Blue Shield of CA Medicare – Medi-Gap – Supplement Plans

Medi Gap plans allow you to go to ANY Doctor or Hospital that accepts Medicare

Medi Gap Introduction

- A Medi-Gap policy is private health insurance that helps supplement Original Medicare.

- This means it helps pay some of the health care costs that Original Medicare doesn’t cover (like copayments, coinsurance, and deductibles). These are “gaps” in Medicare coverage.

- Excerpt from EOC Blue Shield will pay the following:

- If you have Original Medicare and a Medi gap policy, Medicare will pay its share of the Medicare-approved amounts for covered health care costs. Then your Medi-gap policy pays its share.

- A Medi gap policy is different from a Medicare Advantage Plans – Part C (HMO) because those plans are ways to get Medicare benefits, (here’s a comparison of the differences) while a Medi gap policy only supplements the costs of your Original Medicare benefits. Medicare.Gov — Choosing a Medi Gap Policy *

- Scroll or jump down to see a side by side comparison of what Medicare Pays, what Medi Gap pays and then what you pay. You can also see the

- EOC Evidence of Coverage and

- enrollment kit.

-

What is a better choice for Me?

Dental PPO Plan and #Dental + Vision brochure and enrollment application

- Quotit – Online Quotes & Enrollment

- Brochures... If you can't log in, email us [email protected]

Blue Shield Supplement - Medi Gap

- Medi Gap Enrollment #Kit -- Summary of Benefits Rev July 2025

- A, F Extra, G, G Extra, G Inspire, and N Plan G

- Spanish Julio 2025

- Be sure to return the Paper application to us or see link above to enroll online

- Rates Los Angeles Scroll down for other counties

- No tobacco surcharge if you are applying during a guaranteed issue period, like turning 65 or lucking out and there is a Underwriting Holiday

- Going Forward ONLY ONE rate change per year!

- Ways to pay premium

- Don't like Rate Charts - Get Medi Gap quotes here

- Rate increases & rebates are subject to MLR Medical Loss ratio rules

- Rates go up by attained age. Some companies may have community rating see FAQ

- Auto Pay FAQ's - Call Member Services to set it up 1-800-248-2341

- Paper #Application Quotit

- Plan Transfer Application Medicare Advantage & Part D Rx enrollment periods - they don't necessarily coincide with Medi Gap!

- No extra charge for us to assist you! 17 reasons why...

Steve talks about Plan G & Extra - Innovative VIDEO

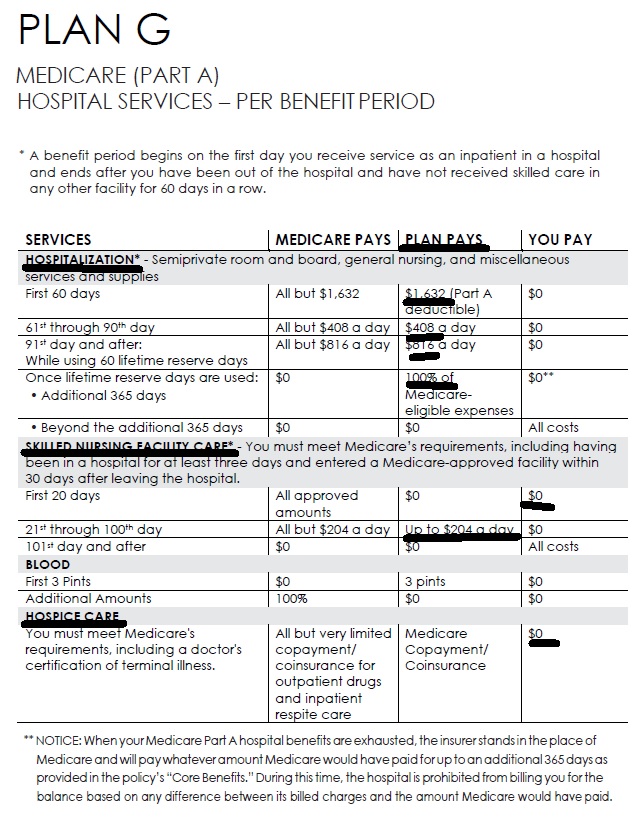

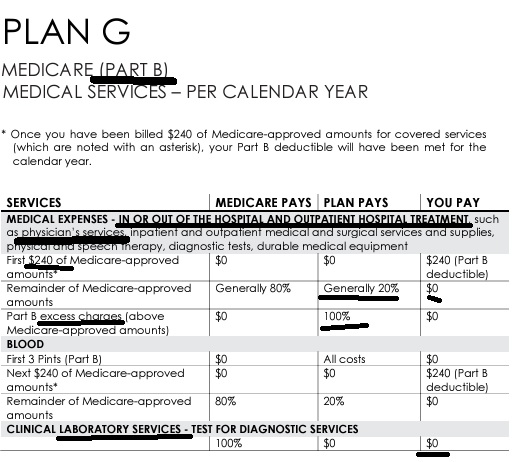

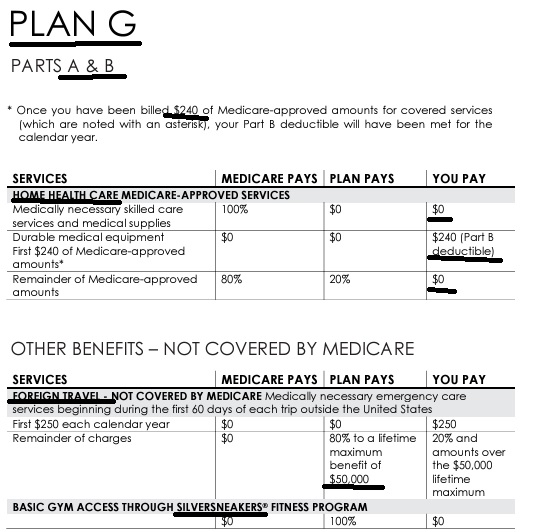

What Plan G pays in addition to Medicare Parts A & B

- Check our Carrier Pages for the latest Info

- Anthem Blue Cross

- Blue Shield – Medi-Gap

- Email us [email protected] for UHC United Health Care information

Introduction to #MediGap

Our video explaining the Governments brochure on choosing a Medi Gap Policy. Click the little square on the right, to enlarge the video.

- 2025 Official Medicare Guide to choosing a Medi Gap Policy # 02110

- Spanish

- Get Quotes for Medi Gap Quotit

- Medicare Supplement Policies CA Insurance Code §§10192.1 - 10192.24

- CA Health Care Advocates HI CAP Fact Sheet

- If you have a Medigap policy and get care, Medicare will pay its share of the Medicare-approved amount for covered health care costs. In most Medigap policies, you agree to have the Medigap insurance company get your Part B claim information directly from Medicare. Then, your Medigap policy will pay your doctor whatever amount you owe under your policy and you’re responsible for any costs that are left. Learn More >>> Medicare.Gov

- Prior Authorization NOT Required! Askchapter.org *

- Supplementing Medicare: An Overview 10-30-20 Hi Cap

- Supplementing Medicare: Medigap Plans 12-14-23 Hi Cap

- Your Rights to Purchase a Medigap 12-14-23 HI Cap

- Search for Participating Doctors & Hospitals - Just about ALL of them!

- Anthem Blue Cross Information & Enrollment

- United Health Care

- Blue Shield – Medi-Gap Information & Enrollment

- Health Net

-

Medi Gap pays the medical expenses that Original Medicare Part A (Hospital) and Part B (Doctor) doesn't. Check out the chart on this page to see what Medicare Pays, what you pay and what a Medi Gap plan pays.

- If you have a Medigap policy and get care, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then, your Medi-gap policy will pay its share. You’re responsible for any costs that are left. Medicare.Gov *

- More than half of all fee-for-service Medicare enrollees without any additional coverage chose a Medicare Supplement plan in 2021 Health Care Finance *

-

Original Medicare, Medicare Advantage nor Medi Gap pay for long term care either in a nursing home or at home care. Get more information on Long Term Care here.

-

Even if you think you can't afford any extra premiums, there's a lot of valuable information to help with planning.

-

What is Medicare A Hospital & B Outpatient?

Medicare Part A

(#Hospital Insurance)

Medicare Part A Hospital coverage helps pay for care in hospitals as an inpatient,... skilled nursing facilities, hospice care, and some home health care (see publication # 10969) but not Long Term Care.

Most people get Part A automatically when they turn age 65 at no charge, since they or a spouse paid Medicare taxes while they were working. You need to sign up close to your 65th birthday, even if you will not be retired by that time. (If you are getting Social Security benefits when you turn 65, your Medicare Hospital Benefits - Part A - start automatically.)

Here's a chart it's just a illustration and is NOT official that shows what Medicare pays, the gaps in Medicare and what you may get when you add a Medi Gap Plan or Medicare Advantage to cover those gaps

.Steve's VIDEO Explanation Comparing what Medicare pays and what you get extra with MAPD or Medi Gap

-

See full brochure I cut and pasted this from

-

Pays on top of Medicare Parts A & B – Any Medicare Provider

Part B - Outpatient helps Pay For Doctors' services, outpatient hospital care, and some other medical services that Part A does not cover, such as the services of physical and occupational therapists, and some home health care see publication 10969, but not Long Term Care. Part B helps pay for these covered services and supplies when they are medically necessary.

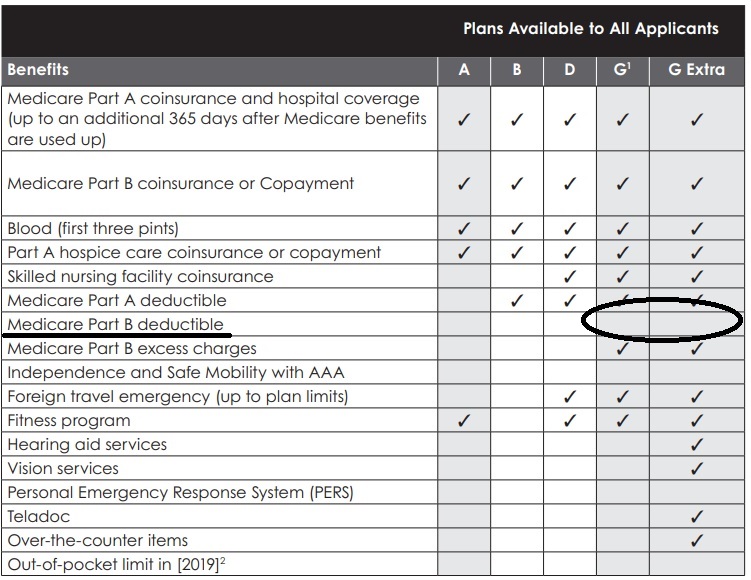

The chart below is a very brief summary. Check the actual Evidence of Coverage for the plan you want to enroll in, Medicare & You or actual Medicare documents.

2024 Fact Sheet Medicare Costs

Our Webpages with more detail:

- Coverage in Part A Hospital & B Doctor Visits? Part D Rx

- Chiropractic – Medicare A & B – MAPD

- Diabetes – Prevention & Coverage under Medicare & ACA

- Durable Medical Equipment

- End Stage Renal – Kidney Failure

- Hearing Aids

- Physical therapy – occupational speech

- Skilled Nursing SNF & Home Health What Medicare Pays

- Togetherness – Loneliness Social Determinants of Health

- Mental Health

- How to sign up for Medicare?

- FAQ Medical Necessity our Medical Necessity Webpage

- Original Medicare & Medi-Gap – Supplement vs Medicare Advantage MAPD

- Medicare Beneficiaries’ Out-of-Pocket Spending for Health Care AARP

Find Medicare Doctors who accept assignment #MD

- Medicare Video - Physician Compare

- Blue Shield Statement Medi Gap uses ANY Medicare MD!

- Care Compare Video

- Video on how to use Medicare Provider Finder VIDEO

- Our Webpage on Medicare Assignment – Doctor Participating or Not?

- Compare Hospitals - Search Medicare.gov

- Medicare Guide to Choosing a Hospital Publication # 10181

- Hospital Readmission Penalty Look Up

- Long-Term Acute Care Hospital (LTACH) Clinical Guidelines - Oscar

- US News & World Report America's Best Hospitals

- UCLA #3

- Cedar's Sinai # 6

- UCSF San Francisco #9

- Stanford #12

Medi Gap A - N #Chart

From Blue Shield Enrollment Guide

Click link or image to enlarge

|

|

- Our webpage on F vs G

- 2024 Fact Sheet Medicare Costs

- Fact Sheet Innovative Benefits Hi Cap

Evidence of Coverage – Resources & Links?

#Evidence of Coverage

Summary of Benefits

- 2024 Summary of Benefits & Evidence of Coverage – if password is required… Email us at [email protected]

2022 Open Plans

Plan A

Plan F Extra*

Plan G

Plan G Extra

Plan G Inspire

Plan N

<<<<<<<<<<<<<<<<<Historical>>>>>>>>>>>>>>>>>>>>>>

Plan A, Jan. 2018 (PDF)

Plan F Extra, Oct. 2018 (PDF)

Plan G, Jan. 2018 (PDF)

Plan G Extra, Jan. 2020 (PDF)

Plan N, Jan. 2018 (PDF)

Evidences of Coverage for 2010 Standardized Closed Plans (closed 9/30/2019)

Plan C, Jan. 2018 (PDF)

Plan D, Jan. 2018 (PDF)

Plan F, Jan. 2018 (PDF)

High Deductible Plan F, Jan. 2019 (PDF)

Plan K, Jan. 2019 (PDF)

Evidences of Coverage for Standardized and Pre-Standardized Closed Plans (closed prior to 5/31/2010)

Get complete descriptions of our closed Medicare Supplement plans.

Plan A (pre June 2010) (PDF)

Plan B (pre June 2010) (PDF)

Plan C (pre June 2010) (PDF)

Plan D (pre June 2010) (PDF)

Plan F (pre June 2010) (PDF)

Plan G (pre June 2010) (PDF)

Plan J (pre June 2010) (PDF)

Plan K (pre June 2010) (PDF)

Plan H Standard (PDF)

Plan H Plus Rx (PDF)

Plan I Standard (PDF)

Plan I Plus Rx (PDF)

Coronet Major Medicare (PDF)

Coronet Senior Standard (PDF)

Coronet Senior Plus Rx (PDF)

Golden Coronet Senior Standard (PDF)

Golden Coronet Senior Plus Rx (PDF)

Preferred Senior (PDF)

Closed plan rate sheets

2010 Standardized Closed Plans (closed 5/31/2010) (PDF)

1990 Standardized Closed Plans (closed 5/31/2010) (PDF)

1990 Standardized Closed Plans (closed 12/31/2005) (PDF)

Resources & Links

Member Services 1-800-248-2341

- Medicare Provider Finder (Any MD that takes Medicare works on this plan)

- Blue Shield guaranteed.acceptance.guide.

- Silver Sneakers.com

- Blue Shield CA .com – Explanation

- Blue Shield Financial Strength

- Medicare Supplement Plan Transfer Application – be sure to put in our name as agent and email [email protected] to us

- Go deeper into your plan to get more Think your plan is just about health coverage? It offers so much more. Take a closer look and see what else you could be getting from us. Seriously, we want you to.

Blue Shield Videos On Medicare

“Medicare Enlightenment” video series out now!

- Medicare Enlightenment – Entire Video 18 minutes

- Different Parts of Medicare

- Original Medicare Parts A& B: What’s Not Covered

- When can I enroll in Medicare

- Your Medicare Coverage Choices at a Glance

- Medicare Advantage Plans – Part C

- Medicare Supplement Plans

- Prescription Drug Plans

- Our Blue Shield Web Pages on Medicare

- Blue Shield 65 Plus – Inspire HMO 2021

- Blue Shield – Medi-Gap – Any Medicare Provider

Blue Shield Medi Gap Forms

- Member Portal

- Get the most out of your health plan – many extras

- Medicare Supplement Plan Transfer Application – Helpful tips, be sure to put in our name as agent and email to us Appoint us as your Broker – No Extra Charge

- Medi Gap Plan Replacement Form

- Silver Sneakers

- Blue Shield Brochure

- Email [email protected] or call us 310.519.1335

- Broker ONLY – Forms on Blue Shield Site

Misc.

“FAQ’s

- Question I think it’s fairly simple — if you want the most coverage, you get Part A, B, D Rx + Medi Gap Plan G.. Am I correct?

- Answer Depends what you mean by “most.” Part A covers hospital. Part B doctor visits. Part D covers outpatient prescriptions, rx. Plan G pays the co pays and most deductibles in A & B. See the comparison chart

- Some would say “most” might be a Medicare Advantage plan, in that the premiums are usually zerp. One downside is the limited HMO doctor list Medicare Advantage MAPD may also cover vision and dental. Check our Medicare Advantage pages to learn more. Here’s our page on comparing Medi Gap vs MAPD. Medi Gap though gives you MUCH more freedom of choice of doctors.

- Question I’m thinking of getting Hi F, with the $2,240 deductible. How do I know if that’s the right plan for me?

- Answer There is no FREE LUNCH when you buy Insurance. The Insurance Companies are in business to make a profit. Either way, the Insurance Company has calculated that they will pay out 80 cents on each dollar of premium they take in.

- Check out the rates from the Blue Shield Medi Gap Brochure above, or get quotes here.

- Does saving around $120/month or $1,400/year make it worth it to get back $2,200 if you have that many claims?

- Why not get Long Term Care, where the stakes are higher and there is the potential for real loss and hardship. The difference between F and Hi F is $800. I don’t think that will bankrupt anyone.

- Question What’s the #difference between attained age, issue age and community rating?

- Answer

- View Larger Image

- Image from Guide to choosing a Medi Gap Policy

- Here’s our quote engine for the plans we do offer in CA.

- AARP UHC has Community Rating However, looking at their rate chart and 3%/year enrollment discounts, it looks like attained age to me…

- Email us [email protected] and we’ll send you the enrollment kit with the rates & details.

- Transamerica has issue age – contact them directly. We don’t represent them. Source *

- State of CA Department of Insurance Comparison Tool

- Insure Me Kevin.com Community vs Attained Age

- AARP UHC has Community Rating However, looking at their rate chart and 3%/year enrollment discounts, it looks like attained age to me…

- FAQs / Ask Us a Question

- My wife is disabled with a brain tumor. She has plan High F. She collects SSDI and qualified for Medicare after two years of disability. She is also on Medi Cal.

- We currently pay $412.30 for Part F and the Duo Package (dental and vision), plus $86.40 for the PDP.

- Any suggestions?

- Please let us know what of 7 qualifications QMB etc. you have for Medi-Cal.

- How are you dealing with the rules of dual coverage Medicare

- dual coverage Medi Cal and dual coverage in general?

- Are you using Medi Cal MD’s?

- Are you paying the Hi F deductible $2,340? or is that getting reimbursed?

- Who is paying the Hi F premium?

- Change to a Medi Gap plan with lower deductible under birthday rule?

- Since you have Share of Cost Medi Cal, do you have to go to Medi Cal MD’s for the portion you pay?

- See CA Health Care Advocates on Medi Gap & Medi Cal

- If you drop your Medi Gap plan as it looks like you will have full scope medi cal, due to your tax loss – magi Income

- There are guaranteed issue rules to let you get a Medi Gap plan, if you lose full scope Medi Cal

- How are you dealing with the rules of dual coverage Medicare

- I’m having medically necessary treatment for varicose veins.

- How much would Medicare pay?

- How much would a Medi Gap plan pay?

- First, we need to find out what the procedure costs, retail.

- On the other hand, the simple answer is see the chart above for Part A Hospital and Part B Medical Services

- Then what Medicare allows.

- What the billing codes are.

- Is the procedure really medically necessary?

- FYI Clinical Bulletin for Varicose Veins

- Vein stripping and ligation takes about 60 to 90 minutes to perform and sometimes requires general anesthesia. Recovery time is also lengthy, usually involving two to four weeks depending on how many veins were stripped and where they were located.

- cms.gov/ Medical Necessity Varicose Veins

- Medicare does cover the medical treatment of varicose veins that cause symptoms and have ultrasound characteristics of chronic venous insufficiency. cleveland clinic.org/health/chronic-venous-insufficiency

- FYI Clinical Bulletin for Varicose Veins

- Costs

- Vein stripping surgery costs between $1,500 and $3,000. This cost may not include additional fees charged by the hospital or surgical center, which can increase the cost exponentially.

- Another varicose vein-removing surgery is called ambulatory phlebectomy. During this procedure, your doctor makes tiny cuts in the skin to remove small varicose veins; usually those that are closest to the surface. The in-office procedure is done with local anesthesia and is considered much less invasive than vein stripping and ligation.

- Ambulatory phlebectomy may cost between $1,000 and $3,000 per leg depending on the extent and number of veins removed. your plastic surgery guide.com/varicose-vein

- A physician office visit and diagnostic ultrasound are needed to determine the medical necessity of vein treatments. Patients are encouraged to try non-medical treatment options such as exercise, weight-loss, and compression stockings (20-30mmHg) prior to medical vein procedures. As varicose vein symptoms become more severe, the likelihood that Medicare will cover the cost of treatment increases dramatically. vanish leg veins.com/does-medicare-cover-varicose-vein-treatments/

Broker ONLY

-

- Broker Training & Resources

- No more commission on PPO Plans in Alameda, Orange & San Diego

- February 2025 Newsletter

- View this email as a web page

- As we move through November, we’d like to take a moment to express our gratitude for your hard work and dedication. With the end of the Annual Enrollment Period (AEP) approaching on December 7, we know this is an especially busy time, and we appreciate your continued commitment to supporting clients through this critical season.

As you help clients make informed choices, remember that resources on Broker Connection are here to support you, from tracking applications to planning 2025 activities. Your efforts during AEP and throughout the year are invaluable, and we’re grateful to have you as a partner.

Additionally, please note that our Medicare Supplement products are available through December 31, 2024, for an effective date of January 1, 2025. Be sure to evaluate any applicable Guaranteed Acceptance (GA) issues that may apply to your clients to ensure they receive the coverage best suited to their needs.

Wishing you and your loved ones a happy Thanksgiving and a wonderful start to the holiday season. Thank you for everything you do!

- Tips for a strong AEP finish: Maximize your self-service tools

- Earn $100 for each completed HRA with new D-SNP enrollments!

- Spotlight on Wellvolution: Support your clients’ wellness with Fitbit® and WW (Weight Watchers® reimagined)

- New Medicare dental buy-up feature now on Broker Connection

- Don’t forget: Complete your 2025 Product Certification

- Now is the time to book your 1st Quarter 2025 Activities

- Explore our 2025 Broker Training and Resource page on Broker Connection

- blue shield ca.com/broker/resources

- blue shield ca.com advertising/online-program

- Elevate mental well-being: Looking beyond Mental Health Awareness Month

- Connecting with Broker Services- Live chat and real time notification

- Tentative Agreement Reached: Providence Health & Services and Blue Shield of California

- Transition from DocuSign to the Connecture Online Enrollment Tool

- Discontinued benefit: AAA Roadwise Rx

- 2024 Broker training dates: Selling Medicare Supplements

- Blue Shield of California: Leading the way in Medicare Supplement Plans

- Rate Changes to Open Medicare Supplement Plans Effective July 1, 2024

- Streamline your day-to-day with Broker Connection Self-Service tools

- New application forms following the closure of Medicare Supplement Plan G Inspire

- Helping your clients transition to Medicare: New FAQs

- 2024 Broker training dates: Selling Medicare Supplements

- 2024 Medicare Toolbox

- New Client List features – autopay and cancellation identifiers

- Exciting updates coming to Broker Connection

- Medicare Supplement Closed Plan Cycle Changes- Effective April 1, 2024

- No new Plan G Inspire applications will be accepted after March 31, 2024

- What to know about GLP-1 weight loss drugs

- 2024 Broker training dates: Selling Medicare Supplements

-

BROKER ONLY

- Why choose Medi Gap Plan?

- Broker Website - updated forms...Access our Broker Connection site for more resources and tools:

- No new Plan G Inspire applications will be accepted after March 31, 2024

- Shield On Demand offers a wide variety of customizable flyers, including benefit highlights, PowerPoint presentations and social media templates. From Broker Connection, go to the Medicare tab and look for “Sales & Marketing Materials,” and start utilizing these branded tools for your sales and marketing efforts.

- Our updated 2024 Medicare Toolbox highlights comprehensive product offerings and provides a blueprint for your success.

It includes our product portfolio, commissions and bonuses, marketing support, and more! - 2024 HRA incentive program details

- Blue Shield and Adventist Health reach new in-network agreement

- Tools and resources to help your clients with their new 2024 plans

- Elevate your social media marketing in 2024

- The Redetermination process will continue in 2024

- 2024 Broker training dates and job aids

- Tools at Your Fingertips- Price Check My Rx tool

-

Medicare website updates:

- Medicare Member - Helpful member link agents can use for quick access to resources

- Med Supp Summary of Benefits - 2024 cost sharing amounts posted

- Med Supp Evidence of Coverages - 2024 cost sharing amounts posted

- Med Supp Dental PPO Evidence of Coverages 2024 updates

Broker Connection web page updates:

- Help Current MA-PD clients

- Help current PDP clients

- Help Current Med Supp clients – Find 2024 updates!

Additional Links and contacts:

- Access Broker Connection site for more resources such as enrollment materials and customized marketing through Shield On Demand

- Medicare Supplement Applications:

Email: [email protected]

- MAPD/PDP Applications:

Email: [email protected]

- Producer Services Support

Tel: 800-559-5905 | Email: [email protected]

Appointment inquiries: [email protected]

|

Medicare Supplement Plan Changes for April 1, 2024

With current market evaluation, we have made the decision to discontinue Medicare Supplement Plan G Inspire effective 4/1/24.

Plan G Inspire has been in the market for 3 years and was only offered in select Northern CA counties. Agents and members will find Medicare Supplement Plan G Extra to be the same benefits and equal or less cost, without the AAA Roadside Driver program.

To help you navigate this change, we sent out a Producer Alert, and attached are PDF documents for Plan G Inspire FAQ, Plan G Extra, and Medicare Supplement Plan Comparisons (G, G Extra, F Extra). All marketing materials with Plan G Inspire will be updated by 4/1/24, including new enrollment, transfer, enrollment kits, marketing flyers, online references. It is highly recommended you read the FAQ and your Producer Alert link .

Current Plan G Inspire members will be notified October 1, 2024 and will be given a Special Enrollment Period to move to another supplement plan with no underwriting.

Plan G Extra is sold statewide and offers these same extra benefits as Plan G Inspire:

Additionally, Plan G Extra offers our popular Welcome to Medicare rate savings of $25 for the first year, Auto-payment savings, Household Savings, and Dental discount. |

https://blueshieldca.crediblemind.com/

https://www.blueshieldca.com/en/medicare/medicare-plan-types/medicare-supplement-plans

https://www.blueshieldca.com/content/dam/bsca/en/broker/auth/docs/2025/July_2025_Med_Supp_Open_Plans_Rate_Action_Talking_Points_FAQs.pdf

My husband turns 65 in June and I turn 65 in January of 2023.

We are both currently covered under my husband’s work for health insurance.

In January 2023 we would both like to be on Medicare with a good ppo policy.

If my husband signs up in June I could lose coverage for 6 months.

What can we do?

Your husband could get Medicare A & B plus Medi Gap this June as he’s turning 65 or just about anytime after that, as he has qualifying employer coverage.

Learn even more about holding off on Medicare Enrollment, when you have employer coverage.

If your husband signs up for Medicare and drops his employer coverage, that would give you a special enrollment into an under 65 plan. Get instant free quotes

Get Medi Gap quotes

If I don’t have a Medi Gap plan, how much would I pay for an angio gram?

This website says a Fair Price is $3k new choice health.com/ct-angiography-chest

Medicare might discount that…

So you would pay 20% or $600

I have Medi Gap Plan F Extra and Blue Shield Rx Plus for Part D

I don’t know if I should keep what I have or if there are better options.

First of, we can lose our license to sell Medicare Advantage plans, if say “this is the best plan.”

So, watch this video and follow the links and we’ll look at the options and the pros and cons.

Set – Schedule a Zoom Meeting

Summary of benefits Matrix

Rate Chart Medi Gap – In the Enrollment Kit

See the menu above and visit our other Medi Gap and Part D Rx pages.

Pros and Cons of Hi F with a $2,300 deductible vs Plan F with no deductible or G with $233 deductible.

See our F vs G Webpage

When might this website report any annual changes in rates or benefits?

Medi Gap rate and benefit changes are not an annual thing like Part D Rx or Medicare Advantage AEP of October 15th through December 7th with an effective date of January 1st.

The medi gap rates change when Blue Shield “gets to it.” Traditionally it seems in April. The main change in rates would be getting older, as opposed to rate changes, inflation or Medical Loss Ratio.

One can get quotes here

I have Plan N and would like to get an Issue Age plan, rather than having the rates go up every year, based on attained age. Are those plans available in CA?

See above

What’s the difference between, G F and G extra?

We tried to get F Extra and were turned down

See our Plan A through N Chart above.

The main difference in Extra or Innovative is the Hearing Aids, Vision, Teledoc, Over the Counter Medications and Help, I’ve fallend and I can’t get up. See the summary of benefits for more detail.

Blue Shield and other companies all have a “Birthday Rule” where you can the same or lesser coverage around the time of your birthday.

Extra and Innovative plans will be considered the same and not better.

Why are Medi Gap companies offered more benefits?

One reason is a new buzz word, Social Determinants of Health.