Can you have Medi-Cal, Medicare, Individual, Employer Group and OHC Other Health Insurance, at the same time?

how much does each one pay?

Which pays first?

Can you still pick which doctor and hospital you go to?

Can you have Private – OHC Other Health Insurance &

Medi Cal at the Same time?

- Yes,

- You can have Medi-Cal even though you have Other Health Coverage (OHC) through individual or group private health (or dental) insurance coverage.

- See the email we rec’d May 17th from Medi Cal to clarify some of these issues.

- Read the rest of the page on which plan pays first, etc. namely, the other plan.

- If you qualify for Medi Cal, you cannot get Covered CA Subsidies.

Which Insurance Plan pays #first

Medi-Cal or OHC Other Health Coverage?

- Under federal law, your private health insurance must be billed first before billing Medi-Cal. Medi-Cal may be billed for the balance, including your other plans co-payments, co-insurance and deductibles. See below about if you have a Medi Cal HMO. Also, you may have a problem if you went to a provider that isn’t a Medi Cal doctor. You may not quote this page. It’s a summary of what we have footnoted and linked to from official documents & law. Cite only those.

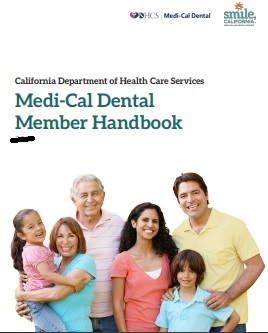

- Denti – Medi Cal and other dental plans See page 19 of Dental Member Handbook

- If you are in a HMO – Managed Care Providers coordination may be difficult and/or you can’t get a Medi Cal HMO, but must have fee for service, see our FAQ’s and response from the Medi Cal Ombudsman for more details.

- See the email we rec’d May 17th from Medi Cal to clarify some of these issues

If you don't #want Medi-Cal

Can you buy private insurance?

If your income qualifies for Medi-Cal, you can buy Insurance coverage (FREE QUOTES), but there won't be ANY subsidies. You pay the full premium. However, if it's Share of Cost, it's not considered Minimum Essential Coverage, so you could get subsidies.

Please note that the Private Plan pays first and Medi Cal won't pay if the doctor isn't a Medi Cal provider. Since Medi Cal is virtually HMO that might be difficult to have both plans pay.

- FAQ's

- Which Pays first Medi Cal or other coverage?

- Choose HMO Plan

- FAQ & Clarification of Mandatory HMO Enrollment

- Friendly Agent's Blog on how to have different plans for different members of the family.

Jump to section on:

- Introductory Brochure to Medi Cal

- Reference Materials

- Mandate to report other coverage

- Cal Medi Connect – Medi Medi

- Which Pays first Medi Cal or other coverage?

- Can you get Private Coverage?

- Basic Law on Coordination of benefits

- FAQ & Clarification of Mandatory HMO Enrollment

- Choose HMO Plan

- Medicare

#My Medi-Cal

How to get the Health Care

You Need

24 pages

Smart Phones - try turning sideways to view pdf better

-

- More explanation

- Enroll with Benefits Cal

- What is Medi Cal - VIDEO

-

How to VIDEO

-

Medi-Cal Managed Care HMO – Health Care Options

- Benefits Cal is a one-stop-shop to apply for...

- Cal Fresh

- Ages 26 through 49 Adult Full Scope Medi-Cal Expansion regardless of immigration status

- Cal WORKs

- Medi-Cal

- CMSP (County Medical Services Program)

- Disaster Cal Fresh

- GA/GR (General Assistance and General Relief )

- Briefing — Medi-Cal Explained: An Overview of Program Basics

- chcf.org/medi-cal-explained/

- #BenefitsCal is a one-stop-shop to apply for...

- Medi-Cal

- County Medical Services Program (CMSP),

- Food Assistance - Cal Fresh (formerly known as Food Stamps)

- How to use Eat Fresh.org VIDEO

- Cooking & Nutrition

- California Work Opportunity and Responsibility to Kids (CalWORKs) or check their other website

- Medi-Cal

-

Here you can review and choose the HMO that you want to deliver your Medi-Cal health Care.

-

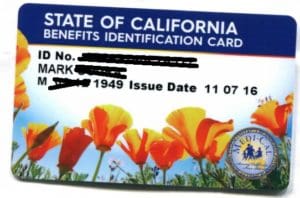

BIC Benefits Identification Card

Pick Medi Cal HMO Provider

Medi-Cal Managed Care HMO – Health Care Options

Here you can review and choose the HMO that you want to deliver your Medi-Cal health Care.

Learn more:

- Disability Rights.org –

- What are Medi Cal Managed Care Plans? What do I need to know?

- Medi-Cal Managed Care Health Plan Directory

- Medi-Cal Listing of HMO plans by county *

- Medi-Cal Managed Care Provider Search

- Medi Cal HMO – Managed Care Providers by County

- health care options.dhcs.ca.gov/tips-help-you-choose-medical-plan

- health care options.dhcs.ca.gov/frequently-asked-questions-faqs

- California’s County-Based Health Plans 2022 CHCF

- Medi-Cal’s Fragmented System Can Make Moving a Nightmare Read More CA Health Line *

- Poor Care Co-Ordination? New contracting process Deficient Oversight CA Health Line *

- Disability Rights – Medi Cal provider HMO’s, what are they? What do I need to know about them?

- Medi-Cal Managed Care – Health Care Options

- EOC’s, Forms & Income Charts from Insure Me Kevin.com

- Sacramento? dhcs.ca.gov//mmcd health plan dir

- Battle Lines Are Drawn Over California Deal With Kaiser Permanente

- Exemption from enrolling in a Health Care Plan

- health care options.dhcs.ca.gov - Download Forms

- You May Get A Medical Exemption If:

- You have a complex medical condition; AND

- The care you get from your Regular Medi-Cal doctor for the complex medical condition cannot be changed, because your condition could get worse; AND

- Your Regular Medi-Cal doctor is NOT part of a plan in your county. You may see more than one Regular Medi-Cal doctor. If you do, have the form filled out by the doctor who sees you most often. Ask your Regular Medi-Cal doctor if he or she is part of a Plan in your county. This should be done before you submit this form.

- You have a complex medical condition; AND

- Provider Search – Statewide Fee for Service

- See our webpage on IMR Independent Medical Review

While you can have an employer or Indivudaul Plan and Medi Cal, there is However a

#MANDATORY Medi Cal Managed Care – HMO health

Enrollment

One must choose a Managed Care – HMO health plan – provider within 30 days after enrollment in Medi-Cal otherwise the State will pick plan for you. Medi-Cal Website Unless you have Other Health Coverage -OHC, then you must go Fee for Service.

When you have an HMO managed health care, the State of California makes a deal with health plans and pays a fixed amount each month per member enrolled in the plan – capitation. The HMO health plan is then responsible for providing you all your Medi-Cal services included under the EOC Evidence of Coverage. HMO Plans are required under state and federal law to maintain an adequate Medi-Cal provider network to ensure that each member has a primary care physician and must report on quality and access measures.

- Medi Cal Managed Care Find a Provider

- See the email we rec’d May 17th from Medi Cal to clarify some of these issues

- chcf.org/primary-care-matters * More readable summary * Health care systems with strong levels of primary care investment have better and more equitable health outcomes, lower care costs, and better care quality. We can build a healthier future for all Californians by focusing resources back to patients and their relationship with primary care providers.

#Clarification from Medi-Cal on

HMO Mandatory Enrollment and other coverage OHC

- What are the Medi Cal HMO’s doing to stop those with other coverage from enrolling?

- On this DHCS page, the public is told they must choose an HMO. Nothing is said about if you have other coverage, it’s excluded. [not mentioned on the DHCS page?]

The website above only applies to Medi-Cal beneficiaries who are required to enroll in a Medi-Cal managed care plan, which is the large majority of the Medi-Cal population.

- On or about 10.26.2020 the Medi Cal Ombudsman emailed and said that if one had private insurance they could NOT enroll in a Medi Cal Managed Care Plan!

If a Medi-Cal beneficiary has active other health coverage upon Medi-Cal enrollment, they are currently not eligible for enrollment into a managed care plan.

- When one has a Medi Cal HMO and other coverage – can the patient still pick which provider or plan to go to?

- When a member uses HMO services, how does the HMO collect & bill other coverage?

- When a member uses say his Employer’s HMO or PPO how does the collect copays & deductibles from Medi Cal HMO and/or fee for service?

The DHCS Health Insurance Premium Payment program does offer an option for a narrow population of newly enrolled Medi-Cal beneficiaries to receive reimbursement for OHC co-pays and deductibles for a limited time, subject to eligibility requirements. Please see dhcs.ca.gov for additional information.

- Of the four approaches to Managed Care & Third Party Liability on Medicaid.Gov which

is CA using?

- How is this being enforced & implemented?

CA currently uses the two out of four approaches:

You cannot choose a medical HMO Managed Care plan if:

You are a member of a commercial medical plan through private insurance Health Care Options DHCA.Gov * response from the Medi Cal Ombudsman * Western Poverty Law Page 5.219 * Medicaid.gov *

You must take Fee for Service.

Request for exemption from enrollment in Managed Care Plan, but I don’t see OHC as a reason

IEHP Provider manual seems to imply their HMO will allow it?

- EHP .org/manuals Medi-Cal

- 20 – Claims Processing (PDF)

See the email we rec’d May 17th from Medi Cal to clarify some of these issues

#Covered CA Certified Agent

No extra charge for complementary assistance

- Get Instant Health Quotes, Subsidy Calculation & Enroll

- Appoint us as your broker

- Get Instant Health Quotes, Subsidy Calculation & Enroll

- Videos on how great agents are

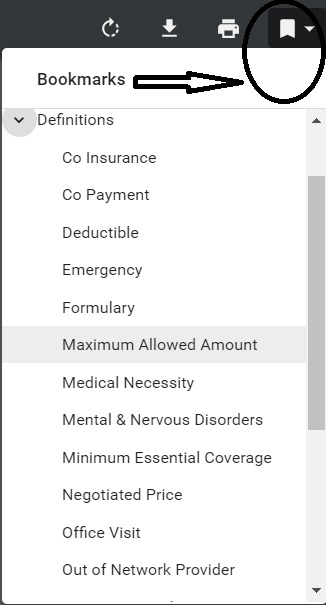

Specimen Individual Policy #EOC with Definitions

Employer Group Sample Policy

It's often so much easier and simpler to just read your Evidence of Coverage EOC-policy, then look all over for the codes, laws, regulations etc! Plus, EOC's are mandated to be written in PLAIN ENGLISH!

- Find your own Individual EOC Evidence of Coverage

- It' important to use YOUR EOC not just stuff in general!

- Obligation to READ your EOC

- Plain Meaning Rule - Plain Writing Act

- Our Webpage on Evidence of Coverage

- OOP Out of Pocket Maximum - Many definitions are explained there.

VIDEO Steve Explains how to read EOC

Medi Cal Fee for Service

What is Medi Cal #Fee for Service?

FFS Fee for Service

Under FFS Fee for Service, the California state pays enrolled Medi-Cal providers directly for covered services provided to Medi-Cal enrollees. It is the enrollee’s responsibility to find a physician who accepts Medi-Cal. CHFS.org *

How much does Medi Cal pay?

Medi-Cal Fee for Service will pay the maximum that they are allowed to!

Here’s information what Full Scope Medi Cal * or see what the HMO’s Evidence of Coverage say, and Denti -Cal Cover. Of course Medi Cal will deduct the payment amount, from your other health plan, if any.

Medi-Cal will not pay higher charges of a provider’s bill when the provider has an agreement with the OHC carrier/plan to accept the carrier’s contracted rate as payment in full. See our webpage on negotiated rates. The Medi-Cal provider must submit an Explanation of Benefits or denial letter from the OHC along with the Medi-Cal claim. If Medi-Cal later discovers OHC, Medi-Cal will bill the OHC for the Medi-Cal services.

If you have a Medi-Cal share of cost you must pay it before Medi-Cal will pay for your service.

For Medi Cal HMO’s check out each one’s summary of benefits and EOC’s Explanation of Benefits.

How do I find a provider that accepts Medi Cal?

Sorry there isn’t a Fee For Service provider directory. Try calling Medi Cal @ 1-800-541-5555. You may need to call providers to see if they accept FFS Medi-cal. Email from Ombudsman 1.26.2021 *

See the email we rec’d May 17th from Medi Cal to clarify some of these issues

(HIPP) Health Insurance Premium Payment Program/Cost Avoidance

The Health Insurance Premium Payment (HIPP) program is a voluntary program for qualified beneficiaries with full scope Medi-Cal coverage. HIPP approved Medi-Cal eligible beneficiaries shall receive services that are unavailable from third party coverage and offered by Medi-Cal. Learn More

How to stay in Fee for Service or Apply for Fee for Service considering the mandatory enrollment in HMO Managed Care?

FFS Fee for Service FAQ’s

- Are you prohibited from getting a Medi Cal HMO managed care plan if you have other coverage?

- See the response from the Medi Cal Ombudsman below!

- Contrast that with the more recent reply from Medi Cal here!!!

- Definitions:

- Coordination of Benefits (COB): The process of determining which insurance coverage (Medi-Cal, Medicare, commercial insurance or other) has primary treatment and payment responsibilities for members with more than one type of health insurance coverage

- Fee-For-Service (FFS): This means you are not enrolled in a managed care health plan. Under FFS, your doctor must accept “straight” Medi-Cal and bill Medi-Cal directly for the services you got.

- I don’t see that commercial insurance excludes one from enrolling in the Medi Cal HMO

- Please note, I’m not an authorized Medi Cal representative and nothing I say changes any Medi Cal rules. On my soapbox, I’m upset that Covered CA expects us to facilitate enrollment, without compensation.

- Please keep in mind that only healthcare providers enrolled in Medi-Cal will be reimbursed by Medi-Cal for your care. The best way to ensure that you will not have to pay for your medical care is to ask your provider before your appointment if they accept Medi-Cal. If you already have a provider that you like, be sure to check to see if they are part of the provider network for any plan you select.

- Response from the Ombudsman

- That is correct, having private insurance does block a Medi-Cal beneficiary from being enrolled in a Medi-Cal Managed Care Plan.

- Office of the Ombudsman 358

Managed Care Operations Division

Dept. of Health Care Services

Phone: (888)452-8609

Fax (916) 440-7438

[email protected]

- Office of the Ombudsman 358

- That is correct, having private insurance does block a Medi-Cal beneficiary from being enrolled in a Medi-Cal Managed Care Plan.

Report other Coverage

Do you have to #tell or Report to Medi Cal that you have other coverage?

If you are a Medi-Cal beneficiary and have individual or group private health (or dental) insurance coverage, you are required by federal and state law to report it. You can report it directly to Department of Health Care Services (DHCS) by visiting their webpage on that.

You can also report it to your county eligibility worker, your health care provider, and/or to the Local Child Support Agency (LCSA), when there is an absent parent who may be responsible for your child(ren)’s medical care, or in establishing paternity of a child born out of wedlock. If you fail to report any private health insurance coverage that you have, you are committing a misdemeanor.

The State of California is mandated to find out if you have other health coverage or if it’s available and to collect payment from liable third parties, like a car accident. Thus, you must assign rights to medical support and help locate liable third parties, even going so far as to helping to establish paternity of children born outside of marriage so that the state may seek payment for medical services provided to the child.

- See our webpage on

What do I do if my other health plan sends a check to me?

Send any payment you get directly from an insurance carrier for services paid by Medi-Cal or medical support payment you get from the absent parent to DHCS at:

Department of Health Care Services

Third Party Liability and Recovery Division

Cost Avoidance Section

P.O. Box 997424, MS 4719

Sacramento, CA 95899-7424

If you have other health insurance coverage, the computer system will be coded to show other health insurance. If this information is incorrect you can contact your county eligibility worker to temporarily override this information.

Better yet you can report your other Insurance Information ONLINE!

If you are having a claims payment problem with a provider, you may call the Beneficiary and HIPAA Privacy Help Desk at (916) 636-1980.

If you have both Medicare and Medi-Cal, aka Medi Medi Medicare (not Medi-Cal) will pay for most prescription drugs for Medi-Cal beneficiaries who are eligible for Medicare Part A (hospital) or Part B (outpatient). Here’s our webpage on Medicare Part D (drug coverage) “Medi-Cal What it Means to you” Section 12

#Report changes as they happen - within 30 days! 10 CCR California Code of Regulations § 6496

10 days for Medi Cal 22 CCR § 50185

Our webpage on ARPA & Unemployment Benefits - Silver 94

IRS Form 5152 - Report Changes

- Our VIDEO on how to report changes to Covered CA

- Lost your job? How to keep your Health Insurance. Shelter at Home VIDEO

- References & Links

- Here's instructions, job aid, reporting change in income

- Our webpage on the exact definition of MAGI Income

- If you've appointed us - instructions - as your broker, no extra charge, we can do it for you.

- Voter Registration

- Denial of benefits and possible criminal charges if you don't report changes in income!

- When Increasing Your Covered California Income Estimate Creates an Ethical Dilemma Insure Me Kevin.com

- Fudging Income?

- Western Poverty Law on reporting changes

- How to cancel coverage.

- agents and brokers who suspect or know a fraudulent application for insurance has been submitted to report the potential fraud to the California Department of Insurance Fraud Division. Read more >>> Wshblaw.com

- Visit our webpage on how to report changes

#Autism

See our new webpage on Autism

Basic Law on Coordination of Benefits

Basic Law & Rules on #Coordination of Benefits

Benefits When You Have Coverage under More than One Plan

When Coordination of Benefits Applies

This coordination of benefits (COB) provision applies when a person has health care coverage under more than one Plan.

The order of benefit determination rules below govern the order in which each Plan will pay a claim for benefits.

The Plan that pays first is called the Primary Plan. The Primary Plan must pay benefits in accordance with its policy terms without regard to the possibility that another Plan may cover some expenses.

The Plan that pays after the Primary Plan is the Secondary Plan. The Secondary Plan may reduce the benefits it pays so that payments from all Plans do not exceed 100% of the total Allowable Expense. §1300.67.13 * UHC EOC

References & Links

More Explanations of #COB Coordination of Benefits

- Delta Dentals Explanation

- “Working Spouse Rule”

- Health Care Reform Dependent Coverage vs Spousal Coverage

- How about an HSA (Health Savings Account) rather than buying extra policies?

-

Supplemental Plans, like Colonial & AFLAC

- There might be some cases where a COB provision is not allowed – like HIPAA policies for when COBRA ends.

- Individual Plans cannot have this clause per CCR California Code of Regulations 1300.67.13 BUT, they might require that you cancel other coverage. Blue Cross EOC Page 5

- With COBRA protections and HIPAA availability when you lose Group Insurance, it probably is no longer necessary to keep an individual plan, “just in case.” The extra premium, would probably be better spent on Life or Disability Insurance.

- Life Insurance does not have a co-ordination of benefits clause. They will ask on the application though if you have other coverage to prevent over insurance and to make sure there is insurable interest.

- See also Balance Billing

What if your doctor charges more than the negotiated rate? - Employer Dental & Individual Dental?

Technical Resources

- Subrogation if you get in an accident and someone else can be sued

- CA Insurance Code §10270.98 Group Health Insurance Co-Ordination of Benefits

Dental

FAQ’s

#Dentala Co Ordination of Benefits

- Delta Dental – COB Co-Ordination of Benefits only on Group Policies

- Denti – Medi Cal and other dental plans Denti Cal Member Handbook

- Question I have an employer group dental plan with Walmart that only coordinates with other group plans.

- I’m interested in a Individual Delta Dental PPO.

- What does their co-ordination of benefits say?

.

- Answer I don’t see a co-ordination of benefits clause in the INDIVIDUAL Delta Dental disclosure

- The disclosure you sent me, says your Walmart Group Plan only coordinates with other GROUP plans.

- The definition of a “Plan” within the COB provision of group contracts enumerates the types of coverage which the Plan may consider in determining whether other coverage exists with respect to a specific claim. The definition:

- 1. May not include individual or family policies, or individual or family subscriber contracts, except… § 1300.67.13. Coordination of Benefits (“COB”)This all is rather complex. Let me email Delta to double check.See our webpage on dual coverage….Non-duplication of Benefits

- Some Delta Dental groups that are not subject to the provisions of California Health and Safety Code §1374.19 have a non-duplication of benefits clause in their contract.

- Such clauses means that the secondary plan will not pay any benefits if the primary plan paid the same or more than what the secondary plan allows for that dentist.

- For example, if both the primary and secondary carrier pay for the service at 80 percent level but the primary allows $100 and the secondary carrier normally allows $80 for the same treatment, the secondary carrier would not make any additional payment. However, if the primary carrier only pays 50 percent of the dentist’s allowed fee, then the secondary carrier would reduce its payment by the amount paid by the primary plan and pay the difference. In this case, the secondary carrier would pay $14 ($80 x 80 percent – $50 = $14).

- Dual coverage saves money for you and your group by sharing the total cost of dental benefits between two carriers. Containing costs is an important part of Delta Dental’s plan to keep you smiling.

- understanding non duplication

- Nonduplication COB – In the case of nonduplication COB, if the primary carrier paid the same or more than what the secondary carrier would have paid if it had been primary, then the secondary carrier is not responsible for any payment at all. ADA.org

- Columbus.Gov

-

How does dual coverage and COB work?

- With non-duplication of benefits, the primary carrier pays its portion first and the secondary carrier, instead of paying the remainder, calculates what it would have paid if it were the primary carrier and subtracts what the other plan paid.

- For example, if the primary carrier paid 80 percent, and the secondary carrier normally covers 80 percent as well, the secondary carrier would not make any additional payment. However, in the same scenario, if the primary carrier paid 50 percent, the secondary carrier would pay up to 30 percent. Dental Dental

-

-

(a) This section shall only apply to a health care service plan covering dental services or a specialized health care service plan contract covering dental service pursuant to this chapter.

-

(b) For purposes of this section, the following terms have the following meanings:

-

(1) “Coordination of benefits” means the method by which a health care service plan covering dental services or a specialized health care service plan contract, covering dental services, and one or more other health care service plans, specialized health care service plans, or disability insurers, covering dental services, pay their respective reimbursements for dental benefits when an enrollee is covered by multiple health care service plans or specialized health care services plan contracts, or a combination thereof, or a combination of health care service plans or specialized health care service plan contracts and disability insurers.

-

(2) “Primary dental benefit plan” means a health care service plan or specialized health care service plan contract regulated pursuant to this chapter or a dental insurance policy issued by a disability insurer regulated pursuant to Part 2 (commencing with Section 10110) of Division 2 of the Insurance Code that provides an enrollee or insured with primary dental coverage.

-

(3) “Secondary dental benefit plan” means a health care service plan or specialized health care service plan contract regulated pursuant to this chapter or a dental insurance policy issued by a disability insurer regulated pursuant to Part 2 (commencing with Section 10110) of Division 2 of the Insurance Code that provides an enrollee or insured with secondary dental coverage.

-

-

(c) A health care service plan covering dental services or a specialized health care service plan issuing a specialized health care service plan contract covering dental services shall declare its coordination of benefits policy prominently in its evidence of coverage or contract with both enrollee and subscriber.

-

(d) When a primary dental benefit plan is coordinating its benefits with one or more secondary dental benefits plans, it shall pay the maximum amount required by its contract with the enrollee or subscriber.

-

(e) A health care service plan covering dental services or a specialized health care service plan contract covering dental services, when acting as a secondary dental benefit plan, shall pay the lesser of either the amount that it would have paid in the absence of any other dental benefit coverage, or the enrollee’s total out-of-pocket cost payable under the primary dental benefit plan for benefits covered under the secondary plan.

-

(f) Nothing in this section is intended to conflict with or modify the way in which a health care service plan covering dental services or a specialized health care service plan covering dental services determines which dental benefit plan is primary and which is secondary in coordinating benefits with another plan or insurer pursuant to existing state law or regulation.

-

Since you said that when you called Walmart’s HR department and you state they told you something different, I googled and found more recent information on their website!

- IF YOU HAVE COVERAGE UNDER MORE THAN ONE DENTAL PLAN

- If you or a family member have coverage under the dental plan and are also covered under another dental plan (for example, your spouse/partner’s company plan), coordination of benefits may apply. The dental plan has the right to coordinate with other plans you are covered under so the total dental benefits payable will not exceed the level of benefits otherwise payable under the dental plan.

- Coordination of benefits procedures and plans referred to as “other plans” are described in

- If you have coverage under more than one medical plan in The medical plan chapter page 89

- If you have coverage under more than one medical plan

- The AMP [associates medical plan] has the right to coordinate with other plans under which you are covered so the total medical benefits payable do not exceed the level of benefits otherwise payable under the AMP. “Other plans” refers to the following types of medical and health care coverage:

- • Coverage under a governmental program provided or required by statute, including no-fault coverage to the extent required in policies or contracts by a motor vehicle insurance statute or similar legislation

- • Group insurance or other coverage for a group of individuals, including coverage under another employer plan or student coverage obtained through an educational institution

- • Any coverage under labor-management trusteed plans, union welfare plans, employer organization plans, or employee benefit organization plans

- • Any coverage under governmental plans, such as Medicare or TRICARE, but not including a state plan under Medicaid or any governmental plan when, by law, its benefits are secondary to those of any private insurance, nongovernmental program, and

- • Any private or association policy or plan of medical expense reimbursement that is group or individual rated.

- So, how would coverage for Crowns work?

- Walmart Plan

- MAJOR CARE

- After you meet the annual deductible, the Plan pays 50% of the maximum plan allowance for major care.

-

Crowns, cast restorations, inlays, onlays, and veneers:

- Covered only when the tooth cannot be restored by amalgam or composite resin filling

- • Replacement is not covered unless the existing crown, cast restoration, inlay, onlay, or veneer is more than five years old and cannot be repaired.

- MAXIMUM PLAN ALLOWANCE (MPA)

- The MPA is the maximum amount the dental plan pays for covered dental services. The MPA applies to network and out-of-network dental services.

- For covered network services, the MPA is that portion of a provider’s charges covered by the dental plan as determined by the provider’s contract with Delta Dental of Arkansas.

- Network providers agree to accept an amount negotiated by Delta Dental for covered services as payment in full, subject to applicable deductible and coinsurance amounts.

- Delta Individual

- So, at best – the Individual Plan pays 50%. Group Plan pays 50%, so in this case, near as I can tell, you wouldn’t get anything extra as your Walmart Plan has Non Duplication of Benefits and not the “normal” Coordination of Benefits which would have allowed you to collect up to 100% of what the dentist charged you.

-

Please note, I’m not an attorney nor an authorized claims representative for Walmart nor Delta Dental.

-

Medicare and other Coverage

Medicare #DualCoverage

Publication - 02179

-

VIDEO how two plans coordinate and pay your claim.

- Medicare.Gov on how Medicare works with other insurance.

- Employer obligation to report # of employees to Medicare

- Explanation from Cal Broker Magazine Sept 2019

- Sample Small Employer Group Health Plan

#Subrogation

Medicare's Right to collect from other Coverage

- You're Medicare Advantage plan has the right and responsibility to collect - subrogate for covered Medicare services for which Medicare is not the primary payer.

- According to CMS regulations at 42 CFR sections 422.108 and 423.462, Anthem MediBlue Access (PPO), as a Medicare Advantage organization, will exercise the same rights of recovery that the Secretary exercises under CMS regulations in subparts B through D of part 411 of 42 CFR and the rules established in this section supersede any state laws. Anthem MediBlue Access (PPO) Evidence of Coverage

- Medi-Cal (for People with Medicare) – 04-19-23 Hi Cap CA Health Care Advocates

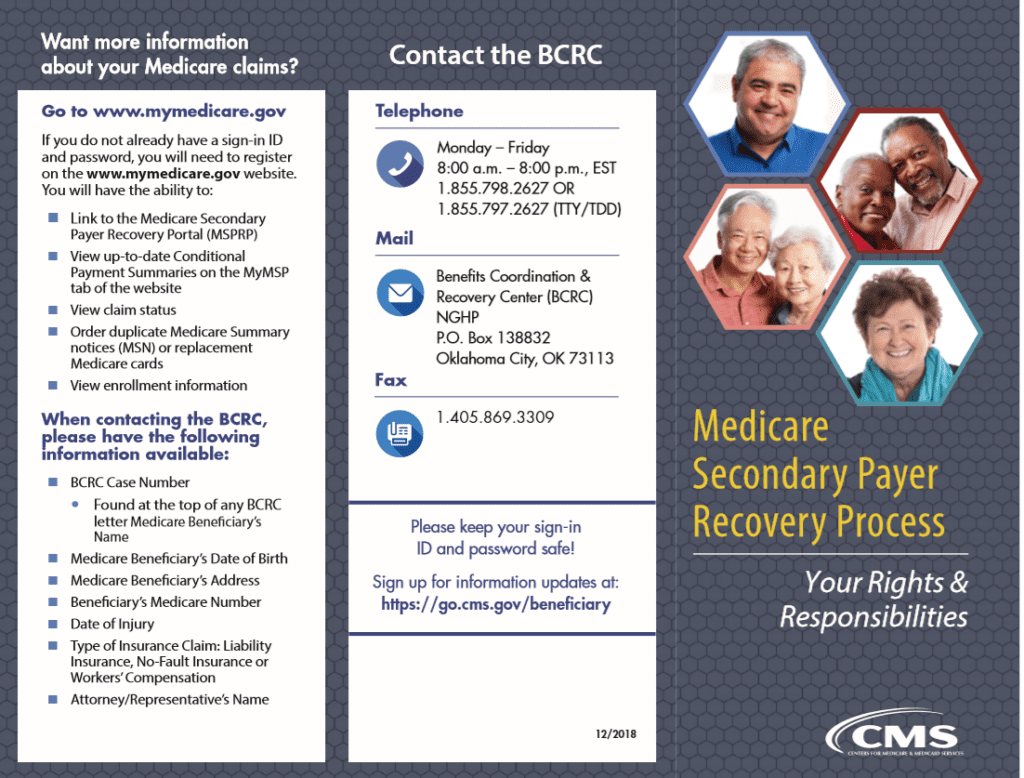

Medicare Secondary Payer Recovery Process

Click to Enlarge

Benefits Coordination & Recovery Center (BCRC)—

The BENEFITS COORDINATION & RECOVERY CENTER (BCRC) acts on behalf of Medicare to collect and manage information on other types of insurance or coverage that a person with Medicare may have, and determine whether the coverage pays before or after Medicare.

BCRC acts on behalf of Medicare to obtain repayment when Medicare makes a conditional payment, and the other payer is determined to be primary – the one that pays 1st.

How are claims paid if you have #Medicare &

Other Insurance?

Dual Coverage?

If you have questions about how Medicare works with other coverage, you’ve come to the right page. Hopefully, we’ve or our links will answer all your questions on dual coverage here. If not, use the FAQs / Ask Us a Question feature below.

We’ve also included the relevant pamphlets from Medicare.

- Medicare Guide to Dual Coverage who pays first publication # 02179

- Medicare website, on dual coverage

- Medicare’s Subrogation Right to collect from other insurance

FAQ’s

I have Medicare and:

- I have Medicaid.

- I’m 65 or older and have group health plan coverage based on my current employment (or the current employment of a spouse of any age), and my employer has 20 or more employees.

- I’m under 65, entitled to Medicare because I have a disability (other than ESRD), I’m covered by a large group health plan because I or a family member is still working.

- I work for a small company that has a group health plan.

- I have a domestic partner with group health insurance coverage.

- I have declined or dropped employer-offered coverage.

- I’m retired, 65 or older and have group health plan coverage from my former employer.

- I’m retired, under 65 and disabled (other than by ESRD), and have group health plan coverage from my former employer.

- I have COBRA continuation coverage.

- I’m in a Health Maintenance Organization (HMO) Plan or an employer Preferred Provider Organization (PPO) Plan that pays first. Who pays first if I go outside the employer plan’s network?

- I get health care services from the Indian Health Service.

- I have more than one other type of insurance or coverage.

- I have TRICARE.

- I have Veterans’ benefits

- I have ESRD and group health plan coverage.

- I have coverage under the Federal Black Lung Program.

- I have a claim for no-fault or liability insurance.

- I filed a workers’ compensation claim.

If you still have questions, email us, * set a meeting, * ask us a question right on this page, you don’t have to even leave your name.

For more information - Also see our desktop version

#Understanding Medicare Advantage Plans (PDF) #12026

- MAPD Plans look like a great deal, as the "premium" is paid by fee from the Federal Government, on average $2k/year.Kff * MAPD Plans must cover all A & B services Medicare.Gov * generally they also cover Part D Rx.

- That's why the premium is very low or ZERO!

- Set a Zoom Meeting

- We can now do SOC Scope of Appointment, before the Meeting via a 3 minute recorded meeting 2 days before. AHIP Training Module 4 Page 14 *

- #Intake Form Berwick Needs Assessment Form - We can better prepare for the meeting

- Medicare Advantage (Medicare Part C): An Overview Hi Cap

- HMO - Narrow Networks?

- HI Cap CA Health Care Advocates Fact Sheet

- Do I just sign up with a Medicare Advantage Company and automatically get * Parts A & B or do I have to get those from Medicare.Gov * VIDEO

- Get Quotes, Full Information and Enroll

- MANDATED wording!: Think Advisor * ‘‘We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1–800–MEDICARE to get information on all of your options.’’

- We disagree with the above wording, as we can use the same tools on Medicare.gov as they do!

- FYI a 4.27.2022 HHS Office of the Inspector General report found that MAPD plans denied 13% of prior authorizations that would have been covered under original Medicare (Conversely, Medi Gap, just follows what Medicare pays.)

- 88% of MAPD enrollees are happy

-

MAPD plans often include Dental & Part D - Rx Prescriptions and often have NO premiums!

-

How is that possible?

-

The Federal Government pays them around $700/month to handle your medical care. You must continue to pay your Medicare Part B premium of about $170/month. It's best to apply when you turn 65 for the supplement plans or advantage plans, as that's the main "Open Enrollment" period, guaranteed issue for any plan.

-

-

-

Medicare Advantage Plans also have an annual open enrollment now known as AEP Annual Election Period October 7 to December 15th.

-

Additional Coverage is important as Medical Bills are increasing Seniors Credit Card Debt or leading to possible bankruptcy?

- If You Have Problems with Your Medicare Advantage Plan

- forbes.com/how-insurers-can-navigate-the-costs-of-medicare-advantage-benefits

- politico.com/medicare-advantage-plans-congress

- Uncle Sam wants you to help stop insurers' bogus Medicare Advantage sales tactics

- ca health advocates/using-ai-to-deny-care

- Dodging the Medicare Enrollment Deadline Can Be Costly

- Medicare Advantage Increasingly Popular With Seniors — But Not Hospitals and Doctors

- Medicare Advantage is bad for patients and bad for investors

- When Medicare Advantage Plans Terminate Coverage

- Medi-Cal D-SNP Feasibility Study

Cal Medi Connect

Historical

Cal Medi #Connect program

D SNP – Dual Eligible Special Needs Plans

Medi Medi – Medicare & Medi-Cal Plan (MMP – Dual Eligible)

Can you choose your own Medicare Advantage Plan & Medi-Cal HMO or one will be chosen for you?

Cal MediConnect Changes to D-SNP in 2023

On January 1, 2023, your Cal MediConnect (CMC) plan will change into matching Medicare and Medi-Cal plans provided by L.A. Care. We are the health plan providing your health care through your CMC plan now.

The matching plans are designed to coordinate care for people who have both Medicare and Medi-Cal. You will still get the same health care benefits. You will begin getting letters about this change in October 2022.

You will continue to get all your services through CMC until December 31, 2022. Then on January 1, 2023, you will automatically start getting services through your matching plans.

If you are in CMC today, you DO NOT need to do anything to enroll into the matching plans and keep your current benefits.

Your new plans will help you with all your health care needs and will continue to coordinate your benefits. This includes medical and home- and community-based services. It also includes medical supplies and medications. The matching plans will include the doctors you see today, or we will help you find a new doctor if you would like.

If you have additional questions about your coverage in 2022, please call us at 1.888.522.1298. Cal Medi Connect *

- Option A Medicare & Medi-Cal in ONE plan (Los Angeles Options)

- Option B Keep Medicare (Get an Advantage Plan or Medi Gap?) and get a Medi-Cal Plan (Los Angeles) Cal Duals.org Cedars Sinai

Our website on Medicare Advantage Plans

- Blue Cross

- United Health Care

- Blue Shield

My Care, My Choice

My Care, My Choice helps people who have both Medicare and Medi-Cal explore health care coverage choices based on their location, their needs, and what they want from their coverage.

Unlike other websites, MyCareMyChoice.org isn’t run by a health plan or broker, and it doesn’t sell any products. But it’s funded by SCAN.

Our goal is simple: helping Californians with Medicare + Medi-Cal learn about their coverage options so they can make the best choice based on their unique needs.

The Advisor Tools page is designed to help the advocates, family members, caregivers, and service providers who help people with Medicare and Medi-Cal make health care decisions.

Consumer Links

Some Cal Medi Medicare MMP Default Plans:

- CalDuals is a website to support California’s Dual Eligible Population. Here you will find information about Medicare and Medi-Cal integration through the Coordinated Care Initiative, or CCI. The CCI was launched by the state of California to provide better coordinated care to people with both Medicare and Medi-Cal – dual eligibles.

- Health Net

- Blue Cross

- A Primer on Dual-Eligible Californians: How People Enrolled in Both Medicare and Medi-Cal Receive Their Care Chcf.org

- cms.gov/MMP Marketing Information and Resources

- Cedars Sinai Tool & Information – How to OPT OUT! Also applies EVEN if you don’t use their facilities!

- dhcs.ca.gov Technical Page on Cal Medi-Connect Demonstration

- Health Care Options 844.580.7272 – State Enrollment Broker – Enroll & Dis-enroll

- HICAP – CA Health Care Advocates – 1-800-434-0222

- Los Angeles Times 2.1.2015 Problems with shifting care for costly patients

- DHCS.Gov Medi-Cal Managed Care

- ca health advocates.org (Medi-Cal)

- LIS – Low Income Subsidy (Medicare Part D Rx – Help with Drug Costs)

- Doctor’s can’t bill Medi Medi patients for Co Pays, Deductibles, etc.

- InsureMeKevin.com on Blue Cross SNP & Dual Eligibility with Medi-Cal

- Fraud, Waste & Abuse

- Justice in Aging duals demo advocacy.org/

- DUALLY ELIGIBLE BENEFICIARIES UNDER MEDICARE AND MEDICAID (Medi Cal) MLN Knowledge Booklet

Technical Links

- SB 1008 and SB 1036

- CMS Reporting Requirements and other technical stuff

- Dual Eligible Performance Studies – Inovalon

- Problems with Medi-Medi – unwitting Guinea Pigs real clear policy.com

Other pages in Medicare Advantage Section

- Additional Social Services – in addition to Medi-Cal

- Medi-Cal Estate Recovery

- Blue Cross Medi Medi – Co Ordination Plan

Cal Medi Connect

Guide Book

Primer on Dual Eligible – Those on Medi-Cal & Medicare

CMS on people dually eligible for Medi Cal & Medicare

BROKER ONLY

Guide to Dual Eligible Special Needs Plan 2021

How to Opt Out of Cal Medi Connect

Cedars Sinai – Plan Section Tool & Info

Cal Medi Connect

Video’s

CHCF California Health Policy Survey

- 1/2 of California's skipped health care in the past year, due to cost

- 1/4 themselves or knew someone who had problems paying a bill

- 1/5 had someone close to them experience homelessness

- 1/2 have used telehealth - phone or video

- 6 in 10 think there is racial or ethnic disparity

Historical Medi Cal Provider Issues

54% of MD’s accept Medi-Cal 4.3.2015

Litigation on Medi-Cal violating Judges order and putting people into HMO’s, rather than fee for service. CA Health Line 8.10.2017

Number of Medi-Cal Providers down by 25% californiahealthline.org/2014/7/15

Paul Ryan – more and more MD’s just won’t take Medi-Cal – Medicaid Fact Checker Washington Post 2.1.2017

Video on problems finding doctors

Many large physician groups no longer contract with health plans serving adult Medi-Cal patients, saying that government reimbursements are too low to cover the cost of treating patients.

For the typical office visit, Medi-Cal pays doctors only about a third of what their peers at federally qualified health centers receive, $150 on average. If the health centers’ fees exceed what insurers will pay, their administrators can bill the state for the residual amount. So, the state is forced by federal law to pay more for office visits at federally qualified health centers than it would have paid physicians in private hospital groups. Sacramento Bee 10.2.2017

The U.S. Supreme Court’s ruling October 2014 that private health care providers cannot file lawsuits against state Medicaid agencies over low reimbursement rates could limit future Medi-Cal lawsuits, the Los Angeles Times‘ “PolitiCal” reports. CA Health Line

Medi-Cal is California’s Medicaid program (Megerian, “PolitiCal,” Los Angeles Times, 3/31).

Los Angeles Times 8.14.2014 – Few Providers, etc

There are now about 11 million Medi-Cal beneficiaries, constituting nearly 30% of the state’s population

Under the Affordable Care Act, the federal government pays 100% of the costs for newly eligible Medi-Cal enrollees for the first three years. But the state is responsible for 50% of the costs for those who qualified for the program before the Obamacare expansion, even if they hadn’t previously enrolled

With payments of $18 to $24 a visit, “doctors can’t continue to accept new patients and keep their doors open,” said Molly Weedn, a spokeswoman for the California Medical Assn. Without enough doctors, Medi-Cal patients could continue landing in costly emergency rooms — the opposite of Obamacare’s aims.

There is application backlog of about 490,000 people,

California has already demonstrated to the rest of the country that it can dramatically cut its rate of uninsured, largely by increasing the size of Medi-Cal. Now it needs to show that its public insurance program can actually deliver the care its new enrollees are counting on. latimes.com

Money in CA budget to expand Medi-Cal but 10% reduction in payments to MD’s california health line.org

https://www.dhcs.ca.gov/provgovpart/Pages/Medicare-Advantage-Information-for-Dual-Eligible-Beneficiaries.aspx

I have Original Medicare A & B, start date 10-01-22 and ffs Fee for Service Medi-Cal .

https://www.dhcs.ca.gov/provgovpart/Pages/Medicare-Advantage-Information-for-Dual-Eligible-Beneficiaries.aspx

Now being told by HealthcareOptions.dhcs.ca.gov, that It is mandatory that I join a Medi-cal Managed care plan.

My question is, how is this not a conflict of interest to join Managed Care when I enrolled in Original Medicare in order to see my Doctors at Cedar Sinai Medical Center who do not belong to Managed care.

We are updating this webpage now, to make it easier to find the sections on dual coverage, fee for service, etc. Check out our Medicare Advantage Plans

Blue Cross

UHP AARP

Blue Shield

that Cedars does accept.

Can child qualify for medi-cal with one parent, when the other parent in a different household has private/ employer insurance for the child

Here’s the household size chart

I don’t find anywhere that having an employer group plan would disqualify you from Medi Cal.

The group plan would pay first, though.

Go ahead and apply, see what happens. Ask any further questions from someone who gets paid or has grant $$$ to help you.

https://www.dhcs.ca.gov/provgovpart/Documents/Duals/DSNP-Feasibility-Study.pdf

I have Medi-cal.

I may get a w2 job that pays for medical insurance. I want to keep my Medi-cal insurance however as I get very expensive immune therapy monthly and I do not want to change providers

Have you verified what providers are available to you from your Employer’s Coverage?

Did you ask your providers what Insurance’s they accept?

Might you still qualify for Medi Cal even if you have a job? See the income chart

We are not compensated to help people with Medi Cal. Here’s Medi Cal’s #’s

Might you qualify under Continuity of Care AB 369? We could research and give you the tools to advocate that for you for a fee. See also our webpage on appeals & grievances.

I currently have medi-cal. But I might be able to also get employer insurance soon if all goes well but I will still be under the bracket of income level [138% Federal Poverty Level]

so I’m wondering am I able to have/keep medi cal and get employer insurance and have both or

Is it better to just keep medi-cal on its own instead?

Same with dental and vision etc.

*********

My son who is 10 is currently under a waiver by the local Regional Center to receive MediCal.

I also have him under my employer insurance but i was thinking of removing him from my employer insurance to improve his care due to a lot of issues this year to get him medical equipment.

Will this affect his eligibility for the waiver and lose his Medi-Cal?

I don’t see any reason why you can’t keep both.

Please re-read the webpage above as to how dual coverage works and what might be “better.”

We don’t get a nickel in compensation to help people with Medi Cal. If the above webpage doesn’t answer your question about “better” you can wait on terminal hold for Medi Cal Contacts & Social Service Agencies or the Medi Cal HMO you are with.

We can give you private tutoring, education & research for a nominal fee. However, we don’t give advice or recommendations.

****

Sorry, I don’t have time right now to research questions that I don’t get compensated for, with the war in Israel going on and some of my own family issues with SSDI.

See above about Employer Plans paying first and if they don’t pay, then Medi Cal will.

If your having problems, contact someone at Medi Cal and hopefully you’ll get the correct authoritative answer.

I am debating on whether to sign up for UCSHIP at Berkeley or to opt-out.

I am also on my parents’ Medi-Cal with Kaiser through LA Care and HealthNet Dental.

1. Can I have both insurances at the same time or will I get dropped from Medi-Cal?

I know when I am on campus I should go to the University Health Services facility for care.

However I’m a little confused about where I should go when I am back home.

2. Can I still go to the usual Kaiser facility and HealthNet Dental Provider?

I don’t want my parents to to get a huge bill when I get treatment at home.

How would the insurance work?

Please help. Thank-you in advance!

We are not Medi Cal representatives nor do we get any compensation or support to help you.

1. Please re-read our webpage above. It’s all about having Medi Cal and other coverage OHC. The other coverage pays first. See the letter we got from Medi Cal explaining some of the more common FAQ’s we’ve come across.

2. I don’t see any reason you can’t go to Kaiser. Just be sure to report to Medi Cal that you have other coveage.

See above contact information for Kaiser & Medi Cal. Check with them.

View MORE FAQ’s

from December 2021 through December 2017

Hi Steve!

Thank-you so much for taking the time to answer my questions!

I was reading through other people’s questions and there was one dated May 11, 2021 where you mentioned that “There may be a problem if he likes his Medi Cal HMO as he would need to change to fee for service, when he has other coverage.”

Could you please clarify this?

I have Medi-Cal with Kaiser through LA Care.

Would I need to change to Fee for Service?

Please review the Q & A that we received from a Big Wig at Medi Cal in response to our inquiry of May 8.

We do not give advice or recommendations for Insurance Plans that we are not licensed and compensated for. This page is for reference and education only.

If you have further questions, please contact Medi Cal, the relevant Insurance Company or one of the consumer help groups.