Blue Shield California Authorized Broker

Instant Covered CA and Direct Quotes Small Employer Quotes Medicare Quotes & Enroll

Introduction to Blue Shield HMO Trio ACO & PPO Plans

We’ve represented Blue Shield for 40 years and have been quite happy. There is no charge for you to have our expertise as Blue Shield pays us. It helps them too!

Check out the rest of this page for more information and enrollment.

Blue Shield Individual

#PPO Plans 2026 * Spanish *

- Understanding Health Care Coverage Rev 1/24

- Summary of Benefits 2024

- Blue Shield Latest News

- Disclosure

- Tele Doc

- HSA Health Savings Accounts – HDHP Plans – High Deductible Health Plans Usually Bronze

- 56,212 doctors 329 hospitals BS Website *

- Paper Application, but online is better, email us for one [email protected]

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

Try turning your phone sideways to see the graphs & pdf's?

- What’s on this page?

All our Health plans are Guaranteed Issue with No Pre X Clause

Instant Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

- Watch our 10 minute VIDEO that explains everything about getting a quote

Blue Shield of California Authorized Agent - Broker

![]()

Blue Shield Trio HMO ACO & PPO Plans 2026

California Individual & Family

Instant Quotes including subsidy & Enroll Quotit.net Email Us [email protected]

Employer Group Quotes Quotit.net

TRIO ACO HMO

Blue Shield Trio HMO ACO Plans Brochure Benefit Summary 2026

-

- Spanish

- Summary of Benefits - If a password is required, email us, [email protected]

- Enroll in Trio Direct Not Covered CA *

- Blue Shield Trio HMO 17,902 doctors 303 hospitals BS Website *

- Understanding Health Care Coverage Rev 1/24

- FAQ's & Ask a Question on TRIO

Pick a PCP Primary Care Physician

Blue Shield Rx Prescription -#Pharmacy Drugs

- Pharmacy networks

- Drug formularies

- Member resources

- Pharmacy FAQs

- Our other webpages on Rx

Blue Shield of California

![]()

Provider #Finder -

Dentists, Doctors & Hospitals

All Plans - Medicare Advantage, Employer Group, Individual & Family - Covered CA

Find a doctor near you

Blue Shield Find a Provider

VIDEOS

- Blue Shield Exclusive PPO Your new ppo * PPO Primary MD FAQ’s * has 50k+ doctors and 320 hospitals statewide, plus Blue Card benefits out of state & country. 2020 Agent Guide * Member Outreach Bulletin *

- Providence Issues 2024

- How to use the Finding a provider tool above VIDEO

- blueshieldca.com/find-a-doctor/help

- blue shield ca.com/choosing-a-provider

- Paper Instructions

- Our FAQ’s

- 2 page pdf on finding doctor of your choice

- Virtual Care

- Understanding Your Plan pdf

- Nurse Help 24/7, Heal and Teladoc save on prescriptions ER vs. urgent care.

- Use your online account to review claims, copays or deductibles and take advantage of other member benefits.

- Explanatory VIDEOS on everything… from Blue Shield

- chcf.org/primary-care-matters * More readable summary * Health care systems with strong levels of primary care investment have better and more equitable health outcomes, lower care costs, and better care quality. We can build a healthier future for all Californians by focusing resources back to patients and their relationship with primary care providers.

- Medicare Advantage Provider Print Directories BROKER ONLY

- Email us [email protected] if you want a pdf print directory

- Enroll and get full details on our

- What do I have to do to see a specialist if I’m in an HMO or Medicare Advantage Plan?

- Generally, just ask your PCP Primary Doctor.

- Check your Evidence of Coverage for details. Email us, [email protected] if you want a copy of it.

- What if my PCP won’t give a referral.

- Check the procedure in your Evidence of Coverage, email us and see our webpage on appeals & IMR Independent Medical Review.

- Generally, just ask your PCP Primary Doctor.

Dental

Blue Shield Individual & Family #Dental Plans

Ask us about Medicare Supplemental Dental Plans

Blue Shield Dental, Vision & Life Plans 2026 * Spanish *

- Blue Shield offers affordable and comprehensive dental plans available to clients with and without a Blue Shield health plan.1

- Specialty Duo

- best of both worlds – dental and vision – with one plan. Specialty DuoSM dental + vision package* is an affordable option that provides: • Comprehensive dental benefits like diagnostic, preventive, basic, and major services • Vision coverage, which includes an annual eye exam and optometric and ophthalmologic visits

- They also offer a dental and vision plan package, Specialty DuoSM,* which includes comprehensive dental and vision coverage.

- Covered CA Blue Shield Dental Plans

- Term Life Plans Email us [email protected] if a password is required

- Blue Shield’s dental provider networks are among the largest in the state. The dental PPO plans include nearly 47,000 providers in California and nearly 400,000 nationwide. The dental HMO network includes more than 22,000+ providers in California. Check out the dental network map for an overview of county coverage.

PPO

Dental

- No waiting period for diagnostic or preventive services

- Covered diagnostic and preventive services, such as X-rays and routine cleanings, do not count toward the annual coverage limit for dental PPO and Specialty Duo dental plans, providing more coverage for other services before reaching the annual limit

- A wide range of dental benefits, including most diagnostic and preventive services and oral cancer screening, at no additional cost when using a dental network provider

- Implants coverage available in our dental PPO plans with a $1,250 calendar-year benefit maximum

- Orthodontic benefits are available for both children and adults

- Choice of $25 or $50 deductible per member, per calendar year

- Choice of a $500, $1,000 or $1,250 calendar-year benefit maximum per member

- Coverage even when your clients use a non-network dentist. Our plan reimburses your clients up to an allowed amount for covered services, and your clients pay the remaining balance of the total billed charges.

HMO

- No deductibles and no calendar-year maximums

- Orthodontic services available with or without a 12-month waiting period, for both children and adults

- Affordable fixed copayments for basic and major services

- Specialty care available with a referral from a primary dentist

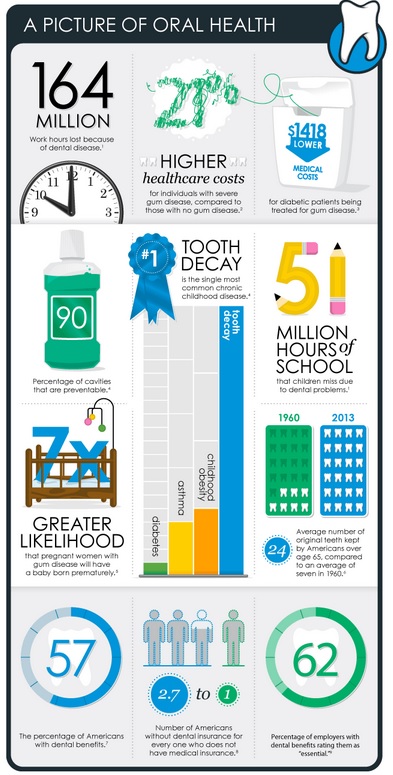

#Importance of Dental Coverage

Picture of Oral Health cdc.gov

- Dental For #Everyone, Instant Quotes - Online Enrollment

-

Delta Dental - Get Quotes & Enroll

- Quotit Quotes for Dental

Our other pages on

Dental Coverage

We don't put a lot of effort into selling dental coverage. Generally it's a wash on paying premiums vs getting back claims payments. Unless it's employer group. Then the premiums are tax deductible under IRS Section 106.

Here's more information on how we feel about dental. Here's our page on implants, where we get lots of inquires, but few sales. Most people only seem to want dental coverage, after they've been told they need a lot of dental work. Not profitable for Insurance Companies. See our other pages for details & explanations. See our page on Medical Loss Ratio. Insurance Companies need to take in $1 to pay 80c in claims.

Medicare Plans

- Anthem Blue Cross

- Blue Shield – Medi-Gap – Any Medicare Provider

- Health Net Medi Gap

- UnitedHealthcare Medi Gap

- Scan

Individual & Family Plans

Dental For Everyone,

has an excellent website with full brochures, Instant online quoting and enrollment

One of our colleagues on how Dental for Everyone Works..

Employer Group Plans

- Medi-Cal

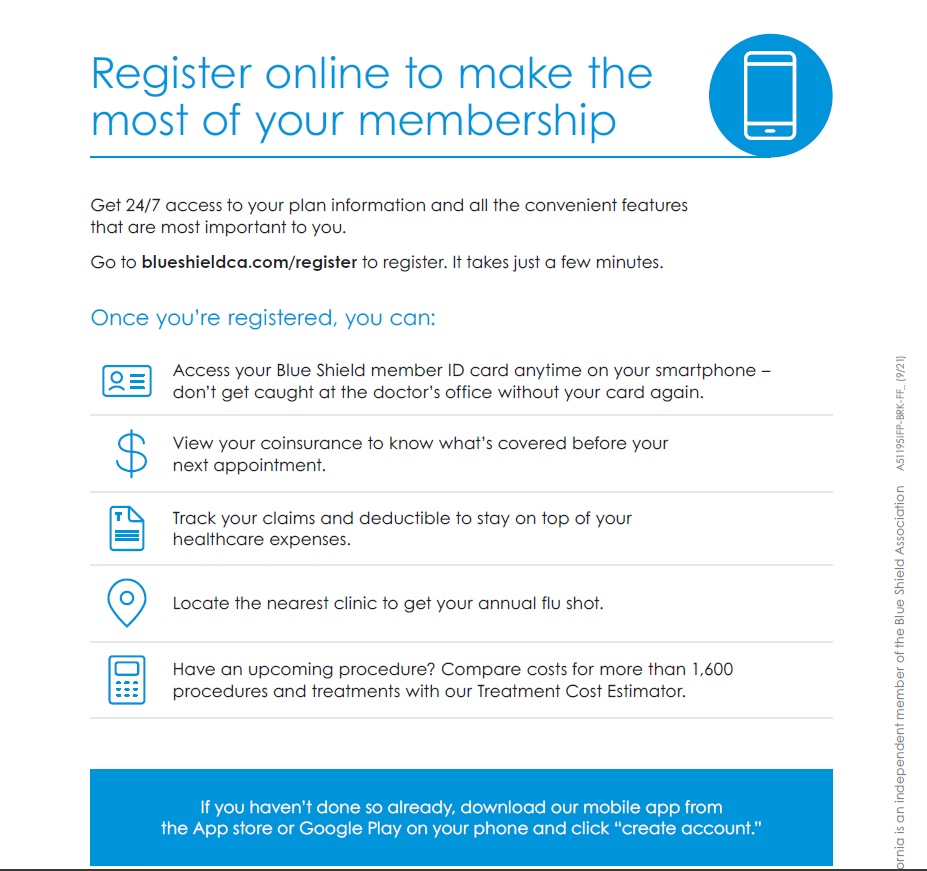

Blue Shield Member Portal

Blue Shield

Member #Portal Account

![]()

- Maximize your coverage from Day One pdf

- Instruction to Register for an ONLINE Member Portal

- Easily search and view benefit information

- Smart Phone App pdf

- Member Website Overview

-

Learn how to register for 24/7 access to your health plan VIDEO

- Teledoc

- Change methods of payment for paying premiums

-

- eChecks use the Automated Clearing House (ACH) to direct debit from a member’s checking account directly to BSC in this case If a member’s premium is not paid by the 1st of the month – it will show the account as late

- web payments.bill matrix.com/BSC One Time Pay

- Payment methods include Automated Clearing House (ACH) transfers and Credit Card payments

- Use member portal or call 888-256-3650

-

- See claims by family member

- Track deductibles and co payment amounts

- Change PCPs and medical groups

- Renew your plan BlueShieldCA.com/Renew

-

- Print member ID cards – anytime, anywhere!

- Members can follow three easy steps to print a new ID card:

- Go to Member Overview and add New Member ID number (required).

- Click View . . . and Print ID.

The ID card will work at the doctor’s office as soon as your client’s membership becomes effective. The plastic ID card will arrive in seven to 10 business days.

- Members can follow three easy steps to print a new ID card:

- Go deeper into your plan to get more Think your plan is just about health coverage? It offers so much more. Take a closer look and see what else you could be getting from us. Seriously, we want you to.

- Treatment Cost Estimator – for PPO Members

- Cost Helper.com what people are paying

- FAQs / Ask Us a Question

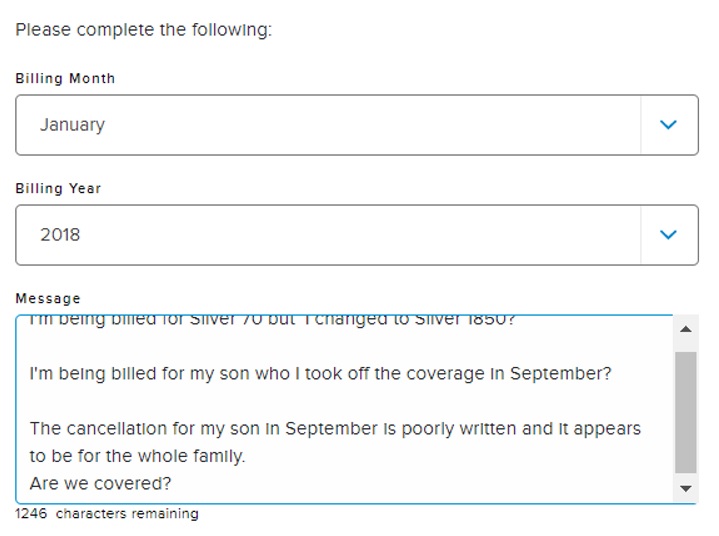

Sample inquiry that you can make through the member portal

Inquiries you can make through the member portal

Blue Shield #Contact Info

![]()

- Many of your issues can be resolved for our clients by emailing us [email protected] and we can help immediately or in a few days via email rather than calling and waiting on hold with Blue Shield.

- Here’s the form to appoint us as your broker for Individual & Medicare with Blue Shield, no extra charge!

- Customer Service (800) 393-6130

- Technical Support

- Claims Department

- phone: 888-256-3650

- fax: 209-371-3049

- mail: P.O. Box 272540 Chico, CA 95927-2540

- BROKER ONLY 877 806-7688

- Provider – Pre Authorizations Website

- Pre-admission (800) 541-6652

- More Contact Info

- Tech Support (800) 393-6130

- Website Technical Support 877 932-3375

- Contact Info on Blue Shield’s website

- Get a Member Portal

#Financial Strength

- news.blues hield ca.com/

- Blue Shield Mission Report 2022

- Financials on Blue Shield Website

- Blue Shield Story

- Wikipedia

- CA Department of Insurance

- AM Best Guide

- HIPAA Notice Privacy Practices Blue Shield CA.com

FAQ’s

BROKER ONLY

| Featured Articles: |

- Stay updated with real-time BOR notifications for On-Exchange clients

- Resources and support for members impacted by wildfires

- Exciting News: AltaMed is joining the IFP Trio network!

- Boost your earnings: Specialty Plan Bonus Program ends December 31, 2024

- Celebrating five years of Wellvolution: A health revolution for your clients

Stay Ahead: Join Our SEP Training Webinars

Broker Connection account management tool

- Elevate mental well-being: Looking beyond Mental Health Awareness Month

- Unlock extra earnings with the 2024 Summer SEP bonus program

- Broker SEP Training: New dates just added

- Connecting with Broker Services- Live chat and real time notification

- It’s bonus season: Our $25 Specialty bonus program continues

- Tentative Agreement Reached: Providence Health & Services and Blue Shield of California

https://www.blueshieldca.com/en/home/about-blue-shield/privacy-and-security/hipaa-notice-privacy-practices