married filing jointly | $250,000 |

| Married filing separately | $125,000 |

| Single | $200,000 |

| Head of household | $200,000 |

| Qualifying widow(er) with dependent child | $200,000 |

- Withholding/Estimated Tax. Employers must withhold this tax from your wages or compensation when they pay you more than $200,000 in a calendar year. If you are self-employed

- you should include this tax when you figure your estimated tax liability.

- Underpayment of Estimated Tax. If you had too little tax withheld, or did not pay enough estimated tax, you may owe an estimated tax penalty. For more on this, see Publication 505, Tax Withholding and Estimated Tax.

If you owe this tax, file Form 8959, with your tax return. You also report any Additional Medicare Tax withheld by your employer on Form 8959. Visit IRS.gov for more on this topic. You can also get forms and publications on IRS.gov/forms anytime.

Each and every taxpayer set of fundamental rights they should be aware of when dealing with the IRS. These are your Taxpayer Bill of Rights. Explore your rights and our obligations to protect them on IRS.gov.

Additional IRS Resources:

Hitler & Mental Health Disabilities T 4

Speak up! Do want you can to make sure this doesn't happen in the USA!

Translation for the poster below:

"This person suffering from hereditary defect costs the community $60,000 Reichsmark during his lifetime. Fellow German, that is your money, too. Translation & Image Courtesy of Psychology Fantom.com

Under the T 4 program, wikipedia.org T4 Certain German physicians were authorized to select patients "deemed incurably sick, after most critical medical examination" and then administer to them a "mercy death" (Gnadentod).[7] The T4 programme stemmed from the Nazi Party policy of "racial hygiene", a belief that the German people needed to be cleansed of racial enemies, which included anyone confined to a mental health facility and people with simple physical disabilities.[31] wikipedia.org T4

The annual cost for a bed in a CDCR-operated, inpatient psychiatric program is around $301,000 lao.ca.gov *

Did President Trump??? really say and mean this? Time.com

Medi Cal Network #Limitations

See the next “module” below for the plans and doctors you have to choose from on Medi-Cal. Do you really want Medi Cal expanded to everyone?

Take a look at Our Medi Cal webpages, let alone the ones we took down as we are not paid a PLUMB NICKEL to help people with Medi Cal. How’s that for funding? Look how many FAQ’s we get as Medi Cal doesn’t have the staff or time to help people! Do Medi Cal, Insurance Company, Salaried Personnel have the background, caring or time to answer questions. Here’s 17 reasons to use Steve Shorr Insurance.

- Medi-Cal

- Narrow Lists? Fewer MD’s than before? Mirrored Plans?

- Medi Cal Pages on Archive.org as we were getting too many requests for Medi Cal uncompensated help

#My Medi-Cal

How to get the Health Care

You Need

24 pages

Smart Phones - try turning sideways to view pdf better

https://fortune.com/well/article/what-is-medicare-tax/

https://taxpolicycenter.org/briefing-book/what-medicare-trust-fund-and-how-it-financed