#Report changes as they happen - within 30 days! 10 CCR California Code of Regulations § 6496 10 days for Medi Cal 22 CCR § 50185

Instant Quotes & Subsidy Calculation Email Us [email protected]

IRS Form 5152 - Report Changes

- Our Steve's - VIDEO on how to report changes to Covered CA

- Steve's Video on MAGI Income

- Covered CA Video on how to report changes

- Visit our webpage on how to report changes

How and when to report changes of income, address, etc. to Covered CA and/or Medi Cal

Try turning your phone sideways to see the graphs & pdf's?

You report must notify Covered CA and/or Medi-Cal any changes, higher or lower in:

-

your Estimated * MAGI Modified Adjusted Gross income for the-upcoming taxable year,

- note the penalties if you under pay your estimated tax under form 2210 – instructions.

- marriage or divorce

- the birth or adoption of a child — number of people in your household,

- starting a job with health insurance

- gaining or losing your eligibility for other health care coverage

- changing your residence – Address

- losing a job & income FAQ’s

- Suggestions on keeping health coverage when you lose a job FAQ

- Affidavit – Attestation of Income for Covered CA

- Proof of Unemployment?

- Reporting these changes will help you avoid large differences between the advance credit payments and the amount of the premium tax credit allowed on their tax return, which may affect their refund or balance due.

- Covered CA has asked agents not to give tax advice. Here’s their suggestions.

Jump to section on:

Covered CA Certified Insurance Agent

Get Covered CA quotes and Direct Quotes too

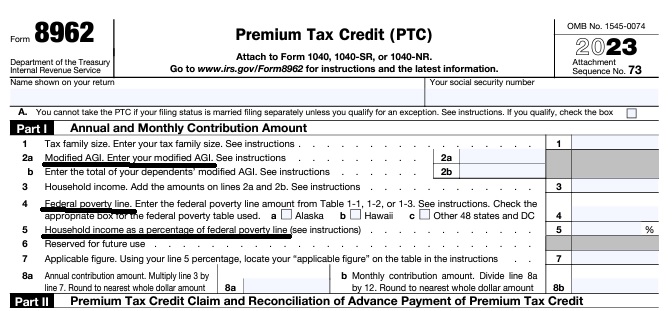

Federal IRS #Form8962 Reconciliation Form for Covered CA Subsidies

attaches to IRS 1040 it all comes out when you file taxes!

-

If you got too high a subsidy or too low, it gets reconciled at tax time on form 8962. If your subsidies were too high you may have to pay the excess back and maybe penalties, if too low, you can get a tax refund or lower the amount you have to pay. In a lot of ways, IMHO subsidies are hocus pocus, jiggery pokery - smoke and mirrors as it's all guesswork and promises. Be sure to report income and household changes within 30 days.

- See below or visit our 8962 Webpage for more information

- MAGI AGI Income, what is it our webpage?

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

Covered CA Member’s #Duty to Report Changes in Circumstances

- An enrollee, or application filer on behalf of an enrollee, must report any change of circumstances with respect to the eligibility standards within 30 days of such change. An enrollee, however, who has a change in income that does not impact the amount of the enrollee’s Advance Payments of Premium Tax Credit (APTC) or the level of Cost-Sharing Reduction (CSR) (See income chart or get a quote) is not required to report such a change. cdss.ca.gov/shd/res/htm/ParaRegs-Covered-California.htm * (45 C.F.R. § 155.330(b); * 10 CCR California Code of Regulations § 6496

- References & Links

- Here’s instructions, job aid, reporting change in income

- Our webpage on the exact definition of MAGI Income

- If you’ve appointed us – instructions – as your broker, no extra charge, we can do it for you.

- Voter Registration

- Denial of benefits and possible criminal charges if you don’t report changes in income!

- When Increasing Your Covered California Income Estimate Creates an Ethical Dilemma Insure Me Kevin.com

- Fudging Income?

- Western Poverty Law on reporting changes

- How to cancel coverage.

- agents and brokers who suspect or know a fraudulent application for insurance has been submitted to report the potential fraud to the California Department of Insurance Fraud Division. Read more >>> Wshblaw.com

§ 6496. Eligibility Redetermination During a Benefit Year.

- . Cal. Code Regs., tit. 10, § 6496, subds. (b), (d).)

- coveredca.com/changes

- healthcare.gov/report-changes

- Our webpage on padding income or deductions

- We can’t give legal advise

- Can’t give tax advise

- Shouse Law on fraud

Definition of change

1a: to make different in some particular : ALTER never bothered to change the will

b: to make radically different : TRANSFORM can’t change human nature

c: to give a different position, course, or direction to changed his residence from Ohio to California Webster

Our webpage on ARPA & Unemployment Benefits – Silver 94

- VIDEO explanation of how the ARPA Silver 94 will work…

- Lost your job? How to keep your Health Insurance. Shelter at Home VIDEO

- Broker Toolkit

- Legal Codes

Learn More about Medi Cal Fraud

Shouse Law webpage on Perjury CA Penal Code §118

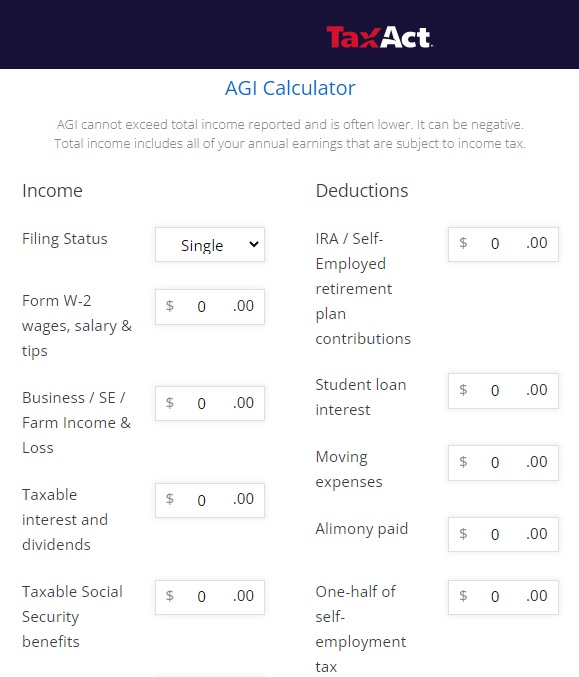

How to #Estimate MAGI Income for Covered CA?

Covered CA bases your subsidies on what you expect your household income will be for the upcoming coverage year, not last year’s income. When you calculate your income, you’ll need to include the incomes of you, your spouse, and anyone you claim as a dependent when you file taxes.

You can start by using your adjusted gross income (AGI) from your most recent federal income tax return, located on line 11 on the Form 1040.

taxact.com/adjusted-gross-income-calculator

- From the AGI above, Add back in any foreign income, Social Security benefits and interest that are tax-exempt. Then, add or subtract any income changes you expect in the next year.

- Health Care. Gov on estimating income

- Scroll down for more information on estimating income.

- Our main webpage on estimating Income

More on estimating Income

If you are self-employed or unemployed, you might have an unpredictable income. If so, just estimate as best you can, Covered CA and the IRS don’t think that you have a crystal ball, then just report changes in income throughout the year in your account.

IMHO all these estimates are just Hocus Pocus. It all comes out in the wash when you file your Tax Subsidy Reconciliation form form 8962 with your tax return. Covered CA *

Self Employed, Free Lancers & 1099?

The amount of your Advance Premium Subsidies APTC go by estimated net income for the year you’ll be covered, not the previous year. Estimating your income to find out how much financial help you’ll get can be tricky for self-employed people. It can be difficult to know how much you’ll make in the coming year, which is information you need to find out your monthly premiums. Estimate your income and expenses as best as you can, using industry trends and past experience as a guide.

If your yearly net income looks like it will be higher or lower than what you estimated, log in to your account, or email us [email protected], if we are your broker and update what you previously reported. If you end up making more than what you estimated, at tax time you may have to pay some or all of the financial help (in the form of Advanced Premium Tax Credits) you received. Conversely, you could get money back if you end up making less. Covered CA *

Resources & Links

- Challenges Estimating Income and Tax Consequences KFF

- Oscar Insurance – Tips on estimating income

- Explaining Health Care Reform: Questions About Health Insurance Subsidies Kaiser Foundation *

- Try some of the tax estimators…

- MAGI – Modified Adjusted Gross Income – Line 11

Deadlines to get your information in, namely new enrollment or annual renewal

ROP Reasonable #Opportunity Period

- ROP Reasonable Opportunity Period to send Covered CA what they need or else you get cancelled Toolkit

- Covered California is required to check federal records several times each year to confirm eligibility

- Periodic Matching Data Information needed by

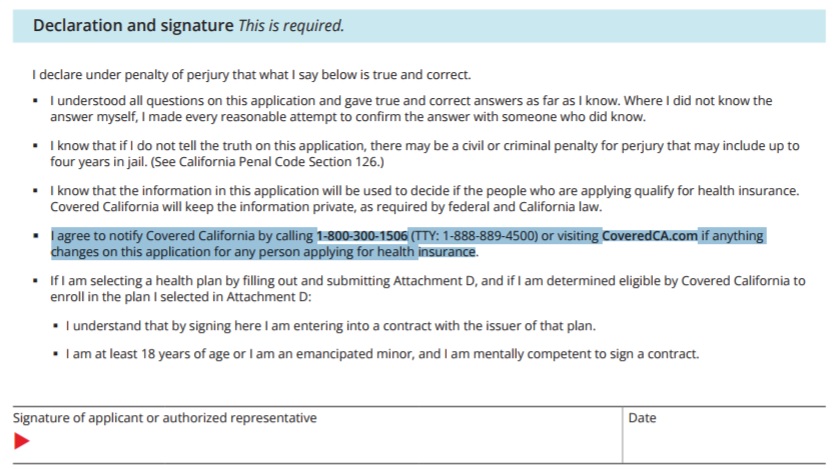

Perjury Declaration - Signature - Agree to notify changes

and that the application is correct in the first place

Mandate to File Tax Return

& Form 8962

Etc. Copied from Covered CA ONLINE application 11.26.2014 – Paper Application Rights & Responsibilities Page 16

I agree to file a tax return before (April 15, ) to claim the Premium Tax Credit. I understand that I am required to submit changes that affect my eligibility, including income, dependency changes, address, and incarceration. These changes could affect the plans I can be enrolled.

I cannot change plans unless I have a life triggering event. Life Events include lost or will soon lose my health insurance, permanently moved to/within California, had a baby or adopted a child, got married or entered into domestic partnership, returned from active duty military service, gained citizenship/lawful presence, Federally recognized American Indian/ Alaska Native, released from jail, and other qualifying life events.

#Withholding W 4

IRS Withholding Calculator

Here’s tools to make sure the right amount is withheld, either for tax refund purposes or to avoid an unexpected tax bill next year.

“It’s a personal choice if you want to have extra money withheld to get a bigger tax refund, but you have options available if you prefer to have a smaller refund next year and more take-home money now.” Advance Premium Tax Credit now or later?

By adjusting your Form W-4, Employee’s Withholding Allowance Certificate, taxpayers can ensure that the right amount is taken out of their pay throughout the year so that they don’t pay too much tax and have to wait until they file their tax return to get any refund. Employers use the form to figure the amount of federal income tax to be withheld from pay. IRS Tax Withholding Calculator

People Working in the Shared Economy

Covered CA Consent for Verification – Income, etc.

Review the Consent for Verification Notice that Covered California sent to consumers last week and the Consent for Verification Quick Guide for more information.

Also, watch the How to Update Consent VIDEO for instructions on updating consumer consent.

Consumers are at risk of losing their Advanced Premium Tax Credit (APTC) and/or cost-sharing reductions for health insurance coverage if their consent form is out of date.

A consumer’s financial assistance may end because of one or more of the following reasons:

- The consumer’s consent to allow Covered California to use computer sources to check their income and family size, including information from tax returns, has expired.

- The consumer may not have filed afederal income tax return for their household to reconcile the Advanced Premium Tax Credit (APTC) used to lower plan premium costs

- The consumer’s household income may be too high.

Covered CA

Right to change plans when there is a #SilverChange due to higher or lower Estimated MAGI Income

One way to to make a change in your Covered CA coverage when it’s not Annual Open Enrollment is if your income changes, so that you qualify for a new or different level of Enhanced Silver Subsidies 73, 87, 94 or income change makes you newly eligible for subsidies. Covered CA’s interpretation of the law is that you must already have coverage through Covered CA, to do this. FN 1

CA CCR Code of Regulations (7)

An enrollee Definition, or his or her dependent enrolled in the same QHP – Qualified Health Plan, is determined newly eligible or ineligible for APTC (Subsidies) or has a change in eligibility for CSR. [Cost Sharing Reductions – Enhanced Silver]

CFR §156.425 Changes in eligibility for cost-sharing reductions. (Enhanced Silver)

Please start your research into Special Enrollment Periods by reviewing our main page of California Code of Regulations on Qualifying Events

- VIDEO What is APTC Advance Premium Tax Credit

- Health Net VIDEO How to get subsidies – pay less for coverage

- Interactive Tax Assistant (ITA)

- Am I eligible to claim the Premium Tax Credit?

Tax #Estimators

- turbo tax.com - FREE for simple returns

- H & R Block

- E file.com

- Estimate the Subsidy for Health Insurance, benefits, premiums, etc.

- 8962 ONLINE Calculator

- Our webpage on 8962 Premium Tax Credit Reconciliation

- Tax Form Calculator.com

- e tax.com

- Marriage Higher or Lower Taxes?

ACA What You Need To Know #5187 (2020) is the most recent

- VITA - Volunteers to help you

- Publication 17 - Your Federal Income tax

- Health Savings Accounts HSA our webpage

#Lose a job? How to keep coverage?

- Question I have lost my job , and am unemployed for now. What can I do regarding my health insurance?.

- Our Answer Are you independent contractor 1099 or employee W 2?

- An employee could apply for unemployment benefits.

- The benefits are taxable, so that would raise your expected annual MAGI income.

- If you want to go for broke you probably could qualify for Medi Cal /benefits cal.com/ under the monthly income rule. We don’t get paid to help you with Medi Cal, so you can either go into your Covered CA Account and change your annual income… If it’s less than 138% Covered CA would get you into Medi Cal. Or, you can apply directly with Medi Cal.

- One downside is, that you may have a difficult time getting out of Medi – Cal.

- Here’s our quote engine to calculate FPL and subsidies.

- If you think things will get real tough, you could drop your estimated income lower… When this tragedy is over and you’re earning $$$ again, you have to report to Medi Cal within 10 days or Covered CA within 30.

- I recently had someone tell me through their employer (hearsay) that Medi Cal may file criminal charges as they didn’t report the wife got a job. See more on that Q & A

- Since you are getting subsidies, there is technically a 90 day grace period.

- I am NOT in any way shape or form suggesting that you attempt to use it!!! If you get cancelled for non-pay, there is virtually NO way that you can get coverage till next January. I will NOT be responsible for anyone attempting to do that. IMHO Moses parting the Red Sea was easier than getting someone reinstated who has cancelled non pay.

- Sure, I’ve had people claim they just called the Insurance Company and it was no problem, but I don’t listen to hearsay.

- If you are not currently getting subsidies or don’t have insurance, check out all the new rules from Covered CA on special enrollment

- If you had coverage on the job, you could check out california-cal-cobra If you are Medicare Eligible check our main webpage on Employer vs Medicare and the sub – child pages underneath.

Brother - Sister - Sibling Side Pages Subpages

View our website with your Desktop or Tablet for the most information