What are the minimum Participation and Contribution requirements for employer small group health plans?

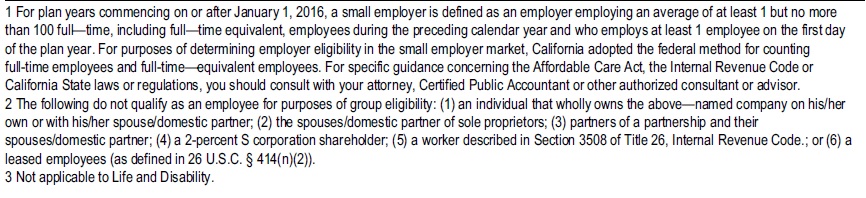

Introduction

Premium, Contribution & Participation Minimums

- All the Insurance Companies have participation & premium contribution rules as they are REQUIRED to write your company under Health Care Reform (AB 1083 ♦ §10753 et seq. Non Grandfathered Plans) regardless of the health status,

- NO MEDICAL QUESTIONS (See our FAQ) of the owner, employees or dependent and want to make sure that they get the young & healthy employees along with those more prone to claims.

- The Principles of Insurance require a large group of people so that there is enough money to pay claims and meet the 80% loss ratio rule, thus spreading the risk and avoiding “adverse selection.”

- If an employer is not covering the employees… the health plan might not qualify as tax deductible business expense under IRS Code Section §106. The employer may require the employee to pay part of the premium, which can be deductible under a POP Plan IRC §125.

- Ebook: Best practices for building a more engaged workforce UnitedHealthCare 8/2025

- See below for more details, quotes and enrollment.

What are the rules of minimum participation & contribution?

Check the EmployER application, brochures & each carriers manuals We are happy to help you with that. Just email us [email protected], get an instant quote and/or schedule a Zoom or Face to Face meeting.

Check out the Option during Special Annual Open Enrollment 11.15 to 12.15 where there are NO Participation rules!

Legal Mandate for Participation & Premium Contribution

Insurance Code §10753.06. (Health Reform – Non Grandfathered Plans)

Every carrier shall file with the commissioner the reasonable participation requirements and employer contribution requirements that are to be included in its health benefit plans. Participation requirements shall be applied uniformly among all small employer groups, except that a carrier may vary application of minimum employer participation requirements by the size of the small employer group and whether the employer contributes 100 percent of the eligible employee’s premium. Employer contribution requirements shall not vary by employer size.

A carrier shall not establish a participation requirement that

(1) requires a person who meets the definition of a dependent in subdivision (e) of Section 10753 to enroll as a dependent if he or she is otherwise eligible for coverage and wishes to enroll as an eligible employee and

(2) allows a carrier to reject an otherwise eligible small employer because of the number of persons that waive coverage due to coverage through another employer.

[some carriers will reject if the person waiving is the ONLY common law employee – call or email for your situation]

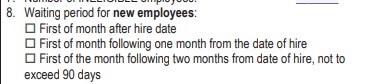

[Health Reform §2708 42 US §300gg requires that Employees be eligible within 90 60 days. DOL Guidance 2012-02 national underwriter.com Health Reform Facts Q & A 249 (email us for a copy) Learn More⇒ Our Page on waiting periods

Definition – Minimum Essential Coverage 5000A (f)

Please note that while the law mentions that an employee that is covered under another group plan (spousal) doesn’t count towards the participation level, the practice has been, to include Medicare, VA – Veteran’s, for many companies, EVEN individual plans and Medi-Cal etc.

Some Insurance companies might consider the non union employees as guaranteed issue, if the employer is mandated under a collective bargaining agreement to contribute to Union Labor Fund. Blue Shield Quick Underwriting Guideline Page 5

Extra 6 week or more waiting period for Part Timers SB 1790 – Insurance Code §10700 f 1 d

California Law under ACA/Health Care Reform says:

“Eligible employee” means

either of the following: §10753 Non Grandfathered Plans (f)

(1) Any permanent employee who is actively engaged

"Actively at Work" or "Not Disabled" CA DOI Bulletin 94-9A

See our webpage on AB 5 on 1099 employees

on a full-time basis in the conduct of the business of the small employer with a normal workweek of an average of 30 hours per week over the course of a month, in the small employer’s regular place of business, who has met any statutorily authorized applicable waiting period requirements.

The term includes sole proprietors or partners of a partnership,

[But it doesn't allow them to be a 1 employee - employer group. They need an individual plan.

See last line of Employer definition 10753 q 1 - only to extent required by PPACA ]

if they are actively engaged on a full-time basis in the small employer’s business, and they are included as employees under a health benefit plan of a small employer, but does not include employees who work on a part-time, temporary, or substitute basis.

AB 5 - 1099 - Independent Contractor or employee?

It includes any eligible employee, as defined in this paragraph, who obtains coverage through a guaranteed association. Employees of employers purchasing through a guaranteed association shall be deemed to be eligible employees if they would otherwise meet the definition except for the number of persons employed by the employer.

A permanent employee who works at least

20 hours but not more than 29 hours

is deemed to be an eligible employee if all four of the following apply:

(A) The employee otherwise meets the definition of an eligible employee except for the number of hours worked.

(B) The employer offers the employee health coverage under a health benefit plan.

(C) All similarly situated individuals are offered coverage under the health benefit plan.

(D) The employee must have worked at least 20 hours per normal workweek for at least 50 percent of the weeks in the previous calendar quarter.

The insurer may request any necessary information to document the hours and time period in question, including, but not limited to, payroll records and employee wage and tax filings.

View Definition Blue Cross Underwriting Requirements

(2) Any member of a guaranteed association as defined in subdivision (s).

See our other pages on Employer – Employee Definition

Just Enter your census or securely send us an excel spreadsheet or a list of employees and get instant proposals

for all these companies that we are Authorized Agents for in California

Anthem Blue Cross

Group #Administrator Manual

- Authoritative answers to questions like:

- Adding or Terminating Employees

- Our Video explanation - 2nd Video

- Late Enrollee's Page 32

- Cal COBRA Information

- Our Video explanation - 2nd Video

- Adding or Terminating Employees

- New Enrollment Checklist

- Eligibility Guidelines

Group Health #Carriers

We are authorized agents for the following companies and have the

"Official" Information

Employer Small Group Health Plans – Introduction

- Carriers – Companies Employer Group no index follow

- Aetna Employer Group Plan Coverage

- Blue Cross – Anthem – Employer Plans

- Blue Shield – Employer Group

- California Choice – Multiple Companies ONE Bill

- Health Net

- Kaiser Permanente – New Enrollment – Administrative

- Oscar – CIGNA + Oscar

- Sharp Health Plan

- SHOP – Covered CA for Small Business

- Sutter Employer Health Plans 2022

- UnitedHealthcare

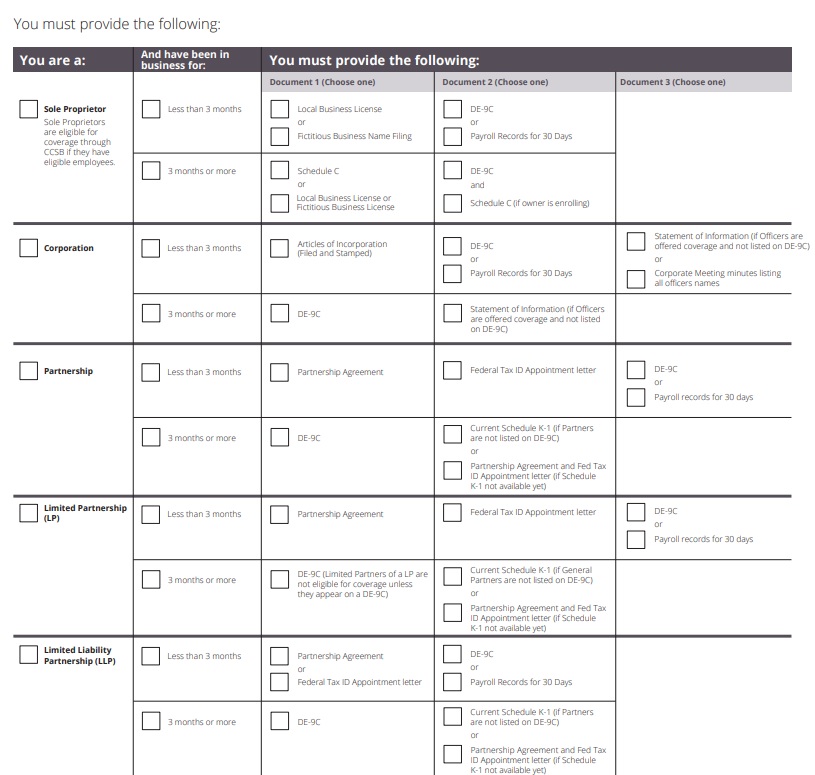

#Proof in Business – Documents Required

Introduction

All Insurance Companies are MANDATED by California AB 1083 Health Care Reform to write any Bona Fide EmployER with 2 or more eligible employees, and part timers. Thus, they require absolute proof (see chart below) that the business is really there and running, though in this economy a profit is not required.

Documents Required by #Type of Business to qualify for Group Health Benefits PDF

Our webpage on proofs required to show you're in business

Proof of Ownership of your business

California Common Ownership Forms

- California Corporate Income Tax Return Form # 100 See questions on Page 3...

- Guidelines for Corps filing a combined report FTB.CA.Gov # 1061

- CA - EDD Unity of Enterprise - Information Sheet DE 231

- Unity of operation is evidenced by central financing, accounting, and management of each business entity which includes, but is not limited to, common management, personnel policies, operating procedures, pricing, collections, and financing.

- Unity of use of two or more business enterprises shall be united if they share a general system of operation and the enterprises are organized for common purposes, and each is coordinated with, or is a part of, the entire operation.

-

A corporation may file a combined report with other members of a unitary group only if the corporations are members of a commonly controlled group as defined by R&TC Section 25105. Generally, a commonly controlled group exists when stock possessing more than 50% of the voting power is owned, or constructively owned, by a common parent corporation (or chains of corporations connected through the common parent) or by members of the same family. A commonly controlled group also includes corporations that are stapled entities, see R&TC Section 25105(b)(3). Special rules are provided in R & T C Section 25105 for partnerships, trusts and transfers of voting power by proxy, voting trust, written shareholder agreement, etc

- Franchise Tax Board Form & Publication Search

- Common Forms of Ownership FTB Publication 1123

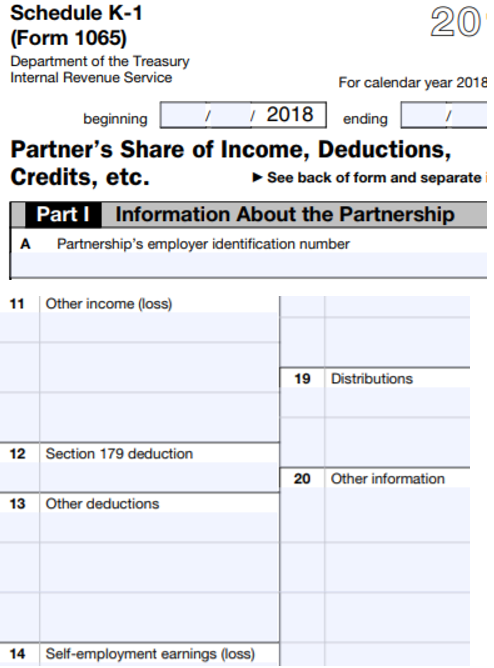

K 1 Partnership Tax Return

Child & Sibling Pages

- Employer Group Association Plans – Trump’s Executive Order – CA prohibition no index

- Management Carve Outs – §2716 – Similarly Situated

- Carriers – Companies Employer Group ni

- Aetna Employer Group Plan Coverage

- Blue Cross – Anthem – Employer Health Plans

- California Choice – Multiple Companies ONE Bill

- Employer Group Blue Shield –

- Health Net Employer Small Group

- Kaiser Permanente – New Enrollment – Administrative

- Oscar – CIGNA + Oscar

- Quotes Employer Group – California – Instantly

- Sharp Health Plan

- SHOP – Covered CA for Small Business

- Sutter Employer Health Plans 2022

- UnitedHealthcare Small Employer Sales & Enrollment

- COBRA & California Cal-COBRA 36 months total coverage

- EmployER Definition – Health Care Reform

- Participation & Premium Contribution Requirements

- Tax Credits Small Business §45 R

Federal - IRS Forms - Common Ownership

- IRC §414 Single Employer §1563 Definition Controlled Group of Companies

- What about Leased Employees? §414 n

- IRS Form #1120 Corp Income Tax Return

- IRS Form 851 Affiliations Schedule & Instructions

- IRS Form #8869 Qualified Subchapter S Subsidiary Election

- IRS Textbook Training - Controlled & Affiliated Companies 108 Pages pdf

- baker law.com 2012 Explanation, including PPACA - Employer Mandate

Attestation Form

Proof owner or officer actually works at the company

I attest that while I am not listed on the DE-6 wage report of this company, ALL of the following conditions are true:

1. I am a sole proprietor, partner, corporate officer or LLC manager/member of the company name indicated below; and

2. I am actively at work at this company working a minimum of 20 hours per week on a permanent and full-time basis; and

3. I draw wages, dividends or other distributions from this company on a regular basis; and

4. I do not derive substantial earned income from any other employer and am not eligible for other employer-sponsored coverage; and

5. I have satisfied the designated waiting period before health insurance coverage is to become effective

There must be at least ONE non spousal employee working 30 hours. See Insurance Code 10700 f for more detail

See Insurance Code 10700 f for more detail

Corporation

-

Officers Signed Statement attesting to actually working, etc…. If Not on DE 9 Payroll Tax Report.

-

Corp Tax Return – Form 1120 * Instructions

-

Statement of Information – Domestic Stock Corporation.

-

Articles of Incorporation Wikipedia (filed and stamped listing names of all officers)

- Secretary of State Business Search Also see bizfile

-

Various forms from the Secretary of State, including Foreign Corporations

Order copies of your filed records with the Secretary of State

FAQ’s -

There are service companies that can help you expedite getting copies or filing these forms.

How to get – prove – #Fictitious Business Name

Who should file a fictitious business name?

- Persons doing business for profit under a fictitious name (does not include surname in company name).

- if John Doe formed a bakery called Doe’s Donuts, he may not need to file a DBA. But if his business was going to be called John’s Donuts, he would. The last name is the key. If he or she does not intend to use his or her last name, a DBA should be filed. Upcounsel.com *

- This filing is required by law in order to connect the name of a business to the business owner. This protects consumers because it allows them to get information about the owner of a company if they have consumer problems or need to file a lawsuit. Free Advice.com *

- Statement must be filed in county of principal place of business and may also be filed in other counties as long as the requirements for filing in the county of principal place of business have been met.

- Non-profit corporations, organizations or associations are not required to file a Fictitious Business Name Statement LA Vote Who should file * LA Vote General Info *

Find or search in Los Angeles Search * Filing *

Fictitious Business Names

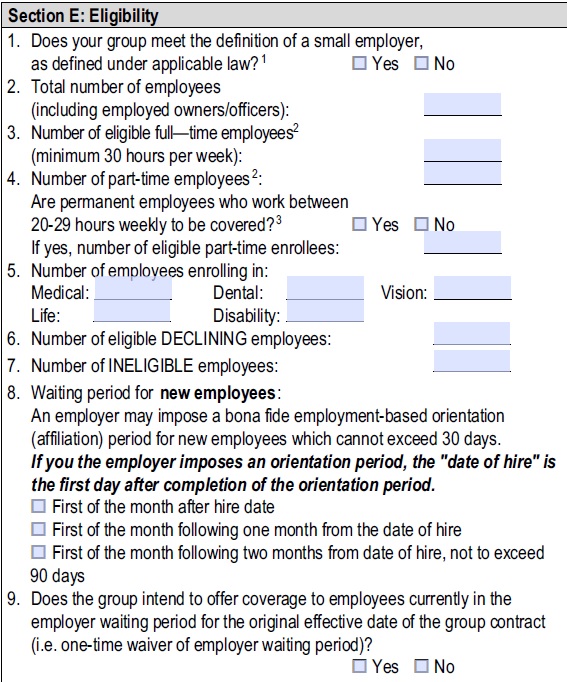

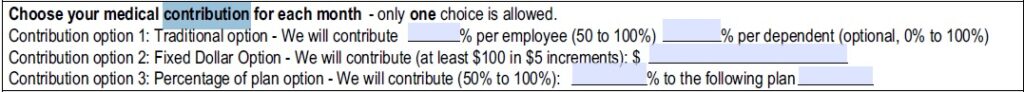

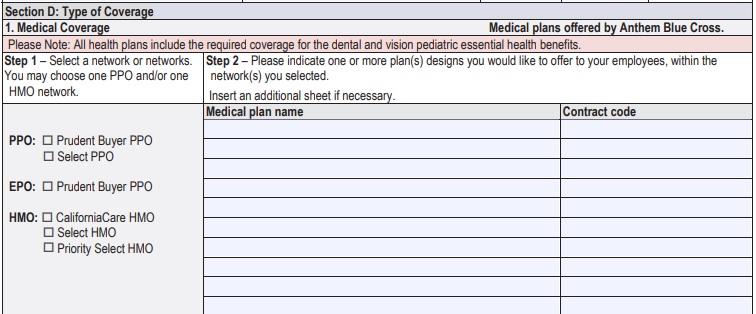

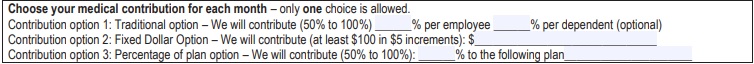

How does it work if you want to #offer more than ONE Health plan?

Let's take a look at the Employer Application

|

Choose what plans you want to offer from our Quote Engine and/or the Anthem/Blue Cross Guides

|

|

Contribution must be the same for all similarly situated Employee's and Owners |

|

Waiting periods to enroll must be the same for everyone.

Our webpage on waiting periods |

We can also double check links to other pages on our website, cited below, Blue Cross Administrator Manual and their underwriting rules

#Special Annual Open Enrollment

There is an Special Open Enrollment Period from November 15th to December 15th every year where a Small Group can enroll without meeting participation or contribution requirements. Cornel 45 CFR 147.104 Final Rule” (2.27.2013 13416 Federal Register Vol 78 gpo.gov *

However, Health insurance carriers are not required to renew existing small group clients who do not meet minimum participation requirements, but only to take new ones. However, carriers generally will renew existing plans because otherwise they would just be circulating these clients from carrier to carrier. Levitt.com *

Just Enter your census or securely send us an excel spreadsheet or a list of employees and get instant proposals

for all these companies that we are Authorized Agents for in California

Recertification – Compliance with Participation and Premium Contribution

#Recertification

Annual Proof that you’re in compliance with

participation rules

- Insurance Companies may enforce their participation rules and the new Health Reform definition of small employer needing at least one bonifide non spousal employee when you 1st apply.

- On the other hand, there is a Special Enrollment from November 15th to December 15th, when an employer can enroll without having to meet participation or contribution requirements. One would have to check with each company to see if they would do an audit at renewal.

- Here’s some information on what Renewal enforcement might consist of:

- Email us [email protected]

- Get a group Employer Quote

Kaiser Recertification Booklet

Rev May 2019

FAQ’s

Health Coverage #Guide

Art Gallagher

Health Care Reform FAQ's

Understanding Health Reform

***********************************

Compliance #Assistance Guide from DOL.Gov Health Benefits under Federal Law

- Health Care Reform Explained Kaiser Foundation Cartoon VIDEO

- Choosing a Health Plan for Your Small Business VIDEO DOL.gov

- ACA Quick Reference Guide California Small Group Employers Revision 2020 Word & Brown

- kff.org/health-policy-101/

- Health Savings Accounts

Employee Handbooks & Communications to Employees about their Health Benefits

Email us [email protected] for sample handbook, information

Related Pages in Participation & Contribution Requirements Section

EDD California 2025 Employers Guide #DE44

- Forms & Publications EDD

- FORMS REQUIRED TO GIVE NEW EMPLOYEES

- More workplace protections in 2022 New laws will shield employee health, safety and wages, but some ‘job killer’ bills were axed Los Angeles Times

- Social Security Forms

************************************************************

New Federal Reporting Requirement for Beneficial Ownership Information (BOI)

- Beneficial Ownership Information Reporting Suspended Smart Tax Fin LLC.com

- Effective January 1, 2024, many companies in the United States must report information about their beneficial owners—the individuals who ultimately own or control the company—to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

- In 2021, Congress enacted the bipartisan Corporate Transparency Act to curb illicit finance. This law requires many companies doing business in the United States to report information about who ultimately owns or controls them.

- Your company may need to report information about its beneficial owners if it is:

- 1. a corporation, a limited liability company (LLC), or was otherwise created in the United States by filing a document with a secretary of state or any similar office under the law of a state or Indian tribe; or

- 2. a foreign company and was registered to do business in any U.S. state or Indian tribe by such a filing.

- FinCEN’s Small Entity Compliance Guide includes checklists for each of the 23 exemptions that may help determine whether your company qualifies for an exemption.

Child & Sibling Pages

- Employer Group Association Plans – Trump’s Executive Order – CA prohibition no index

- Management Carve Outs – §2716 – Similarly Situated

- Carriers – Companies Employer Group ni

- Aetna Employer Group Plan Coverage

- Blue Cross – Anthem – Employer Health Plans

- California Choice – Multiple Companies ONE Bill

- Employer Group Blue Shield –

- Health Net Employer Small Group

- Kaiser Permanente – New Enrollment – Administrative

- Oscar – CIGNA + Oscar

- Quotes Employer Group – California – Instantly

- Sharp Health Plan

- SHOP – Covered CA for Small Business

- Sutter Employer Health Plans 2022

- UnitedHealthcare Small Employer Sales & Enrollment

- COBRA & California Cal-COBRA 36 months total coverage

- EmployER Definition – Health Care Reform

- Participation & Premium Contribution Requirements

- Tax Credits Small Business §45 R