Supplemental Security Benefits (SSI)

SSDI if you worked and become disabled

Please note, that this page is way beyond our pay grade. We are not qualified to answer your questions. Contact legal counsel, your Social Worker, or the Social Security Office…

Introduction SSI Supplemental Security Income

Get a term life quote here,

to protect your loved one

What is the Supplemental Security Income (SSI) program and

how can I apply?

- What you need to know when you get SSI Publication # 110111

- More than you ever wanted to know on SSI Understanding SSI Publication # 17-008 120 pages

- What You Need to Know When You Get Social Security Disability Benefits #10153

- Disability Benefits #10029

- Social Security Website Publications

- WHAT DOES “DISABLED” MEAN FOR AN ADULT?

- If you are age 18 or older we may consider you “disabled” if you have a medically determinable physical or mental impairment (including an emotional or learning problem) which:

- results in the inability to do any substantial gainful activity; and

- can be expected to result in death; or

- has lasted or can be expected to last for a continuous period of not less than 12 months.

- If you are age 18 or older we may consider you “disabled” if you have a medically determinable physical or mental impairment (including an emotional or learning problem) which:

-

WHAT IS SUBSTANTIAL GAINFUL ACTIVITY (SGA)?

We use the term substantial gainful activity (SGA) to describe a level of work activity and earnings that is both substantial and gainful. SGA involves performance of significant physical or mental activities, or a combination of both. For your work activity to be substantial you do not need to work full time. Work activity performed on a part-time basis may also be SGA. If your impairment is anything other than blindness, earnings averaging over $1,070 a month (for the year 2014) generally demonstrate SGA.

Gainful work activity is:

-

-

work performed for pay or profit, or

work performed for pay or profit, or work of a nature generally performed for pay or profit; or

work of a nature generally performed for pay or profit; or work intended for profit, whether or not a profit is realized.

work intended for profit, whether or not a profit is realized.

-

- Is SSI Title XVI?

- Resource & Income Limits

- SSI Home Page – Table of Contents on Social Security Website

- Medicaid – Medi-Cal is generally automatic.

Supplemental Security Income (SSI) Basics.

FAQ’s

- How much does SSI pay in monthly benefits? CA Assisted Living

- What counts as assets and/or resources?

Representative #Payee

Guide for Representative Payees Publication # # 5 10076

- Gets your Social Security check and manages the money $$$

- ssa.gov/payee Home Page

- Social Security’s Representative Payment Program provides benefit payment management for our beneficiaries who are incapable of managing their Social Security or Supplemental Security Income (SSI) payments.

- We appoint a suitable representative payee (payee) who manages the payments on behalf of the beneficiaries. Generally, we look for family or friends to serve as payees. When friends or family members are not able to serve as payees, we look for qualified organizations

- FAQ’s for Representative Payee

Jump to section on:

- Release from Prison

- Publications & Links

- Assets, Resources & Income Limits

- Automatic Medi-Cal Qualification

- Attorney List

- Medicare Savings Programs – Pay the $170/month

- Understanding Medicare Advantage Plans

- Working while disabled

- Social Security Handbook

- Medicare Information

- FAQ’s

- #Social Security Disability Benefits Publication # 10029

- SSI Introduction Publication # 5-11000

- More than you ever wanted to know on SSI

Understanding SSI Publication # 17-008 120 pages - SSI in CA #11125

6 Steps to apply for Social Security #Disability

- Video 6 steps to apply

- ssa.gov/benefits/ssi/start

- SSI Child Disability Starter Kit (for children under age 18)

- Adult Disability Starter Kit(for children age 18 or older)

- What you need to know to get Social Secuirty Disabiltiy Benefits # 10153

- Disability Benefits # 10029

- How Social Security decides if you are still disabled # 10053

- Social Security Outline Court of Appeals 9th Circuit

SSI #Resources & Income Limits

The Aged & Disabled Medi-Cal program uses SSI countable income rules as well as a few extra rules you should know. For more information, visit our webpages on the SSI & Medi Cal programs, and follow the various links on this page

- Medi-Cal section of the

- Countable resources are the things you own that count toward the resource limit. Many things you own do not count.

FLASH!!!

The asset limit in the Medi-Cal programs serving older adults and people with disabilities has been eliminated! Ooops, better double check that! CA Health Care Advocates * DHCS *

Have less than $2,000 in Countable assets for an individual ($3,000 for a couple).- Medi-Cal property limitations.

- asset questionnaire

- CANHR Fact Sheet

- Understanding Medi-Cal’s Asset Test for Seniors and People With Disabilities

- Western Poverty Law

- Nolo - SSI Income & Asset Limits

- Income SSA.Gov

- Will my settlement affect my government benefits? VIDEO

- dhcs.ca.gov/Asset-Limit-Changes-for-Non-MAGI-Medi-Cal

- california healthline.org/sset-test-elimination

- FAQ's

- Our webpage on SSI Resources & Income

- Have less than... of FPL in countable monthly income for an individual ... for a couple). ca health advocates.org ADFPL * AB 715 Fact Sheet * Western Poverty Law *

- Share of Cost if income is too high, but you qualify on asset test?

SSI = Automatic Medi Cal

Is Medi-Cal #automatic linked for SSI – Supplemental Security Benefit beneficiaries – recipients?

***Yes, according to

- Nolo.com *

- Disabilty Secrets.com *

- CA Health Care Advocates *

- Western Poverty Law Center

- See our webpage on

- DAC Disabled Adult Children & Pickle Amendment

- Medi Cal

- Our webpage on DAC Disabled Adult Child Program

- SSI in CA Factsheet

Many individuals receive SSI due to poverty (over 65) and others receive SSI due to disability.

Links & Resources

Disability Benefits 101 on SDI * SSI *

Our webpage on

#My Medi-Cal

How to get the Health Care

You Need

24 pages

Smart Phones - try turning sideways to view pdf better

Social Security Disability Insurance #SSDI

The Social Security disability program SSDI for an average family is equivalent to a private disability insurance policy worth over $233,000. Social Security pays benefits to people who cannot work because they have a medical condition that is expected to last at least one year or result in death. (ssa.gov #10029)

Once you have received Disability benefits for two years you will automatically be covered under Medicare Parts A & B ssa.gov # 10029 * (there is a $170 premium for Part B – If you are low income there may be ways to get that paid for you) and we can then help you enroll in a

If you’re interested in Medicare Advantage Plan (NO PREMIUM!), Part D Rx and Medicare Supplemental Medi-Gap Plans visit those webpages and contact us be sure to contact us RIGHT away, as there are deadlines!

Resources, Links & Bibliography

“Social Security Disability – SSDI”

FAQ’s

- a #child,

- Childhood Disability Benefits (CDB) — SSDI for “adults disabled since childhood,”

- SDI and unemployment is on my website. I’

-

- Medi Cal Eligibility

- Covered CA Quotes

- Medicare after two years on SSDI

- Medi Cal In Home Supportive Services

- Covered CA Income Chart… If income under say $18k it’s Medi Cal, NOT Covered CA

- 1954 – 66 years disability-benefits-help.org/disability-benefits-switch-retirement-65

- Do you meet the medical and disability criteria? ssa.gov/disability/step4and5

- Try this questionnaire ssa best.benefits.gov/

- Processing an application for disability benefits can take three to five months. ssa.gov/10029

- ? ssa.gov/10029

- disabilitysecrets.com/if-you-get-disability-do-you-have-pay-medicare

- Check out Medicare Savings Programs or Medi Cal if you need help paying premiums.

- Medicare Advantage Plans that include part D, Rx and generally zero premiums.

- Guide to Social Security Disability. Nolo Press

-

Appeals

See our main webpage on ALL appeals

- Our Webpage on Appeals in General

- ONLINE Disability Appeal

- SSA 561 Request for reconsideration

- Guide to writing letters

- Navigating the System: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI)

- Authorization to disclose Information SSA 827

- Request for Reconsideration SSA 561 U 2

- Your Right To Representation 05-10075, . Audio

- What You Need To Know When You Get Retirement Or Survivors Benefits 05-10077, Audio

- What You Need To Know When You Get Social Security Disability Benefits 05-10153, AUDIO

- Fact Sheet: Social Security Disability Insurance (SSDI) 05-11001,

- Are You Eligible for Supplemental Security Income (SSI)? 05-11003,

- What You Need To Know When You Get Supplemental Security Income (SSI) 05-11011,

- You May Be Able to Get Supplemental Security Income (SSI) 05-11069,

- SSI In California 05-11125, January 2023

- Understanding Supplemental Security Income 17-008,

- Red Book 64-030,

- Blue Book 64-039,

- Your Guide to Social Security Disability Video Hearings 70-067,

- Your Right To An Administrative Law Judge Hearing And Appeals Council Review Of Your Social Security Case 70-10281,

-

Online Video Hearings at the Social Security Administration 70-10284,

- Representing a Client with Mental Illness A South Dakota Defense Attorney’s Guide

- 18 Tips to Successfully Advocate for Clients with Mental Illness

- More publications @ https://www.ssa.gov/pubs/

Find an Attorney

- Legal Match

- Findlaw.com

- American Bar Association

- Attorney Search Network

- Follow the links on this webpage. Many of them go to articles on Attorney Websites

- Also, see our appeals webpage

- Medi Cal Contact

- State Bar of California Attorney Referral Service

#Attorney 's --- Social Security Disability maze

- Sellers Law

- Hill & Ponton

- premier disability.com

- Cantrell & Green

-

- We don't necessarily know these attorney's...

- Editorial: Lawyers are fighting innovative proposals for more affordable legal assistance. That’s wrong LA Times 1.30.2022

Estate Planning

- We don't necessarily know these attorney's...

InsuBuy International Medical Coverage –

Instant Quotes & Enrollment

Coverage for Travel - $50k Emergency under Medicare Medi Gap or MAPD Advantage may not be enough!

HOW DOES DEEMING – Considering Parents Income WORK FOR A CHILD?

The term deeming means – identifies the process of considering another person’s income and resources to be available for meeting an SSI claimant’s (or recipient’s) basic needs of food and shelter. SSA.gov *

If a child is under age 18, not married, and lives at home with parent(s) who do not receive SSI benefits, we may consider a portion of the parents’ income and resources as if they were available to the child. We may also count a portion of a stepparent’s income and resources if the child lives with both a parent and a stepparent (or an adoptive parent and a stepparent). We also do this when a child is temporarily away at school, returns home during weekends, holidays or during the summer and remains subject to parental control.

We make deductions from deemed income for parents and for other children living in the home. After we subtract these deductions, we use the remaining amount to decide if the child meets the SSI income and resource requirements for a monthly benefit.

| For more information, see the SSI Spotlight on Deeming Parental Income and Resources. |

WHEN DOES DEEMING NOT APPLY?

Deeming from the parent stops when a child attains age 18, marries, or no longer lives with a parent. Deeming does not apply, and we may pay up to $30 plus the applicable State supplement when:

![]() a disabled child receives a reduced SSI benefit while in a medical treatment facility; and

a disabled child receives a reduced SSI benefit while in a medical treatment facility; and

![]() the child is eligible for Medicaid under a State home care plan; and

the child is eligible for Medicaid under a State home care plan; and

![]() deeming would otherwise cause ineligibility for SSI benefits.

deeming would otherwise cause ineligibility for SSI benefits.

Also, we do not consider the income of a parent for deeming purposes if the parent receives a Public Income Maintenance payment (PIM) such as Temporary Assistance for Needy Families (TANF) and his or her other income was used to compute the PIM payment.

| See SSI AND ELIGIBILITY FOR OTHER GOVERNMENT AND STATE PROGRAMS for information on TANF. |

If either child or parent is temporarily absent from the household (less than 60 days), the rules about deemed income still apply. ssa.gov/ssi child-ussi

In–Kind Income is food or shelter that you get for free or less than its fair market value.

Bibliography

Supplemental Security Income # 11125

- Publication 3966, Living and Working with Disabilities

#Disability SSI & SSDI Publications, Resources & Links

- Disability Benefits #10029

- SSI Child Disability Starter Kit (for children under age 18)

- Adult Disability Starter Kit(for children age 18 or older)

- Benefits For Children under 18 With Disabilities

- Other Disability Publications

- Social Security Handbook

- Understanding Supplemental Security Income SSI For Children-- 2019 Edition

- Western Poverty Law Center - Coverage for Low Income California's DAC Program Page 84 - Non Magi Medi-Cal 3.71

- Our webpage on SSI & Medi Cal

- ObamaCare - Mental Health - One of 10 Essential Benefits

- New Jersey 2 page explanation

- ssa.gov Section 1634

- Social Security Disability Planner: Benefits for A Disabled Child

- Pickle Amendment Screening Q & A

- The State Council on Developmental Disabilities (SCDD) is established by state and federal law as an independent state agency to ensure that people with developmental disabilities and their families receive the services and supports they need.

- Cal Fresh

Social Security Publications relating to Disability, SSI, SSDI

- What you need to know to get Social Secuirty Disabiltiy Benefits # 10153

- Disability Benefits # 10029

- How Social Security decides if you are still disabled # 10053

- Check list for what’s needed on the application 001

- Medicare # 10043

- Supplemental Security Income # 11125Benefits for Children with Disabilities #10026

- Benefits for Children # 10085

- How to get a benefit verification letter # 10552

- The Red Book – Employment Support for SSDI and SSI

- Working while disabled 10095

- Ticket to Work Program

- Publication 3966, Living and Working with Disabilities

- Publication 907, Tax Highlights for Persons with Disabilities

- How International Agreements can help you # 10180

- Social Security for Foreign Governments # 10566

- MORE Social Security Publications on their website

- Nolo's Guide to Social Security Disability We do have a reference copy in our office

- Sleepy Girl Guide to Social Security Disability

-

Links & Resources

Disability Benefits 101 on SDI * SSI *

publication 10026 - Benefits for Children with Disability

- What must I do to Qualify?

- What is Social Security's eligibility process

- Where is Social Security's home page for disability

- Can I get a Disability "Starter Kit?

- Tell me more about the Ticket to Work Program which gives you more choice in obtaining the services one needs to be able to go back to work and achieve your employment goals.

- Where can I get more disability information?

- Can I get an estimate of my retirement benefits? Sample Calculation

- Nolo.com Disability Benefits

Medicare Coverage

- Can I get Medicare After 2 years on Social Security Disability #10029?

- Learn More @ * Medicare Interactive *

- I'm already on SSDI, where can I get more information?

- Can we see a sample response to a website visitors questions?

- Do I automatically get Medi - Cal? (Medicaid?)

- bet tzedek.org Free Legal Aid

#SSI-Related Programs, Private Disability & Coverage Groups

Our web pages on:

- Aged and Disabled Federal Poverty Level Program

- Disability Income – Pay Check Protection

- Part D Rx Low Income Subsidy – LIS – Extra Help

- Hospice Coverage – Medicare

- SSI for Groups & Organizations Publication # 11015

- Regional Centers Department of Developmental Services

- City of Los Angeles - Disability

- Access - Transportation for disabled

- Law Research Guides Library of Congress

#SocialSecurityDisability

Factors in Evaluating

Parents & Care Givers

Check out our webpage on getting your own private disability coverage, in addition to Social Security Disability or SDI State Disability Coverage

- Disability Income – Pay Check Protection

- SSI – Supplemental Security Benefits – Automatic Medi Cal – SSDI

FAQ's

- Deafness?

- Mental Health – ACA/Health Reform Mandated Essential Benefit

- nolo.com/guide-to-social-security-disability

SSI and SSDI – Contact Info

PRISON

How does being incarcerated – Jail, #Prison affect Social Security or SSI Benefits?

Please read this pamphlet from Social Security 10504

Prerelease Agreements – Institutionalization. https://secure.ssa.gov/apps10/poms.nsf/lnx/0423530001

Benefits for the Incarcerated

This fact sheet describes

- income support through the Supplemental Security Income (SSI) and

- Social Security Disability Insurance (SSDI) programs, and

- health coverage under Medicaid – Medi Cal and Medicare, which together can enable someone with mental illness to transition successfully from jail or prison to community life.

- Our webpage on

- reinstating Part B Medicare if you lost it

- Get Quotes for Health Insurance

- Our webpage on

-

Entering the Community after #Jail, Prison – Incarceration Publication # 10504

What prisoners need to know Publication # 10133

How to Navigate California County Jails: A Guide for Inmates and Their Loved Ones

Our webpages on

Work & Disability

FAQ

Overpayments

Overpayments En 05 10098

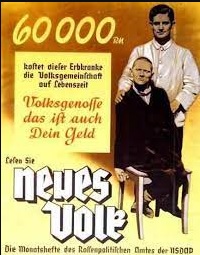

Hitler & Mental Health Disabilities T 4

Speak up! Do want you can to make sure this doesn't happen in the USA!

Translation for the poster below:

"This person suffering from hereditary defect costs the community $60,000 Reichsmark during his lifetime. Fellow German, that is your money, too. Translation & Image Courtesy of Psychology Fantom.com

Under the T 4 program, wikipedia.org T4 Certain German physicians were authorized to select patients "deemed incurably sick, after most critical medical examination" and then administer to them a "mercy death" (Gnadentod).[7] The T4 programme stemmed from the Nazi Party policy of "racial hygiene", a belief that the German people needed to be cleansed of racial enemies, which included anyone confined to a mental health facility and people with simple physical disabilities.[31] wikipedia.org T4

The annual cost for a bed in a CDCR-operated, inpatient psychiatric program is around $301,000 lao.ca.gov *

Did President Trump??? really say and mean this? Time.com