What are the advantages and why buy of Life Insurance?

Instant Term Life Insurance Quotes

The loss of your income to your Family or Business

will be devastating to them, won’t it?

- If you had the Goose that laid the Golden Eggs, would you insure the Goose or the Eggs?

- The Goose as it produces the eggs – the income from your family breadwinner.

- The fruits of your labor, a car, house, (Get Mortgage, Life Insurance Instant Quote) clothes, food, education and medical bills, can be replaced by insurance, your savings, credit cards, etc. Replacing your income requires life insurance. Life Insurance benefits are generally income tax free. IRC Sec. 101(a)(1) ♦ IRS.Gov There may be estate taxes, but there are estate planning ways to minimize them.

- Many of our website visitors are here to find out where their loved ones policy is. Your survivors depend on your income, make sure that are taken care of whether you are here on earth or in heaven. Get coverage now, so that your family knows where your policy is. Here’s a claim paid to the wife of one of our policy holders. View $300k Life Insurance Payment

- The Family Breadwinner’s income is considered so important by the Federal Government that Social Security has some limited death benefits for your family. We can help you build on this base to fully protect your family and estate.

- Seven reasons Why do you need life insurance

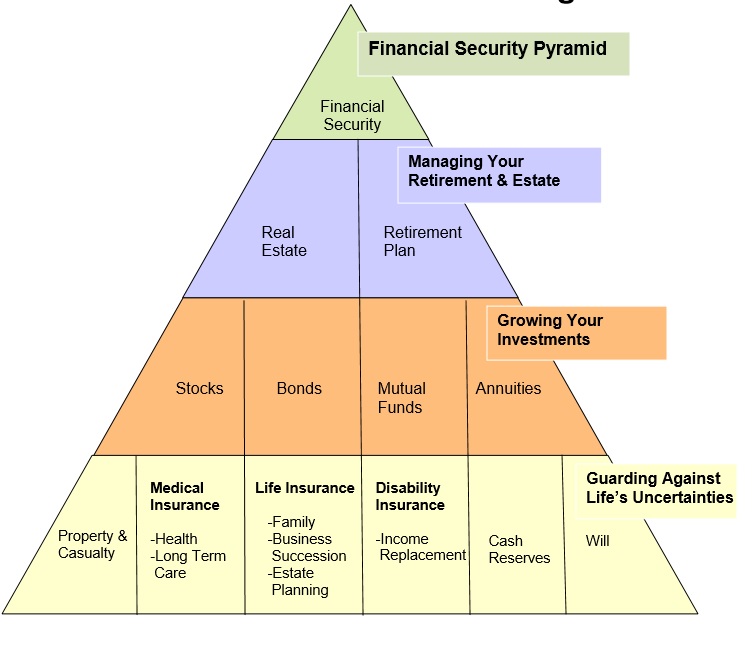

Financial Security Pyramid

Short Video - Life Insurance 101 + Plus MANY more

Check our Site map for Health, Medicare, Disability, Long Term Care, etc.

Protective Life Brochures

Video Life Insurance – Your Future Protected  |

|

|

Life Insurance – Numbers to Know

|

Sample Life Premiums – How much Life Insurance do you need?

How much Life Insurance do you need?

- Calculate How much Insurance you #need, to be adequate, based on Income, Net Worth, Family Responsibilities, etc. – Life Happens.org

- Monthly.expense.fact.finder Jackson

- 10 reasons you might need life insurance even after your kids are grown.

- People killed in mass shootings got around 275,000 each from charitable fund raising

- So don’t you think that means that you should have at least 300,000 because nobody knows how they’re going to die

- Nor should you rely on charity

- la times.com/victims-fund-vegas

- Can A Court Make You Maintain Life Insurance For Your Ex-Spouse?

- People killed in mass shootings got around 275,000 each from charitable fund raising

- Policy review: Make sure your clients’ life insurance is still working for them

- Principal Business Needs Assessment Tool

Uses of universal & Term life insurance

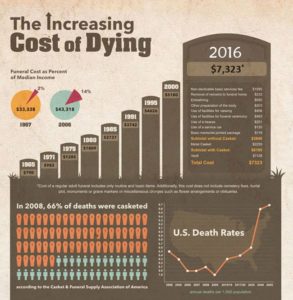

- Final expenses, such as a funeral, burial, and unpaid medical bills

- Income replacement, to provide for surviving spouses and dependent children

- Debt coverage, to pay off personal and business debts, such as a home mortgage or business operating loan

- Estate liquidity, when an estate has an immediate need for cash to settle federal estate taxes, state inheritance taxes, or unpaid income taxes on income in respect of a decedent (IRD).

- Estate replacement, when an insured has donated assets to a charity and wants to replace the value with cash death benefits.

- Business succession & continuity, for example to fund a cross-purchase or stock redemption buy/sell agreement.

- Key person insurance, to protect a company from the economic loss incurred when a key employee or manager dies.

- Executive bonus, under IRC Sec. 162, where an employer pays the premium on a life insurance policy owned by a key person. The employer deducts the premium as an ordinary business expense, and the employee pays the income tax on the premium.

- Controlled executive bonus, just like above, but with an additional contract between an employee and employer that effectively limits the employee’s access to cash values for a period of time (golden handcuffs).

- Split dollar plans, where the death benefits, cash surrender values, and premium payments are split between an employer and employee, or between an individual and a non-natural person (e.g. trust).

- Non-qualified deferred compensation, as an informal funding vehicle where a corporation owns the policy, pays the premiums, receives the benefits, and then uses them to pay, in whole or in part, a contractual promise to pay retirement benefits to a key person, or survivor benefits to the deceased key person’s beneficiaries.

- An alternative to long-term care insurance, where new policies have accelerated benefits for Long Term Care.

- Mortgage acceleration, where an over-funded UL policy is either surrendered or borrowed against to pay off a home mortgage.

- Life insurance retirement plan, or Roth IRA alternative. High income earners who want an additional tax shelter, with potential creditor/predator protection, who have maxed out their IRA, who are not eligible for a Roth IRA, and who have already maxed out their qualified plans.

- Term life insurance alternative, for example when a policy owner wants to use interest income from a lump sum of cash to pay a term life insurance premium. An alternative is to use the lump sum to pay premiums into a UL policy on a single premium or limited premium basis, creating tax arbitrage when the costs of insurance are paid from untaxed excess interest credits, which may be crediting at a higher rate than other guaranteed, no risk asset classes (e.g. U.S. Treasury Bonds or U.S. Savings Bonds).

- Whole life insurance alternative, where there is a need for permanent death benefits, but little or no need for cash surrender values, then a current assumption UL or GUL may be an appropriate alternative, with potentially lower net premiums.

- Annuity alternative, when a policy owner has a lump sum of cash that they intend to leave to the next generation, a single premium UL policy provides similar benefits during life, but has a stepped up death benefit that is income tax-free.

- Pension maximization, where permanent death benefits are needed so an employee can elect the highest retirement income option from a defined benefit pension.

- Annuity maximization, where a large non-qualified annuity with a low cost basis is no longer needed for retirement and the policy owner wants to maximize the value for the next generation. There is potential for arbitrage when the annuity is exchanged for a single premium immediate annuity (SPIA), and the proceeds of the SPIA are used to fund a permanent death benefit using Universal Life. This arbitrage is magnified at older ages, and when a medical impairment can produce substantially higher payments from a medically underwritten SPIA.

- RMD Required Minimum Distribution maximization, where an IRA owner is facing required minimum distributions (RMD), but has no need for current income, and desires to leave the IRA for heirs. The IRA is used to purchase a qualified SPIA that maximizes the current income from the IRA, and this income is used to purchase a UL policy.

- Creditor/predator protection. A person who earns a high income, or who has a high net worth, and who practices a profession that suffers a high risk from predation by litigation, may benefit from using UL as a warehouse for cash, because in some states the policies enjoy protection from the claims of creditors, including judgments from frivolous lawsuits. Wikipedia * [2]

Sample Life Insurance Rates

10 year level term

40 year old Male

Super Preferred Non Tobacco

Myths

Recognizing these myths and understanding the facts about the critical line of coverage can help you and your loved ones make informed decisions.

- Life insurance is only for seniors. Contrary to popular belief, life insurance is not just for older adults. Regardless of age, having coverage offers peace of mind for your family in unforeseen circumstances. In fact, nearly half of those with life insurance wish they had obtained it sooner.

- Only primary wage earners need life insurance. Recognizing the crucial role of stay-at-home parents (SAHPs) or caregivers is essential, especially when considering the financial realities. For instance, the average cost of a funeral with viewing and burial stands at $7,848. Additionally, child care for an infant averages $321 a week for daycare and $766 a week for a nanny.

- The IRS will tax my life insurance benefit. Fortunately, death benefits from life insurance are not taxable. However, you will have to report and pay taxes on any interest received related to your investment.

- Employer-provided coverage is enough. Employer-provided life insurance may leave you underinsured. Most experts recommend 10x your salary. Remember, employer coverage typically ends when you leave the job, and even if it’s transferable, premiums often skyrocket.

- Life insurance is too expensive for most budgets. Over 80% of Americans overestimate the costs of a policy. In reality, premiums can be more affordable than anticipated, with healthy individuals in their 30s paying as little as $170 annually.

- Pre-existing conditions make life insurance unattainable. While health conditions may impact premiums, there are still options available for individuals with pre-existing conditions. Don’t assume you can’t get coverage without exploring your options.

Universal Life – Key Man

#Universal Life Insurance

- Universal life insurance a type of whole life –

- cash value[1] life insurance. Under the terms of the policy, the excess of premium payments above the current cost of insurance is credited to the cash value of the policy, which is credited each month with interest. The policy is debited each month by a cost of insurance (COI) charge as well as any other policy charges and fees drawn from the cash value, even if no premium payment is made that month. Interest credited to the account is determined by the insurer but has a contractual minimum rate (often 2%). When an earnings rate is pegged to a financial index such as a stock, bond or other interest rate index, the policy is an “Indexed Universal Life” contract. Such policies offer the advantage of guaranteed level premiums throughout the insured’s lifetime at a substantially lower premium cost than an equivalent whole life policy at first. The cost of insurance always increases, as is found on the cost index table (usually p. 3 of a contract). That not only allows for easy comparison of costs between carriers but also works well in irrevocable life insurance trusts (ILITs) since cash is of no consequence. Wikipedia *

- variable universal life insurance policy (VUL)

- variable universal life insurance policy (VUL). VUL lets the cash value be directed to a number of separate accounts that operate like mutual funds and can be invested in stock or bond investments with greater risk and potential growth. Additionally, there is the recent addition of indexed universal life contracts similar to equity-indexed annuities which credit interest linked to the positive movement of an index, such as the S&P 500, Russell 2000, and the Dow Jones. Unlike VUL, the cash value of an Index UL policy generally has principal protection, less the costs of insurance and policy administrative fees. Index UL participation in the index may have a cap, margin, or other participation modifier, as well as a minimum guaranteed interest rate. Wikipedia *

- More Links & Reference

- National Life

- CA Department of Insurance on Life Insurance

- Treatise The Universal Life Policy

- NAIC Model Regulation

- How universal Life Works

- Vermont Department of Insurance

- Maryland Department of Insurance

- Wikipedia

- Ramsey

- Policy Genius

- Prosperity Thinkers

- Study: Consumers find life insurance policies overly complex – We can help you figure it out!

#Key Man Life Insurance –

Protect your Business if you lose a Top Producing Employee

- Key Person Life Insurance Wikipedia

- Business Buy Sell Agreement – Nolo Video (Life Happens.org)

- Life Insurance Proceeds are Income Tax Free. irs.gov

- Section 162 Executive Bonus

- When a business interest is contingent upon the life of an individual, Failure to Survive insurance plans are designed to protect a business against the loss of those lives critical to a venture and safeguard the firm from financial disaster.

Can a minor child #under 18, be a Life Insurance beneficiary?

- No per Jackson National Life JNL Letter

- Free Advise.com

- California Uniform Gift to Minors Act Probate Code 3900-3925

- To young to sign a binding contract. Nolo

Coverage for your Grand Children – Leave a legacy – College Tuition

Official Ratings

Here’s where you can get the “#official” ratings and financials…

iii.org/how-to-assess-the-financial-strength-of-an-insurance-company

|

*To use these Web sites, you have to register, but the service is free.

#Guarantee Funds Association

(Insurance Company Insolvency – Bankruptcy)

- We are in NO WAY suggesting that you rely on this fund to take the cheapest policy with a bozo or podunk company!!!

- §1067-1067.18

- 1067.02. …(2) (A) With respect to any one life, regardless of the number of policies or contracts:

- (i) Two hundred fifty thousand dollars ($250,000) in life insurance death benefits, but not more than one hundred thousand dollars ($100,000) in net cash surrender and net cash withdrawal values for life insurance.

- (ii) One hundred thousand dollars ($100,000) in the present value of annuity benefits, including net cash surrender and net cash withdrawal values.

- 1067.17. (a) No person,…shall …in any … way, any …statement, written or oral, which uses the existence of the California Life and Health Insurance Guarantee Association for the purpose of sales, solicitation, or inducement to purchase any form of insurance

- 1071.5. Every insurer which withdraws as an insurer, or is required to withdraw as an insurer, from this State shall, prior to such withdrawal, discharge its liabilities to residents of this State. In the case of its policies insuring residents of this State it shall cause the primary liabilities under such policies to be reinsured and assumed by another admitted insurer. In the case of such policies as are subject to cancellation by the insurer, it may cancel such policies pursuant to the terms thereof in lieu of such reinsurance and assumption.

- 1067.02. …(2) (A) With respect to any one life, regardless of the number of policies or contracts:

- Jackson National Disclosure of Guarantee Fund

- Insolvency ………………………………….. 980-989

Other pages in this section

- Life, Disability, Long Term Care & Retirement no index

- Benefits of Retirement Planning & Effect on MAGI Income

- Disability Income – Pay Check Protection

- Estate Planning

- Life Insurance – Instant Quotes – Universal – Key Man Life

- Long Term Care Nursing & Home Health Care

https://insurancenewsnet.com/innarticle/overcoming-mistrust-in-life-insurance-sales

What is the maximum amount of time that an Insurance Company MUST pay out a death claim?

What if the claim is contested?

If claim not paid within 30 days after the date of death of the insured shall pay interest, Insurance Code 10172.5

I travel for my business. How am I to be able to put in dates of travel, when I don’t know when I might be going abroad next?

certain countries pose a higher risk to travelers and residents.

When you fill out an application for life insurance, it usually asks whether you plan to travel or live outside the US or Canada in the next two years. If you answer yes, you will most likely have to fill out a foreign travel questionnaire with your application.

Life insurance companies generally rate countries based on attributes such as economic conditions, political stability, sanitary conditions and availability of medical resources.

Arch Insurance

US Constitution Right to travel between states

The Freedom To Travel Law, Section 626.9541(1)(dd), Florida Statutes, was enacted in 2006 by the Florida legislature. The law defines as an Unfair Trade Practice, the practice of limiting the life insurance coverage available to a person based on lawful foreign travel in the past. It also prohibits discrimination based on future lawful travel plans unless the insurer demonstrates that the persons who travel are in a higher risk, actuarially supportable class – insurance underwriting . Florida Right to Travel – I haven’t found a CA right to travel

In view of the continuing outbreak of Coronavirus Disease (COVID‐19) and the U.S. Department of State issuance of an unprecedented Level 4: Do Not Travel advisory at a worldwide level, we will postpone coverage on any individual recently returned from international travel for a period of 30 days following his or her return https://www.myprotective.com/COVID-19/