Table of Contents

MAGI Income, Expenses or Deductions

Just scroll down and visit the page you need.

no index

More detail on Deductions from MAGI Income

[child-pages]

-

- MAGI – Modified Adjusted Gross Income – Line 11

- APTC Advance Premium Tax Credit – Subsidies – Introduction

- Income Chart – Line 11 1040 Covered CA MAGI

- Report a Change – How & When – Especially Income Create Account

- Table of Contents – Details of Income, Deductions & Expenses for MAGI

- Metal Levels – Platinum, Gold, Bronze – Silver & Enhanced

- EmployER Definition – Health Care Reform

- Tax Credits Small Business §45 R

- IRC §106 Health Insurance Deduction for Employers & Employees

- Section 125 – POP Plan Employee Contributions are Tax DeductibleLife, Disability, Long Term Care & Retirement

- Disability Income – Pay Check Protection

- Estate Planning

- Life Insurance – Instant Quotes – Universal – Key Man Life

- Long Term Care Nursing & Home Health Care

- Retirement Planning & MAGI Income

- MAGI – Modified Adjusted Gross Income – Line 11

- Medi-Cal – California’s version of Medicaid

- Contact Info – Complex Questions – Reference Materials Medi-Cal

- Eligibility Criteria for Medi-Cal – MAGI Income

- Site Map

Calculate your Covered CA MAGI Income

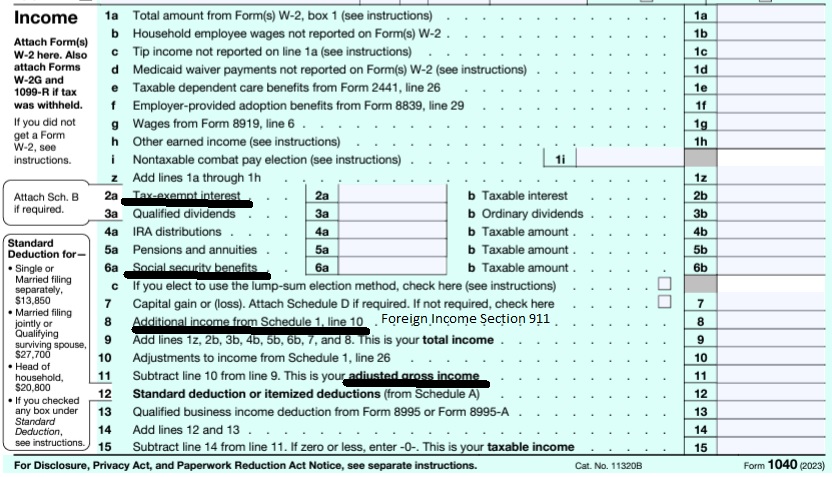

take #Line8b 11 Adjusted Gross income then add line 2a, 6a & 8 (Foreign Income)

- 1040 IRS Annual Tax Form

- Schedule 1 Additional Income & Adjustments to Lower your MAGI Income

- IRA Retirement

- Health Savings Account

- Trumps Big Beautiful Bill - may lower line 6 A Social Security Income Learn More >>> Newsweek * PBS *

- Estimate next years MAGI Income?

- Get instant quotes, subsidy calculation and coverages

- NO ASSET TEST for MAGI based subsidies in Covered CA or MAGI Medi Cal Qualification. Steve's VIDEO

- Nor is there a lien against your estate for Covered CA or MAGI Medi Cal

- Schedule 1 Additional Income & Adjustments to Lower your MAGI Income

#VITA Volunteers Income Tax Assistance

get your taxes done Free

- Publication 3676 with more details on VITA

- Our Webpage on VITA & Covered CA prohibition to give tax advice

- More places to find FREE tax help Covered CA list

- Turbo Tax -

- See more tax calculation links in the section on IRS Publication 974 Premium Tax Credit

**********************************

My divorce agreement provides that my X Spouse must provide lifetime housing in one of their rental units or bedroom. More specifically – My ex-wife is providing me one room for my living space which values around $450 per month. She also allows me to use her car. Does that count as alimony even though it’s non cash? Does that count as income for Covered CA subsidies?

-

In the example on page 14 of IRS Publication 504 https://www.irs.gov/pub/irs-pdf/p504.pdf it says that it wouldn’t be alimony as it’s a home you own and the debts are yours. If you owned the home jointly with your spouse see page 15 table 4

-

Publication 504 is a 30 page document and refers one to other documents, including your actual separation agreement. Be sure to seek competent tax and legal counsel. Covered CA basically just goes by the definition of MAGI line 37 of your 1040 and not how your AGI is calculated.

-

I am trying to calculate my income to see if I am eligible for Medi-cal or what I can buy through Covered California [with a certified agent, at no additional charge]. Would you please answer these questions for me:

1) Does spousal support count as income?

2) Do gifts count as income?

3) What time period is taken into account when calculating one’s income?

Spousal Support – When was your divorce decree signed? See our webpage on Alimony

How much is the gift? See our page on gifts

The time frame is the future! See MAGI Definition. Sure, many people think it’s the past as Covered CA may ask for last years paperwork, but that’s BS! You might have to give back all the subsidies when you file form 8962!

Agents are prohibited from giving tax advice. You can try VITA

Once you know your expected MAGI income for this or the upcoming year – use our free subsidy and FPL calculator to get quotes or see if your income is below 138% of income and you go Medi Cal.

Hi Steve,

I am trying to calculate my income to see if I am eligible for Medi-cal or what I can buy through Covered California [with a certified agent, at no additional charge]. Would you please answer these questions for me:

1) Does spousal support count as income?

2) Do gifts count as income?

3) What time period is taken into account when calculating one’s income?

Thanks,

Linda

1. Yes, it’s line 11 of your 1040. See our page on spousal support for more detail

2. No. See our Gift page for more detail

3. It’s what you expect that your 2016 1040 return will show for line 37 AGI Adjusted Gross Income, then add in, Social Security Line 20…, Foreign Income and Exempt Interest line 8b. See our MAGI Income page for more detail.

Get free quote, subsidy calculation, Enhanced Silver Level here, once you have your estimated MAGI Income. You can easily change the income amount and see if you get Medi-Cal, Enhance Silver, etc. There is no extra charge for our help. We get paid, when you appoint us as your agent.