Introduction

Medicare & Employer Health Plans?

If you are covered by an Employer Group Health Plan Health Care Advocates Definition, then when you or your spouse turn 65 and become eligible for Medicare Part A Hospital and Part B Dr. Visits, there are several things to look into, check out and make decisions on:

- Does your employer’s health insurance plan have more or less than 20 employees?

- If fewer than 20, you MUST sign up for Medicare A & B as Medicare is Primary which means Medicare pays any bills first and if they don’t pay in full, then other coverage you might have, like your Employers Group health plan would pay. This may also mean, if you don’t have Medicare, you don’t get your bills paid! You must enroll in Medicare when you are supposed to, if not, there are penalties!

- Medicare rights.org/Medicare-and-Current-Employer-Insurance-Scenario

- Supplementing Medicare: Retiree Plans 04-06-21 Hi Cap

- Coverage While You and Your Spouse Work 04-06-21 Hi Cap

- Don’t just take our summary. Medicare’s rules are very complex and confusing. The rules are not ours, they are Medicare’s, CA State, Insurance Company etc.

- Follow the links, official brochures and footnotes below for the exact forms and citations you need. There are penalties if things are done even just a tiny bit wrong.

Try turning your phone sideways to see the graphs & pdf's?

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

Does your employer have more or less than 20 Employees?

If your Employer Group Insurance has

#Fewer than 20 employees

.

If you work for an employer who has fewer than 20 employees, Medicare will be primary and pays before your other coverage. You MUST sign up for Part A and Part B * when you’re first eligible.

- There may also be Part A penalties if you have to pay a premium because you don’t qualify for Premium Free Part A along with having to wait to get your coverage.

- For more information see the Special Enrollment Periods) for when you lose Group Coverage!

- FAQ’s on should you enroll from Medicare.gov

- medicare.gov/working-past-65

- Medicare-Eligible Employees Pose HR Challenges SHRM

- Branden Benefits.com

-

We have seen a situation where the employee did not enroll in Medicare Part B thinking he had coverage through his company’s health insurance. A major medical event occurred and the health insurance company did not cover medical expenses that should have been covered by Medicare Part A & B. This left the employee with a large financial exposure.

The employer had been misinformed by the group health insurance agent who was not aware of the Medicare Part B requirement for companies with less than 20 employees.

-

- ca health advocates.org/other-health-insurance/employer-coverage

- medicare rights.org/Medicare-and-Current-Employer-Insurance-Scenario

- SCROLL DOWN for more information and details!

Just Turning 65? Less than 20 Employees

Enroll 1st in Medicare Parts A Hospital and B Dr. Visits

Then we can help you with Medi Gap, Part D Rx or Medicare Advantage

FAQ

Staying on Employer Plan — This question was asked a few years back, so the numbers might be old.

- I turned 65 a few months ago, I’m still working and I’ve stayed on my employers group plan.

- 1. If I cancel my current medical insurance, with my employer, then I guess I would need to sign up for Medicare part “B”, right?

- 2. My income probably falls into the first tier so there would be a premium of $205 +/-

- 3. Then I would need a Medicare Supplemental plan like my High Deductible F or Plan G so another premium of $xxx or so, right?

- 4. Then another supplemental Prescription Plan Part D with a premium of around $xxx

- 5. Also, my Granddaughter, whom I have legal custody of is on my group plan, so I would need to get individual coverage for her, right?

- 6. I believe that was around $350 for a plan Covered CA or direct I liked.

- 7. So I would end up with an estimated monthly expense of: Part B Medicare xxx Plan Hi F Medi Gap $xx Part D Rx $xxx Individual Plan for Grand daughter $350 For a total of xxx

- 8. On Medicare Part “B” how would she pay that premium? A. Monthly bank withdrawal?

- Answer

- 1. Yes

- 2. Correct. Here’s our page for Part B Premiums and the Surcharge on Part D

- Medi-Gap High F with Blue Shield is explained on our webpage here.

- Part D is explained in general on this page.

- 5 & 6. Coverage for dependents. You can get quotes here. We need to clarify on a case by case basis as to if an employer plan will cover dependents when the employee is covered by Medicare. In general, they will.

- 7 Yes, your calculations are correct. $350 for a young child gets you a platinum plan with Blue Shield.

- 8. Ways to pay Part B Medicare Dr. Visits are in the Medicare & You manual page 27 & 28

Medicare vs employer group when there are

#more than 20 employees

- If you have group health coverage based on your current employment (does NOT include COBRA!) you may be able to delay Part A and Part B and won’t have to pay a lifetime late enrollment penalty if you enroll later.

- Verify with your HR or benefits manager that you have minimum essential group health plan coverage as defined under 26 U.S. Code § 5000

- See Our webpage on the Employer Tax Deduction Section 106 for the premiums paid into a Group Health Plan.

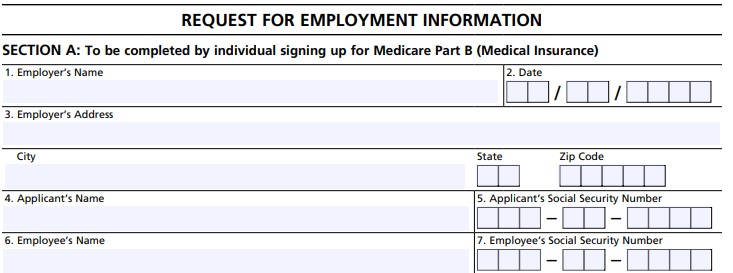

- When you retire and decide to go on Medicare, Medi Gap, Part D Rx, etc., will your employer be able to certify on form L564 E OMB No. 0938-0787 that you had qualifying Group Health Coverage. If your employer won’t or can’t fill out this form, what about your 1095 B Conformation of Employer Minimum Essential Coverage?

- Insurance ID Cards? Pay Stubs?

How you delay your Medicare coverage depends on your situation:

- If you’ll be getting benefits from Social Security or the Railroad Retirement Board (RRB) at least 4 months before you turn 65, you’ll automatically get Part A and Part B. You’ll get your red, white, and blue Medicare card in the mail 3 months before your 65th birthday.

- If you don’t want Part B, follow the instructions that came with the card. If you keep the card, you keep Part B and will pay Part B premiums.

- If you won’t be getting benefits from Social Security or the Railroad Retirement Board (RRB) at least 4 months before you turn 65, you don’t need to do anything when you turn 65.

- It’s illegal for an employer to offer any incentives to encourage you to take Medicare and drop the employer plan! Coremarkins * The Age Discrimination in Employment Act (ADEA) prohibits employers with 20 or more employees from cancelling group health coverage for current employees due to age, even when such employees become eligible for Medicare. SHRM *

Links, Resources & Bibliography

- Interactive Q & A from IRS on when to sign up for Medicare

- Centers for Medicare & Medicaid Services employer web page

- Fact Sheet: Medicare decisions for someone nearing age 65

- Fact Sheet: Deciding whether to enroll in Medicare Part A or Part B when you turn 65

- Fact Sheet: Medicare Decisions for Those Over 65 and Planning to Retire in the Next 6 Months

- See our module in the upper right on Should I get A & B?

FAQ’s

#Important

Let your Employer know you’re eligible for Medicare A & B

You must tell your employer if you are enrolled, or eligible to enroll, in Medicare (Part A and/or Part B coverage). Your boss is mandated to tell Medicare who is working there and is eligible for Medicare.

- cms.gov/Mandatory-Insurer-Reporting-For-Group-Health-Plans

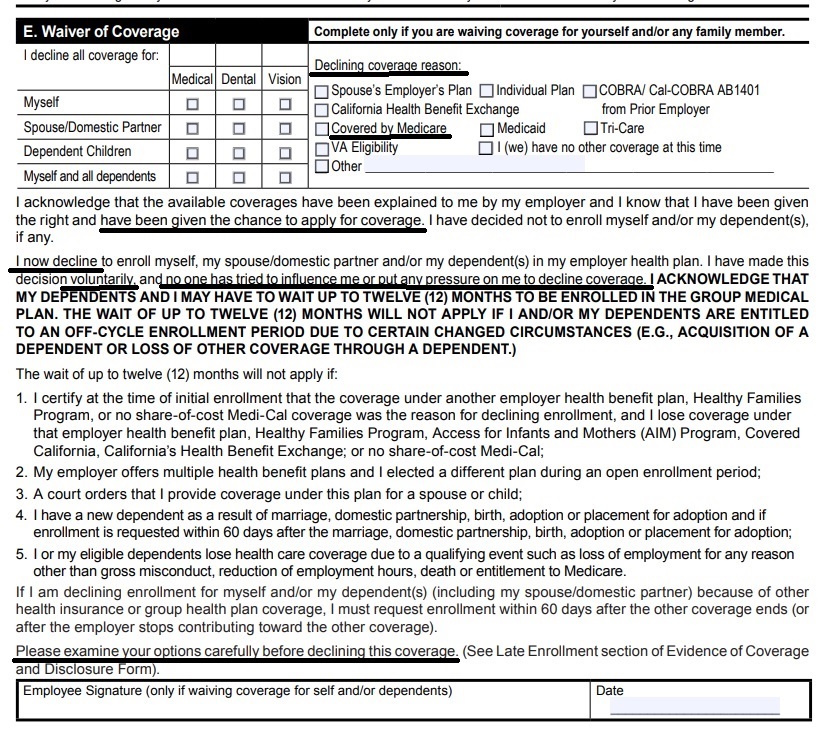

- Employee Enrollment Application – waiver form

FAQ

- If an employee goes onto Medicare, can his #dependents stay on the group Plan?

- Yes, for dependent to be covered, the term is ELIGIBLE employee, not enrolled employee

- I got a client an $18k REFUND by doing this!

- Employer Dependent Definition

- Blue Cross Group Administrator Manual

- See waiver of coverage above, just decline for the employee due to Medicare. Don’t decline for the dependents!

- Yes, for dependent to be covered, the term is ELIGIBLE employee, not enrolled employee

General Information on

- Medicare A Hospital

- Medicare B Dr. Visits

#Medicare10050 and You 2025

Spanish

Everything you want to know

- Steve's Video Seminar Introduction to Medicare & You

- Clear View to Medicare Patient Advocate.org - 36 pages

- Get Ready for Medicare * Spanish

***********

- Your Medicare #Benefits # 10116

- Inpatient ONLY - How Medicare Pays for your Surgery Part A vs Part B Very Well Health.com

- Enroll in Blue Cross

- Use our scheduler to Set a phone, Skype or Face to Face meeting

- #Intake Form - We can better prepare for the meeting (National Contracting Center)

- Get more information and FAQ's

- #Intake Form - We can better prepare for the meeting (National Contracting Center)

Medicare #DualCoverage

Publication - 02179

-

VIDEO how two plans coordinate and pay your claim.

- Medicare.Gov on how Medicare works with other insurance.

- Employer obligation to report # of employees to Medicare

- Explanation from Cal Broker Magazine Sept 2019

- Sample Small Employer Group Health Plan

- Medicare & Other Insurance CA Health Care Advocates Fact Sheet pdf

#Subrogation

Medicare's Right to collect from other Coverage

- You're Medicare Advantage plan has the right and responsibility to collect - subrogate for covered Medicare services for which Medicare is not the primary payer.

- According to CMS regulations at 42 CFR sections 422.108 and 423.462, Anthem MediBlue Access (PPO), as a Medicare Advantage organization, will exercise the same rights of recovery that the Secretary exercises under CMS regulations in subparts B through D of part 411 of 42 CFR and the rules established in this section supersede any state laws. Anthem MediBlue Access (PPO) Evidence of Coverage

- Medi-Cal (for People with Medicare) – 04-19-23 Hi Cap CA Health Care Advocates

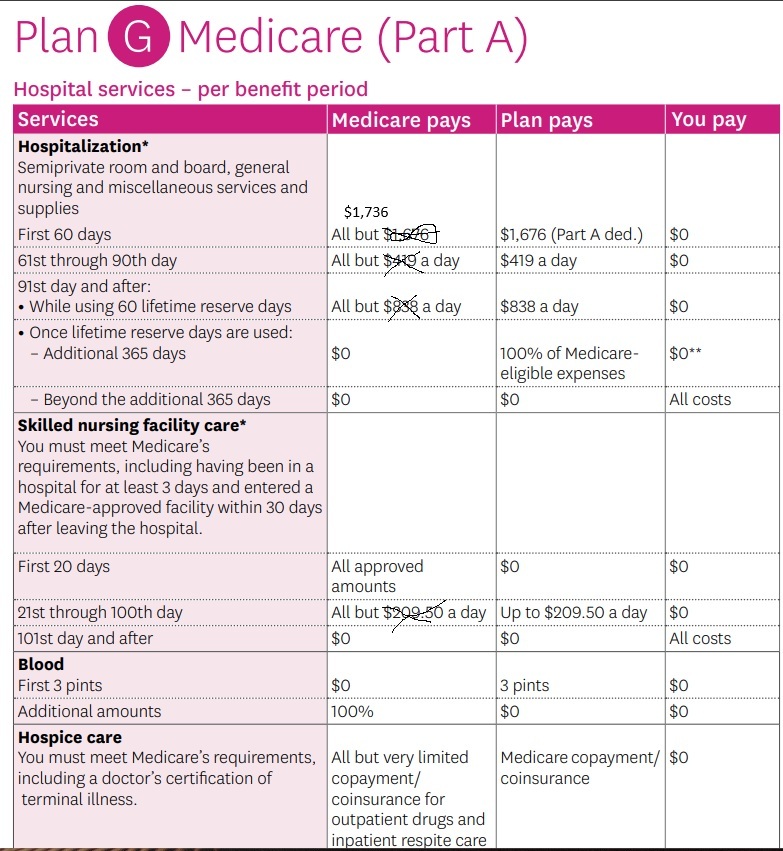

Medicare Part A

(#Hospital Insurance)

- Medicare Part A Hospital coverage helps pay for care in hospitals as an inpatient,... skilled nursing facilities, hospice care, and some home health care (see publication # 10969) but not Long Term Care.

- Most people get Part A automatically when they turn age 65 at no charge, since they or a spouse paid Medicare taxes while they were working. You need to sign up close to your 65th birthday, even if you will not be retired by that time. (If you are getting Social Security benefits when you turn 65, your Medicare Hospital Benefits - Part A - start automatically.)

- Here's a chart it's just a illustration and is NOT official that shows what Medicare pays, the gaps in Medicare and what you may get when you add a Medi Gap Plan or Medicare Advantage to cover those gaps

- Chart Updates 2026 Fact Sheet Medicare Costs Publication 11579

- . standard Part B monthly premium amount ($202.90 in 2026)

- Steve's VIDEO Explanation Comparing what Medicare pays and what you get extra with MAPD or Medi Gap

-

See full brochure I cut and pasted this from

-

- "Hospital at Home" Programs Improve Outcomes, Lower Costs But Face Resistance from Providers and Payers Commonwealth Fund

- Explanation from Fortune Magazine

- Price lookup from Medicare.gov on what you pay with Original Medicare without a Medi Gap plan

-

Pays on top of Medicare Parts A & B – Any Medicare Provider

- Steve's YouTube Video

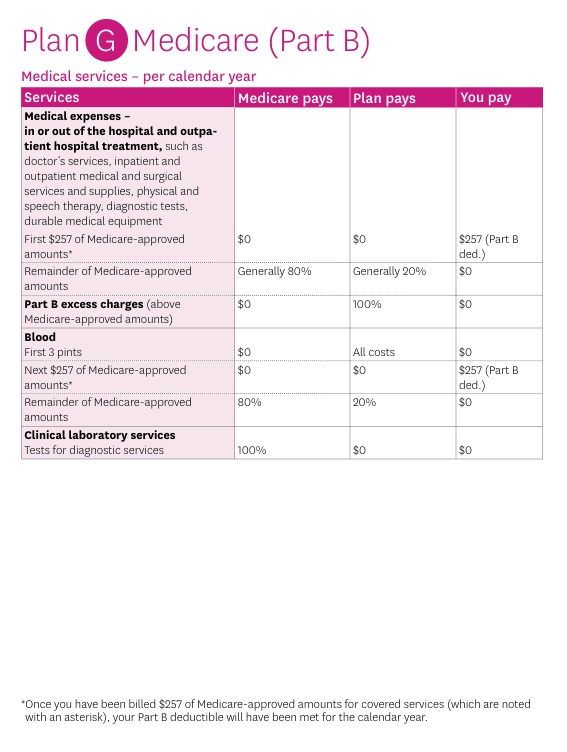

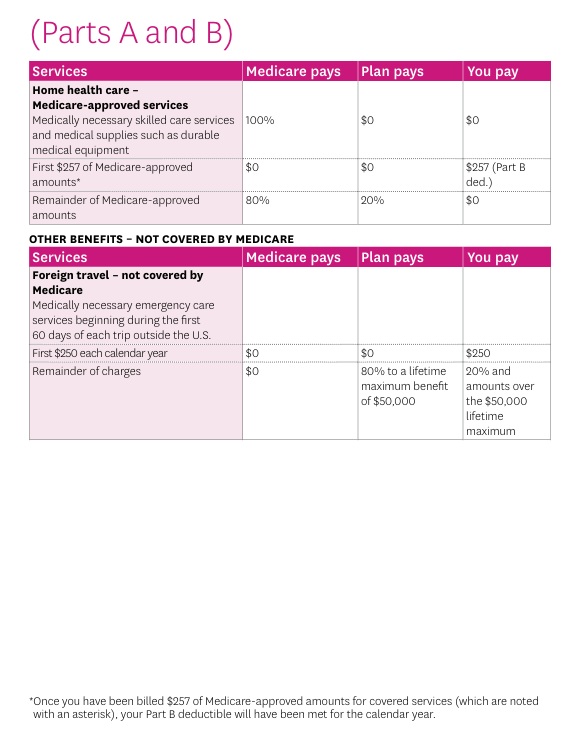

Part B - Outpatient helps Pay For Doctors' services, outpatient hospital care, and some other medical services that Part A does not cover, such as the services of physical and occupational therapists, and some home health care see publication 10969, but not Long Term Care. Part B helps pay for these covered services and supplies when they are medically necessary.

The chart below is a very brief summary. Check the actual Evidence of Coverage for the plan you want to enroll in, Medicare & You or actual Medicare documents.

2026 Part B deductible—$283 before Original Medicare starts to pay You pay this deductible once each year

Our Webpages with more detail:

- Coverage in Part A Hospital & B Doctor Visits? Part D Rx

- Chiropractic – Medicare A & B – MAPD

- Diabetes – Prevention & Coverage under Medicare & ACA

- Durable Medical Equipment

- End Stage Renal – Kidney Failure

- Hearing Aids

- Physical therapy – occupational speech

- Skilled Nursing SNF & Home Health What Medicare Pays

- Togetherness – Loneliness Social Determinants of Health

- Mental Health

- Blue Shield Mental Health Resource Hub >>> Visit *

- How to sign up for Medicare?

- FAQ Medical Necessity our Medical Necessity Webpage

- Original Medicare & Medi-Gap – Supplement vs Medicare Advantage MAPD

- Medicare Beneficiaries’ Out-of-Pocket Spending for Health Care

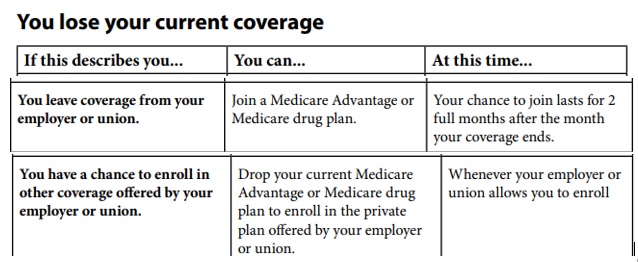

Special Enrollment Periods SEP

When you lose Employer Coverage

Special Enrollment Period SEP for Medicare Parts A & B

When you #lose or give up Group Health Coverage

Watch for the Deadlines!

When you retire, decide you don’t want or lose your employer coverage (COBRA doesn’t count! CA Health Care Advocates) you may then have an SEP Special Enrollment Period to enroll in Part B Doctor visits, without penalty.

- Special enrollment period Social Security Publication # 10012

- You can use an SEP to enroll in Medicare Part B while you’re still in a group health plan based on current employment. Also, if your employment ends or employer-provided medical coverage ends

- If you already have Part A Hospital, you can enroll online, or fill out the

- #application for Part B OMB No. 0938-1230 ! and the

- Certification from your Employer that you had Group Coverage OMB No. 0938-0787 – L564 E

- If the employer can’t fill it out, complete Section B of the form as best you can, but don’t sign it.

- You’ll need to submit proof of job-based health insurance.

- What forms of proof can I send?

- Income tax form that shows health insurance premiums paid

- W-2s showing pre-tax medical contributions

- Pay stubs showing health insurance premium deductions

- Health insurance cards with a policy effective date

- Explanations of benefits paid by the employer group health plan

- Statements or receipts that show payment of health insurance premiums

- You can apply online (at Social Security) – select “Already Enrolled in Medicare” from the menu.

- Or, fax or mail your forms to your local Social Security office. Medicare.gov *

- If the employer can’t fill it out, complete Section B of the form as best you can, but don’t sign it.

- This Special Enrollment Period also doesn’t apply if you have one of these:

- ■ End-Stage Renal Disease (ESRD)

- ■ Veterans Affairs and

- Individual Health Insurance Marketplace – Covered CA 11036-Enrolling-Medicare-Part-A-Part-B.pdf page 13

Introduction to #MediGap

Publication 02110

- 2025 Official Medicare Guide to choosing a Medi Gap Policy # 02110

- MORE Information and Links

- Matrix - Spreadsheet of what Medicare Pays, Medi Gap pays and what little you pay

When you enroll in Medi Gap beyond age 65 for Part B as you had

Qualifying #Employer Coverage

Termination of Employment or Retirement Plan

You have the right to purchase a Medi-gap policy for 6 months if your, your spouse’s or a family member’s current employment or retirement plan coverage terminates, or you lose your eligibility due to divorce or death of a spouse or family member.

The 6-month period to apply for a Medigap policy starts on the date you receive notice that your health benefits will end. If you do not receive advance notice, the 6-month period starts the date the benefits end or the date of your first denied claim. This protection of California law applies whether your group health benefits were primary or secondary to Medicare.

Our webpage on the pros & cons of Employer Coverage vs Medicare

Loss of COBRA or Cal Cobra

You are also entitled to this protection when you become eligible for COBRA (Our webpage on COBRA) or have used up all your COBRA benefits. It does not apply if you stop paying COBRA premiums before you use all your benefits. COBRA benefits are always secondary to Medicare benefits unless you have ESRD Renal Kidney Failure and are in a 30-month coordination period. For more information on COBRA, see Medicare & Other Health Insurance. CA HealthCare Advocates *

COBRA and Medicare are VERY VERY confusing. Double check with us [email protected] on your specific situation!!!

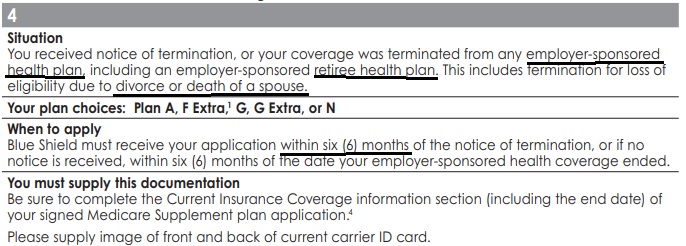

Situation 4 From Medi Gap Guaranteed Issue Guide

You received notice of termination, or your coverage was terminated from any employer-sponsored health plan, including an employer-sponsored retiree health plan. This includes termination for loss of eligibility due to divorce or death of a spouse.

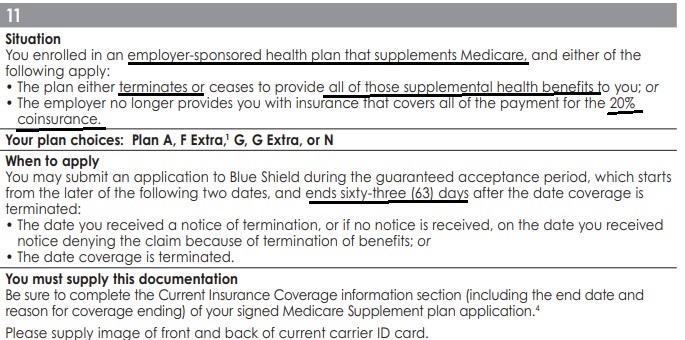

Situation 11 from Medi Gap Guaranteed Issue Guide

- You enrolled in an employer-sponsored health plan that supplements Medicare, §419 (e) Welfare Benefit Plans and either of the following apply:

- The plan either terminates or ceases to provide all of those supplemental health benefits to you; or

- The employer no longer provides you with insurance that covers all of the payment for the 20% coinsurance.

- Why is there Both situation 4 and 11?

- I asked and was told # 11 applies to §419 (e) Welfare Benefit Plans

- Learn More about not enrolling in Part B if you have employer coverage

- See our main page on loss of employer coverage

MAPD Medicare Advantage &

Part D Rx

#Understanding Medicare Advantage Plans (PDF) #12026

- Set a Zoom Meeting

- We can now do SOC Scope of Appointment, before the Meeting via a 3 minute recorded meeting 2 days before. AHIP Training Module 4 Page 14 *

- #Intake Form - Please email us [email protected] for the form - That way we can better analyze your situation to give you the answers to your needs and questions.

- Get Quotes, Full Information and Enroll

- MANDATED wording!: Think Advisor * ‘‘We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1–800–MEDICARE to get information on all of your options.’’

- We disagree with the above wording, as we can use the same tools on Medicare.gov as they do!

- Visit our general webpage on Medicare Advantage for much more detail and information.

Medicare Advantage Guaranteed Issue

When you lose Employer Coverage

Our webpage on Guaranteed Issue & Enrollment Periods for MAPD Medicare Advantage & Part D Rx

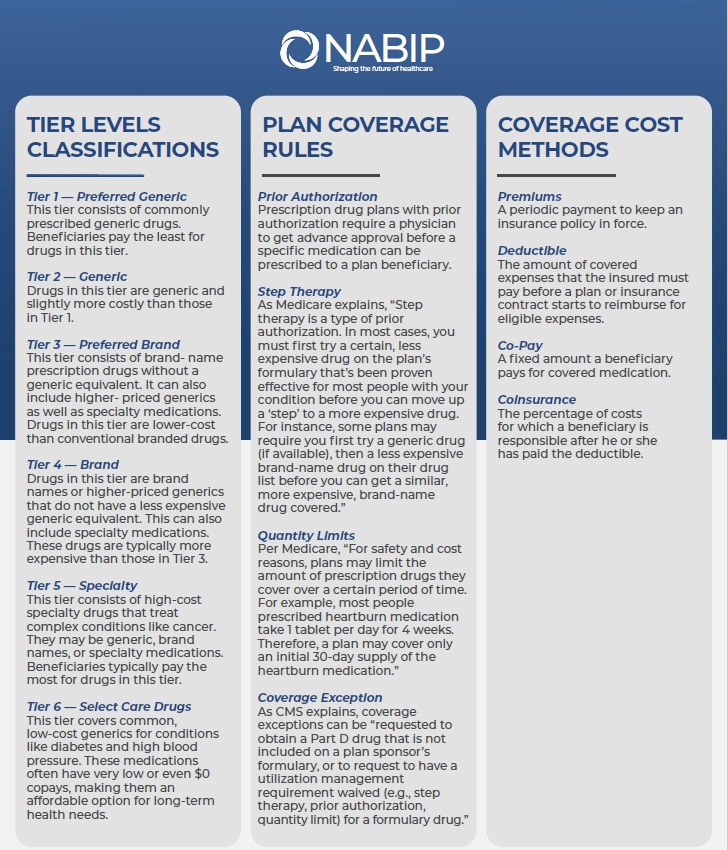

Prescription Drug 2025 #RxGuide

PDF # 11109

*****************

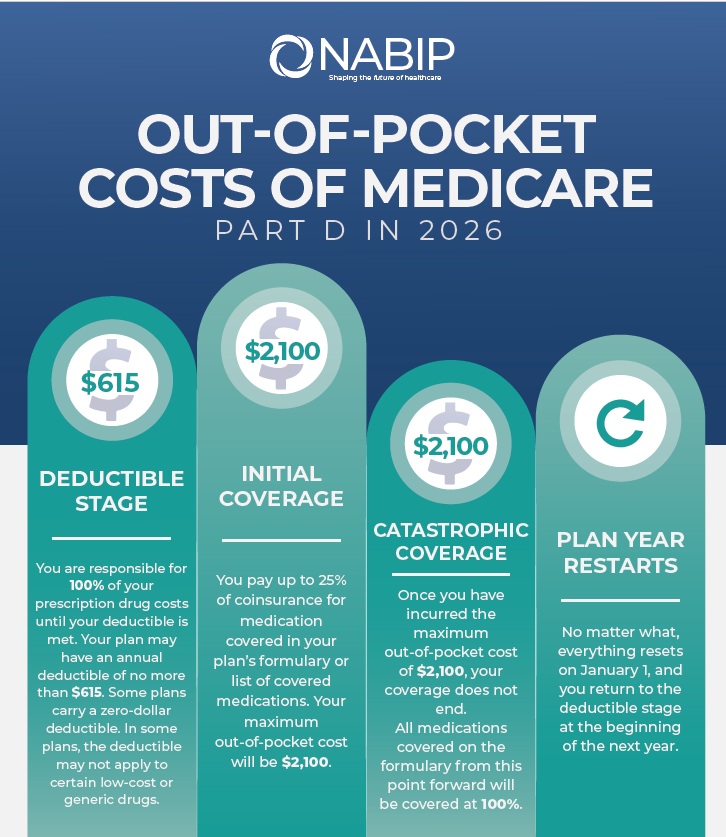

No more Coverage Gap - Donut Hole $2,100 Cap

******************

- Medicare Part D Rx premiums can be found on Medicare . Gov See instructions on how to shop premiums.

- Scope of appointment - permission to discuss Rx and MAPD Plans

- Our Webpage Premiums for those with High Income Parts D Rx & B Doctor Visits

- Medicare Rules for High Income People Medicare Costs # 11579

- Our #High Income Surcharge Video Explanation

- Kaiser Foundation Introduction - Overview

- Fact Sheet Medicare Part D CA Health Care Advocates Hi Cap

-

. Prescription Drugs Hi Cap

- Medicare Part D: An Overview – 10-31-23

- Prescription Drug Resources – 11-07-22

- When Your Part D Prescription is Denied– 11-22-22

- Shop & Compare Tools Part D Rx

- Get Instant Quotes, Information & Enroll online

- See our web page on Part D Shop & Compare for more information & FAQ's

- MANDATED wording!: ‘‘We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1–800–MEDICARE to get information on all of your options.’’ § 422.2267(e)(41).

- We disagree with the above wording, as we can use the same tools on Medicare.gov as they do!

Miscellaneous

Just Enter your census or securely send us an excel spreadsheet or a list of employees and get instant proposals

for all these companies that we are Authorized Agents for in California

FAQ’s

Please note, some of the answers may be old… check with us [email protected]

- I’ve retired early, I’m not 65 yet What do I do for Health – Medical Insurance?

- ***There are plenty of Health Plans in the Individual Market. Get quotes here.

- If your MAGI income is below 400% of Federal Poverty Level you may even qualify for subsidies – tax credits. Get a complementary quote, benefits, rates & subsidy calculation for California here.

- If you are 62+ and getting Social Security some of your Social Security is taxable and counts towards MAGI income for subsidies.

- If you are disabled, you get Medicare after two years of SSDI. If you can really live on a budget or are unfortunately forced to, there is Medi-Cal if you are under 138% of Federal Poverty Level. We don’t get paid to help you with that, so just contact Medi-Cal directly. Benefits cal.com/ Check out the Retirement Section of our website.

- ***There are plenty of Health Plans in the Individual Market. Get quotes here.

- Are Medigap policies written during the 8-month Special Enrollment Period issued subject to the same terms as terms, with regard to pre-existing conditions, as those written during the Initial Enrollment Period?

- ***We will answer your question on our Medi Gap Guaranteed Issue page.

- How do I show Medicare that I had qualifying employer coverage?

- See above under SEP Special Enrollment when you lose Group Coverage

- What Happens If I Don’t Take Part B as Soon as I’m Eligible?

- ***If you do not enroll in Medicare Part B during your initial enrollment period, you must wait for the general enrollment period (January 1- March 31 of each year) to enroll, and Part B coverage If you wait 12 months or more, after first becoming eligible, your Part B premium will go up 10 percent for each 12 months that you could have had Part B but didn’t take it. You will pay the extra 10 percent for as long as you have Part B.

- If you didn’t take Part B at age 65 because you were covered under as an active employee (or you were covered under your spouse’s group health insurance plan and he/she was an active employee), you may sign up for Part B (generally without an increased premium) within 8 months from the time you or your spouse stop working or are no longer covered by the group plan. You also can sign up at any time while you are covered by the group plan. opm.gov/medicare-part-b-coverage/

- This is a wonderful service you’re providing and I will be sure to refer my friends to you for their insurance needs.

- ***Thank you

- I’m disabled and covered under my Dad’s retirement plan. I just qualified for Medicare. Must I enroll in Part B or can that be postponed as I have employer coverage?

- What about? Medi Cal? Aged & Disabled Program? Are there programs to pay the Part B Doctor Visits and Part D Rx.

- Yes, disabled people can be covered under their parents coverage

- Check these links:

- Medicare Part B Forgiveness

- ca.db101.org/medicare/program

- Aged and Disabled Federal Poverty Level Program

- Dual Coverage? Medi Cal, Employer Group, Individual, Cal Medi Connect & Medicare.

- FAQ on Medicare.gov

Anthem Medicare Supplement - Get Quotes, Information and ONLINE Enrollment - No extra charge for our help

Links, References & Resources

official Medicare link to enroll in Medicare Part A Hospitalization and Part B Doctor Visits.

Learn More ===>

- Medicare.gov – should I get part B?

- Publication 11036 Enrolling in Parts A & B and

- Medicare & You #10050

- Can you postpone Part A enrollment if you are covered under a Employer Group Plan?

- Early Retirement – What Health Insurance?

- Transitioning from Employer Group Coverage to Medicare

- Dual Coverage?

- the horses mouth on if you should get Part B Doctor Visits, how to enroll, COBRA Traps, etc.

- Medicare Eligibility & Premium Calculator Tool

- Part B Late Enrollment Penalty

- PBS News Hour FAQ’s Employer vs Medicare