How & When does one enroll, sign up for Medicare ONLINE?

Part A – Hospital, usually for no premium and

It's best to enroll in Medicare A & B 3 months #before you turn 65

- You can only sign up for Part B (and/or Part A if you have to buy it) during these enrollment periods. The most common one is:

- Initial Enrollment Period

- Generally, you can first sign up for Part A and/or Part B during the 7-month period that begins 3 months before the month you turn 65 and

- ends 3 months after the month you turn 65.

- We cannot stress enough how important it is to sign up three months before, this gives Medicare more time to enroll you. I've seen a lot of people get all messed up.

- If your birthday is on the first of the month, your 7-month period starts 4 months before the month you turn 65 and ends 2 months after the month you turn 65. Example: If you turn 65 on June 2, your 7-month period would begin in March and end in September. If you turn 65 on June 1, your 7-month period would begin in February and end in August. If you sign up for Part A and/or Part B during the first 3 months of your Initial Enrollment Period, in most cases, your coverage begins the first day of your birthday month. However, if your birthday is on the first day of the month, your coverage starts the first day of the prior month. If you sign up the month you turn 65 or during the last 3 months of your Initial Enrollment Period, your coverage starts the first day of the month after you sign up. Medicare & You * Medicare.Gov on when coverage starts

- Consolidated Appropriations Act, 2021 to starting January 1, 2023 change the effective date to the month after enrollment! If you're late. CMS.Gov Fact Sheet * Proposed Rule *

- Be sure to work on your Enrollment in Parts A & B as soon as your eligible to do so, 3 months before your birthday. We will NOT take the flack if you run into SNAFU's. Like not getting coverage when you are supposed to or getting a 5 month bill for part B. Some brokers make you sign this form, if you don't enroll early.

- Video from HHS.Gov on Initial Enrollment Period

- Use this Medicare tool to Find out when you’re eligible for Medicare.

- The best time to sign up is 3 months before your 65th birthday and coverage will start on the 1st of the month of your birthday. Be sure to let your prior carrier know at least 30 days in advance that you have new coverage and want to cancel. Especially if it's Covered CA! That way you don't have double premiums and duplicate coverage.

- Once you enroll in Medicare A & B, Part D or MAPD or Medi Gap, generally everything is on automatic renewal. You don't have to reenroll every year. You can shop and compare if you want...

- Initial Enrollment Period

- Enroll ONLINE for Medicare Part A Hospital & B Doctor Visits

- Scroll down for more information, details and learning

- What’s on this page?

Visit the Official Medicare/Social Security

ONLINE enrollment website

Scroll down or visit our main Medicare Enrollment Page for more information

on how to apply, what the coverages are, what your options are

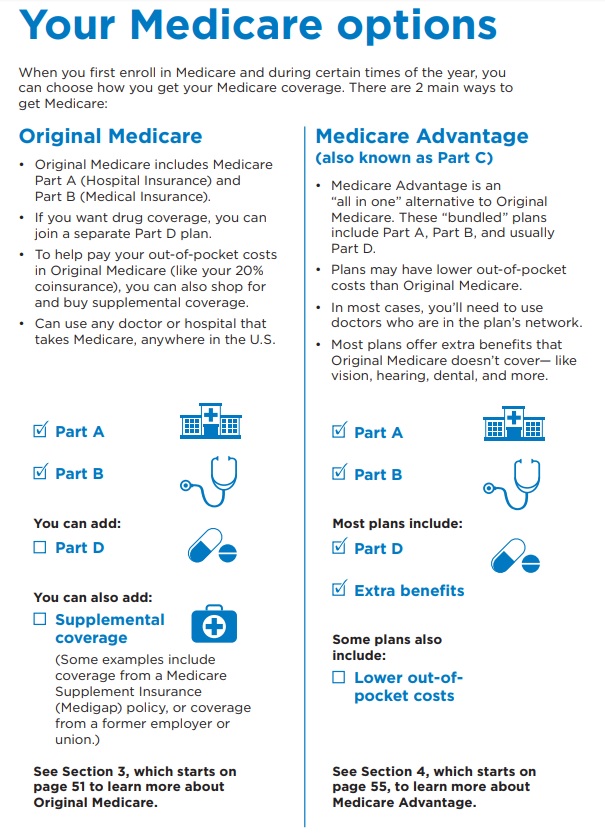

What plan choices Parts are there for Medicare?

Medicare #Choices - from Medicare & You 10050

Once you have your Medicare ID # you can then add Medi Gap, Part D Rx or Medicare Advantage

The below graphic is from Medicare & You 10050 See more detail there |

|

Wed, 24 Dec 2008

Steve,

I was looking for some specific Medicare information and found your site on Google.

You have a great site. It is very informative without a lot of meaningless information.

I thought I’d tell you that. I think I am glad you are not in my area. I’d hate to have you as a competitor.

Best regards,

Mark A. Squires.

Principal

Squires. and Associates

Independence MO

Enrollment Details – How to

How to #Apply - sign up ONLINE for Medicare Part A & B

Publication # 10530

Applying for Part B ONLY?

- If you already have Part A, you can’t enroll online. In the past you had to fill out form OMB No. 0938-1230 ! So, Try ONLINE first, things have been updated

- You can mail it in, but be sure to follow up that Social Security has the form. If not, go to your local Social Security Office and enroll. Make sure you get a receipt!

- Please note also, that it’s been reported that your Social Security number is required, even though there is NO PLACE on the form for it!

- If you're enrolling past age 65, use CMS form to fill out L 564 E to prove you had Employer Coverage and get a special enrollment period, when you retire. VIDEO

Should you start taking Social Security too?

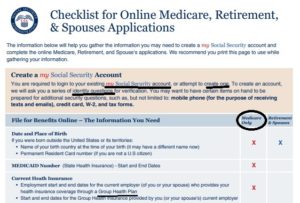

Screen Shot of Medicare's Enrollment Site

Checklist of what information you need to enroll

- Direct Link to Medicare's Enrollment Website

- Medicare's Video on how to enroll on their site

- medicare.gov get-started-with-medicare

- Paper Application Part A Hospital

Our webpages on:

- enrolling online

- creating a Social Security Account

- Which will also let you know sooner, that you've been approved!

- When to Start Receiving Retirement Benefits

FAQ's

Open up FAQ’s below for answers

I went to Social Security and got all signed up. Now they say they have a record of me being there, but no record of signing up. What do I do?

disability secrets.com/social-security-office-lost-my-appeal-paperwork-what-do-i

We did have a client who reported that her local Congressperson helped her out and got the problem resolved.

- house.gov/find-your-representative

-

nytimes.com/how-senators-and-representatives-can-help-constituents

I won’t have 40 quarters until I’m 68. When is my initial enrollment period? I don’t want any penalties.

Use this tool to determine when you are eligible for Medicare.

Your Initial Enrollment Period based on your age

Your Initial Enrollment Period based on your age contextual help

October 1, 2019 – April 30, 2020

Am I eligible to enroll?

Medicare is for people age 65 and older and those who have special condition or disability. You’re not eligible to enroll in Medicare now because you don’t meet the special condition/disability requirements.

If you’re a U.S. citizen or you meet the lawful presence and residency requirements, the Initial Enrollment Period (IEP) is your first chance to sign up for Medicare. It starts 3 months before your 65th birthday, includes the month you turn 65, and ends 3 months after the month you turn 65.

Sign up for Medicare

Costs for Medicare since you won’t get it for free…

Costs for Medicare… How does that compare to the under 65 plan you have now?

What if I have Employer Coverage?

See our webpage on that

- Medicare enrollment, if covered by Employer Plan? Retiring?

Just to make sure, is renewal automatic?

Yes, everything Parts A Hospital, B Doctor Visits, Medi Gap, Medicare Advantage and Part D Rx automatically renew.

I’m having trouble finding citable sources. I don’t count other agent websites, as it seems I’m the only one, who cites a source.

https://www.medicare.gov/pubs/pdf/10050-medicare-and-you.pdf

Didn’t you get a January bill for Parts A & B? Just pay it.

Does your prior coverage before enrolling in Parts A & B have anything to do with the coverage you will receive?

Part B Doctor Visits is exactly the same for everyone.

To get the “best” greatest selection of MD and providers you would want to sign up for a Medi Gap plan. Plan F has the most comprehensive benefits. This would be most similar to PPO and not the restrictive provider lists in a Medicare Advantage Plan (MAPD). MAPD though generally has zero premium.

If you are thinking of keeping your COBRA beyond age 65 and not getting Part B, that won’t work, see Medicare Publication 11036 Enrolling in A & B page 13.

See link above to use our Blue Cross and Blue Shield affiliate sites to view benefits, pricing and enroll online. We also have tons of detail on each page in our website.

Where and how do I shop all the Insurance Companies to get the best coverage and premium for Part B Doctor Visits?

The Federal Government – Medicare is the ONLY place to get Part B Dr Visits. I guess one could argue though that if they have employer coverage available, that would be “Part B.”

Some people might get confused though, thinking Medicare Advantage is giving them their Parts A & B…

The decisions on getting Part D Prescriptions, Medi Gap or Medicare Advantage are separate and give you additional coverage on top of Medicare Part A Hospital and Part B Dr. Visits.

Probably the first decision is if you want a Medi Gap Plan which allows you to go to any MD or Hospital that accepts Medicare, which most do or a Medicare Advantage plan with oftentimes zero premium.

Here’s our web page on helping you make that decision

Our page on how most all doctors take Medicare and if they don’t the limit on what they can charge over Medicare allowance and how if they don’t take Medicare at all, they must have you sign a form that you understand that.

How to create a

My #SocialSecurity.Gov & My Medicare.Gov Account on SSA.gov

- Create ONLINE Account Publication # 10540 pdf

- VIDEO on advantages and saving time by creating a Social Security Account

- Our webpage on how to create a Social Security and My Medicare Account

- You need a Social Security Account Enroll ONLINE for Medicare Part A Hospital & B Doctor Visits.

- Create Social Security Account Here

-

Get estimates of future benefits based on your actual earnings, see your latest Statement, and review your earnings history.

- What can you do with a my Social Security account? pdf # 10121

- Check your application status

- explanation of benefits for recent MRI and X rays, copies of bills, Etc?

- Set up or change direct deposit

- Request a replacement Social Security card

- Get a Social Security 1099 (SSA-1099) form

- Get a proof of income letter

- Change your address

- Get New ID Cards?

- SSA 3288 Social Security - Authorization to release information

- Call Social Security at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, 8:00 am – 7:00 pm. At the voice prompt, say “helpdesk”; SSA FAQ’s

- Survivor Benefits?

- Email Social Security

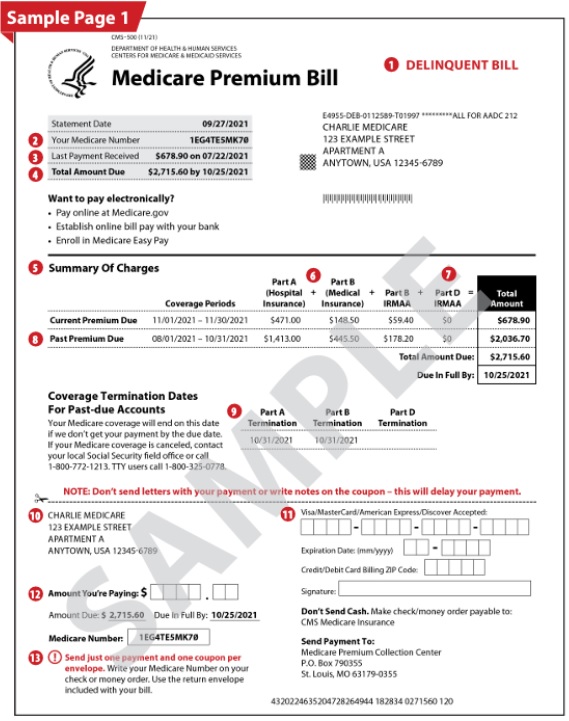

- Sample Medicare Bill

Resources & Links

Medicare has done an excellent job of explaining how and when to enroll in their:

- Guide Medicare & You,

- Publication 11036 Enrolling in Parts A & B,

- CA Health Line 10.27.2016

- Washington Post on how to figure out Medicare and choose the correct plan

- Information you need to have to apply for Medicare or Social Security

- What Documents Do You Need to Apply for Retirement Benefits?

- Seniors Find Medicare Enrollment Confusing, Avoid Changing Plans

BROKER ONLY

Medi-Cal & Medicare Lookup Jarvis

Should I apply for Part B Out Patient now?

Medicare Part B Out of Hospital

#Late Enrollment Penalty

- In most cases, if you don’t sign up for Part B when you’re first eligible, (FAQ Calculate the dates) for Medicare, during the 7-month Initial Enrollment Period to sign up for Part A and/or Part B. you’ll have to pay a late enrollment penalty. You’ll have to pay this penalty for as long as you have Part B.

- Your monthly premium for Part B may go up 10% for each full 12-month period that you could have had Part B, but didn’t sign up for it. Medicare.Gov *

- Medicare Initial Enrollment, Part B late penalty, high income surcharge Eligibility & Premium Calculator

- See our webpage on Part B Late Enrollment Penalty, how to avoid and how to calculate the penalty

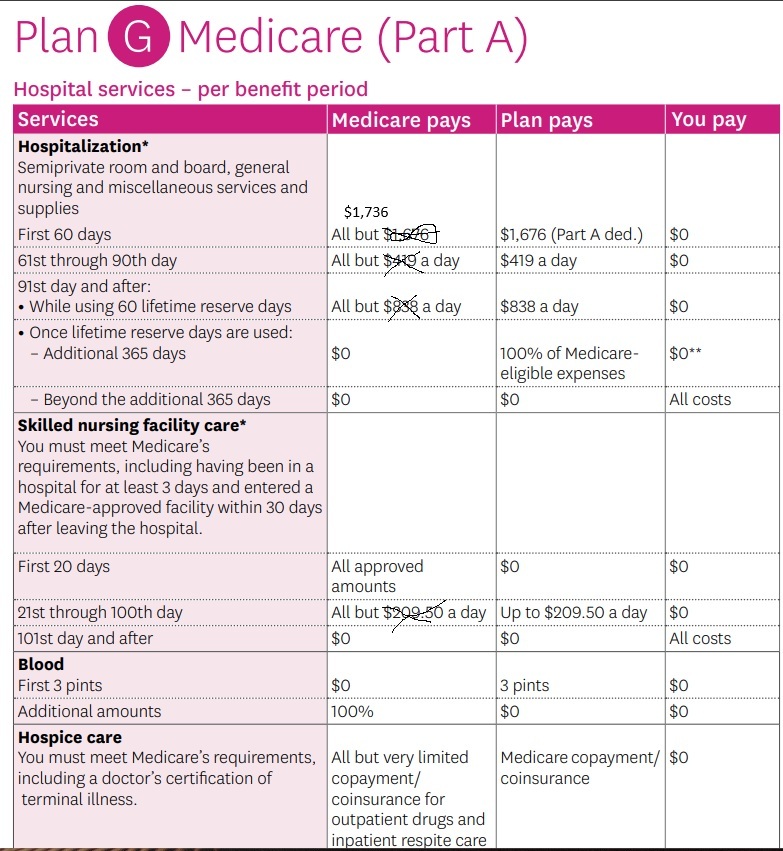

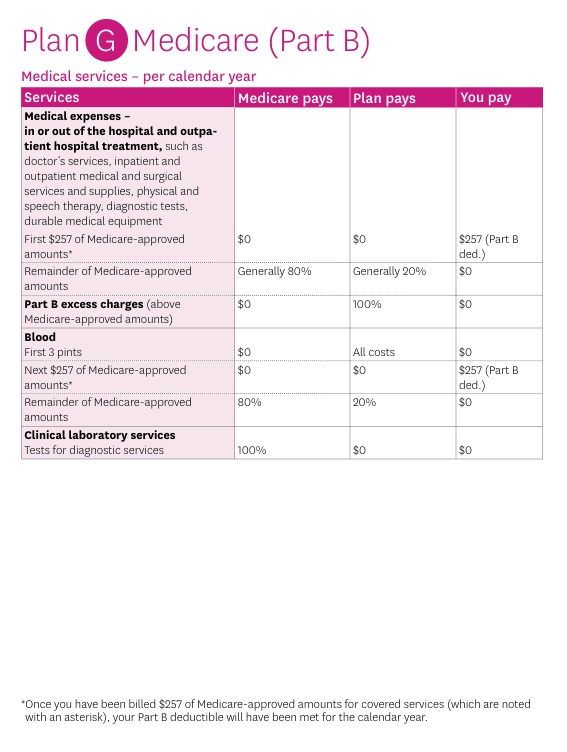

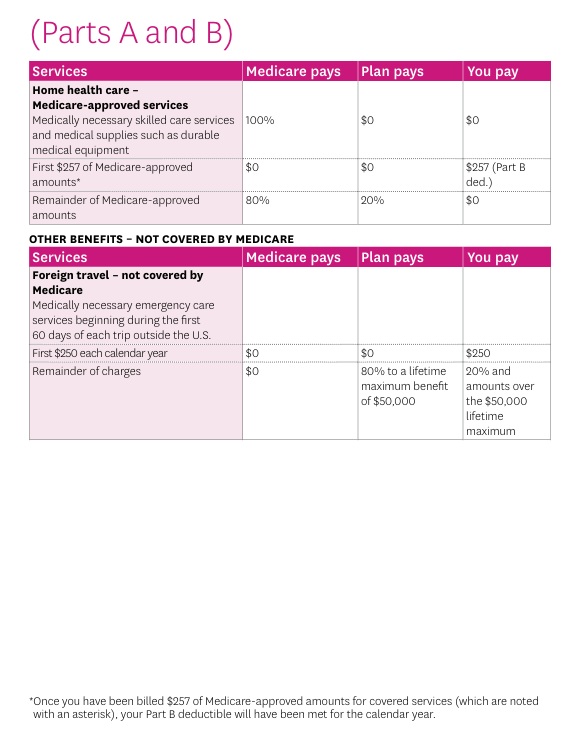

What is covered under Part A Hospital &

Part B Out Patient

Medicare Part A

(#Hospital Insurance)

- Medicare Part A Hospital coverage helps pay for care in hospitals as an inpatient,... skilled nursing facilities, hospice care, and some home health care (see publication # 10969) but not Long Term Care.

- Most people get Part A automatically when they turn age 65 at no charge, since they or a spouse paid Medicare taxes while they were working. You need to sign up close to your 65th birthday, even if you will not be retired by that time. (If you are getting Social Security benefits when you turn 65, your Medicare Hospital Benefits - Part A - start automatically.)

- Here's a chart it's just a illustration and is NOT official that shows what Medicare pays, the gaps in Medicare and what you may get when you add a Medi Gap Plan or Medicare Advantage to cover those gaps

- Chart Updates 2026 Fact Sheet Medicare Costs Publication 11579

- . standard Part B monthly premium amount ($202.90 in 2026)

- Steve's VIDEO Explanation Comparing what Medicare pays and what you get extra with MAPD or Medi Gap

-

See full brochure I cut and pasted this from

-

- "Hospital at Home" Programs Improve Outcomes, Lower Costs But Face Resistance from Providers and Payers Commonwealth Fund

- Explanation from Fortune Magazine

- Price lookup from Medicare.gov on what you pay with Original Medicare without a Medi Gap plan

-

Pays on top of Medicare Parts A & B – Any Medicare Provider

- Steve's YouTube Video

Part B - Outpatient helps Pay For Doctors' services, outpatient hospital care, and some other medical services that Part A does not cover, such as the services of physical and occupational therapists, and some home health care see publication 10969, but not Long Term Care. Part B helps pay for these covered services and supplies when they are medically necessary.

The chart below is a very brief summary. Check the actual Evidence of Coverage for the plan you want to enroll in, Medicare & You or actual Medicare documents.

2026 Part B deductible—$283 before Original Medicare starts to pay You pay this deductible once each year

Our Webpages with more detail:

- Coverage in Part A Hospital & B Doctor Visits? Part D Rx

- Chiropractic – Medicare A & B – MAPD

- Diabetes – Prevention & Coverage under Medicare & ACA

- Durable Medical Equipment

- End Stage Renal – Kidney Failure

- Hearing Aids

- Physical therapy – occupational speech

- Skilled Nursing SNF & Home Health What Medicare Pays

- Togetherness – Loneliness Social Determinants of Health

- Mental Health

- Blue Shield Mental Health Resource Hub >>> Visit *

- How to sign up for Medicare?

- FAQ Medical Necessity our Medical Necessity Webpage

- Original Medicare & Medi-Gap – Supplement vs Medicare Advantage MAPD

- Medicare Beneficiaries’ Out-of-Pocket Spending for Health Care

- Official Medicare Brochures

- Introduction to Medicare

- How to purchase Medi Gap

- Part D Rx

- Understanding Medicare Advantage

#Understanding Medicare Advantage Plans (PDF) #12026

- Set a Zoom Meeting

- We can now do SOC Scope of Appointment, before the Meeting via a 3 minute recorded meeting 2 days before. AHIP Training Module 4 Page 14 *

- #Intake Form - Please email us [email protected] for the form - That way we can better analyze your situation to give you the answers to your needs and questions.

- Get Quotes, Full Information and Enroll

- MANDATED wording!: Think Advisor * ‘‘We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1–800–MEDICARE to get information on all of your options.’’

- We disagree with the above wording, as we can use the same tools on Medicare.gov as they do!

- Visit our general webpage on Medicare Advantage for much more detail and information.

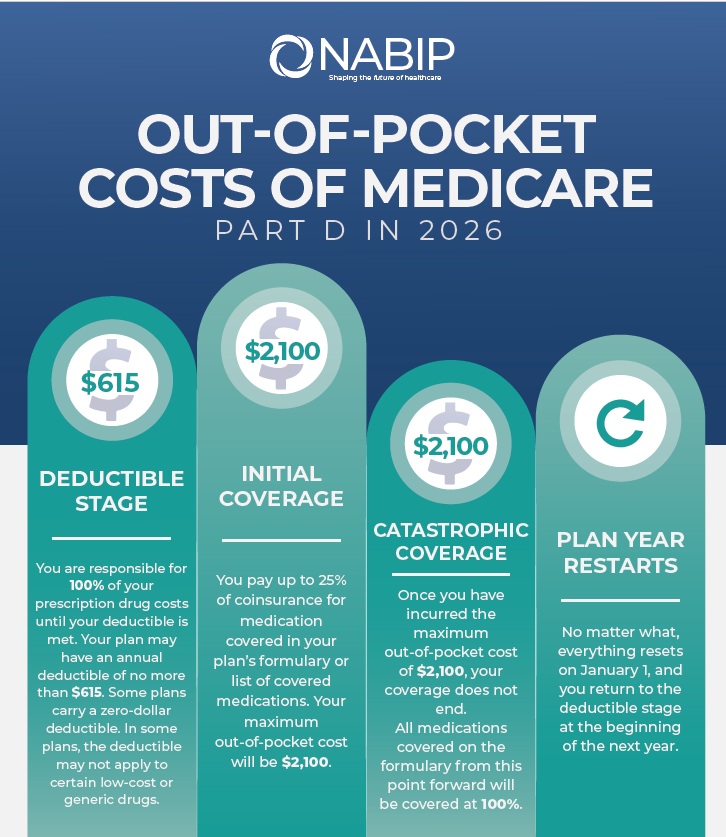

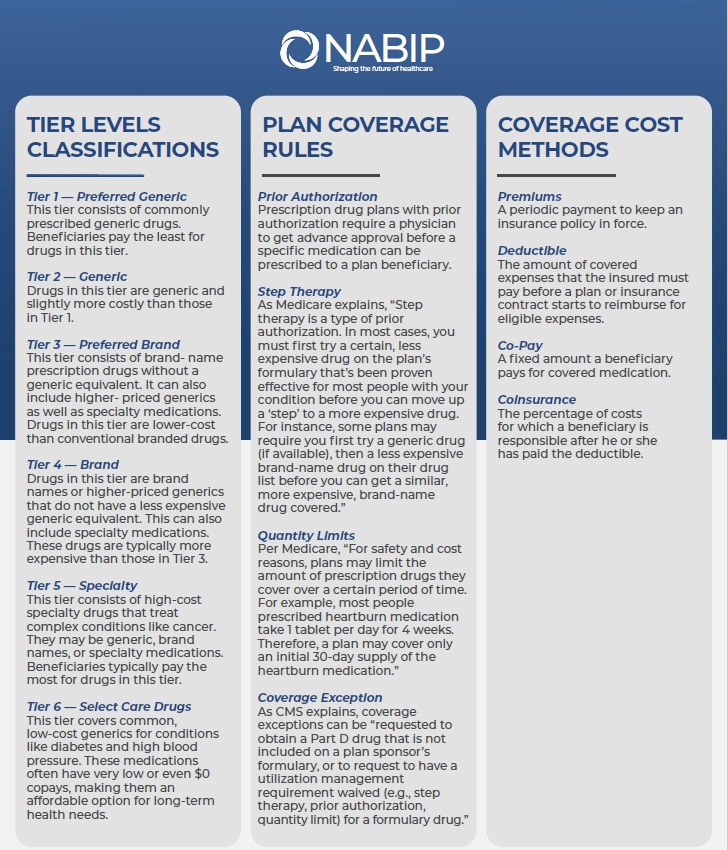

Prescription Drug 2025 #RxGuide

PDF # 11109

*****************

No more Coverage Gap - Donut Hole $2,100 Cap

******************

- Medicare Part D Rx premiums can be found on Medicare . Gov See instructions on how to shop premiums.

- Scope of appointment - permission to discuss Rx and MAPD Plans

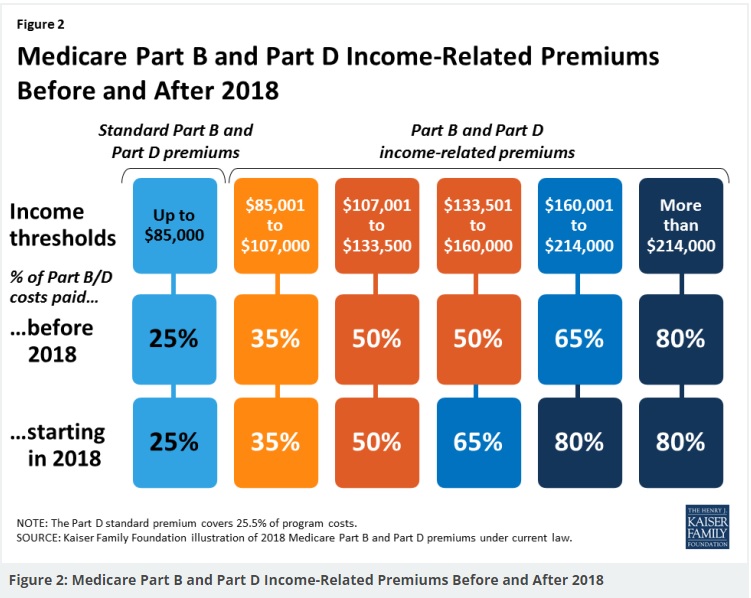

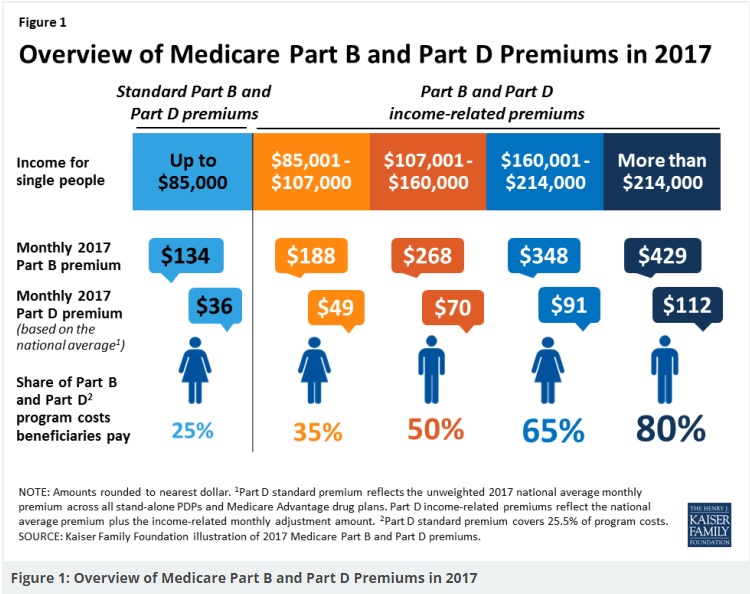

- Our Webpage Premiums for those with High Income Parts D Rx & B Doctor Visits

- Medicare Rules for High Income People Medicare Costs # 11579

- Our #High Income Surcharge Video Explanation

- Kaiser Foundation Introduction - Overview

- Fact Sheet Medicare Part D CA Health Care Advocates Hi Cap

-

. Prescription Drugs Hi Cap

- Medicare Part D: An Overview – 10-31-23

- Prescription Drug Resources – 11-07-22

- When Your Part D Prescription is Denied– 11-22-22

- Shop & Compare Tools Part D Rx

- Get Instant Quotes, Information & Enroll online

- See our web page on Part D Shop & Compare for more information & FAQ's

- MANDATED wording!: ‘‘We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1–800–MEDICARE to get information on all of your options.’’ § 422.2267(e)(41).

- We disagree with the above wording, as we can use the same tools on Medicare.gov as they do!

#Medicare10050 and You 2025

Spanish

Everything you want to know

- Steve's Video Seminar Introduction to Medicare & You

- Clear View to Medicare Patient Advocate.org - 36 pages

- Get Ready for Medicare * Spanish

***********

- Your Medicare #Benefits # 10116

- Inpatient ONLY - How Medicare Pays for your Surgery Part A vs Part B Very Well Health.com

- Enroll in Blue Cross

- Use our scheduler to Set a phone, Skype or Face to Face meeting

- #Intake Form - We can better prepare for the meeting (National Contracting Center)

- #Intake Form - We can better prepare for the meeting (National Contracting Center)

- Get more information and FAQ's

Understanding your Medicare Premium Bill

- Medicare has more detail on your billing statement at these links on the Internet:

- medicare.gov/11659-understanding-cms-500-trifold

- hhs.gov/11659-understanding-cms-500

- Medicare Premium Bill CMS 500

- cms.gov/cms 500

- medicare.gov/11659-understanding-cms-500-trifold

- Steve's YouTube VIDEO to explain late payments...

- What are the payment options to pay the Part B Premium?

- medicare.gov/How to pay Part B premiums and when

- What if you pay Medicare late?

- For Original Medicare (parts A and B), Medicare sends a person an initial bill. If you pay it late, you will get a second bill, which includes the past-due premium amount and the premium that is due the following month.

- If a person does not pay the second bill by the 25th day of the month, they will receive a Delinquent Bill. People who do not pay the Delinquent Bill by the 25th day of the next month will lose their Medicare coverage.

- Basically, you may get your first bill for 4 or 5 months. After that it's monthly if taken from your Social Security Check and quarterly if you get a bill via USPS mail.

- Coverage Termination Date: You’ll only see this notification if your payment is 90 days past due. If you don’t pay the full balance of the “Total Amount Due” by the “Due In Full By” date, your Medicare coverage will be terminated.

- Easy Pay Premium Statement CMS 20143

- Medicare Premium Bill CMS 500

- Why is my first bill higher than I expected?

- After you sign up for Medicare, your first bill might include premiums owed for previous months not already billed. That means the bill might be higher than you expected.For example:

- If you sign up for Medicare in February and your coverage begins February 1st, your premium will be billed quarterly, and your first bill will be dated March 28. It will arrive around April 10 and be due April 25. This bill will be for the upcoming 3 months and include any premiums you weren't previously billed for.

- That means your first bill would include the previous amount owed (for February, March, and April) and what you owe for the upcoming 3 months (May, June, and July). Moving forward, your future bills will only be for 3 months at a time. Learn More>>> Medicare.gov

- After you sign up for Medicare, your first bill might include premiums owed for previous months not already billed. That means the bill might be higher than you expected.For example:

- Why did the Part B premium go up to $170? in 2022 Los Angeles Times

- Live Chat with Medicare - Call 1 800 Medicare

Why isn’t it Free?

I paid taxes all my life!

Blue Shield of California Authorized Agent - Broker

![]()

FAQ’s, Misc and Historical

FAQ’s

- I am trying to get my Mom on Medicare part A. She is on part B but not part A. How can I get this done?

. - Did your Mom or Dad work over 10 years in the USA and pay into Medicare?

- Here’s our webpage on the rules if they have to pay a premium, if they don’t have enough credits

- Why didn’t your Mom sign up for Part A previously?

- When was she first eligible for Part A?

- There are monetary penalties for late enrollment.

- Please send the details to the questions above, the answer is not as simple as the question seems. Let us get you the correct information, based on your situation.

- You might have to wait for the General Enrollment Period, if you have to pay for Part A Hospital?

- How about checking our website and getting information on Medicare Advantage or Medi Gap. We can help you enroll with no extra charge for our expertise.

.

.

- My husband turns 65 in November. I’m 61. How does that affect my Covered CA coverage and subsidies? How does that affect our MAGI income? All the income is in his name! Does that mean I’ll have to be on Medi Cal as I won’t show any income?

. - Covered CA rules mandate that married people file jointly.

- Thus, your MAGI income doesn’t matter whose name it is in.

- Web visitors can get quotes here.

- I’ll send you a private email with quotes, just for you with Covered CA

.

.

- Because my 65th birthday is 10/17/2019, today I submitted an online application for Medicare. What’s next?

. - Thank you so much for submitting your enrollment in Medicare A & B on the very first day that one is able too. 3 months before the month one turns 65. See our webpage above for more explanation. There are often SNAFU’s – Situation Normal All Fouled Up that can cause a lot of grief, worry and delays.

- Did you get a receipt or confirmation that you submitted your application?

- Click here to the links and instructions to get an ONLINE Social Security and Medicare Account so that you can track your progress of getting enrolled into Medicare A & B.

- One can always just wait till Medicare sends your ID card…

- Once you have your Medicare ID #, then we can submit applications for Medi Gap, Part D Rx & Medicare Advantage. See those pages on our website for more detail. Email us with any questions, visit our scheduling page to make a phone, Skype, What’s App or face to face meeting. Please note that for Part D or MAPD Medicare Advantage Federal Law requires you to sign a form to allow us to discuss those plans with you.

- Here’s our page to better explain the advantages – disadvantages of MAPD vs Medi Gap and what the plans add to cover the gaps in Medicare A & B.

- This page has a chart on what Medicare Pays, then Plan F Medi Gap, then what is still left for you to pay. Most of the time zero. Note that after 1.1.2020 Plan G will be the most comprehensive. Those that have Plan F, Extra or Innovative can keep Plan F forever!

- Here’s one way of knowing in advance of your approval for Medicare A & B so that we can proceed with getting Medi Gap or Medicare Advantage.

- See also our webpage on getting a Social Security Account.

.

.

- I turn 65 in July. I just applied for Social Security and have received two checks so far. Will I be automatically enrolled into Medicare?

. - Some people get Part A and Part B automatically

- If you’re already getting benefits from Social Security or the Railroad Retirement Board (RRB), you’ll automatically get Part A and Part B starting the first day of the month you turn 65. (If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month.) https://individuals.healthreformquotes.com/medicare/sign-medicare/#medicare10050

- If you’re getting these benefits, in most cases,

You’ll get the “Welcome to Medicare” package that welcomes you to the program. This package is mailed about 3 months before your 65th birthday. In this package, you’ll get your Medicare card. https://www.medicare.gov/publications/10050-Medicare-and-You.pdf - I suggest you double check and make sure Social Security does it. Do you have an ONLINE account with them? https://www.ssa.gov/myaccount/

.

.

- I applied for Medicare, but they are asking for tons of extra paperwork. Will my effective date still be my birthday month or will their scrutiny make it take longer?

. - Here’s the reply from CA Health Care Advocates:

- I imagine the effective date would be retroactive to the original date of entitlement if the person is deemed to be eligible. But I’ve never faced this situation. Region 9 https://www.ssa.gov/sf/contact.htm would be the place to call about that.

.

.

- I imagine the effective date would be retroactive to the original date of entitlement if the person is deemed to be eligible. But I’ve never faced this situation. Region 9 https://www.ssa.gov/sf/contact.htm would be the place to call about that.

- My wife needs health insurance from Medicare.

- She’s 65 years old us citizen but still working.

- Social security can’t support her due to over the limit income.

.

- If you or your wife have worked in the USA for more than 10 years, go ahead and use the enrollment link above.

- Here’s the rules about qualifying for no Charge Part A

- If you don’t qualify for no cost Part A Hospital, scroll down and view the sub or child pages. If you still have questions post them on the most relevant page. You do not have to put in your name.

- What do you mean Social Security can’t support her, your over the Income Limit?

- Do you mean Medi Cal, Medicaid? Obamacare/ACA subsidies?

.

.

- I’m interested in getting Medicare at 63 years old. I have MS and have been told I’m eligible at 63. Is that true?

. - Yes, if you qualify for SSDI, after two years you automatically get Medicare.

.

. - Medicare was enacted in 1965. I first had it deducted from paychecks starting in 1966. I retired in 2016 so Medicare was deducted from all my earnings for 50 years.

- I finally had occasion to use my Medicare benefit getting a doctor ordered blood test in order to continue receiving medication for high blood pressure. Medicare paid a whopping $2.94. My share was only $241.84.

.

- I finally had occasion to use my Medicare benefit getting a doctor ordered blood test in order to continue receiving medication for high blood pressure. Medicare paid a whopping $2.94. My share was only $241.84.

- See the chatter between high school friends on facebook to respond to this issue.

History of Medicare

on cms.gov

cms.gov/History cms.gov/KeyMilestones.pdf

Consumer Resources & Links

- Medicare.Gov Eligibility Tool

- Privacy… having a friend talk to your MD # 11441

- CBS News 10.2015 How will you get Health Insurance in Retirement?

- Calif. Department on Aging

- 2015 Costs to remain the same CA HealthLine

- Law Help.org Medicare

- medicare.gov/cost/ deductibles, co pays, premium

- Reforms to the Medicare payment system are meant to promote greater efficiency in the healthcare delivery system by restructuring Medicare reimbursements from fee-for-service to bundled payments.[44][45] Under the new payment system, a single payment is paid to a hospital and a physician group for a defined episode of care (such as a hip replacement) rather than individual payments to individual service providers. In addition, it has been asserted that the Medicare Part D coverage gap (commonly called the “donut hole“) will shrink incrementally, closing completely by January 1, 2020.[46] Wikipedia

- The CBO averred that the bill would “substantially reduce the growth of Medicare’s payment rates for most services; impose an excise tax on insurance plans with relatively high premiums; and make various other changes to the federal tax code, Medicare, Medicaid, and other programs”[216]—ultimately extending the solvency of the Medicare trust fund by 8 years.[249]

- Q & A on Medicare’s Website ♦

- Health Affairs.org ♦

- AHIP info ♦

- See our Medicare Advantage Page

- insure me kevin.com/creating-a-spreadsheet-to-compare-medicare-advantage-plans

Problems on the phone with Social Security or Medicare?

The Centers for Medicare & Medicaid Services is providing equitable relief to individuals who could not submit premium-Part A or Part B enrollment or disenrollment requests timely due to challenges contacting us by phone. This relief applies to the 2022 General Enrollment Period, Initial Enrollment Period, and Special Enrollment Period.

If you were unable to enroll or disenroll in Medicare because you could not reach us by phone after January 1, 2022, you will be granted additional time, through December 30, 2022. SSA.gov *

Child & Sibling Pages

Site Map

- Enrollment Tools and Decisions for Medicare Table of Contents

- MAPD Medicare Advantage Plans – Part C General Info all companies

- Advantages – Disadvantages of Dual SNP Medi Cal & Medicare

- Anthem Blue Cross Select HMO MediBlue Plus & SNP

- Blue Shield 65 Plus – Inspire HMO 2025

- Enrollment Dates for MAPD – Medicare Advantage & Part D Rx

- MAPD UnitedHealthCare

- SCAN MAPD Medicare Advantage

- SNP Special Needs Plans Medicare Advantage no index

- Medi Gap – Supplement Plans

- Part D Rx Prescriptions no index

- zCoverage for Specific Disease or Questions FAQ’s no index

- Demential & Alzheimers Medicare & ACA/ObamaCare coverage

- Diabetes – Prevention & Coverage under Medicare & ACA

- Durable Medical Equipment, Chiropractic, Physical Therapy

- End Stage Renal – Kidney Failure – ESRD

- Hearing Aids Insurance Coverage

- Hospice Coverage – Medicare

- Skilled Nursing SNF & Home Health What Medicare Pays

[sibling-pages]

https://www.cms.gov/files/document/cms-10797-application-medicare-part-and-part-b-special-enrollment-period-exceptional-conditions.pdf

https://www.cms.gov/newsroom/fact-sheets/2026-medicare-parts-b-premiums-deductibles